Crypto’s Ethereum Killers.

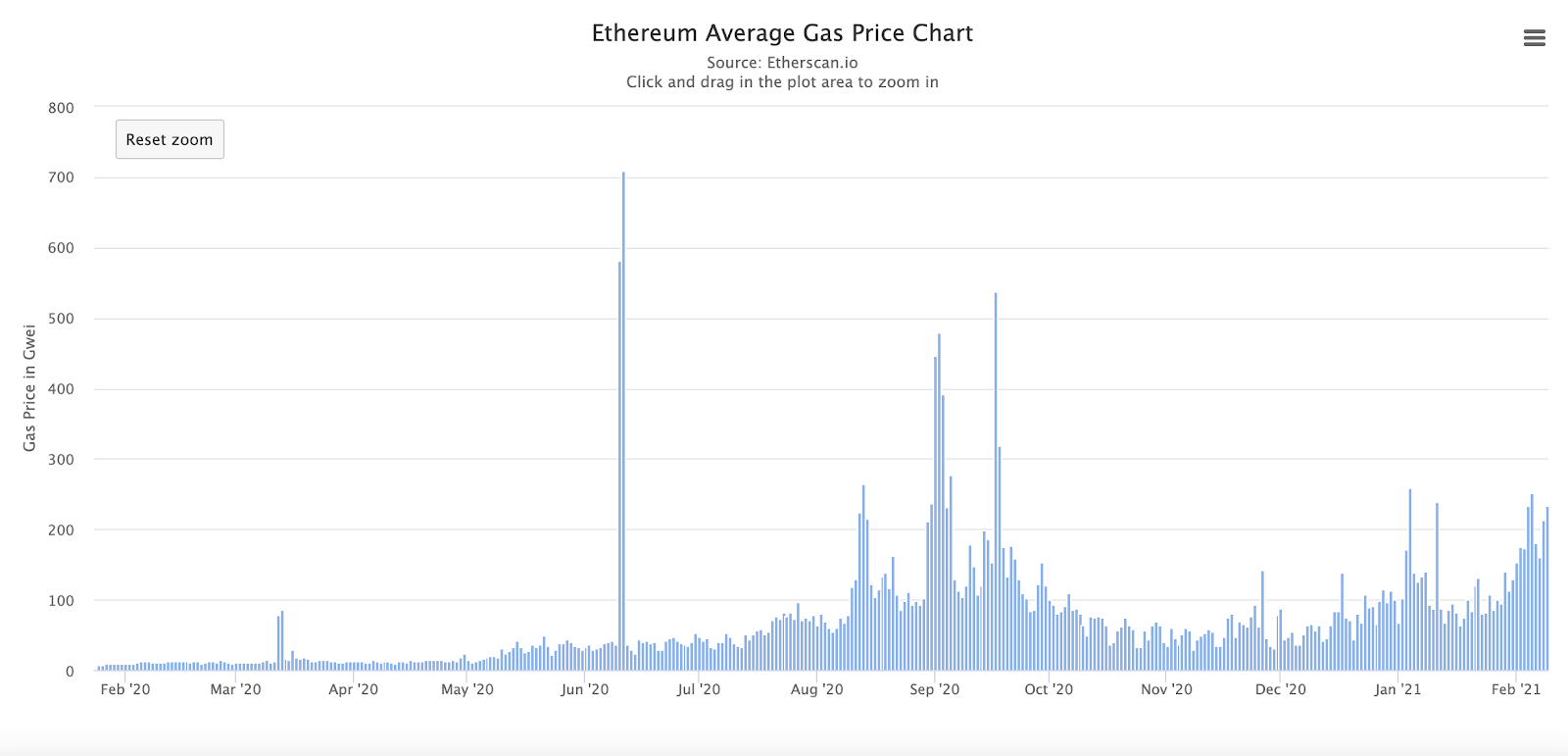

High transaction fees are once again choking crypto adoption. Currently, most of the decentralized finance (DeFi) action happens on Ethereum, which is struggling under the load.

I won’t dive into why Ethereum gas exists and which projects try to make the network cheaper; you can read about it in my analysis here. The fact is this—doing most anything on Ethereum is ridiculously expensive right now, and the problem is likely to worsen.

