When Will Bitcoin Crash?

Bitcoin is revving, renewing the potential of another all-time high with record breaking Twitter and Google search activity. Seeing the sudden euphoria around crypto, I often wonder how this next market cycle will play out.

History doesn’t repeat itself, but it does rhyme. Looking at how drastically the crypto industry has changed in the last few years, I think the next Bitcoin bear market could be different from the one we saw in 2018.

In my previous Digest, I described how it’s risky for companies to ignore Bitcoin. Unless companies add assets like Bitcoin to their balance sheet, the expansion of the money supply through 2020-21 means that keeping cash equals losing money in the long run.

The most obvious outcome of companies tapping into Bitcoin is an increase in demand for the asset. That’s where Bitcoin’s proposition as a store of value plays out beautifully.

During the recent months a single institution-focused company, Grayscale, bought more Bitcoin than what was produced by all BTC miners put together. Now the company has a whopping 680,000 BTC (3.2% of the total supply).

If the trend continues, Bitcoin’s price may exceed people’s wildest expectations. But eventually the music will stop. And the S&P 500 and the M1 money supply could provide some hints as to when this might happen.

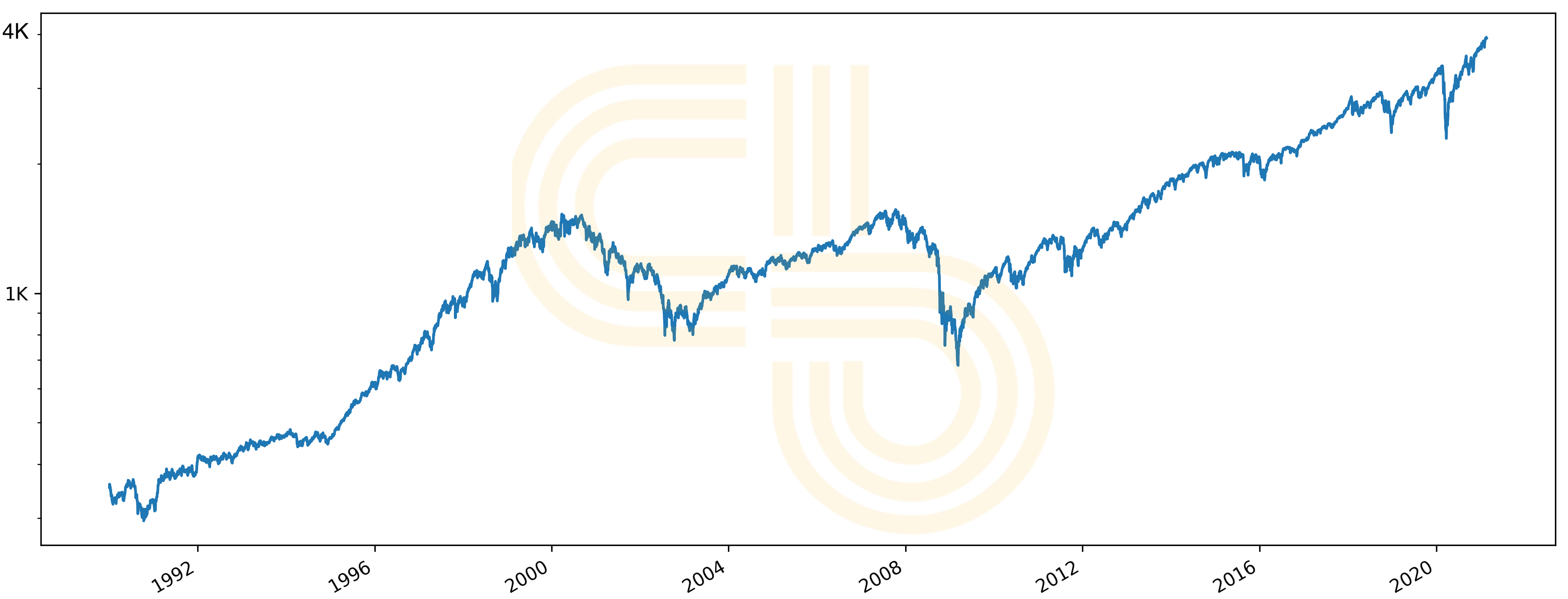

S&P 500. Source: Yahoo Finance.

