Tesla Bets on Bitcoin.

Bitcoin started in 2009 as an answer to the problems of traditional finance. It was not meant to be ‘nerd money.’ At least, that is what its creator Satoshi Nakamoto suggested with his inscription in the first Bitcoin block.

The road to becoming institutionalized is long. In fact, Bitcoin started as curious geek money, and the rest of the world shrugged and said “that’s kinda interesting.” It took 10,000 BTC to buy a few pizzas back in 2010.

Eleven years later, S&P 500 companies and countries are trying to get their hands on Bitcoin. Bitcoin’s derivative instruments like futures and options are already mature, and it’s only a matter of time before a Bitcoin ETF arrives.

One of the primary reasons for rising interest in Bitcoin (and crypto in general) is the unprecedented amount of inflation. The traditional financial system, once again, needs a bailout. However, printing more dollars isn’t a choice, it’s a necessity.

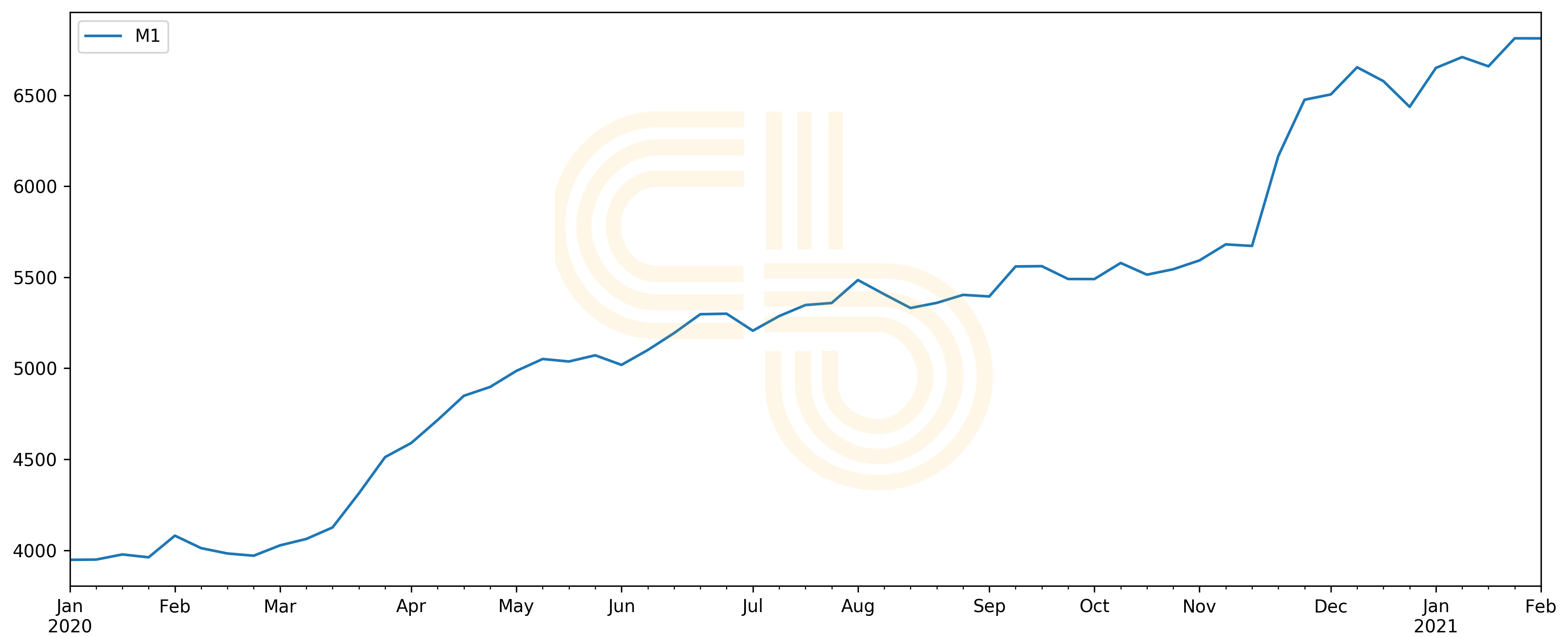

U.S. M1 money stock. Source: FRED.

