Welcome to the Altseason.

Since we started Portfolio digest, the mantra was “hold tight and wait for the outsized returns to come to you.” I’m happy to say that the altseason we’ve all been waiting for has started.

The recent BTC correction was stopped by a swift improvement in sentiment around crypto. Arguably, it all started with Elon Musk putting “Bitcoin” in his Twitter bio. After that, several high profile non-crypto influencers tweeted about crypto, mostly DOGE.

Elon Musk Twitter bio. (Note: “Bitcoin” hashtag was recently removed from his profile)

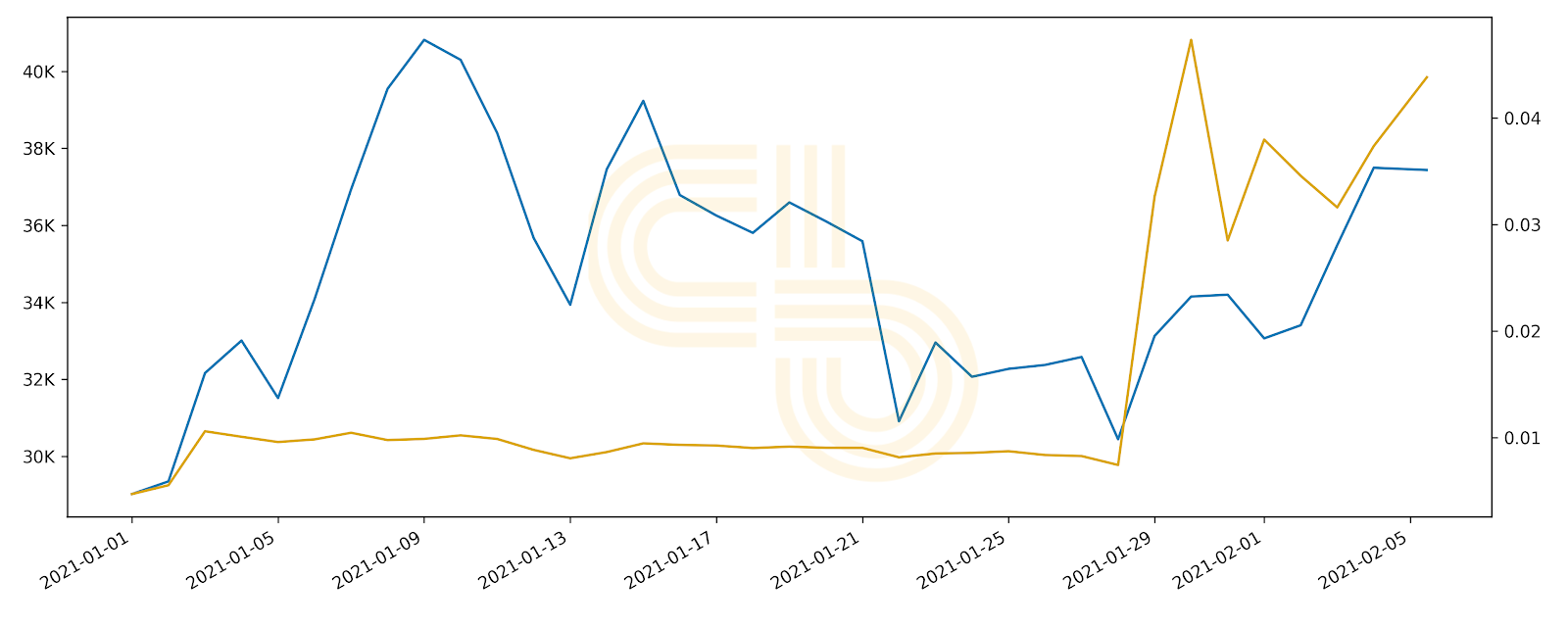

BTC (blue) vs. DOGE. Source: CoinGecko.

As BTC started ascending, more sustainable bullish signals surfaced. For instance, Visa is going to foster crypto integration in the traditional banking space. Another example is another BTC purchase by MicroStrategy. This time the company bought 295 BTC for $10 million in cash.

