The Big Game.

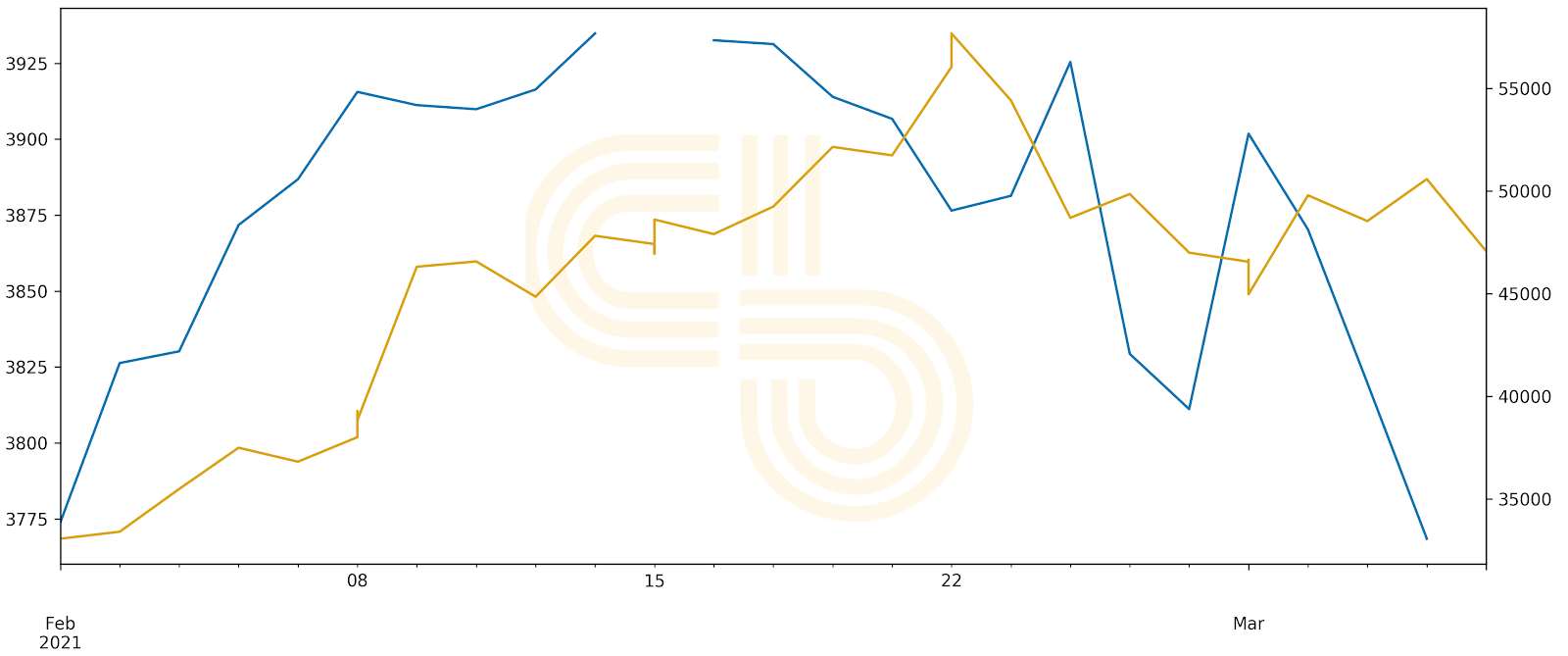

As we discussed in the last issue of the Digest, the macroeconomic environment is now extremely important for risk-on assets like stocks and crypto. The market was waiting for Jerome Powell and the Federal Reserve’s reaction to rising treasury bond yields.

Unfortunately, there was no reaction. Mr Powell didn’t make any statement on the Fed stepping in, so the market continues to go on autopilot.

Meanwhile, 10-year Treasury-bonds are on the rise, going over 1.6%. To put the rate into perspective, just a month ago, this number was at around 1.08%. In other words, the long-term bond yields are rising fast.

Last Friday, I explained that the surge in bond yields makes stocks less attractive for investors. Buying Treasury bonds gives the government a loan with guaranteed payouts while buying speculative stocks can result in losses.

Keep in mind that crypto falls into the same bucket as equities and will suffer too. However, Bitcoin didn’t perform as poorly as the S&P 500.

Meanwhile, the DXY index, which represents the strength of the US dollar, is going up after sliding for weeks. Again, this is not great news for assets like Bitcoin and gold which are sold as hedges against inflation.

DXY. Source: Trading Economics.

Although today bitcoin dropped to $46,500 level from $48,700, the price quickly recovered back to over $48,000. Meanwhile, another 12,000 BTC left Coinbase and Microstrategy announced a purchase of $10 million worth of bitcoin.

Clearly, institutional investors are happy to buy bitcoin dips as retail investors get spooked. It remains to be seen whether this strategy will be successful in the short term, but in my opinion, institutions couldn’t care less if it won’t. If BTC is going to new highs, institutions can wait.

