Bullish Dumping.

Across recent Digest issues, I keep coming back to the macroeconomic overview because it dictates the outlook of all other assets, including cryptocurrency. Since the stock market took a hit and Bitcoin had another dip, I want to outline what may be coming in the future for risk assets.

The traditional market is getting nervous, according to the surging yield on 10-year Treasury bills. To understand what such a hike might signal, let’s review what bonds are and how to interpret the yield curve.

Treasury bonds are nothing more than IOUs (I owe you) from the government. By purchasing bonds, people or organizations effectively lend money to governments.

Most people consider these investments “safe,” at least for developed countries, so treasury bonds are typically considered low-risk. Still, if you lend money to the government for a more extended period of time, the uncertainty about what might happen with the economy grows, and you want to be appropriately compensated for this far into the future risk.

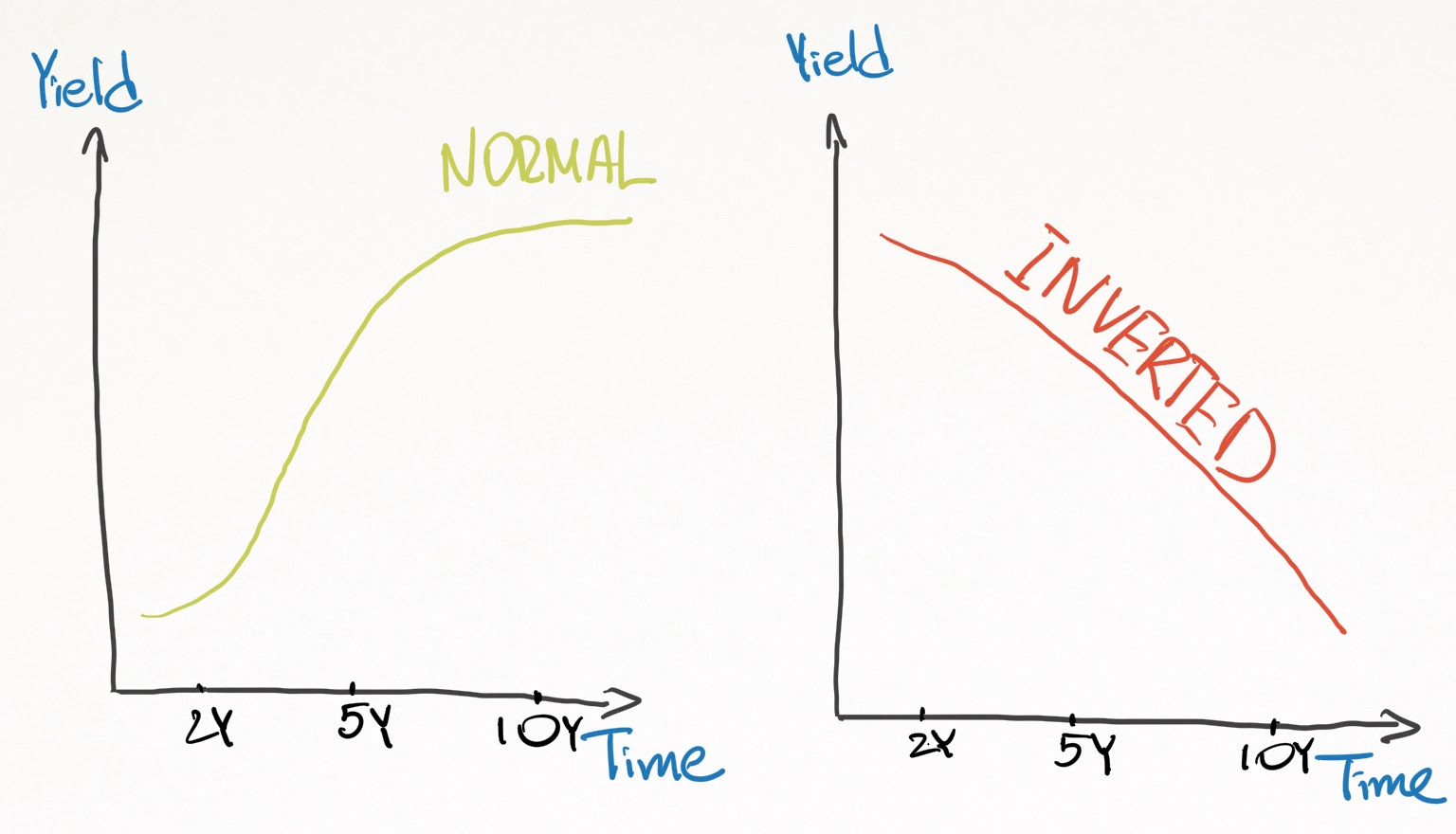