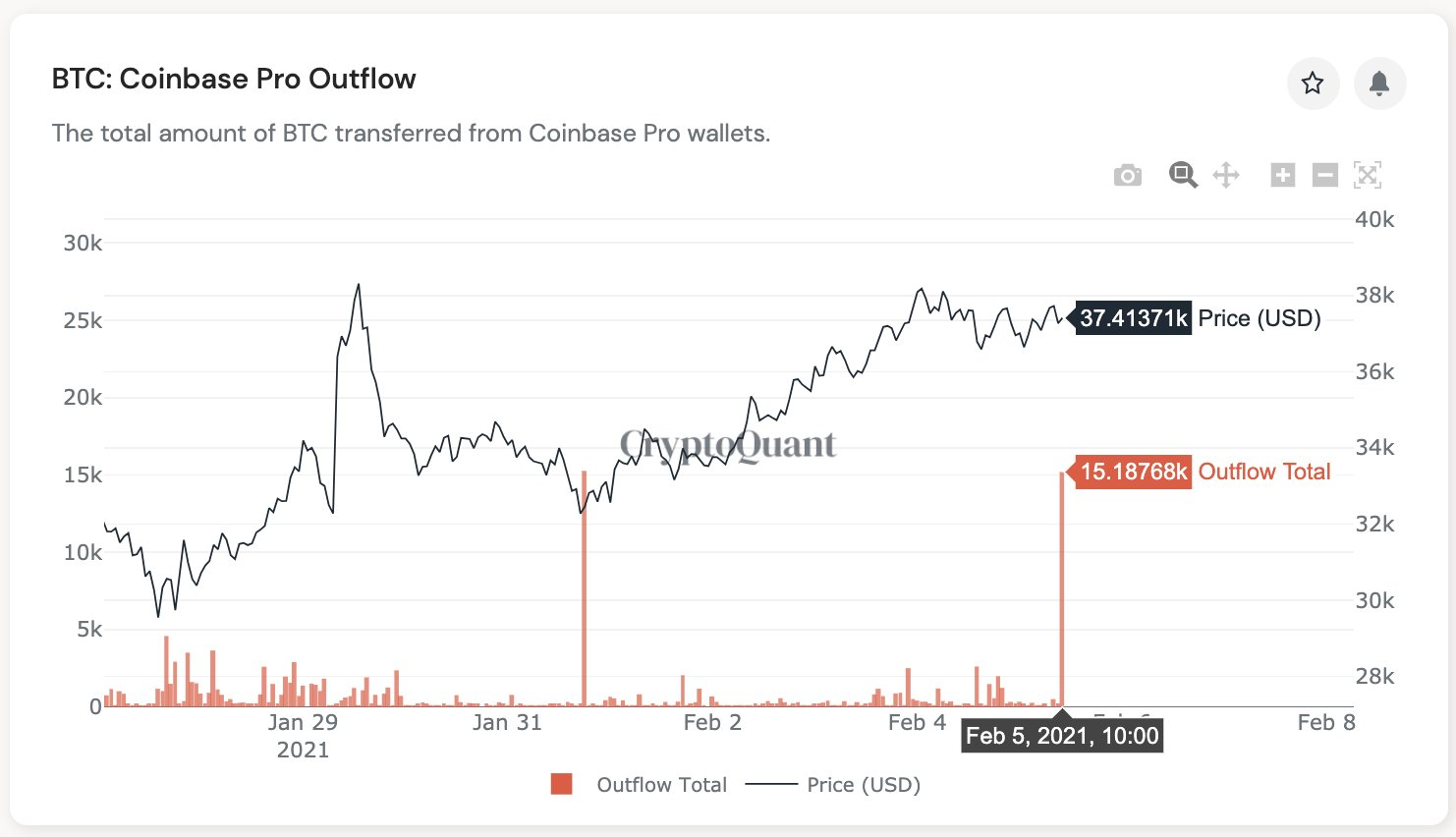

MicroStrategy wasn’t alone. The chart of Coinbase outflows shows that large players are actively adding BTC to their balances.

BTC outflow from Coinbase. Source: CryptoQuant.