The ‘cash is trash’ narrative is growing in popularity. With the government’s dedication to keeping inflation high, it doesn’t make sense for companies—or anyone—to hold their reserves in cash.

At minimum, businesses have to invest their money to protect it from inflation. But finding somewhere to invest that money is problematic. The world is starved for yield as central bank interest rates hit historic lows. And that’s where crypto comes in.

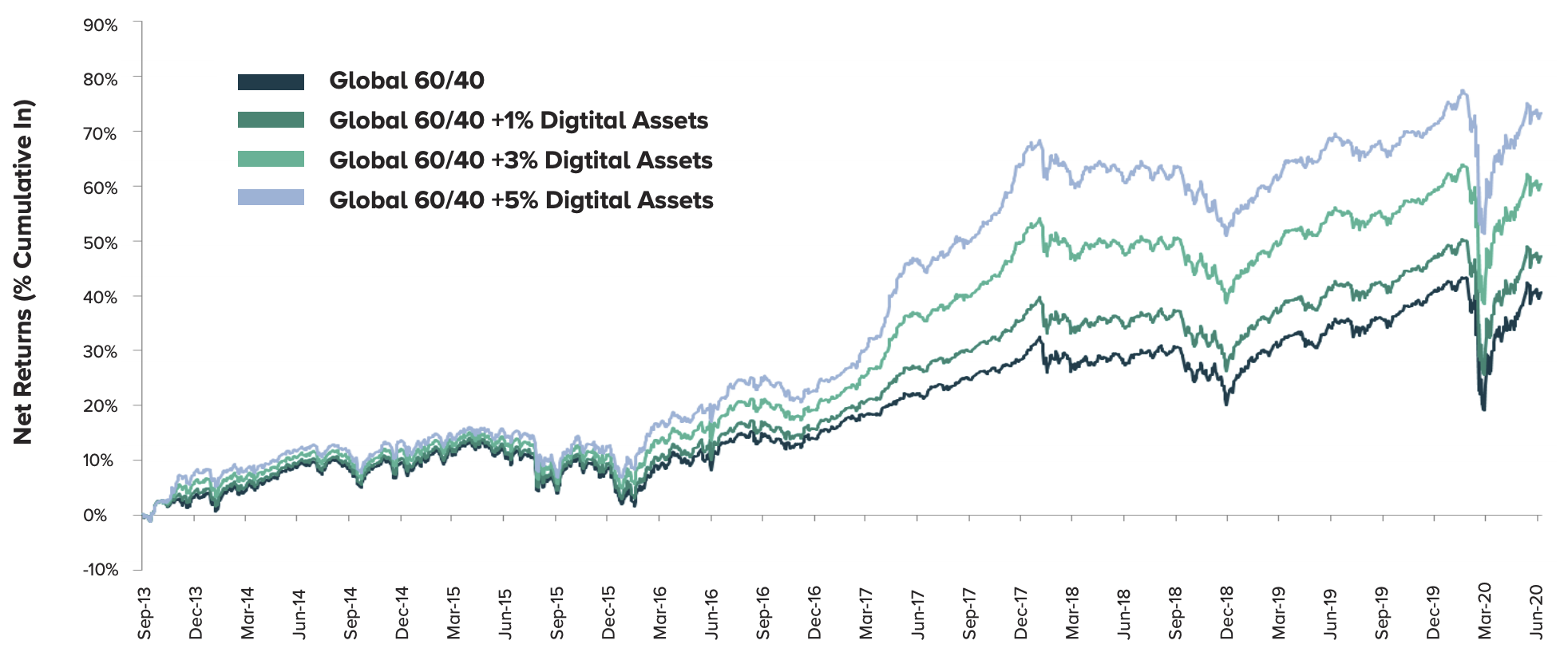

Cryptocurrencies are volatile but they make up for it in performance. Grayscale, one of the leading institution-focused crypto investment firm simulated portfolios with and without crypto exposure. It shows that keeping crypto on the balance sheet is a smart thing to do.

Portfolio simulations. Source: Grayscale Toolkit for Financial Advisors.