Let’s translate this to the yield curve. Usually, it would be upward sloping because of the reasons outlined above. On the other hand, if the market expects interest rate cuts, people may be more willing to buy long-term bonds to protect their money. Bonds will be paying them greater amounts of interest, offsetting interest rate cuts.

Bond yields are calculated by dividing their return by their total price, which means that if the market anticipates recession, it will drive up prices of long-term bonds and reduce their calculated yields.

Notably, the market’s sentiment about some future events is priced in the bonds way before these events may occur.

The yield curve shows the difference between bond prices. The most popularly used one is the difference between a 10-year Treasury bond and a 2-year Treasury bill. When such a curve slopes downwards, it means that the bonds are signaling trouble. If it crosses the ‘0’ mark, the yield curve is considered to be inverted, which is highly correlated with impending economic recessions.

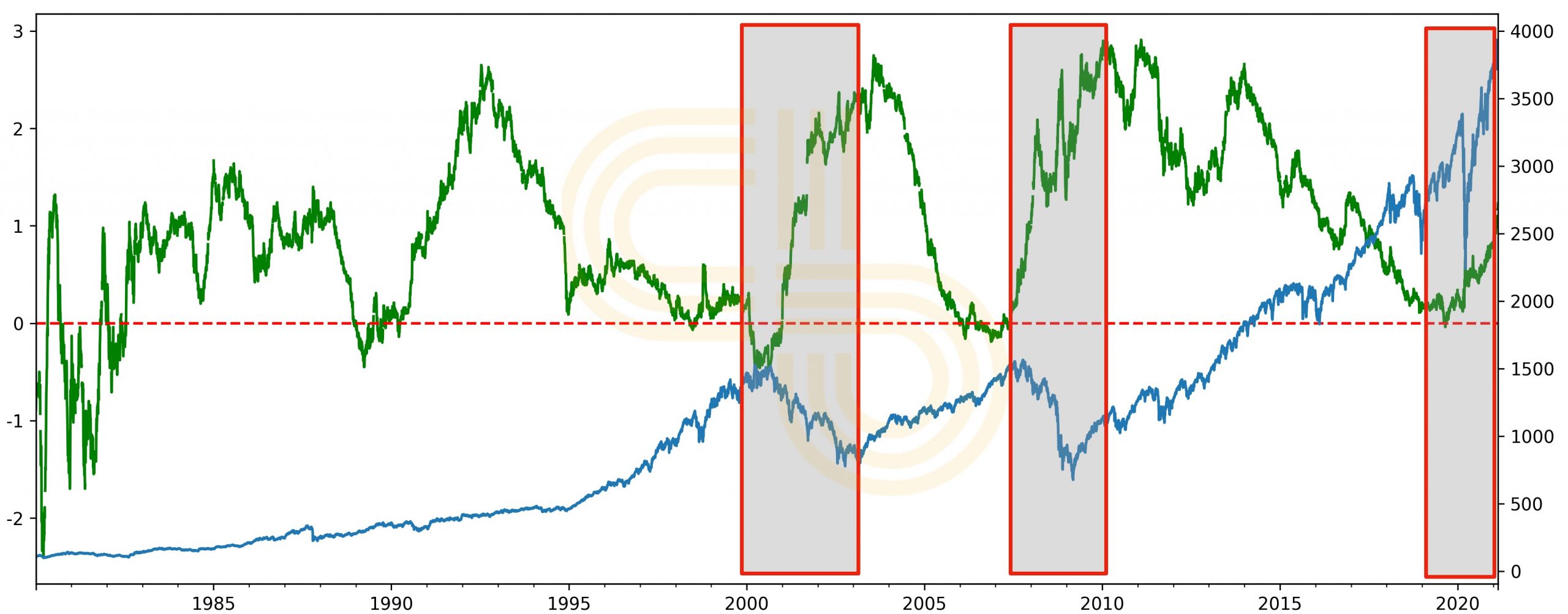

Take a look at the 10Y-2Y spread and S&P 500 performance. When the yield curve goes inverted and then starts a sharp recovery, a recession follows. In fact, an inverted yield curve preceded the last seven recessions out of the total 47.