First, big players have deep pockets and invest only a fraction of their cash in BTC. For instance, Tesla put around 8% of its cash there. So, if BTC drops, the company won’t be underwater.

Second, these companies have long time horizons. Unlike retail players, who need to pay their bills, institutions can withstand corrections and bear markets for months and years if the stock market doesn’t collapse.

If bitcoin is to go to $100,000 and beyond, it doesn’t really matter for a company if it buys BTC for $50,000 or $20,000. On the other hand, no one knows if BTC will plunge and how long it will remain low. So, buying dips makes sense.

We are witnessing bitcoin being taken away by stronger hands from the weaker ones. It’s a natural process for any scarce asset.

I recently watched an interview with a prominent crypto analyst Su Zhu, where he expressed an opinion that retail investors tend to lose out on supercycles by cashing out too early. I guess the key to solving this is to have some BTC stored somewhere safe and just forgetting about it.

If Bitcoin’s promise materializes, you are going to be generously rewarded. If not, well, at least you didn’t lose the game to the big guys.

SIMETRI Portfolio – Up and Away

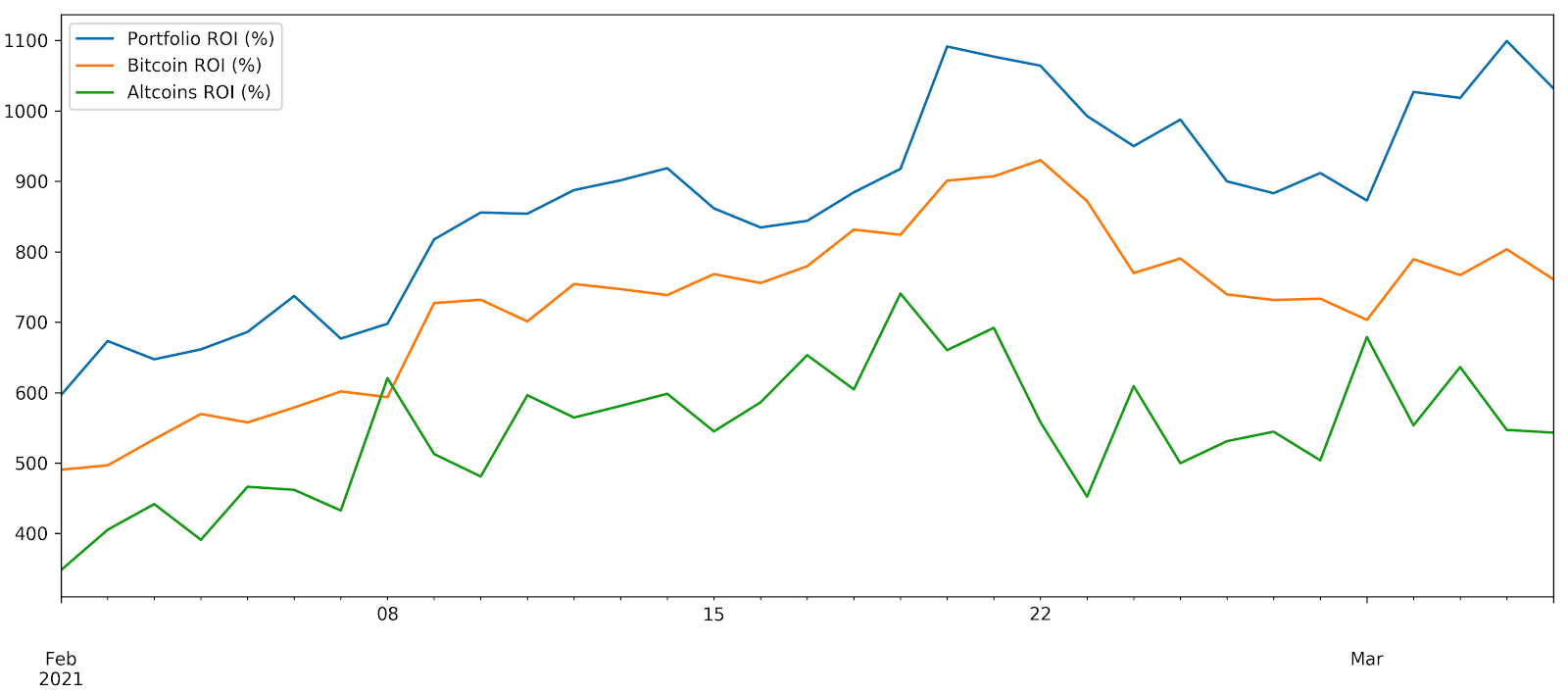

There’s not much to say about our Portfolio. It continues to beat Bitcoin and altcoins. Over the previous month, SIMETRI Portfolio’s ROI hasn’t dipped below BTC and alts, meaning that holding our picks turned out to be the best strategy.

Currently, it sits at 2628% ROI, compared to last week’s 2211%.