First they laugh…

During this bull cycle, Ethereum’s narrative has developed in a curious way. After DeFi started to explode last summer, people started to understand that despite its flaws that Ethereum has tremendous potential.

Twitter’s CEO, Jack Dorsey, on ETH price. Source: Twitter.

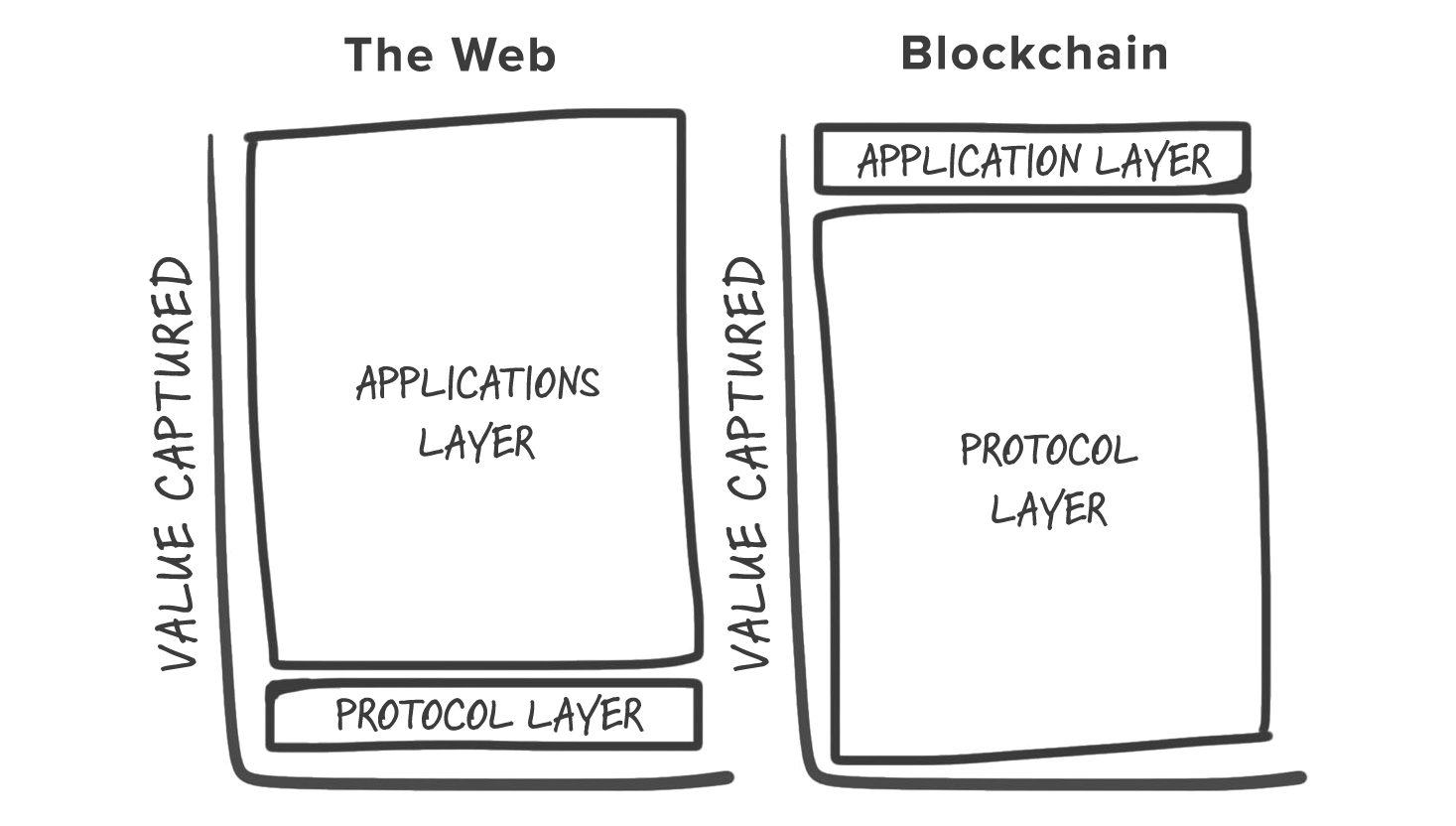

Back in 2018, one of the prominent venture capital firms, Union Square Ventures, published a post called ‘Fat Protocols.’ The author, Joel Monegro, claimed that crypto works like the Internet but accrues value differently.