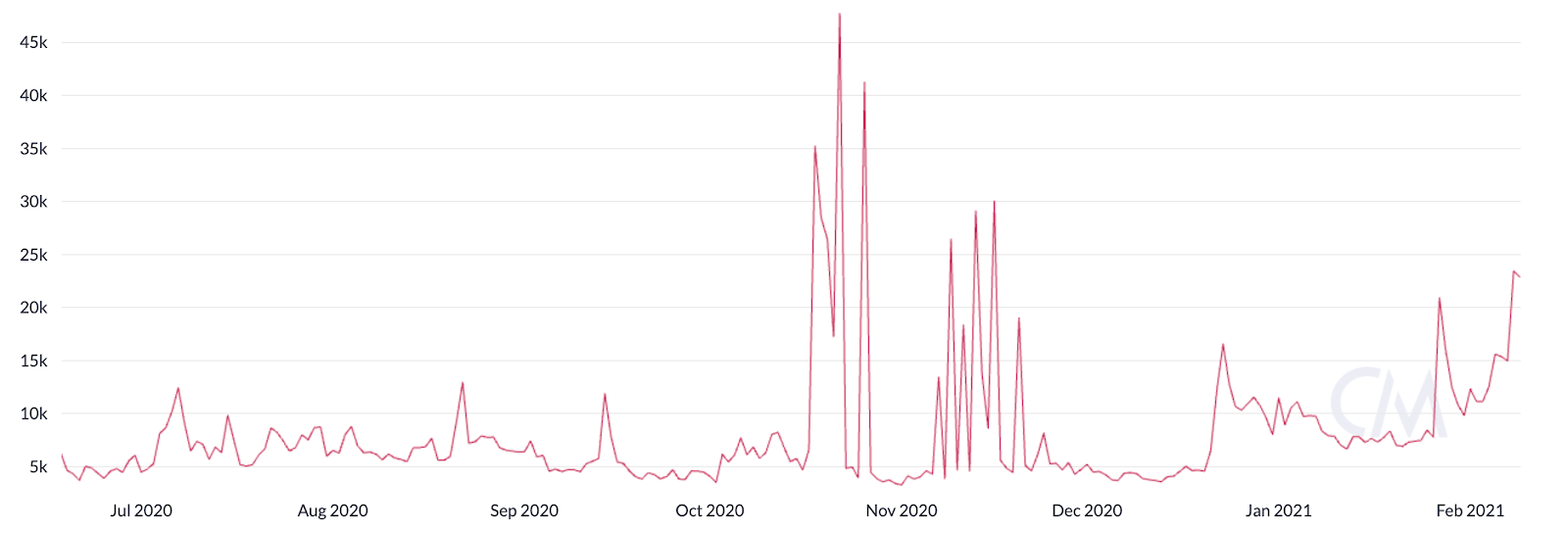

Ethereum average gas price. Source: Etherscan.

Congestion on Ethereum is nothing new. The SIMETRI team acknowledged the network’s drawbacks from the get-go. Layer-1 platforms that appeared after Ethereum’s launch also realized that scalability would be a problem in the future, hence why there are so many blockchains that promise faster speeds and cheaper transactions.

Yet, over five years since Ethereum’s launch, it remains the epicenter of decentralized application development. Neither Tron nor EOS, two blockchains that raised billions, could unseat the slow and expensive creation of Vitalik Buterin and his team’s slow and costly creation.

In 2021, I predict that Ethereum killers will re-emerge with a vengeance. Since 2017 many more Layer-1 competitors have sprung up. But it’s not just the number of competitors that’s different. Demand from cryptocurrency’s retail segment has exploded, and that pent-up demand seems ready to spill into other blockchains.

Can Ethereum lose its leading position this time, or does it have the secret sauce that will allow it to hold onto its top spot? Let’s find out.

What’s Up With Ethereum Killers?

The easiest, most efficient, and representative way of assessing Ethereum killers is by looking at their on-chain statistics. Each platform’s community (including Bitcoin and Ethereum) will shill their beloved project to newcomers, saying that their solution is superior.

Fortunately, we don’t need to trust shills. We can look at the data.

I took the liberty of selecting a couple of Layer-1 platforms that I think have the potential to unseat Ethereum. You can find similar charts to assess any network’s traction.