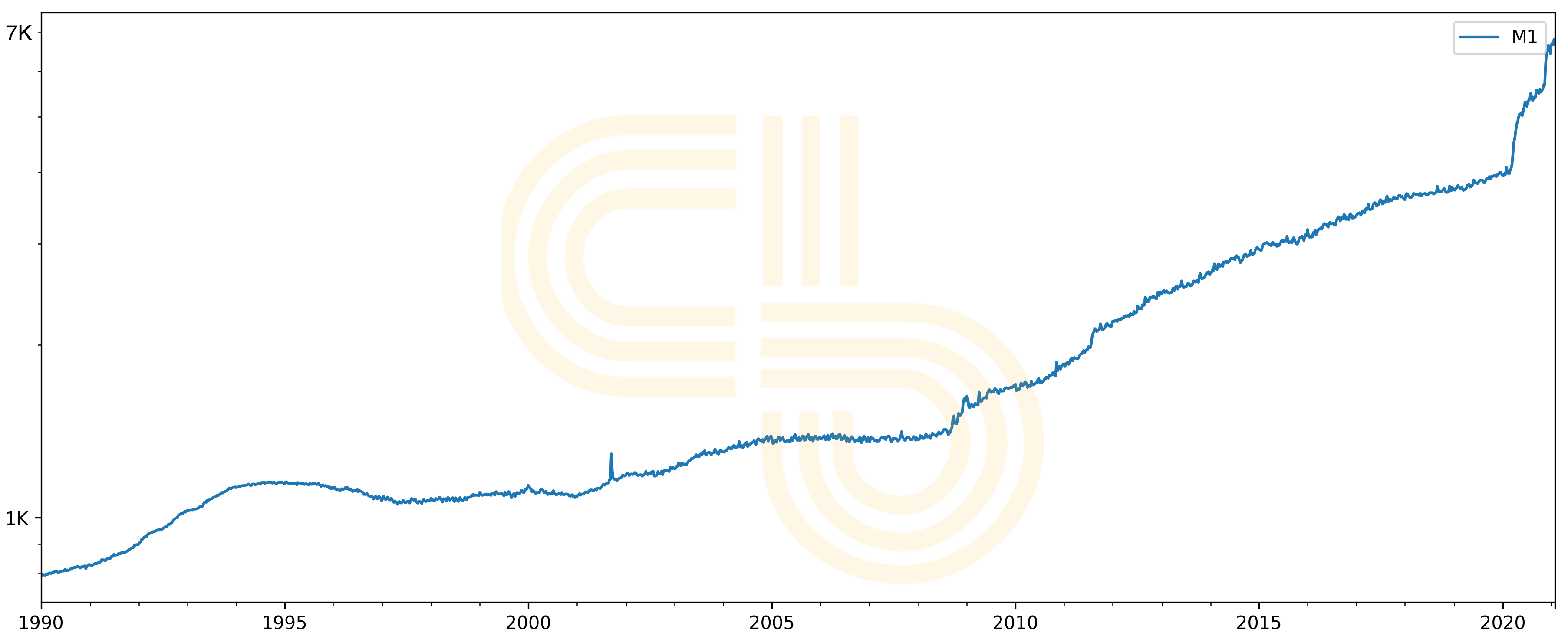

M1 money supply. Source: FRED.

On the S&P 500 chart, notice two notable recessions in the American economy. The first one is the infamous dot-com bubble, and the second is the 2008 housing market crash.

After the dot-com bubble, the economy was in free fall for about four years. Meanwhile, the money supply around this time was relatively flat. After the housing market bubble, it didn’t take much for the economy to bottom out. Here is the first time we saw the printers kick into high gear and go “brrrrrrrrrr.”

Jereme Powell and his “Money Printer” by Tim van Helsdingen

Financial markets are forward-looking. When S&P 500 bottoms out and then starts surging again, it’s not because the economy has actually recovered, but because institutions think stock prices will rise in the future.

With more money entering the economy, cash loses its value, and people would rather invest their cash in equities and other yield-generating assets. Inflation is the obvious result.

The consequence of more cash entering the economy is that equities will reach new highs even when the underlying companies show no change in profitability or underlying fundamentals. Sound familiar?