According to the Fat Protocols thesis, so-called Layer-1 platforms like Ethereum will capture the value from the apps on top of it. This is in contrast to the current Web, in which value is captured by companies like Google and Netflix, while the underlying protocols like TCP and UDP are free.

Fat protocol thesis illustrated. Source: USV.

Despite the rise of “Ethereum killers,” the second-largest crypto network still has the most dominant ecosystem in the space. Given the recent surge of DeFi apps, the ongoing NFT trend, and the astonishing growth of BTC, ETH looks undervalued even after a 3x increase since Dorsey’s December tweet.

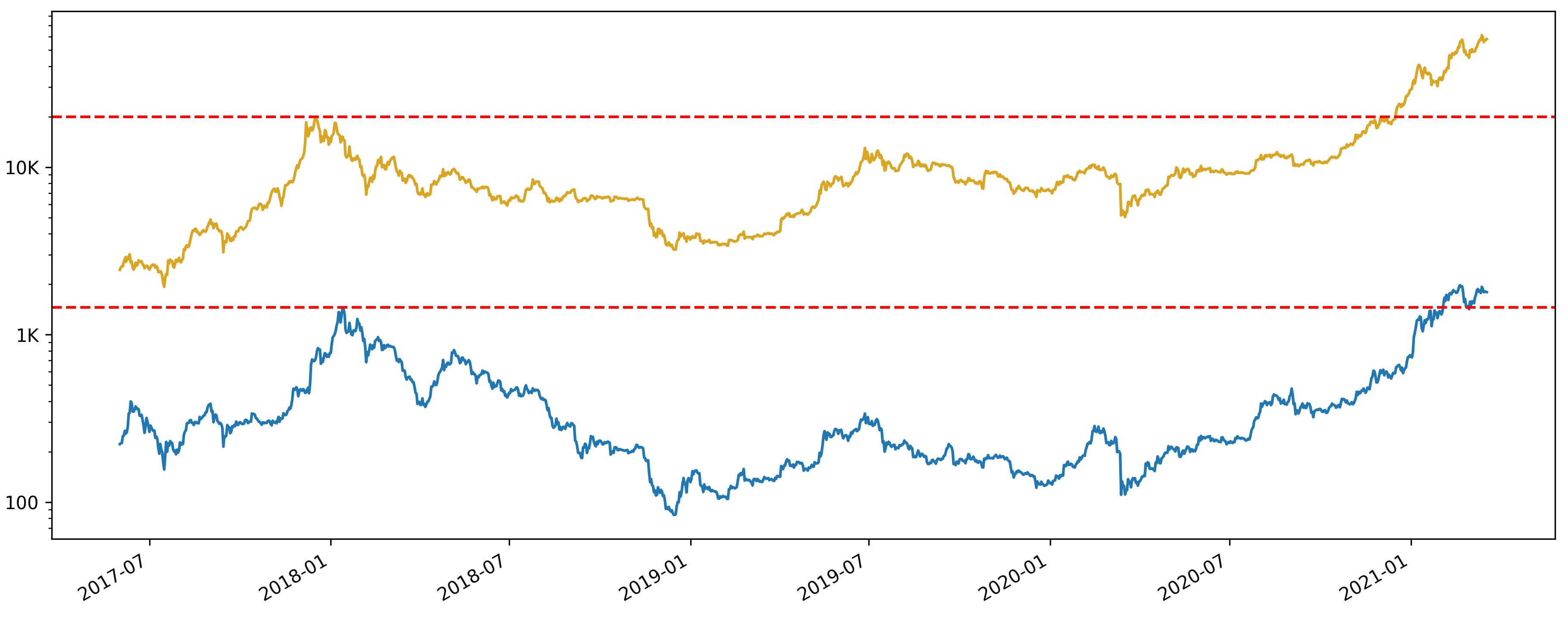

To give you more context, let’s look at BTC’s performance compared to ETH. Bitcoin was 3x higher than its 2017 all-time high at its peak, while Ether is not even half of its high.

BTC (gold) vs. ETH price. Source: CoinGecko.

Meanwhile, the activity on Ethereum grew to the point where banks that previously looked down on crypto now recognize the value of blockchain. The latest—Bank of America published a report about Ethereum’s capabilities.

Banks are already losing to DeFi in terms of yields. All they can do now is adapt, which is why we see large investment banks like JP Morgan invest in Ethereum.

