When the Market Shakes.

It’s Anton here, SIMETRI’s lead analyst.

It’s been a rough week, with the total crypto market cap losing over $69 billion in a matter of days. Experienced investors still have trauma from the last bear market. Newcomers run when they see such severe drawdowns for the first time. It’s a trying time.

Nevertheless, big pullbacks are natural to highly volatile assets like cryptocurrencies. For perspective, I analyze the previous bull cycle, which lasted from 2016 to the end of 2017.

Crypto Market Drawdowns are Normal

First, let’s take a look at the annualized volatility. During the last bull run, Bitcoin’s annualized volatility was 69% and Ethereum’s was 134%. For comparison, the S&P 500 annualized volatility was 26% over the same period. As you probably guessed, crypto prices are a lot shakier.

Volatility is not necessarily a bad thing. It also means more upside when the market goes your way (and more risk when the market moves against you).

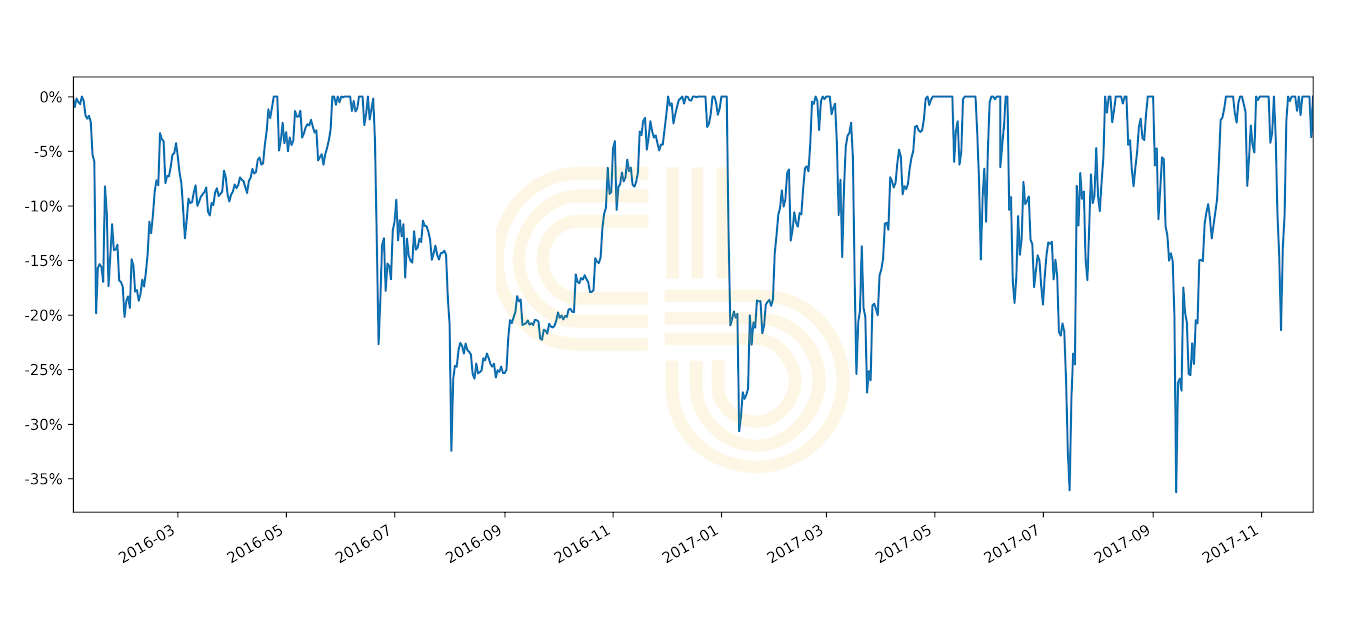

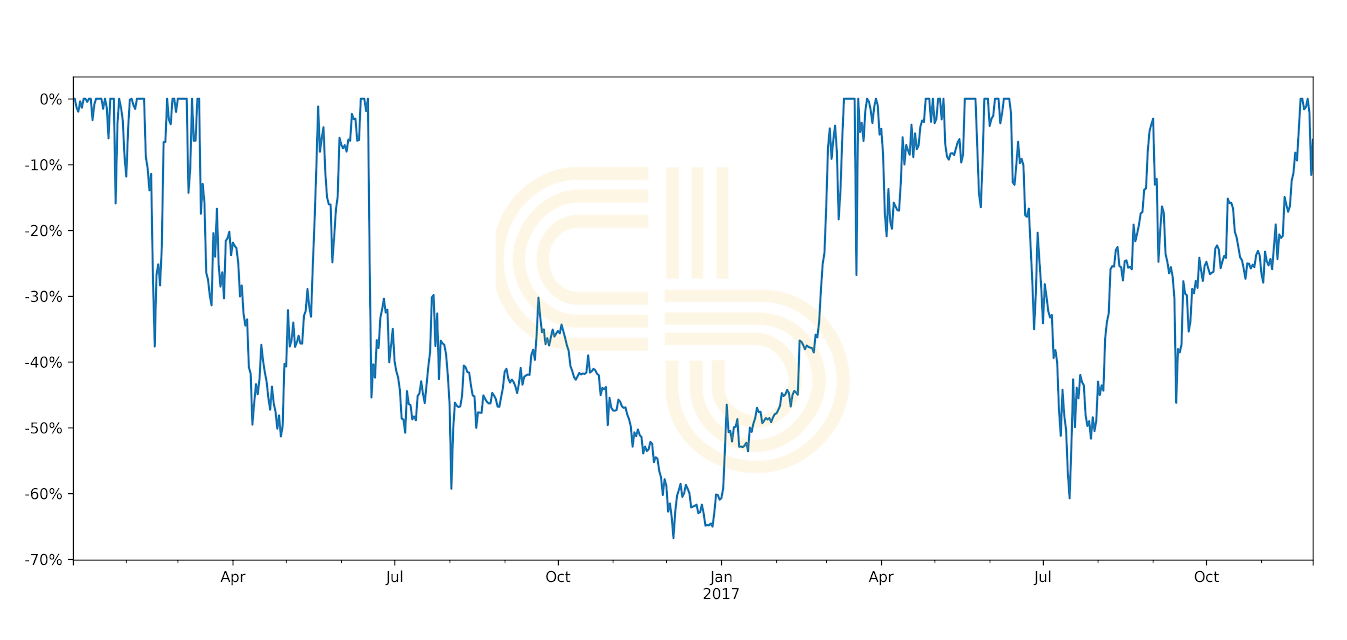

During the past bull market, Bitcoin and Ethereum had several devastating drawdowns. In some cases, BTC lost as much as 35% from its previous peak, and ETH lost as much as 70%.

BTC drawdowns. Source: CoinGecko

ETH drawdowns. Source: CoinGecko

At the end of the day, this data shows that you need to be comfortable with wild price swings if you want outstanding returns. Prices are driven by multiple factors—emotions, leverage, news, and adoption. Most of these factors have short-term effects. But we’re confident that the overall direction is up.