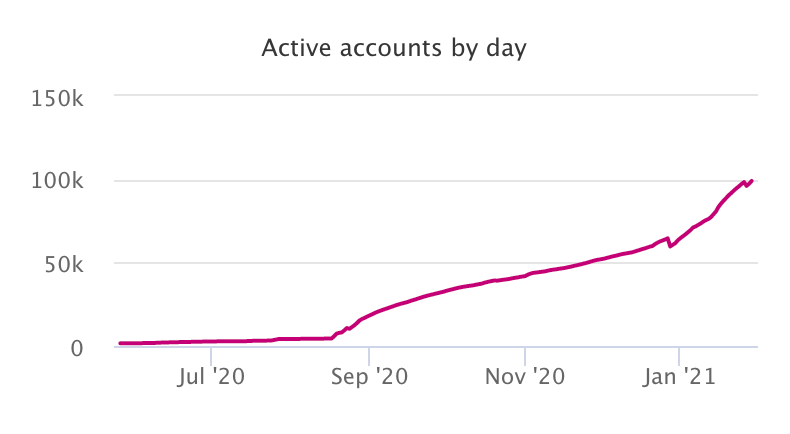

Polkadot

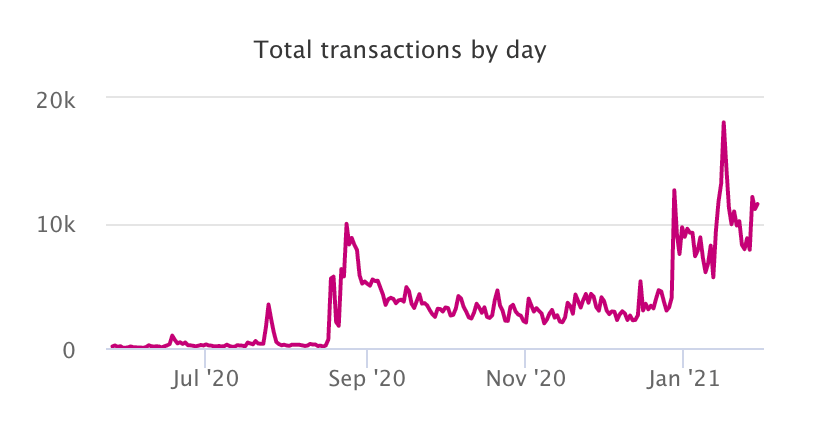

Polkadot has been in the works for a while but launched only recently. Since then, both the number of addresses and the number of transactions have been on the rise.

Polkadot active addresses. Source: Polka Stats.

Polkadot daily transactions. Source: Polka Stats.