10Y-2Y spread on treasury yields (green) vs. S&P 500. Source: FRED.

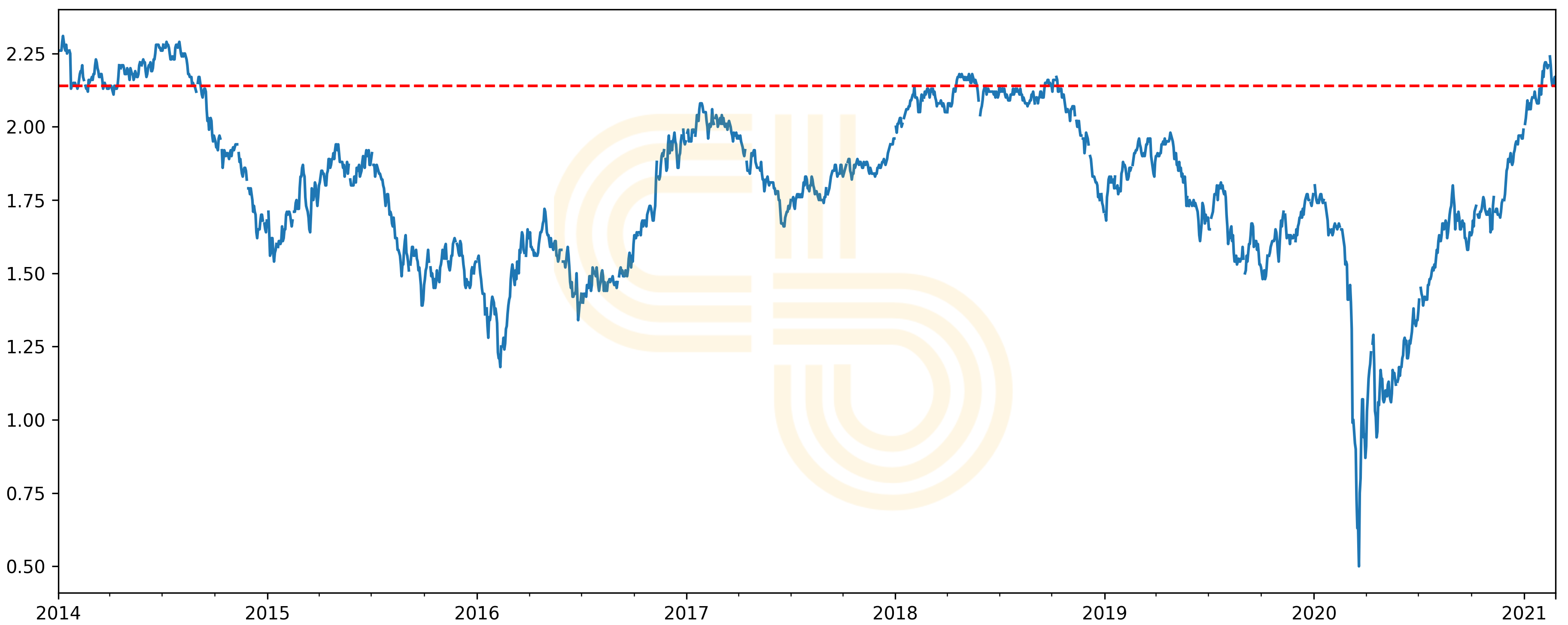

In addition to the steepening of the yield curve, the market’s unease is represented by the expectations of inflation. The 10-year breakeven inflation rate is usually used for measuring inflation expectations. Currently, it’s over 2%, relatively high compared to the past several years.

S&P 500 price during the latest recessions. Source: Yahoo Finance.

As Bitcoin matures, it is likely that it will begin to resemble other heavily-traded assets. How do these changes affect Bitcoin’s next bear market?

When Bitcoin sees the next massive sell-off, companies may deem it a good investment from a risk-return perspective and jump in. Like stocks, my prediction is that Bitcoin prices will rebound more quickly than they have in the past.

However, more companies will need to follow Tesla’s example for this scenario to play out. Even today, BTC is primarily a speculative asset, and it will likely remain an afterthought for institutions if the stock market plunges anytime soon.