Surely, the yields in DeFi will go down with time, but that’s because efficiency will improve. While Bank of America mentioned that DeFi primitives are unable to create credit, platforms like Teller are already on the way to solving this.

Layer-1 platforms have the potential to unseat banks, and Ethereum is leading the way. While it has scalability issues, devs are hard at work on solutions. Moreover, projects that are trying to solve scalability are receiving large amounts of venture and retail funding.

All this is to say that while ETH price is being constrained by its current scalability and prohibitive on-chain fees, Ethereum’s fundamentals are strong, and it’s yet to reach its full potential during this bull run. Obviously, this is also bullish for many of our Ethereum-based picks.

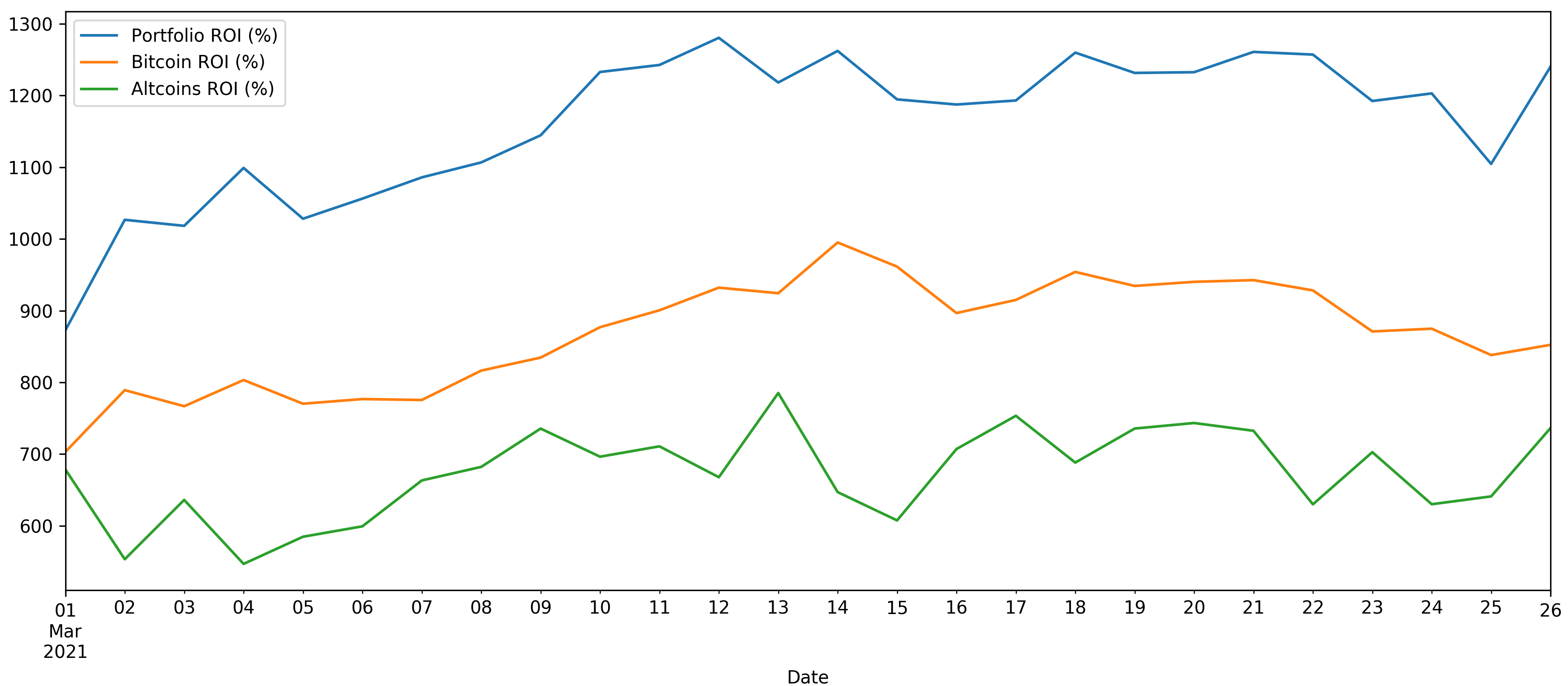

SIMETRI Portfolio – Plateauing With the Market

SIMETRI’s Portfolio follows the broader market, which is currently moving sideways. But, the gains on our Picks remain way above BTC and alts, with ROI of 3,098%.