What’s up with $stETH?

If you’re following crypto Twitter, you most likely heard about the drama around Lido’s staked $ETH ($stETH). Some people are trying to compare the events around $stETH to what happened to $UST. Let’s try to understand whether this comparison is valid and what are the real risks here.

What’s Lido Anyway?

Although Lido is a popular product, some of you are probably asking, “what’s Lido?” Let me give you a quick overview.

Most of today’s blockchains use either Proof-of-Work (PoW) or Proof-of-Stake (PoS) to maintain security. More precisely, in some networks like Bitcoin, a potential attacker would need immense computing power and energy to attack, while in others like Cosmos, they would need a lot of the network’s tokens.

Blockchains also have inflation of their native tokens. That’s because they need to subsidize block production. In other words, for a blockchain to function, somebody has to run nodes, and the network needs to incentivize people to run those nodes.

In PoW networks, miners capture rewards. In PoS networks, it’s validators who have substantial amounts of native tokens. In some networks, there are delegators: accounts with not enough native tokens to put at stake and validate, but they can still get access to rewards by delegating their tokens’ power to validators.

Ethereum should soon transition to PoS. A limited version of Ethereum PoS, called “Beacon Chain,” has already been running for some time.

The transition from PoW to PoS means block rewards will go to validators. The Beacon Chain already has this functionality, and users can stake their $ETH to get rewards. However, setting up a node is cumbersome, risky for non-technical people, and requires substantial capital to be locked up.

The current requirement for becoming an Ethereum PoS validator has 32 $ETH. Even if $ETH drops to $1,000 per token, that’s still a whopping $32,000. At this stage, staking is one-way. You can transfer $ETH to the Beacon Chain, but you can’t get it out until the network is fully ready. It’s clearly not for everyone.

Here comes Lido to save the day. You can give the protocol your $ETH, and it will handle all the background tasks like deploying and maintaining validator nodes, giving you easy access to $ETH staking rewards. There’s no minimum of $ETH to stake this way. That’s because Lido can bundle your $ETH with that of other depositors to reach that 32 $ETH requirement.

On top of that, you will still technically control access to your locked tokens. When you deposit $ETH to Lido, you get an ownership token for that staked $ETH ($stETH).

Source: Lido homepage.

On paper, the benefits of Lido are attractive. You can yield on $ETH without saving up 32 $ETH and bothering with running a node. But is it that good in practice?

$stETH Liquidity Issues

First, let’s examine the “1:1” peg claim. Here’s a chart of $stETH/$ETH.

Source: CoinGecko.

As you see, $stETH barely had a strong peg to $ETH. Moreover, it lost the peg to the lowest levels in its history. What’s going on with it?

Although some might argue that because $stETH is a yield-bearing asset, it should trade at a slight premium to $ETH. However, the market thinks Lido’s execution risk is a reason for a discount. But the ongoing issues aren’t because Lido is a bad product.

Remember that Ethereum staking right now is one way. When you give Lido your $ETH, the protocol sends it to the Beacon Chain. Nobody can get it out until the network is fully functional. So, while your $stETH is technically redeemable for $ETH, redemption is currently unavailable.

As Lido states on its website, the only way to get $ETH for $stETH holders is to sell it. The project mentions Curve and Balancer as venues to do so. Let’s look at liquidity there.

Starting with Curve, liquidity in the $stETH pool is around $630 million. That’s substantial, but 80% of it is in $stETH. That means that somebody has been aggressively selling $stETH lately. The higher the share of $stETH, the faster the price of $stETH will go down compared to $ETH. At this stage, a sharp decline of $stETH, or in other words, a “depeg,” is a real concern.

The situation on Balancer is similar to Curve’s. The only exception is that the overall size of the pool is more than six times smaller, which doesn’t instill optimism for $stETH holders.

Overall, liquidity for swapping $stETH to $ETH is drying up, causing the depeg to widen. If there is a sell-off, it will easily accelerate the depeg. Meanwhile, there’s no other way out than selling for $stETH holders because redemptions aren’t available yet.

Is It Dangerous?

The short answer: it depends on who you are. A significant depeg of $stETH has first-order effects that will negatively affect the $stETH holders (especially those who used it as collateral) and second-order effects that will negatively affect the rest of the market. All of this shouldn’t be as bad as the $UST demolition because, unlike $UST, $stETH is backed by $ETH, albeit it’s locked now.

The core use case for $stETH is the same as for regular $ETH: DeFi. Mainly, market participants use it as collateral for loans to borrow money and, potentially, invest more. This is leverage. The more levered you are, the smaller price movements may take you out of the game.

The trick about leverage is that even responsible parties may be “squeezed.” Imagine some $stETH holder with a large position borrows a lot of money. If the market goes against them, their collateral (money they pledged to get a loan) is forcibly sold to make the lender whole. This sell-off triggers a liquidation of other parties with lower leverage and so on. It’s like an avalanche.

The biggest threat currently is potential liquidations on Aave. Aave’s Lending Pool holds 33% of $ stETH’s total supply.

34% of the $stETH in Aave Lending Pool. Source: Nansen.

Without dumping too much jargon on you, Aave may experience an avalanche of liquidations. An interesting tidbit is that there’s a proposal to stop new $stETH and $ETH loans and lower the liquidation bar for the existing ones. The goal is to reduce leverage in the system, which is good at first glance. However, the community disagrees.

Source: Aave governance.

But what would trigger liquidations? Large owners of $stETH. You might have heard of Celcius halting withdrawals and facing insolvency. If they have to liquidate their $stETH, the avalanche will start. The catch here is that Celsius isn’t the only company with such problems.