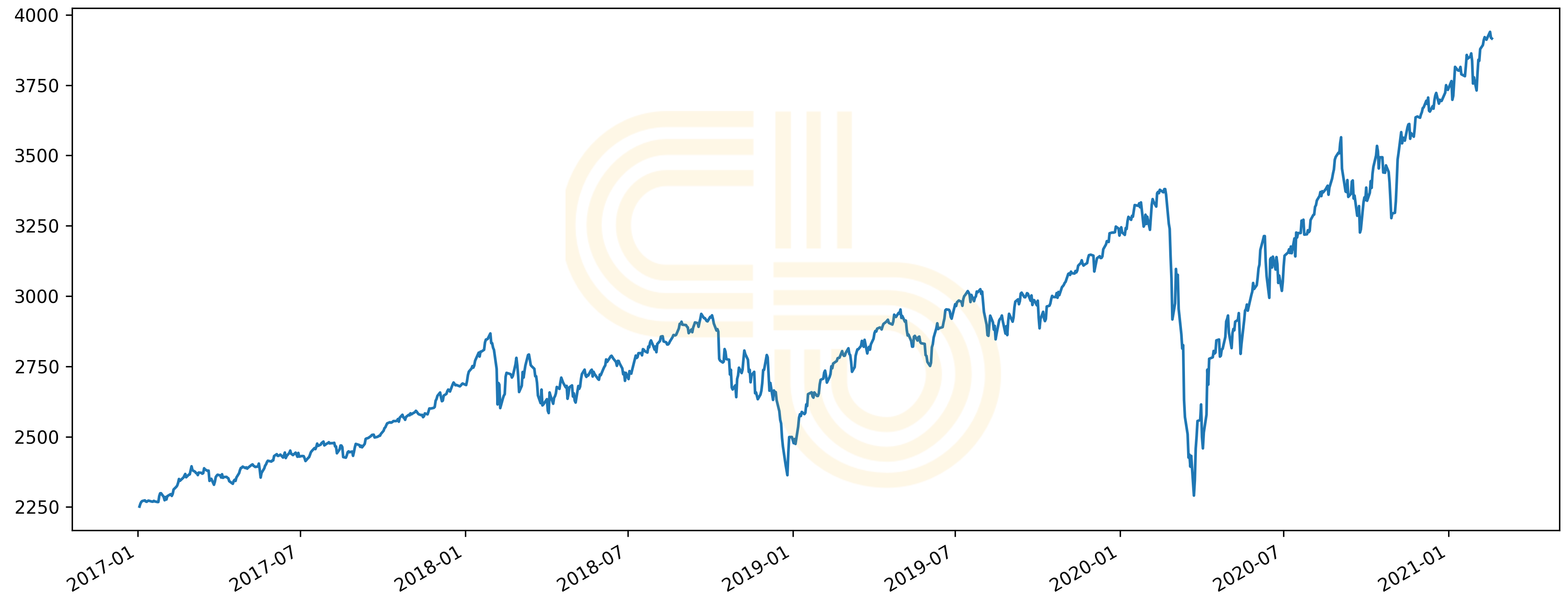

Retail investors pouncing on stock market drops, corporations plowing tax cuts into buybacks, and unchecked stimulus payouts are all forces that push the market up and up. As a result, the S&P 500 starts to recover more quickly. Now it only takes a few months for the economy to bounce back from even the heaviest blow.

S&P 500 price during the latest recessions. Source: Yahoo Finance.

As Bitcoin matures, it is likely that it will begin to resemble other heavily-traded assets. How do these changes affect Bitcoin’s next bear market?

When Bitcoin sees the next massive sell-off, companies may deem it a good investment from a risk-return perspective and jump in. Like stocks, my prediction is that Bitcoin prices will rebound more quickly than they have in the past.

However, more companies will need to follow Tesla’s example for this scenario to play out. Even today, BTC is primarily a speculative asset, and it will likely remain an afterthought for institutions if the stock market plunges anytime soon.