My prediction only holds if the US stock market continues to do incredibly well. Historically, the stock market can move sideways for decades, so we can’t rule the possibility of this pattern repeating.

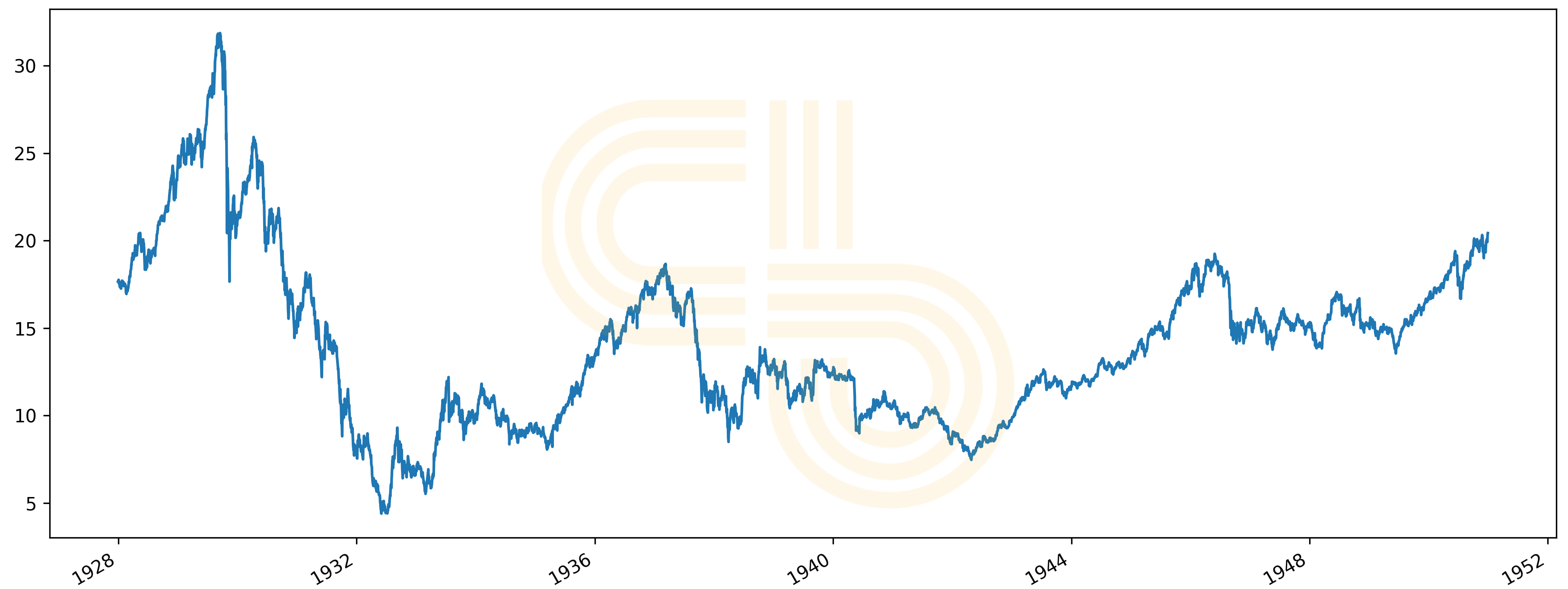

Take a look at the stock market’s performance after the Great Depression in the 1930s. Twenty years of bleak price action doesn’t look very good for speculation. If a similar thing were to happen today, Bitcoin could trade sideways for decades alongside stocks once it matures.

Don’t be blinded by Bitcoin’s incredible returns. There is always the possibility that it trades sideways for long periods of time. Right now, Bitcoin is already the 6th most valuable asset in the world, and it’s hard to tell when it will reach full maturity. Keep this risk in the back of your mind when you place your bets.

10-year breakeven inflation rate. Source: FRED.

Rising inflation expectations and accelerating Treasury bond yields may negatively impact the market and cause stocks and cryptos to fall even deeper. For instance, investors may start viewing bonds as a more attractive investment and abandon stocks. However, it’s not guaranteed.

The governments largely determine the macroeconomic landscape, and so far, the Fed doesn’t see any threat in the rising yields and the expansion of the money supply. For instance, Jerome Powell recently stated that printing money doesn’t necessarily result in persistently high inflation.