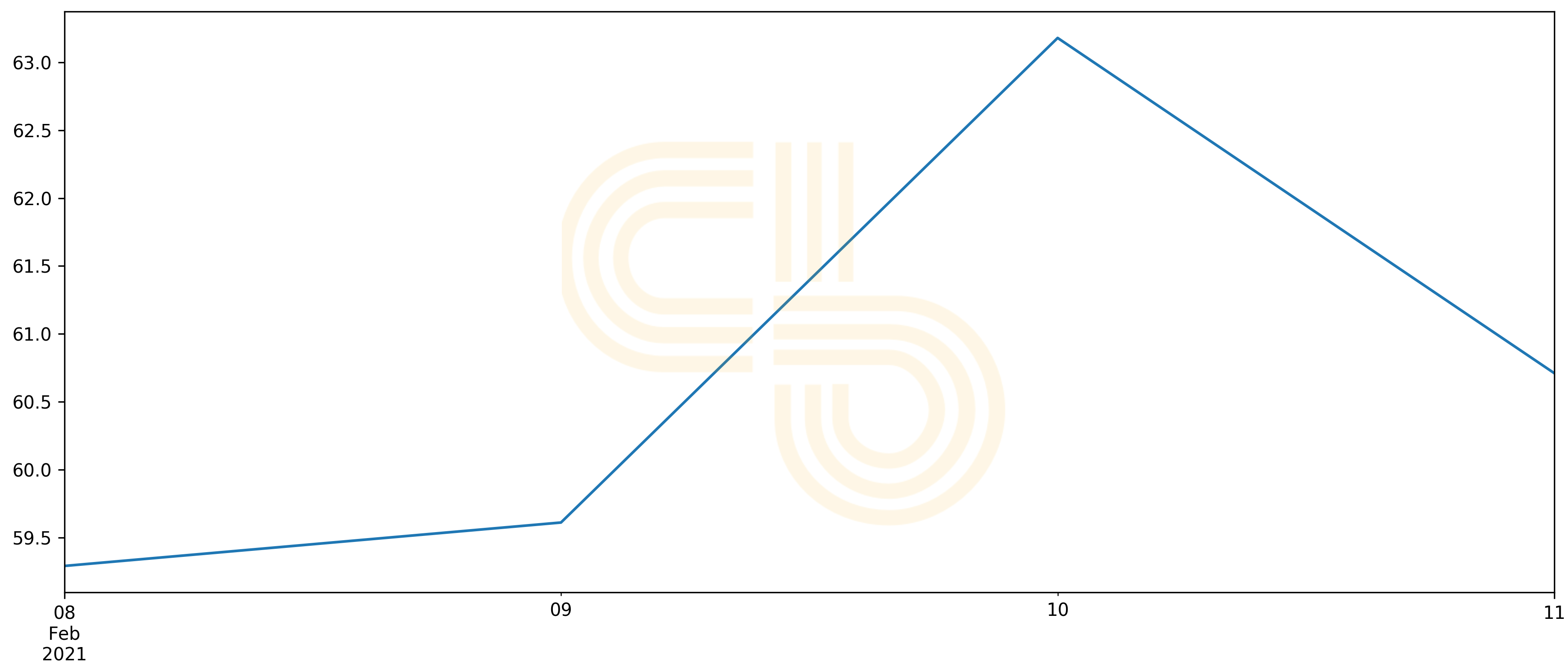

After companies like Microstrategy pioneered corporate crypto investment, the trend started to spread quickly. Most recently, one of the world’s largest companies, Tesla, reported buying $1.5 billion of BTC.

Shareholders see the writing on the wall for the greenback, so they react accordingly. When Tesla revealed its Bitcoin purchase its stock wasn’t affected, meaning that TSLA holders saw no risk in such an investment. Conversely, when Uber stated that it won’t invest in BTC, its stock plunged.

Uber stock. Source: Nasdaq.

The narrative quickly shifts from “it’s risky to hold Bitcoin” to “it’s risky not to hold Bitcoin.”

Moved by macroeconomic factors and retail sentiment, companies are pushed to enter the race of buying Bitcoin before everyone else does. If that happens, $100,000 per BTC doesn’t seem too distant anymore…

For now though, we are in the midst of the bull trend. At least in the short-term, BTC is likely to surpass $50,000 according to our lead Bitcoin analyst, Nathan Batchelor. The crypto market cap is almost $1.5 trillion, which is overwhelmingly positive for both BTC and alts.

