Put Your Helmet On.

I want to brief you with an outline of the Research department’s vision for 2022. In short, we’re entering the “war” mode.

We don’t know 100% how the market will behave in the coming months, so I won’t speculate whether Q1 will be bullish or bearish. Instead, we’ll focus on what we can do, and that’s highlighting potential ways to make gains.

The crypto space changes rapidly and significantly, requiring us to adapt our approach continuously. In the past, you could pick projects based on their fundamentals like team, tokenomics, and tech; then buy and win. In 2021, this approach wasn’t that effective, and I think it will lose relevance in 2022.

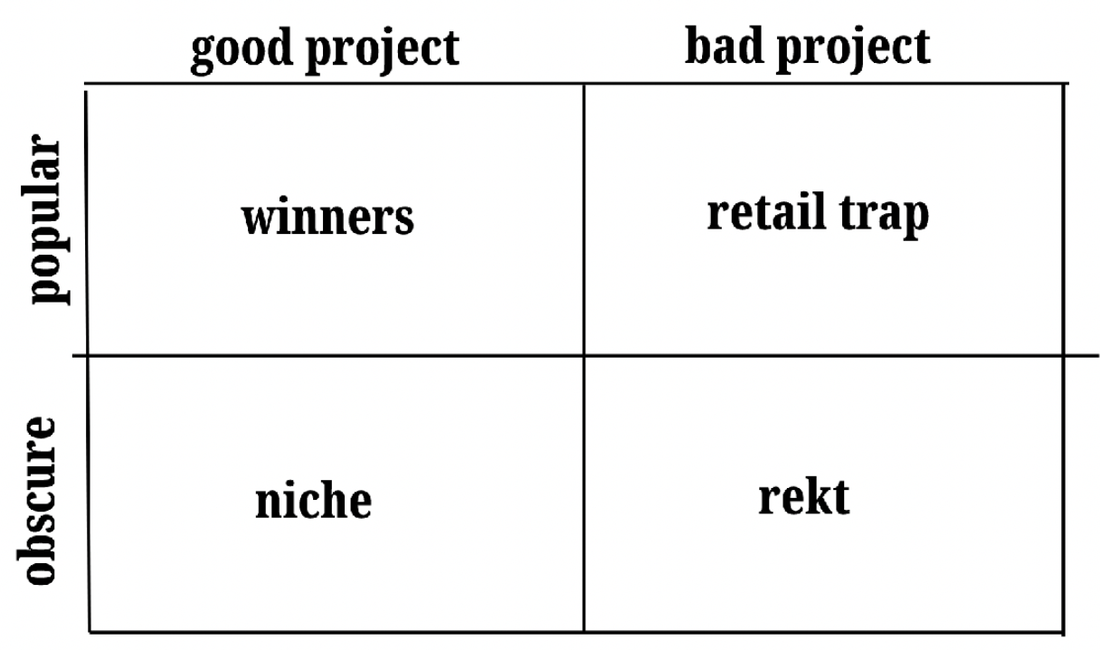

Take a look at the following chart from Cobie, one of the high-profile influencers in crypto Twitter.

Source: Cobie blog.

I think it provides a good summary of what we’re looking at in the blockchain space. It becomes “attention economy,” where you should actively participate in the discussion or at least keep your ear close to the ground to win.

On top of that, the space became fragmented after the explosion of Layer-2 solutions and the emergence of Ethereum competitors. Each chain has dozens of projects with their communities, forming whole intricate ecosystems.

If you aren’t actively participating in those projects’ Discord servers, you’re missing out on alpha. By the time it gets to Twitter (not even talking about news outlets), it’s already late. Same with Pick of the Months and Radar: they aren’t designed for signals that require immediate action (and that’s why we have Discord).

We expect the fragmentation to be even more pronounced in 2022 and beyond. Besides splitting on the technological level, the market now has a more pronounced niche specialization, such as infrastructure, DeFi, NFTs, gaming, privacy, payments, etc. You can’t be everywhere because every specialty is so deep, you won’t have time to master it.

The easy days in crypto when you could merely create a portfolio and forget about it for a couple of months are gone. It doesn’t mean you can’t make money on Coinbase or Binance, but your upside will be much less than that of active participants.

Given all the above, we are adjusting our approach. We will be focusing more on things beyond base fundamentals. We will be looking for catalysts that may not be obvious to outsiders but clear for people immersed in the action.

We already did the first step towards this when we picked Curve. It’s a great project with solid fundamentals, but in our opinion, it wouldn’t stay strong in this weak market if not for Curve Wars.

Moreover, I want to ask you to be more active in this space. As I said, we can’t be everywhere. Otherwise, we won’t produce meaningful results. We will keep an eye on everything trending, but there may be some obscure alpha.

I encourage you to go where your heart calls you. Whatever projects you like, even if somebody is trash-talking about them, just be around their communities—don’t passively hold. And if you see something interesting, share it with your fellow subscribers in Discord.

A strong community is the key to success in 2022 and beyond. I can’t allocate much of my time to be around, but Sergey and Nivesh are always there to share their observations and listen to yours. They always share your findings with me, be sure of that.

We need to become a squad, so put your helmet on and see you in the trenches.

SIMETRI Portfolio – No Surprises

As the market dives, our Portfolio follows. Hence, I will use this section to share my plan about Portfolio tracking.

The numbers you see in the Portfolio tracker are quite misleading. That’s because it merely tracks the difference between the current and entry prices. It doesn’t track when we closed positions.

I plan to fix this over the coming weeks to get a more realistic view of the performance. I also want to introduce checkpoints into the tracker, which would show performance for people who joined SIMETRI at different points in time.