Fuel and FUD.

Market sentiment is as volatile as crypto prices. If you’re watching things closely, you can see how quickly people go from euphoric to spooked.

FUD, which stands for Fear, Uncertainty, Doubt, is a common meme among crypto investors. Much like the term “HODL,” People will scream ‘FUD’ at any bad news that can potentially affect the value of their bags.

Today the market shook from the news about CFTC investigating Binance for allowing U.S. residents to trade on the platform. Let me remind you that Binance had to stop serving Americans in November 2020.

The news triggered a sell-off in BTC, which didn’t come as a surprise since Binance is one of the largest centralized exchanges in the industry. Changpeng Zhao, the exchange’s CEO, shrugged the news off as FUD.

Although we are yet to see how the CFTC investigation unfolds, CZ has a point. Spooky news will continue to come out and shake the market in the short term. However, if the market’s fundamentals are strong, the long-term perspective doesn’t change.

This brings us back to Bitcoin’s price action. Today I want to draw your attention to two key fundamental factors: the upcoming U.S. stimulus package and BTC accumulation.

On Wednesday, the U.S. Congress passed a $1.9 trillion stimulus package with President Joe Biden’s sign-off. More dollars being injected into the economy is bearish for DXY (dollar strength index) and bullish for assets perceived as an inflation hedge like gold and Bitcoin.

After a correction, BTC is back close to its recent ATH. At this point, if the stimulus package will push it higher, the growth will likely be fast and substantial. Why? Because people have been accumulating.

Take a look at the addresses that hold from 100 to 1,000 BTC. This type of holder timed the market perfectly. The line started to decline just before bitcoin topped.

Bitcoin held by addresses with a balance of 100 – 1,000. Source: Glassnode.

Now, these addresses are signaling substantial accumulation. Looking at this chart, we are nowhere near the BTC top if the history rhymes.

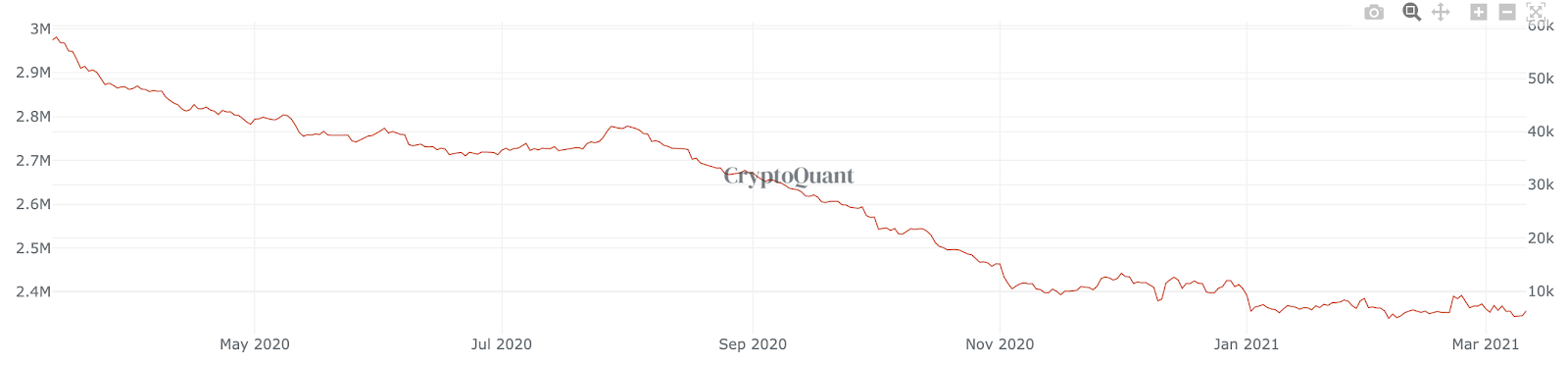

Meanwhile, exchange reserves remain dry. If the accumulation continues, we’ll likely see another sell-side crisis with its respective price pump.

BTC reserves on exchanges. Source: CryptoQuant.