Moreover, the yield returning to normal in part means that the investors believe in economic recovery, which is also a good sign.

Still, if the Fed has to intervene and make money harder to access by rising interest rates, it may contribute to market turbulence. Hence, the uncertainty about risky assets remains.

To sum it all up, the global economy is in the driver’s seat now, and we as crypto investors should be ready to react. If the government reassures the market that rates will stay low, right now we may be witnessing a good buy opportunity for risky assets like stocks and crypto.

SIMETRI Portfolio – An Expected Correction

As I mentioned in the previous issue of Digest, the market was over extended over the past weeks and the correction was due. The macroeconomic factors contributed to sell-offs.

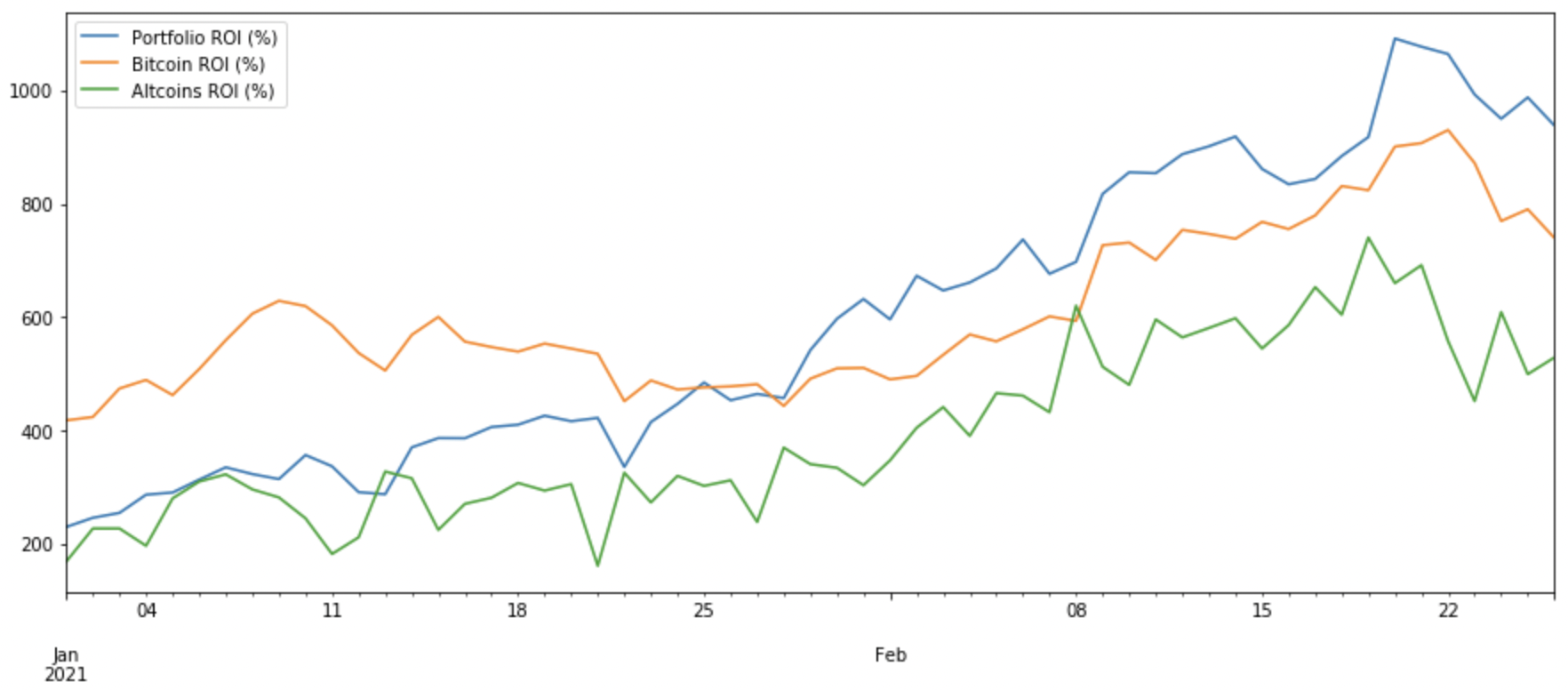

Still, SIMETRI portfolio continues to outperform the market and currently sits at 2283% ROI.