Selling Options on Chain.

This issue concludes our short voyage into options. You now know that it’s safer to sell (write) options and know where to get proper training for free. The missing piece is where to apply your new skill set once you feel ready to put money on the line.

Today I will share a walkthrough of selling a Put option on a decentralized platform called Lyra. Surely, you can use centralized platforms, but only a few let you sell cash-secured puts and covered calls. Moreover, of those available, not all are accessible to all countries.

After all, we live in a decentralized world. “Not your keys—not your crypto” is the mantra we keep chanting. So, if we have good venues to trade options in decentralized finance conveniently, why not go this way?

If you ever used Robinhood, Lyra’s interface will look familiar. And that’s a good thing. I’m sure after you’ve seen Deribit, you’ve learned to appreciate the simplicity of a user interface.

The good thing about Lyra is that it is available on Optimism. Hence, you don’t need to think about those draconian transaction fees.

You can use the official bridge to get your money to Optimism, but I recommend opting out for Hop Protocol or Celer. They are also better for withdrawals from Optimism because you don’t have to wait a week like on the official bridge.

Once you transfer some funds to Optimism, connect your wallet to the app by clicking on the respective button in the upper right corner.

Currently, you can trade BTC, ETH, SOL, and LINK options. For comparison, Deribit doesn’t have LINK.

In the interface, you need the option selection window first. It’s located on the main page. You won’t miss it. Here you will see the range of expiration dates, a selector for Buy/Sell and Call/Put, strike prices, and contracts’ prices. To view each option’s details like Delta (our guiding metric), click on the arrow button next to its price.

After selecting an option that fits your strategy, look at the window on the right. It will show you all the details about what you’re going to buy. Remember, you’re selling collateralized options. Therefore, you need to have money to lock up.

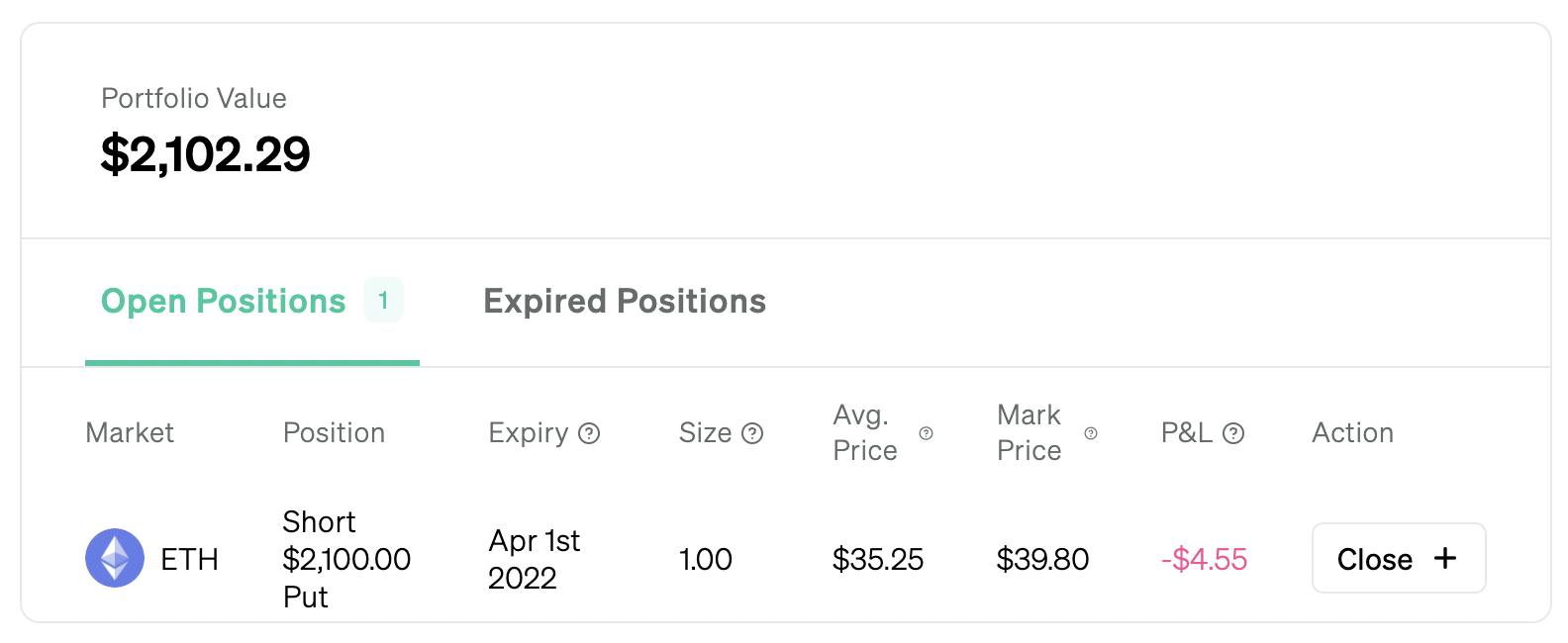

In my example, I’m selling an ETH Put option that expires on Apr 1, 2022 with a strike price of $2,100. If ETH price goes below $2,100 by this date, my collateral will be used to buy ETH from the person who bought the option from me.

It’s a good strategy if you plan to accumulate ETH anyway and are fine with the $2,100 price. But be wary of the risks. Also, consider how attractive the premium is. In my case, it’s $40, which some people would disregard as “too small.”

Collateral and fees on Lyra are paid in sUSD. The platform will offer you to swap whatever you have on your wallet to sUSD via 1 INCH. Remember, you still need some ETH to pay transaction fees.

Lyra will kindly let you know how many transactions you will be able to do with your ETH leftovers after the swap. I know I’m swapping from ETH to sUSD to sell an ETH Put. I can’t be helped.

After swapping, allow Lyra to spend your sUSD and sell the Put. When you are done, you can click on the “Portfolio” button on the left of the screen and see your open position.

Make sure you feel confident before putting real money on the line like I just did. I’m totally fine buying ETH at $2,100, even if it goes to $80 the next minute. You might not be willing to take this risk.

Also, please remember that it’s not about trading. You are using options as an investor to augment your investment strategy. You almost can’t make life-changing money trading options because of how risky it is for active traders.

Spend enough time on Deribit before trying Lyra or any other platform. If you feel adventurous, I recommend trying Dopex out. It’s really good.

There you have it. I hope I made options look less intimidating over the past three weeks. For some who will add them as accumulation and hedging helpers to their main portfolios, options should become second nature pretty soon. Good luck.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Stefan, and my colleagues: Anton, Sergey, and Nivesh.

Disclosure: At the time of writing, the author held ETH and several other cryptocurrencies. Read our trading policy to see how SIMETRI protects its members against insider trading.