WTF is “Curve Wars”?

The last six months in DeFi look like they came straight out of one of Dan Carlin’s Hardcore History podcast episodes. Some of the largest protocols in the space are fighting for liquidity, and this war is slowly but surely changing the entire DeFi landscape.

The so-called Curve Wars are arguably one of the most important happenings in crypto, and there are good reasons why you’ll keep hearing increasingly more about them in the near future.

Today, I’ll do a breakdown of the Curve Wars and explain how bribes and the “vote escrow” primitive are changing how DeFi projects will facilitate their business in the future.

At a high level, the Curve Wars are a fight for deep liquidity. For the uninitiated, liquidity refers to the quantity of crypto assets available for trading on a particular exchange. Liquidity is important because it determines how easily an asset can be traded for other assets without impacting its market price.

Deep liquidity means traders can efficiently execute large trades without incurring slippage—a phenomenon referring to the difference between the expected and the actual price of a trade. Low liquidity makes trading disproportionately more inefficient and expensive, which repels traders and dries up liquidity even more. It’s a vicious cycle.

Therefore, sourcing and securing liquidity is the end-all and be-all for all DeFi projects looking to succeed. Being the largest decentralized exchange for like-pegged assets like stablecoins and various versions of BTC and ETH, Curve is at the center stage of the liquidity wars. It is the go-to place for trading stablecoins, hence why for many stablecoin projects securing liquidity on Curve has become an existential issue.

The way DeFi protocols typically secure liquidity is through liquidity mining. It means rewarding liquidity providers with governance tokens. The problem with this model is that it’s incredibly costly for the projects. According to some calculations, projects pay around $1.25 in their native tokens for every $1 of liquidity secured.

On top of that, projects have to perpetually issue reward tokens to prevent liquidity miners from going away. This puts considerable inflationary sell pressure on their respective tokens and disincentivizes users from holding.

More recently, however, protocols found another, more efficient way to secure liquidity on Curve by controlling CRV emissions.

To participate in Curve’s governance, CRV token holders need to lock their CRV into a voting escrow. The longer the tokens are locked, the more voting power they give, making locking significantly more attractive for longer periods. So attractive, in fact, that several DeFi protocols have recently revamped their tokenomics to incorporate the “vote escrow” model. Currently, over 50% of the CRV is locked for an average lock time of 3.65 years (max is 4 years).

By “vote-locking” CRV as veCRV into the platform, stakers can benefit from Curve’s trading fees, receive up to 2.5x times boosted CRV rewards, and most importantly—gain control over Curve’s future token emissions.

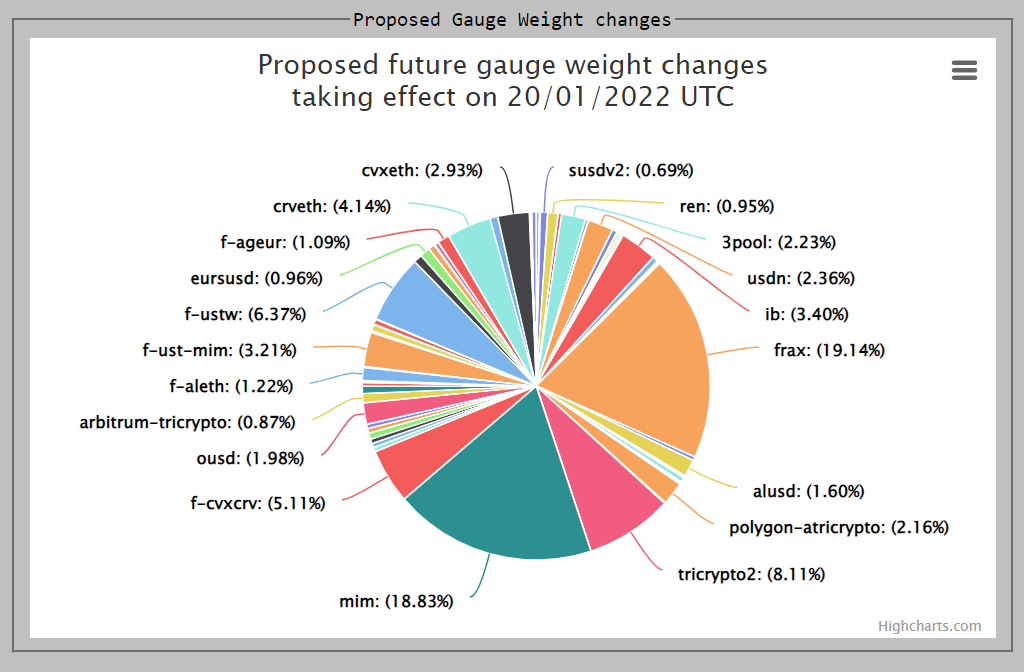

Curve holds a so-called “gauge weight vote” every week. There, veCRV holders vote on how CRV emissions should be allocated between the different liquidity pools on the exchange for the following week.

Instead of incentivizing pools with their own tokens, projects like Alchemix, Abracadabra, or Terra Labs are now waging wars to acquire more “vote-escrowed CRV” or veCRV tokens to control emissions and allocate more rewards toward their pools. More CRV rewards equal higher yields for liquidity providers, leading to higher liquidity and adoption for their tokens.

Importantly, these protocols don’t dilute their supply while keeping liquidity. If the rewards for liquidity providers are in CRV, projects don’t have to print more of their native tokens. On top of that, protocols accumulate additional value by owning increasingly more CRV.

Because the supply of CRV is hard-capped, projects can only acquire so many, which leads to interesting market dynamics. The scarce supply turns this game into an accumulation race where the winning play is to acquire CRV, vote-lock it on the exchange for veCRV, then vote to distribute CRV tokens to a specific pool, earn more CRV—rinse and repeat.

Also, the crazy demand for veCRV has recently spurred an entirely new market: bribes.

Bribes: The new DeFi primitive

Because projects can acquire only so much veCRV to influence Curve governance and boost CRV rewards for their pools, they’ve recently started bribing veCRV holders to vote for their pools through platforms like bribe.crv and Votium.

Bribing veCRV is currently the most efficient way to rent liquidity from liquidity providers on Curve. Without increasing their budgets for maintaining liquidity, Abracadabra and Alchemix have attracted much more liquidity through bribes than they have with liquidity mining incentives before.

Bribes have effectively become a new DeFi primitive for sourcing and securing liquidity on Curve. Knowing this, projects like Convex and Redacted Cartel—whose sole purpose for existing is acquiring ever-more veCRV—have entered the business of accepting bribes as another source of revenue.

Convex and Redacted Cartel are primitives built on top of Curve that, each in their own way, make holding vote-escrowed CRV tokens much more lucrative for holders. On top of that, they also allow projects to secure Curve liquidity without diluting their native tokens too much, thus greatly benefiting the entire DeFi space.

As the market and the total value locked in DeFi grows, more projects will likely start seeing the benefit of this liquidity sourcing model and start using it for themselves. The old ways of liquidity mining will eventually be gone, and an increasing number of protocols will start replicating “vote escrow” tokenomics and leveraging bribes as the primary way for securing liquidity. This will eventually concentrate much of the liquidity in the hands of a few liquidity management or Liquidity-as-a-Service protocols, leading to significantly increased overall efficiency for the entire DeFi ecosystem.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Stefan Stankovic, and my colleagues: Anton Tarasov, Sergey Yakovenko, and Nivesh Rustgi.