Rule #1.

As BTC is rebounding after giving us some stress over the past couple of weeks, I want to remind you of rule number one in any market: survive.

Many treat markets as a way to generate income, and due to the injection of immense amounts of money in the system post-pandemic, it started to look easy, but it’s not.

Some of those who jumped in tech stocks in 2020 when they were booming got burnt as the earnings reports came out. Not all of them survived this wipeout.

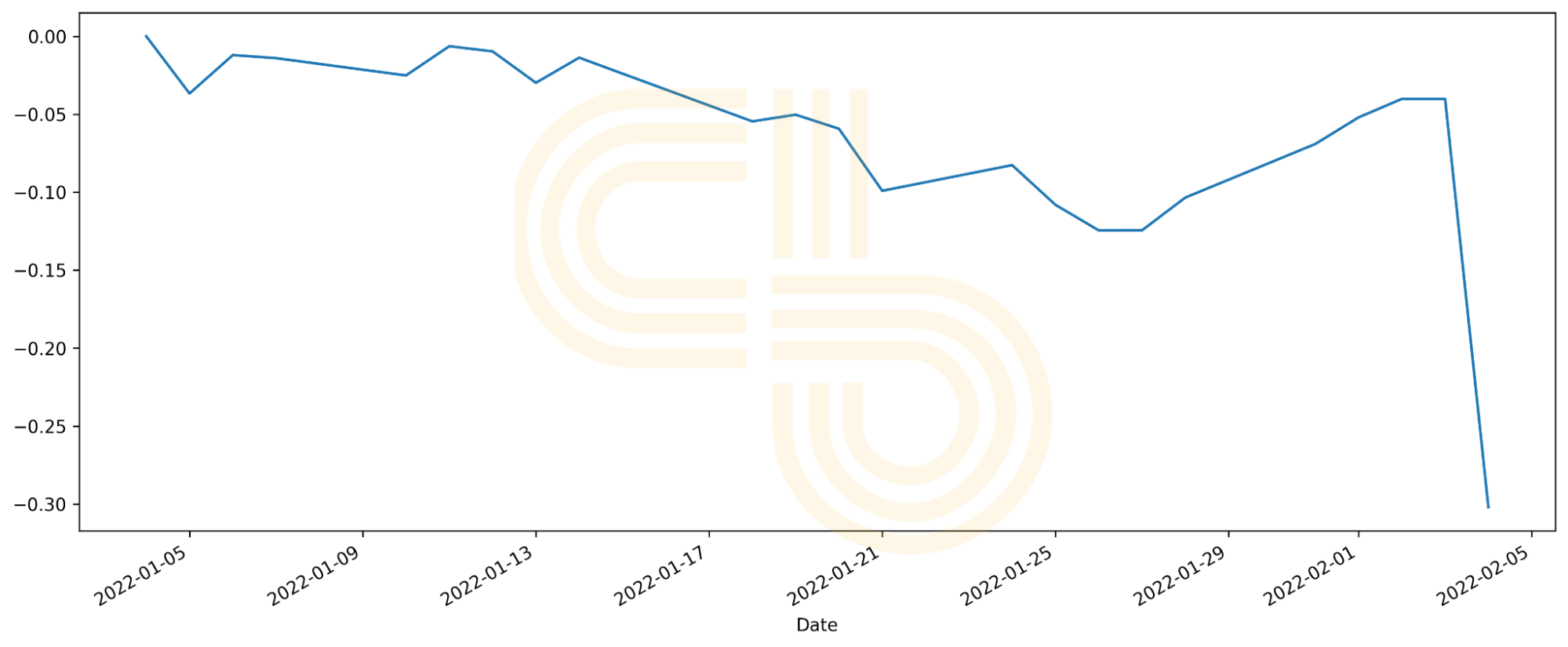

Meta (Facebook) drawdowns in 2022. Source: Yahoo Finance.

Some got over-leveraged; others put in the money they couldn’t afford to lose. The main issue here is that, in general, if people get burned like this, they may not return to the market in decades and miss many great opportunities.

The markets are inconsistent, and there should be no expectation to build cash flows solely by investing. Earlier it was possible, and day traders did it, but algorithms came and pushed people out.

On higher time frames, sentiment is distorting what seems fair. Euphoria extends prices to exuberant levels, and extreme fear causes extended sell-offs. Sentiment rules, and while you can play along with it to some extent, you should always remember about rule number one.

Theoretically, we can be entering a wide sideways grind in the stock market that can continue for months, even years. I have never lived through a period like this, but I think that’s where many will get burned. For others, it may end up being the best entry point.

While I agree with people who consider the Fed a helping force for the economy, there’s high uncertainty about their actions and sentiment rules. And that uncertainty may keep the market stewing for a while.

But, as I said, if the goal is to survive and pick up good-looking projects, the risk of an extended choppiness shouldn’t appear scary. After all, we picked our best performers when the market was performing the worst.

So, if you are reading this, this is the time you don’t leave and follow rule number one, even if the recovery doesn’t come as soon as you want it to.

SIMETRI Portfolio – Pending for a Recovery

Overall, the Portfolio’s performance remains similar to the previous week and is around 1,000% at the moment. However, given the BTC move up, we should see a bump in the performance in the coming days. Whether or not that bump will be sustained depends on the market’s sentiment.