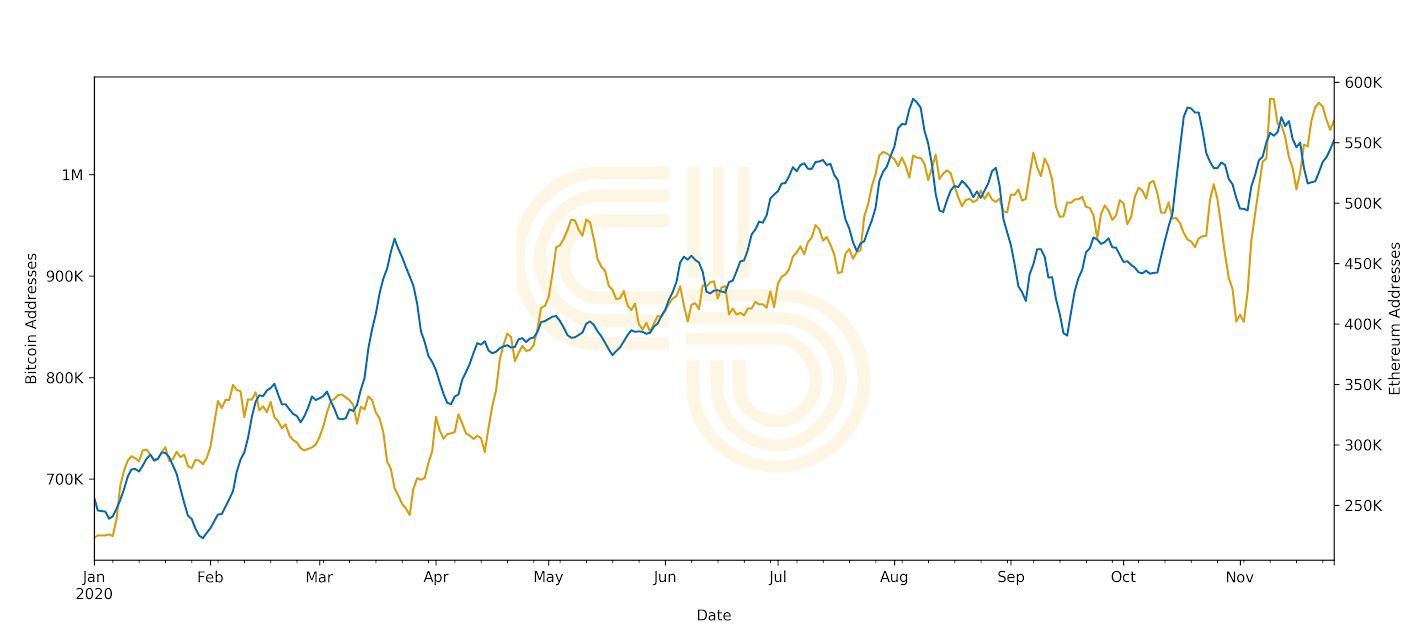

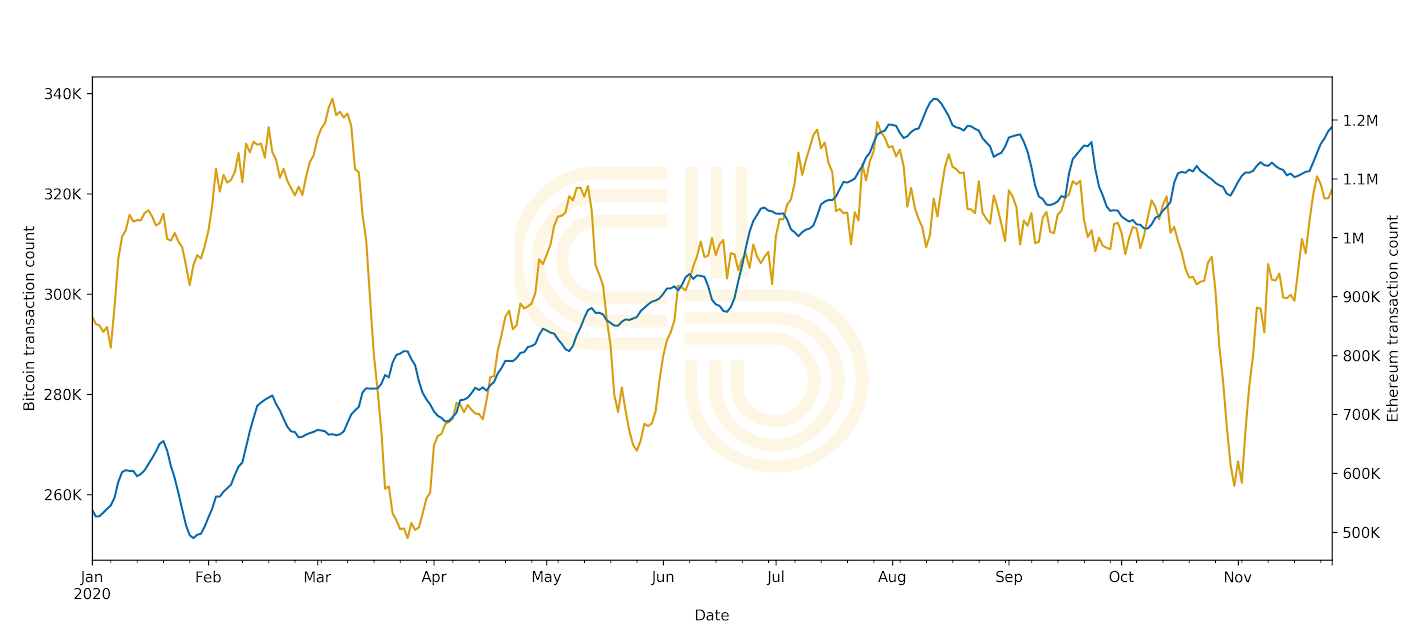

While the latest price action may scream “sell,” on-chain metrics tell a different story. The number of active addresses and the number of transactions on Bitcoin and Ethereum remains near all-time highs, illustrating a rise in real usage and demand.