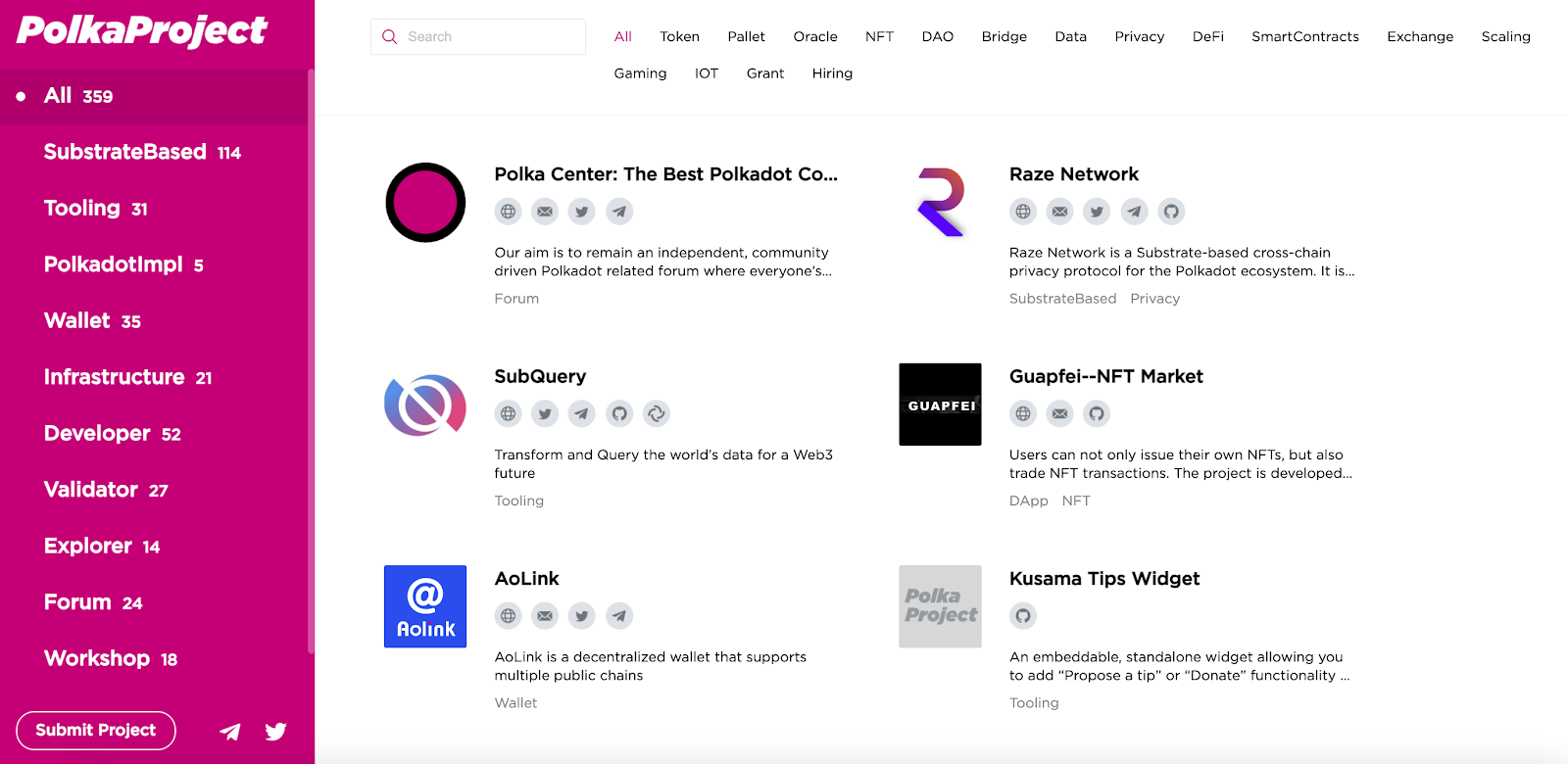

Besides, the number of teams building on Polkadot has been quickly growing. Token sales for Polkadot-based projects happen every week, and the ecosystem resembles Ethereum during the ICO mania.

Overall, Polkadot is doing well in terms of its adoption and growth. Add to this the expanding ecosystem of Kusama, Polkadot’s testnet—and one of SIMETRI’s previous buy recommendations—to see that both users and developers pay attention to this network.

Binance Smart Chain

Binance Smart Chain (BCS) piggybacks on Binance’s dominance as a centralized exchange. From a technological standpoint, BCS doesn’t have much going for it. It’s mostly a copy of Ethereum with a smaller handful of nodes to speed things up.

However, the bullish factor for BSC is financial and media support. Binance is a well-known brand with sizable liquidity and a large user base attached to it. Changpeng Zhao and his team have everything to kickstart BSC ecosystem growth by incubating projects and funneling existing Binance customers to BSC-based products.

