The Basics of Investing in NFTs.

If you are reading this, there’s a 99.9% chance that you know what an NFT is. Although NFTs aren’t new, their explosive popularity took many by surprise.

Source: Reddit (edited).

In the “Boomer’s Guide to NFTs,” I discussed whether digital collectibles are just a fad and how they can be valued. However, regardless of whether you agree with the current NFT valuations, one thing is certain: there is a lot of alpha locked in there. Today, I want to outline ways how you can extract this alpha.

Know Your Buyer

The first and most important thing to consider about speculating on NFTs—knowing your buyer. Although there’s a lot of excitement around NFTs, most lose value after purchase. Survivorship bias, where people only recognize the winners, is real.

Unlike regular tokens like ETH and BNB, NFTs don’t have market makers, and the NFT market is largely illiquid. The two options are direct sales and marketplaces like OpenSea and Treasureland.

If you buy something that the market doesn’t deem rare, there’s a high chance you won’t be able to sell your NFT, even at a discount. So, always try to gauge how many people would want to buy your item and why.

Always check whether influencers discuss an NFT you are about to scoop. It’s not guaranteed that endorsement on high-profile Twitter accounts will drive demand for your NFT, but it’s better than nothing.

I took the liberty and created a shortlist of crypto/NFT influencers with large followings. Enjoy.

- ∞ CO฿IE (260k+ followers)

- WhaleShark.pro (turned $150k to over $70 million on NFTs)

- Aftab Hossain (one of the earliest promoters of the NFT space)

- gmoney.eth (purchased a CryptoPunk for 140 ETH)

- BlackPool (NFT hedge fund)

Found something thousands of others are ready to ape in? Good. But, overhyped NFTs are as bad as underhyped ones. They take your time for no good reason.

Generally, the number of highly demanded NFTs is very limited. To balance this with outsized demand, sellers use various schemes like lotteries and auctions. Chances of winning, in this case, are slim, so you’d be better off hunting for more realistic opportunities.

Know Your Tools

NFT space is still developing in terms of tech, but the growing interest in the topic attracts talented developers who have already built out the basic set of tools. Moreover, if your NFT is from a popular series, you can count on enthusiasts creating additional tools for trading and engagement.

NFT Marketplaces

If you haven’t had an NFT before, the best place to start is a marketplace. The most popular ones are Nifty Gateway, OpenSea, and Treasureland. Marketplaces help partially solve the liquidity problem of NFTs and provide security for buyers and sellers.

I left a very popular marketplace, NBA Topshot, out because it’s almost impossible to get NFTs they regularly drop due to the huge demand. The cue for a drop may be longer than 150,000 users.

Rarity Analyzers

Many NFTs are launched as collections. The first metric to watch is the price floor, which can be easily found on a marketplace via filtering by a collection and sorting by price. The second by importance is a rarity.

A good example of how rarity can be measured and how it affects the price is Hashmasks, a collection of 16,384 unique images. Hashmasks’ interesting feature is that initial purchasers couldn’t see pictures during the sale. They were revealed only sometime after.

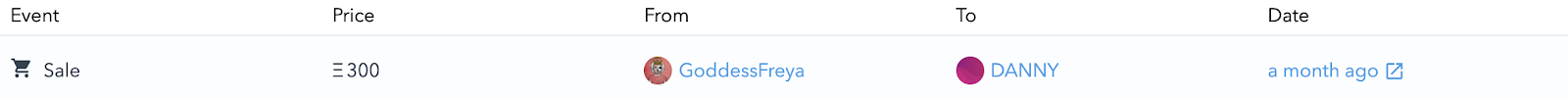

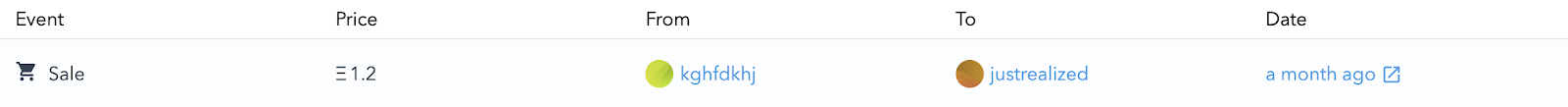

Once people saw their Hashmasks, they started to figure out what features were rarer than others. Soon after, people started to create rarity rankings. Let’s see how one of the rarest Hashmasks compares to the most common one.

Source: Rarity Studio.

It’s a good practice to check the rarity of an item you’re about to buy. Who knows, maybe a seller doesn’t fully understand what they have.

Index Funds

If you don’t feel like digging through individual NFTs, it’s better to go with index funds like NFTX and NFT20. Index funds bundle NFTs of various collections and enable users to profit if the entire collection becomes more valuable.

Using an index fund is a shotgun approach. It’s easier and safer than buying individual pieces, but you also lose on potential opportunities to snipe good deals.

And there you have it. I hope this guide helps you select the next winner in your NFT portfolio.

Disclosure: The author of this newsletter holds Bitcoin and Ethereum. Read our trading policy to see how SIMETRI protects its members against insider trading.