Own a Beeple.

In Alphaverse’ previous issue, we talked about where to look for alpha in the NFT niche. The key ideas: be early, buy something hyped, and flip when the crowd comes in. But, does that mean you miss out if you’re late to the party?

Not really.

As NFT space matures, developers find new ways to accommodate wider audiences. One of these ways is fractional ownership. It potentially enables you to get your hands on a piece of a highly-priced NFT, like those from Beeple or CryptoPunks. Let’s look at the available solutions and their value from an investor’s perspective.

The Basics of Fractional Ownership

As you may have guessed, fractional ownership means somehow distributing a one-piece NFT like a JPEG image among potentially hundreds of people. But how exactly is it done, and what are the benefits?

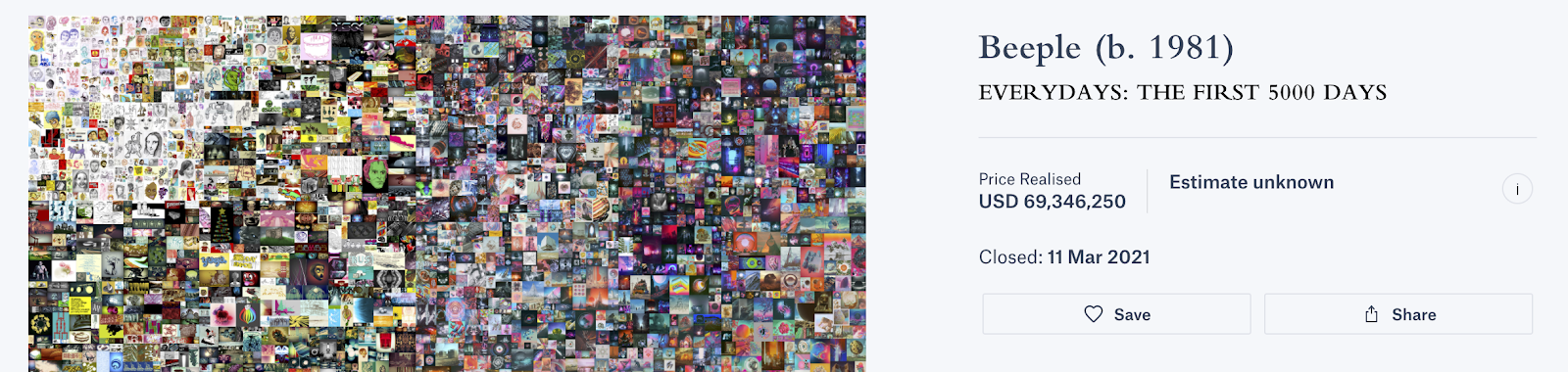

Let’s consider a practical example, “Everydays: the First 5000 Days” by Beeple, which was recently sold for almost $70 million.

Everydays: The First 5000 Days on Christie’s.

The buyer of the picture turned out to be a heavily NFT-focused crypto fund called Metapurse. What’s interesting is that Metapurse already offers fractional ownership for some of Beeple’s other works.

Metapurse locked some highly-priced NFTs in a smart-contract vault and launched “B20 tokens,” which provide pro-rata ownership of the vault. If you own all the tokens, you essentially own everything in the vault.

Advantages of Having NFT Fractions

The benefit of owning tokens like B20 is accessing something that you otherwise couldn’t.

There aren’t many people out there with a couple hundred million dollars to spend on ultra-hyped NFT collectibles. Yet, owing such items is a safe bet since you know their market value will likely remain high and potentially grow as time passes.

The current price of a B20 token is roughly $8.5, a pretty democratic price to have a piece of a collection of NFTs worth millions. What’s more, if someone decides to buy vault’s contents, B20 entitles their owners to a pro-rata share of the proceeds.

Metapurse is not the only startup focused on fractional ownership of NFTs. Various startups, including DAOfi, NIFTEX entered the game. Even traditional startups get involved. For instance, Dibbs, a marketplace for fractions of sports cards, recently raised $2.8 million and may get to the level of NBA TopShot.

In the future, we will likely see many platforms enabling fractional ownership for NFT items. Besides buying collectibles, you will be able to tokenize your own items to tap the value of that art immediately.

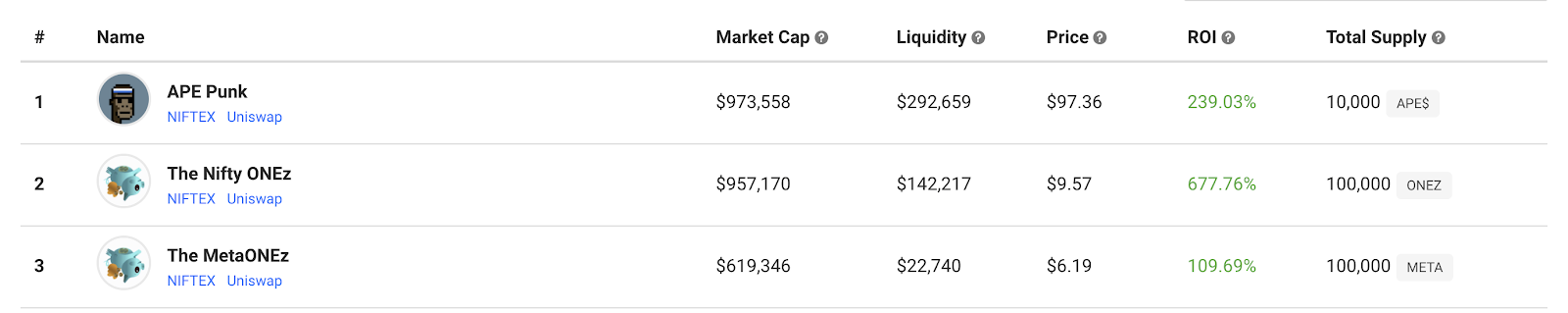

Fractionalized NFTs on NIFTEX. Source: DappRadar.

Note: the highest bit on APE Punk was 350 ETH (over $600,000).

You may not find a person who’s going to buy you an expensive NFT, but there may be dozens of people willing to invest in a part of one.

Conversely, you may not have enough funds to acquire a JPEG you think will go 10x in a few years. Instead, you can dollar-cost average in by buying fractions.

The NFT space is still in its infancy, and the platforms I outlined still have an underdeveloped user experience. Still, I would encourage you to follow their evolution, as they will likely be at the forefront of the NFT game pretty soon.

Disclosure: The author of this newsletter holds Bitcoin and Ethereum. Read our trading policy to see how SIMETRI protects its members against insider trading.