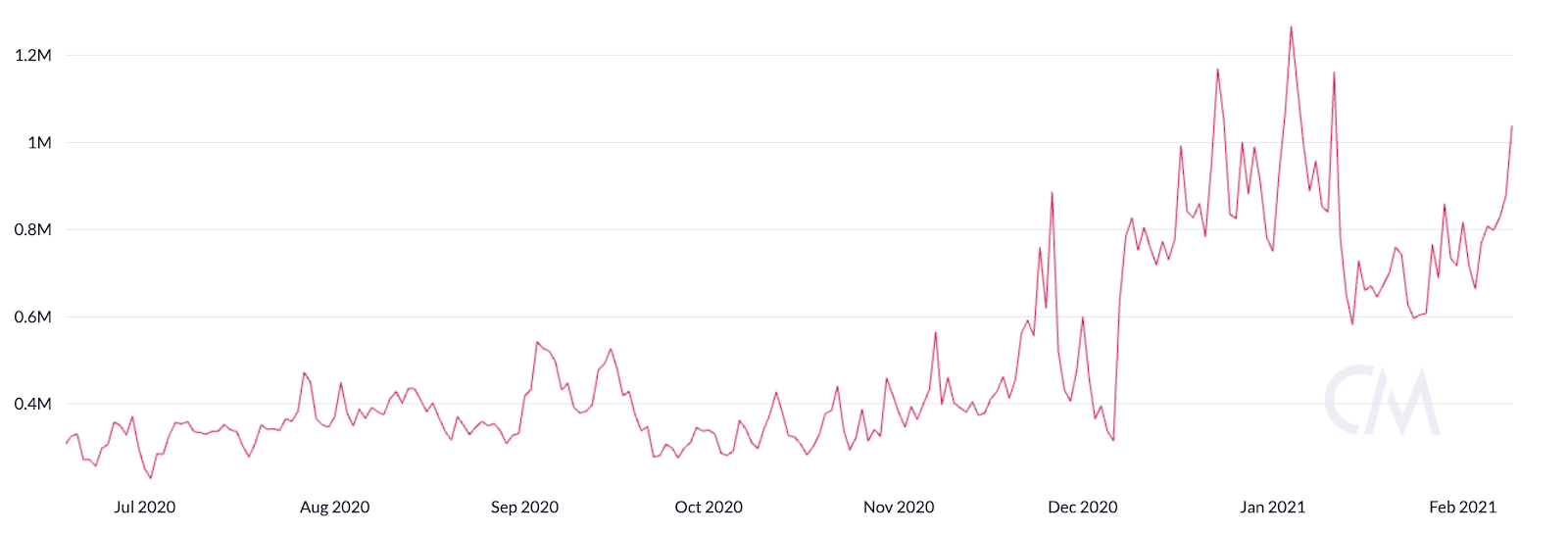

For now, however, on-chain data shows that BSC doesn’t have a strong uptrend in terms of usage.

BSC active addresses. Source: CoinMetrics.

BSC daily transactions. Source: CoinMetrics.

While BSC has seen some bump in usage starting from mid-2020, it’s too early to say whether the growth is sustainable. Still, connection to one of the world’s largest centralized exchanges can be a “killer feature” for BSC-based apps.

The limiting factor for most dApps is users, not speed or cost. Having the option to open up the floodgates to liquidity and customers is a major advantage.

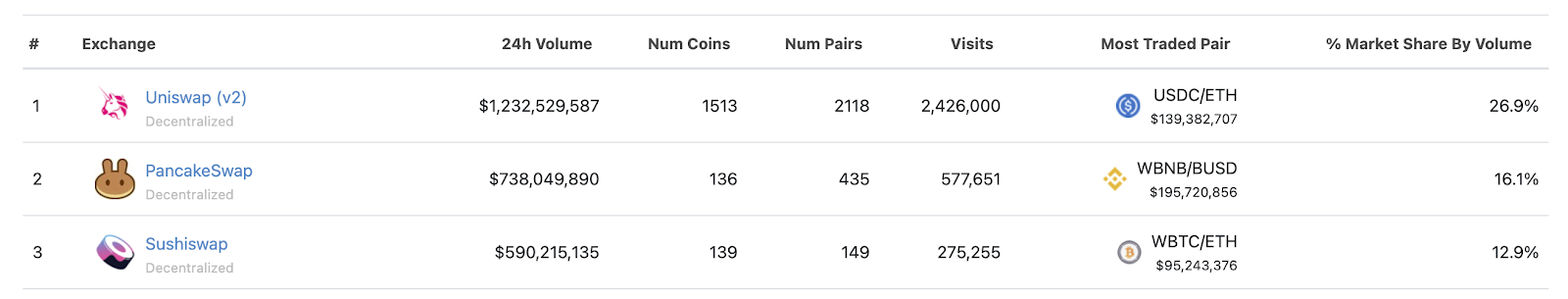

Trading volume on top DEXes. Source: CoinGecko.

Caveats of Spotting a Winner

Getting a network to critical mass is difficult. At a certain point, a Layer-1 blockchain needs to gain enough momentum to make further growth self-sustaining. When market sentiment is bullish, numerous Layer-1 projects look strong.