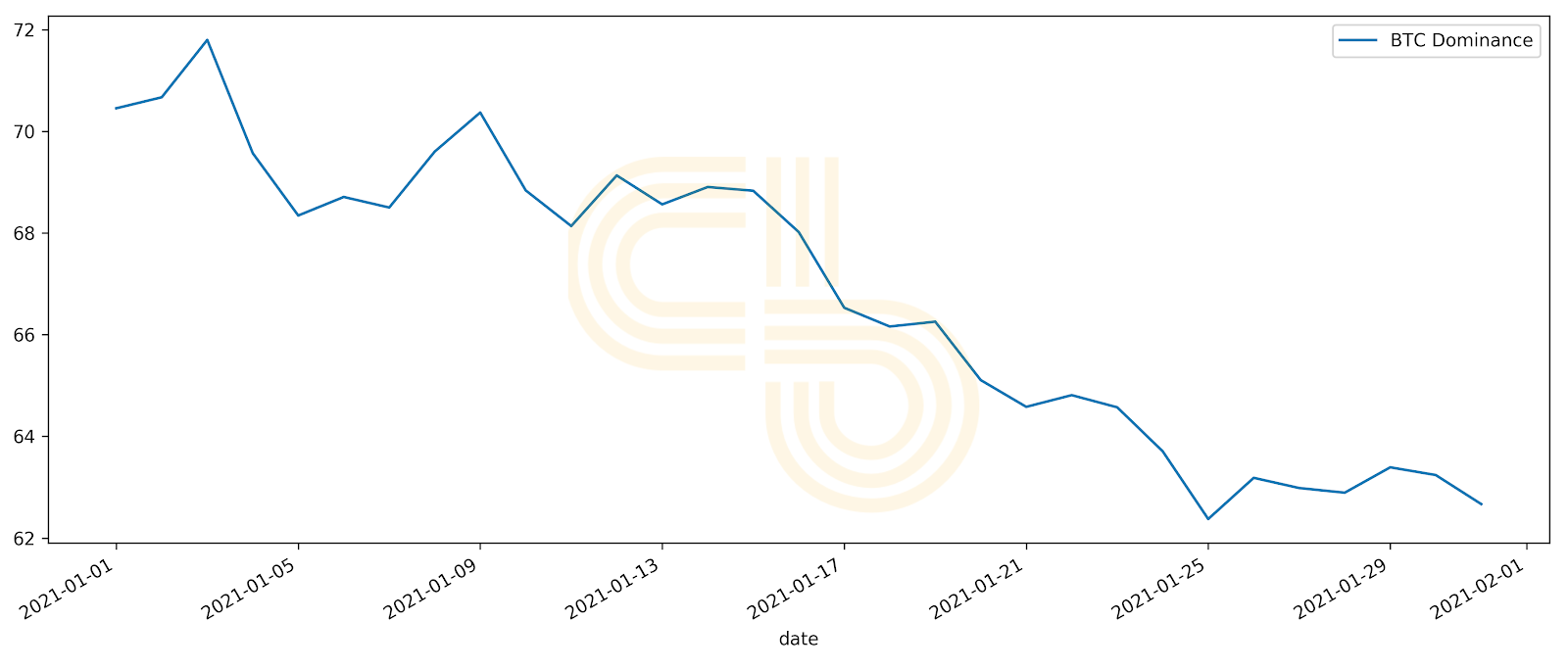

Despite the bullish activity around BTC, its dominance has been declining. Altcoins finally entered the growth stage.

BTC dominance. Source: CoinMarketCap.

