Selling Options.

If you read the previous letter by Stefan, I’m sure you know that we’re viewing derivatives as something supplemental to your investment strategy. It’s not a day trading advertisement.

Today I want to share with you a simple yet powerful strategy of selling options as a way to earn yield. I know “options” sound complicated, but I promise to keep it simple.

Options are a complex topic, but we need to understand only several parts of it for now. These parts are order type, strike price, expiration date, and delta.

Starting with the order type. You may have heard that there are “Call” and “Put” options. Whether or not you’re buying or selling options determines whether or not you bet on some asset’s price to go up or down.

In our case, we only care about selling options. The main reason is that they have considerably less risk than buying options. That is because you have the asset in question one way or the other, so you don’t risk losing it all in one trade in most cases.

In particular, we are interested in covered calls and cash-secured puts. That means that you need collateral to either buy (put) or sell (call) BTC or ETH once the price goes below or above the strike price.

The strike price is the price at which you agree to either buy (put) or sell (call) BTC or ETH at some time in the future. So, if you were a total stranger to options, you now know that it’s merely an agreement between you and someone else to buy or sell BTC or ETH at some time later.

“Some time in the future” is called an “expiration date.” Ideally, you want your expiration date to be far out into the future to avoid high volatility. It’s the short-term options where day traders generally use money. You want to avoid that.

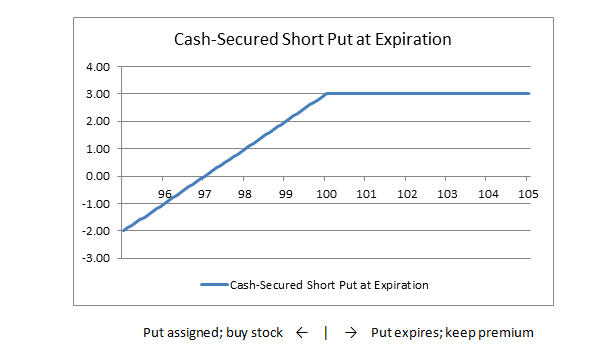

Cash-secured put is you agreeing to buy an asset at a certain price in the future. So, if the asset’s price goes down significantly lower than that price, you lose money. Otherwise, you earn a premium. Source: Fidelity.

Lastly, there’s delta. In simple terms, it’s the probability that an asset will reach the strike price. You want it to be at least over 85%.

Now that you know the basics, the strategy is in selling covered calls or cash-secured puts at strike prices that have good deltas. Using this strategy, you can either accumulate BTC or ETH or profit off their growth.

Let’s consider an example of you expecting BTC to go down to $30,000 lowest from the current level of over $37,000. You don’t necessarily want BTC to dip, but since you believe in it long-term, you are ok with buying the dip if the price goes to $30,000 or a little lower.

You sell a cash-secured put with a delta of -0.15, a strike price of $30,000, and an expiry date of May 1, 2022.

The delta is positive for calls and negative for puts. The lower it is for puts, the more probable the outcome is. In our case, the probability of the price going our way is 85% (1-0.15).

Now, there are two potential outcomes for your option. The price stays above or below the strike price.

It only makes sense for the option’s buyer to exercise the option if the price goes below the strike price. In this case, you will buy BTC from them at a price higher than the market price.

However, you get the premium that compensates for that. When somebody buys your option, they pay a premium.

The more probable the outcome (delta), the lower the premium is. So, realistically you should expect some relatively small premium, but if the price doesn’t go too low, it should be enough to compensate for the loss.

Plus, you will have BTC that you believe in the long-term. Option being exercised isn’t an ideal scenario, but it’s better than losing all your money in liquidation or something like that.

In the case where the strike price isn’t reached, the buyer won’t exercise the option because they have no incentive to sell you BTC at lower than the market price. That’s where you walk away with a premium.

I know it might be a lot to digest, even though I tried to simplify the strategy. If you still didn’t get it 100%, don’t fret. Next time, I will show you how to implement this strategy on the Deribit testnet, so you can safely try it without risking your money.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Stefan Stankovic, and my colleagues: Anton Tarasov, Sergey Yakovenko, and Nivesh Rustgi.

Disclosure: At the time of writing, the author held ETH and several other cryptocurrencies. Read our trading policy to see how SIMETRI protects its members against insider trading.