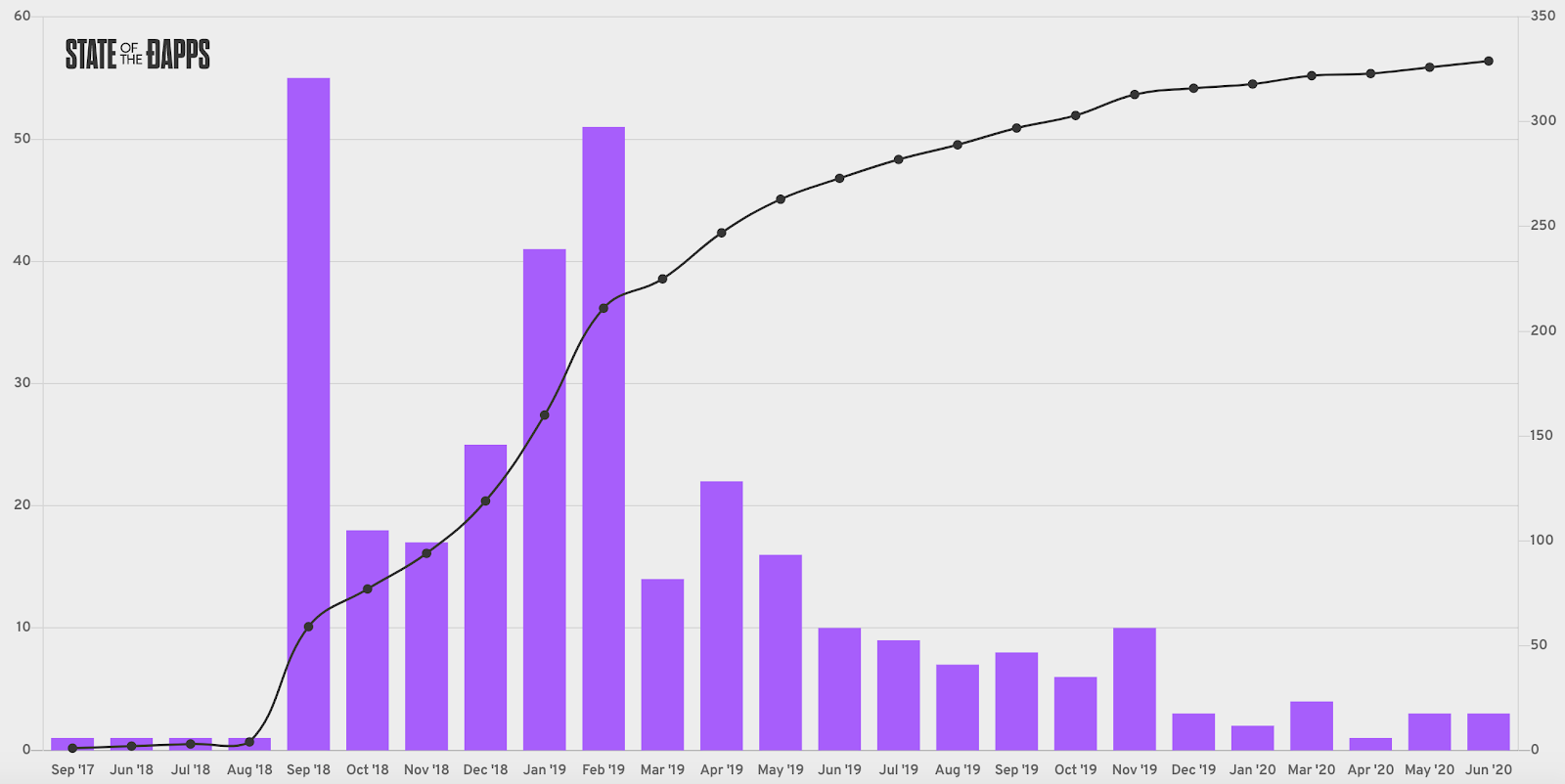

However, once the market starts going south, short-term-focused users and teams abandon the previously rising chains. Looking at the data, one of the blockchains touted as the likeliest Ethereum killer in 2018-19 is now a ghost town.

New dApps per month on EOS (purple). Source: State of the Dapps.

Financial incentives drive the majority of users and teams to choose another network instead of building on Ethereum. It can be low transaction fees, staking, or token sales. Yet, if they don’t offer anything outside of financial incentives, the ecosystem lacks the glue to hold everything together. Like EOS, things for a Layer-1 can quickly fall apart.