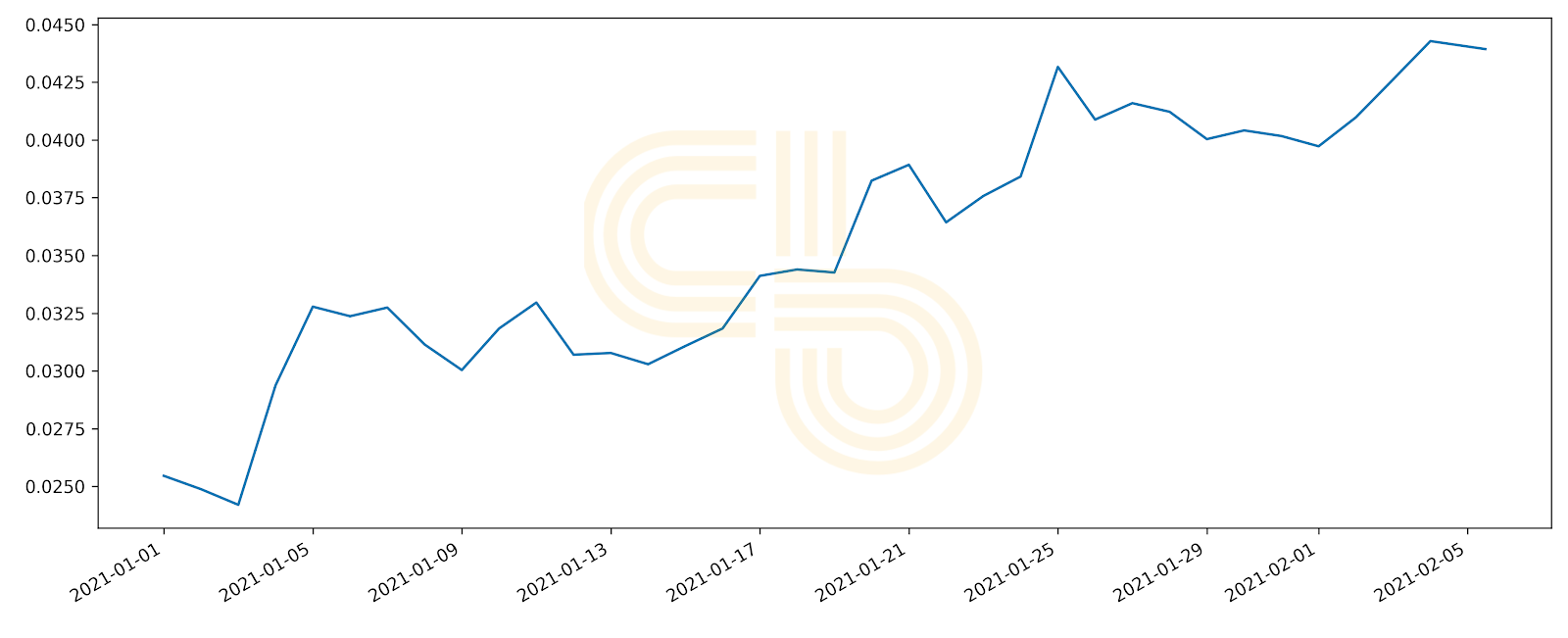

Ethereum broke its 2017 ATH. Importantly, ETH has been growing against BTC, which means that market participants start to have more appetite for risk. Smaller cap alts performed even better amid the overall optimism.

Ethereum price in BTC. Source: CoinGecko.

As Ethereum gets more expensive and the activity on it grows, gas prices soar. This makes decentralized apps on it inaccessible for many users. The market is heated, and a correction is due.

Still, there’s likely another leg up before that happens. According to our lead Bitcoin analyst, Nathan Batchelor, BTC looks like it’s getting ready to challenge $42,000 to $43,000. However, the broader target still looks to be $55,000.

The good news that while many other investors are chasing green candles, SIMETRI subscribers are calmly riding the wave.

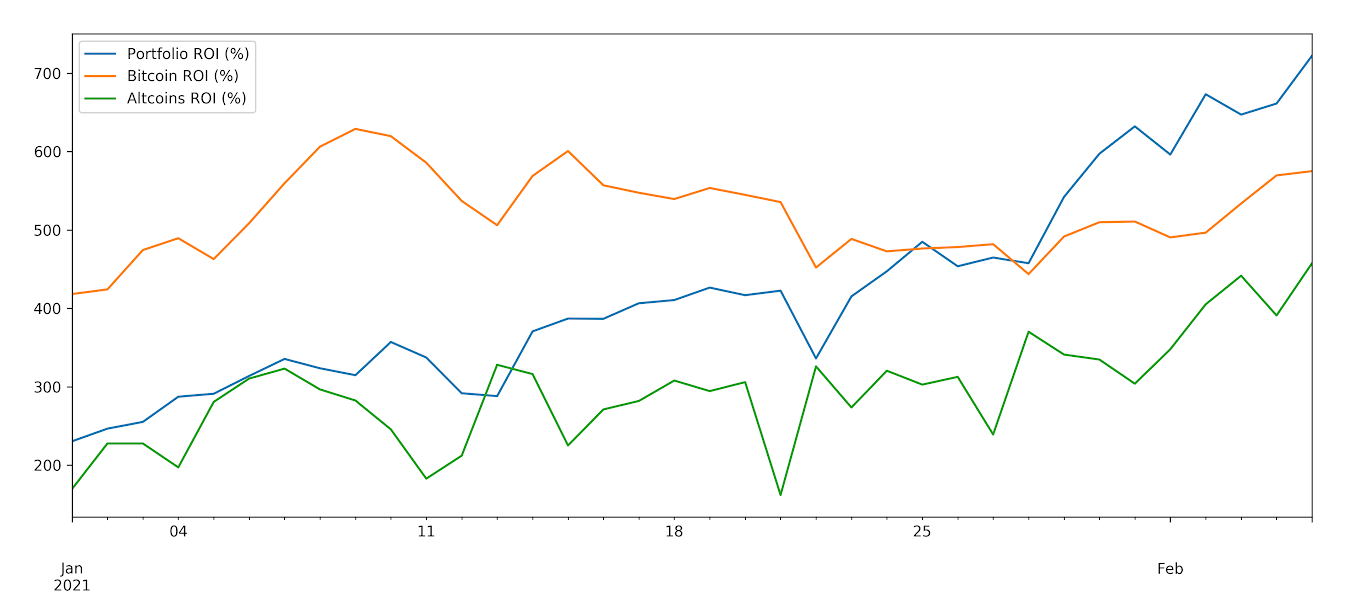

SIMETRI Portfolio – 20x Faster Than Bitcoin

Last week, SIMETRI Portfolio posted another achievement by breaking past the 2000% ROI mark. Like I said across the previous issues of the Digest, we needed to wait until BTC gives altcoins room to grow, and now it’s happening.

Importantly, our Portfolio continues to outperform the rest of the market. Projects with stronger fundamentals capture value better. And if SIMETRI’s track record says anything, it’s that we know how to pick projects with strong fundamentals.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.