Technically the need to close loans may trigger the selling of companies’ other assets like $BTC, which would send the market further down. However, if you zoom out, you would see that unlevered market participants, even $stETH holders, should be fine.

Yes, prices might go down, and $stETH may be severely depegged. However, it doesn’t change the fact that $stETH is redeemable for $ETH in the future. That’s why some parties will love to have cheap $stETH, and those without leverage and long-term investment horizons will just wait it out.

So, if you haven’t been recursively borrowing $ETH for $stETH or heavily borrowing in general, there’s no significant risk. Yes, the market may negatively react to an avalanche of $stETH liquidations, but in the long run, it shouldn’t hurt.

How to Monitor the Situation?

Since major $stETH liquidity is on Curve, let’s look at how it works. In simple terms, it enhances Uniswap’s formula to help concentrate liquidity in a narrow price range. In other words, it makes it, so the money for swaps is heavily concentrated around the 1:1 peg between two assets. As a result, large swaps don’t cause the price to jump or dump.

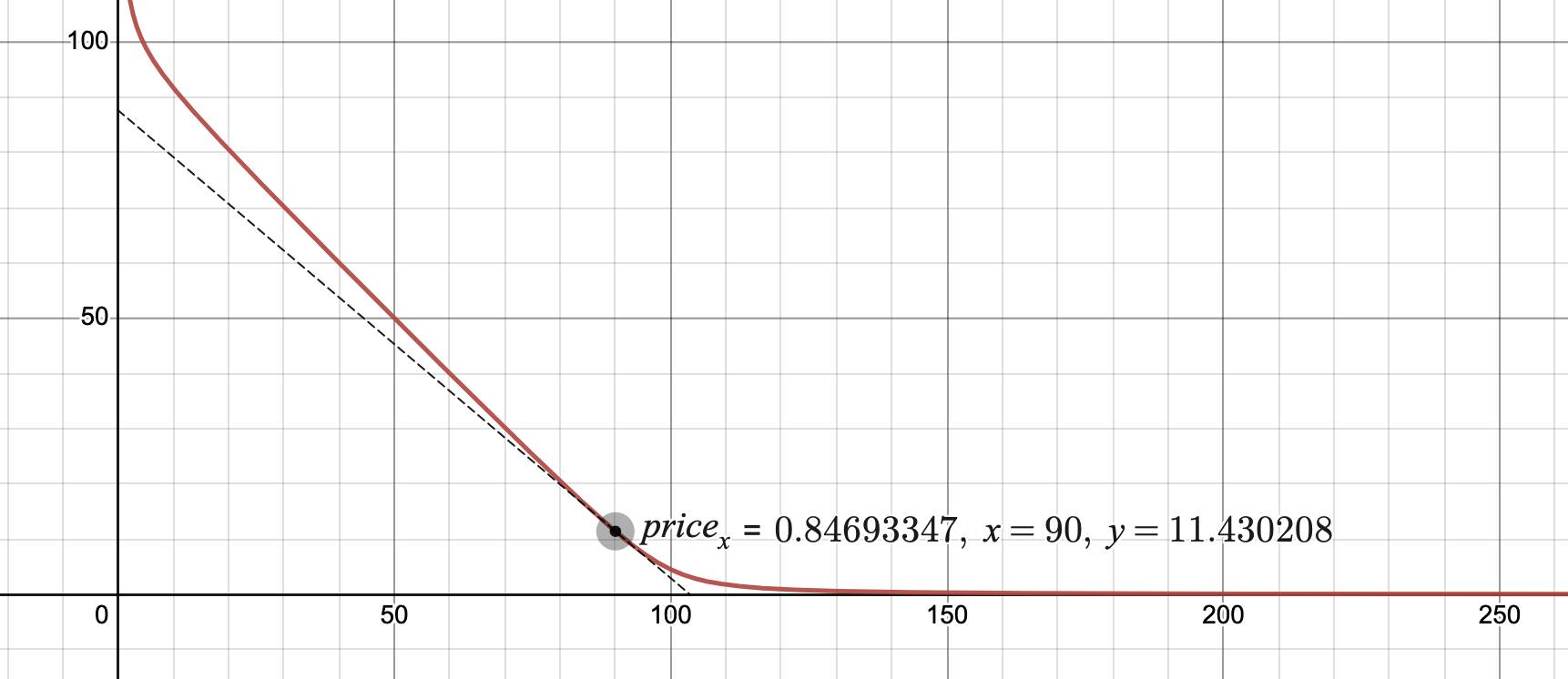

Since liquidity is concentrated, even a heavy imbalance (like I showed on a screenshot at the beginning) in the pool doesn’t lead to dramatic price action. The exchange uses a variable ‘Amplification factor’ (or A factor) in its pricing algorithm, which determines the confidence level in a swapping pair. If A factor is 100, a pair can withstand a 3:1 imbalance in the pool before severely depegging. The ratio increases with higher A values.

The A value for stETH/ETH pools is 50. In the model below, if $stETH in the pool goes from the current 80% to 90%, the peg will drop to around 0.85 from the current ~0.92. But it’s not as bad as what will come after this mark. At 95%, the peg will be ~0.7, and it goes down faster from there. Remember liquidations?

Source: Desmos.com.

Keep track of the stETH/ETH liquidity pool on Curve and Aave loans to monitor $stETH health. It might be a valid play if you have a long-term plan and want to buy $stETH at a discount to redeem it for $ETH later. However, consider the deteriorating macroeconomic environment and the fact that Lido still presents a risk because it’s a third party, and things may break under its hood.

Till next time.

Stay safe!

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.