Composability is King

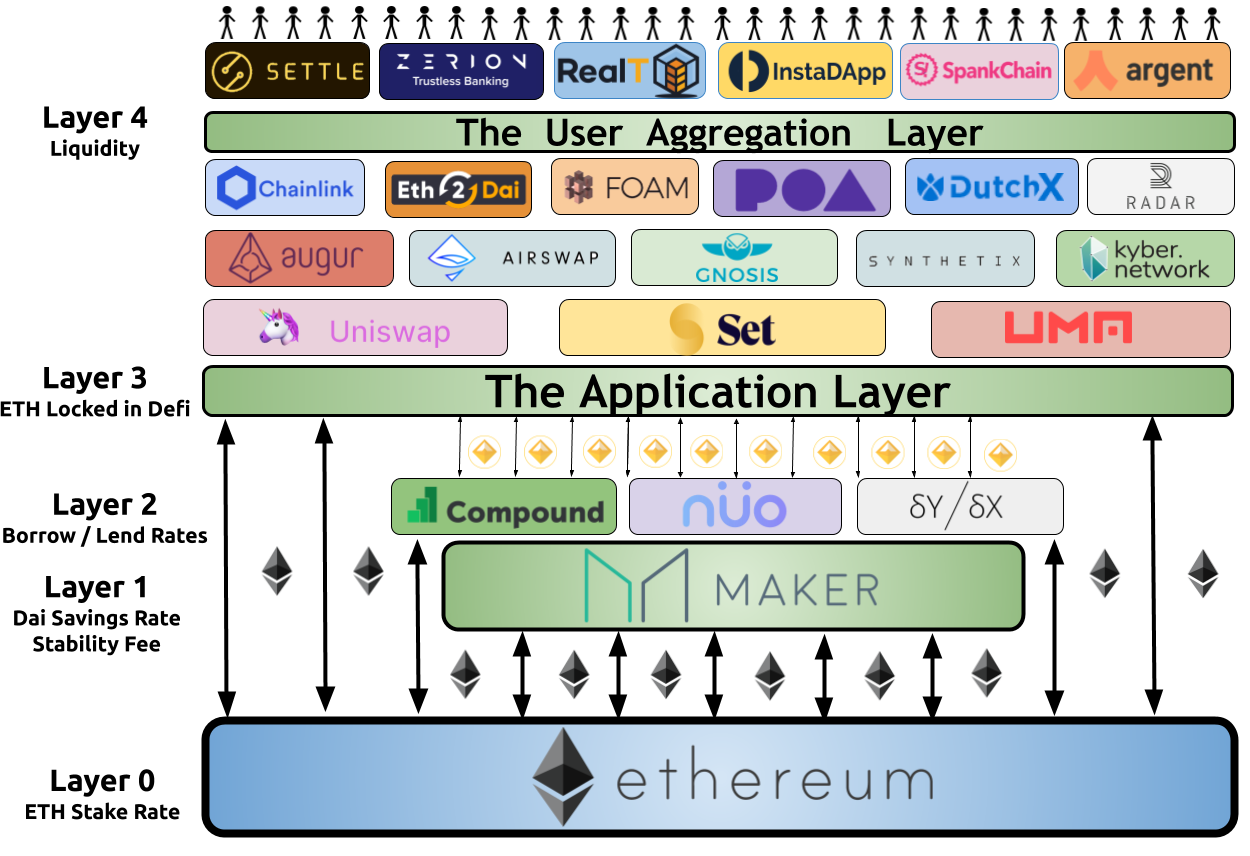

An essential factor that contributes to both the user experience and software developer retention is something called composability. You may have heard the expression “DeFi legos,” which means that dApps are tightly knit and interconnected.

DeFi stack. Source: The Defiant.

The more dApps on a network actively ‘talk’ to each other, the better chances are that new opportunities will emerge from these interactions. New teams will join the process of building a system and design essential infrastructure tools. As time passes, basic tools become better for the entire ecosystem, allowing the developer community there to flourish.

This phenomenon explains the power of DeFi on Ethereum. If a project migrates from Ethereum, they lose connections to the existing ecosystem, community, tools, and customers. Hence, the chain it migrates to should, at minimum, provide a comparable environment or make up for it using financial incentives. And we know financial incentives don’t work in the long term.

Ethereum still has the most vibrant ecosystem out there, thanks to its long history of community building and tool crafting. Surely some of Ethereum activity will bleed to faster chains until the network’s scalability improves. But, unless an Ethereum killer nurtures a similar community, they are unlikely to unseat the leader.