Still, with all eyes on Bitcoin altcoins are slowly losing the market’s spotlight. We may see BTC sucking liquidity from alts once again before the alt season resumes.

SIMETRI Portfolio – Continuously Beating the Market

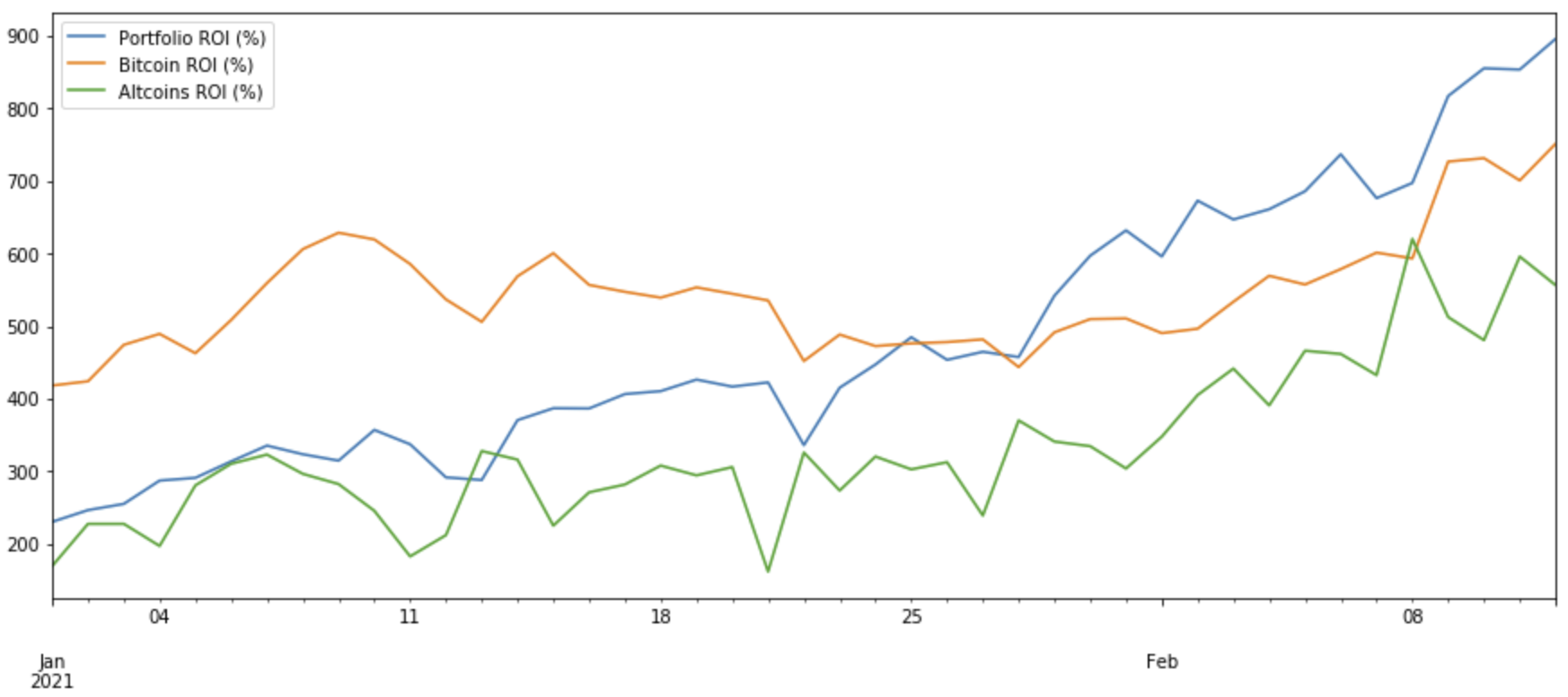

If you’ve been closely following the Portfolio Digest, it may sound like I’m beating a dead horse, but I can’t help but enjoy seeing our portfolio crush the market. Despite Bitcoin’s run up, our portfolio has still outpaced BTC. Currently, the Portfolio’s ROI is 2105%.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.