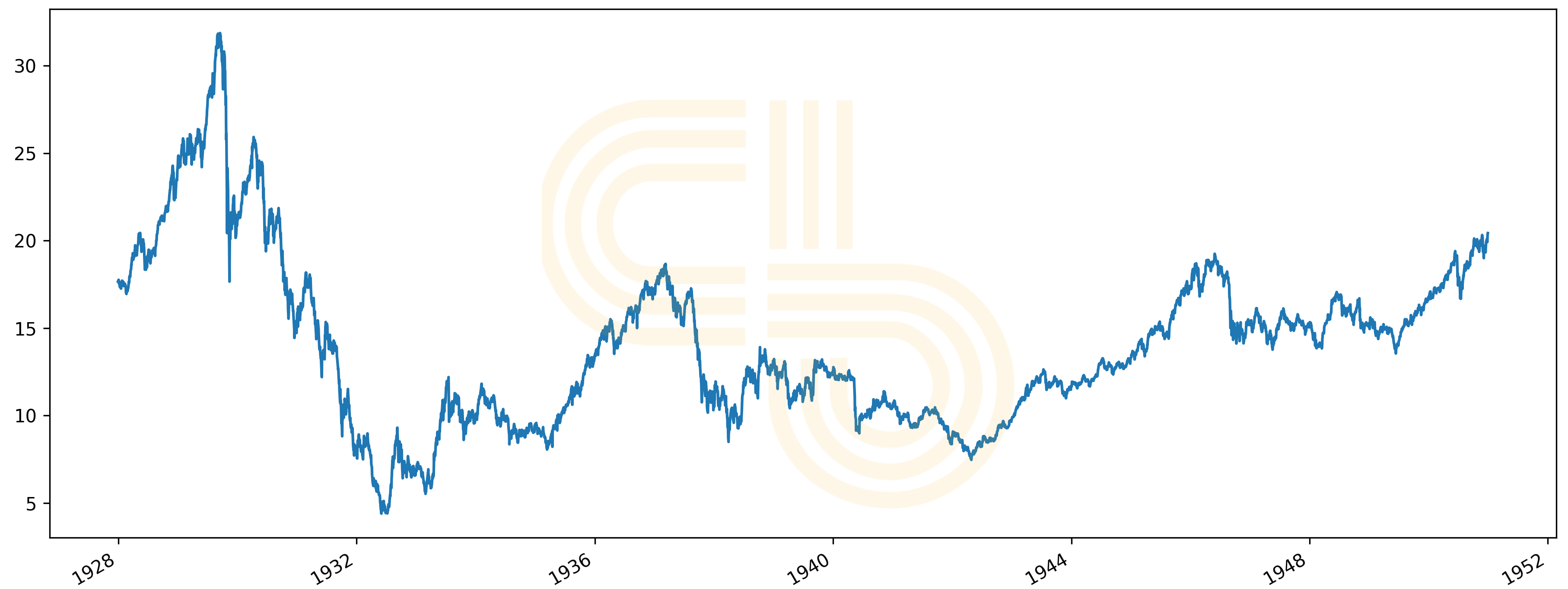

My prediction only holds if the US stock market continues to do incredibly well. Historically, the stock market can move sideways for decades, so we can’t rule the possibility of this pattern repeating.

Take a look at the stock market’s performance after the Great Depression in the 1930s. Twenty years of bleak price action doesn’t look very good for speculation. If a similar thing were to happen today, Bitcoin could trade sideways for decades alongside stocks once it matures.

Don’t be blinded by Bitcoin’s incredible returns. There is always the possibility that it trades sideways for long periods of time. Right now, Bitcoin is already the 6th most valuable asset in the world, and it’s hard to tell when it will reach full maturity. Keep this risk in the back of your mind when you place your bets.

S&P 500 after the Great Depression. Source: Yahoo Finance.

Still, these are predictions for the future. For now, the market is overextended by our estimations, slightly exceeding the short-term targets from our lead Bitcoin analyst, Nathan Batchelor. Although his long-term outlook is long-term bullish, the SIMETRI team is in agreement that a local correction is due.