Comparing Binance news with the macro environment and on-chain data, I think the positive fundamentals outweigh the FUD. Moreover, remember what we talked about in ‘The Big Game’ newsletter. You won’t get too spooked if you treat some of your holdings as if you lost them.

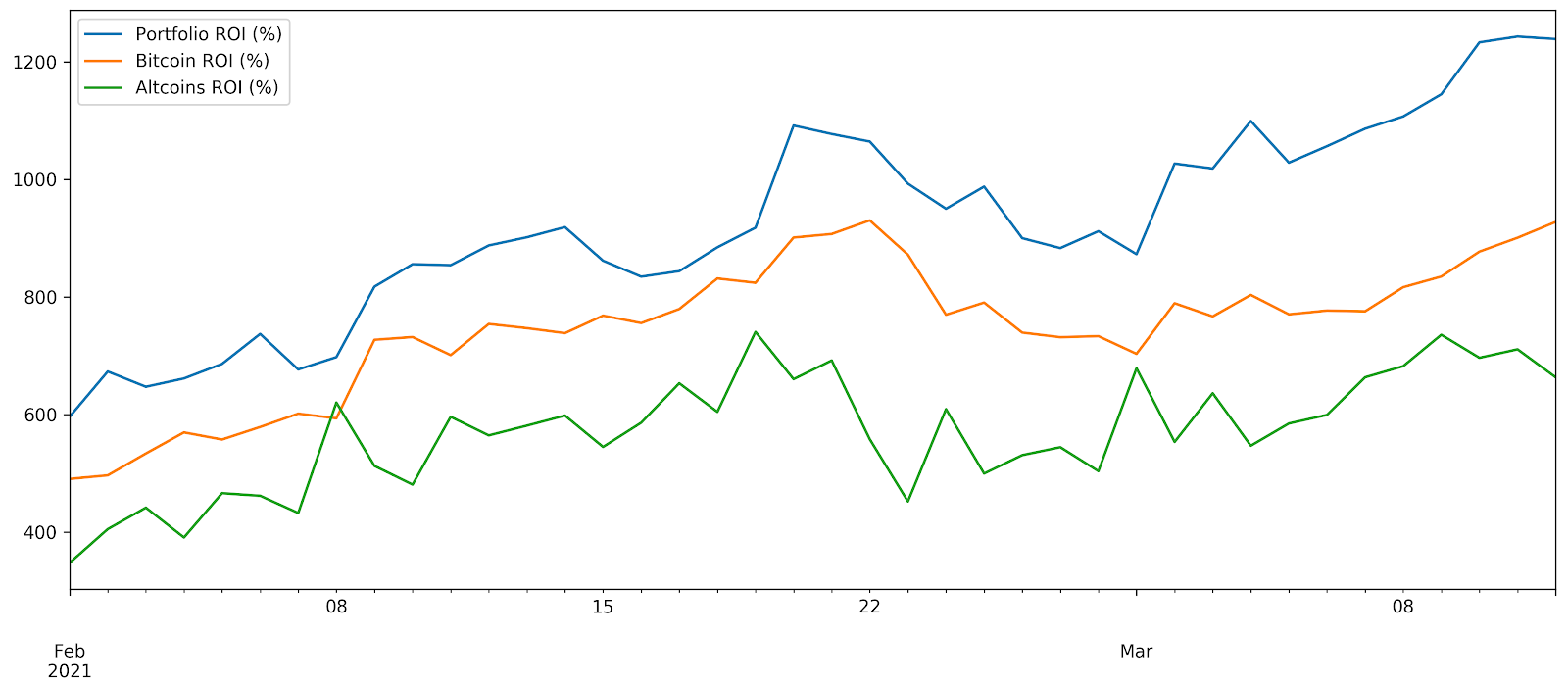

SIMETRI Portfolio – 30x

I’m proud to state that SIMETRI Portfolio’s ROI went over 3000% and now sits at 2975%. Moreover, the gap between the Portfolio’s performance and the performance of BTC and alts is increasing.