Bitcoin (gold) and Ethereum active addresses. Source: CoinMetrics

Bitcoin and Ethereum transaction count. Source: CoinMetrics

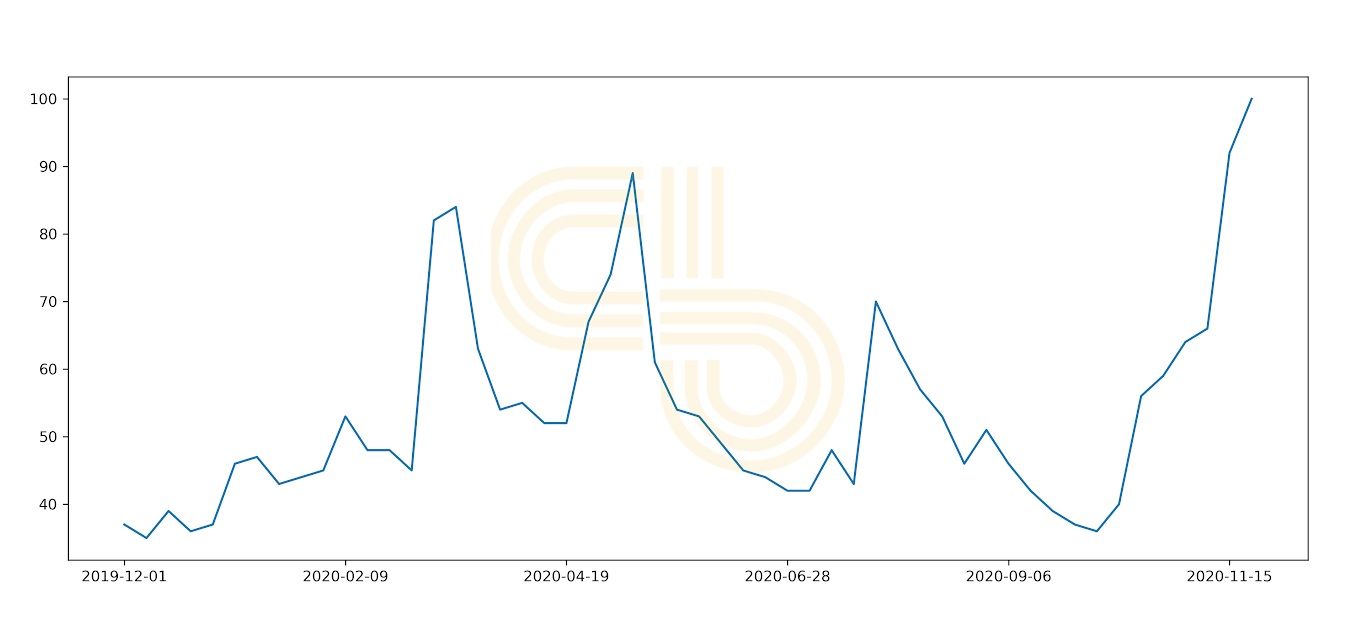

Meanwhile, Google Trends shows that search queries for “Bitcoin” are at a 12-month high. Add to growing interest from institutions and integrations from crypto giants like PayPal , and you have plenty of new retail buyers who are happy to buy the dip.

Google trends for ‘bitcoin’ search term. Source: Google Trends

A rebound is by no means guaranteed. So it’s a good idea to review your position sizes in the future. Being overexposed to any market introduces unnecessary emotions, which may lead to hasty (and costly) decisions.

Keep this in mind as we go over our portfolio performance below.

SIMETRI Portfolio Still Outperforms Altcoins

Although our portfolio took a hit from the latest BTC pullback, it has still done better than Bitcoin and the broader market based on all-time performance. Our ROI dropped from 531% to 452%, but this is merely a short-term fluctuation for a portfolio that is thrashing stocks and crypto.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.