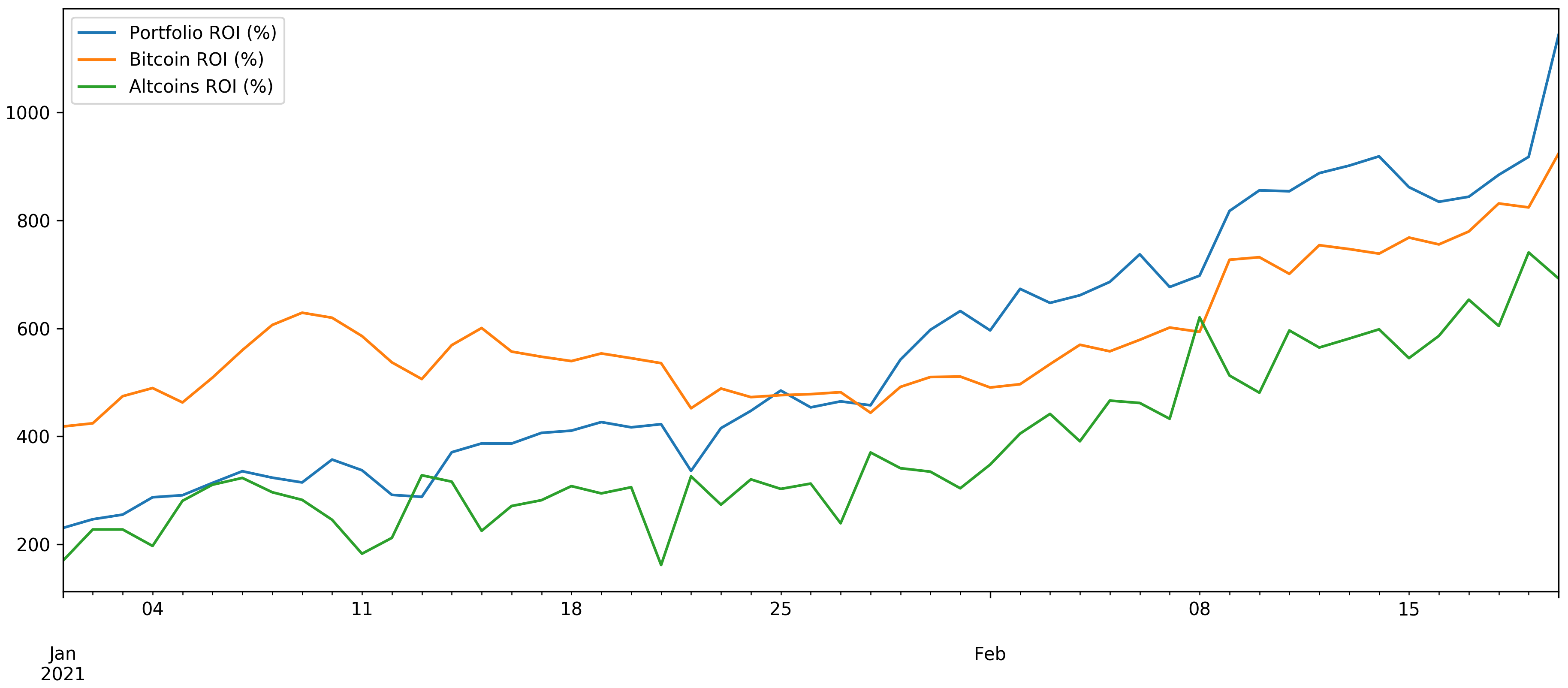

The altcoin market was largely suppressed by Bitcoin’s move upward, even though there were a few weeks of strong gains as altcoins caught-up. If BTC enters a sideways channel at this point, alts will likely pop. Otherwise, they will follow BTC’s drop or continue to have subpar performance compared to Bitcoin if it has another leg up.

SIMETRI Portfolio – Shooting High

As usual, the SIMETRI Portfolio is thrashing bitcoin and altcoins. As bitcoin took the lead and alts got hammered, our picks still shot up—emphasizing the strength of our portfolio. The portfolio’s current ROI is an astonishing 2528%.

Note: Recently, we started receiving feedback from members that the $100 positions on our hypothetical SIMETRI portfolio are too small. Right now, buying one of our picks could cost as much as $100 in transaction fees alone.

We want our hypothetical portfolio to model the average SIMETRI subscriber’s portfolio. So, from this Digest issue onward, we are changing our hypothetical position size from $100 to $1000 to give readers a more realistic picture of how to use our buy recommendations.