October 12 Crypto Market Roundup

The BTC/USD pair staged a major range breakout above the $11,000 resistance level last week, prompted by bullish news that Jack Dorsey’s Square Inc was investing $50 million in Bitcoin.

Square Inc’s move marked the second major institutional investment in BTC this year, following Microstrategy’s $425 million move this summer.

BTC officially moved to its highest trading level since September 1st, touching $11,499 on Coinbase, and marking a gain of close to 6% for the month of October so far.

Markets also received a boost from positive risk sentiment, as news that President Donald Trump re-opened negotiations between the Republican and Democratic party over the second COVI-19 stimulus package.

BTCUSD H1 Chart

Source: Tradingview

On-chain data from crypto behaviour analytics platform, Santiment, flagged that a major move was about to take place last week, as BTC Token Age Consumed spiked dramatically just one-day prior to Bitcoin’s breakout.

This was confirmed by the Smart Money on-chain indicator. The indicator showed that Bitcoin whales were accumulating the cryptocurrency ahead of its next major rally.

A number of other widely on-chain metrics and technical indicators also forewarned that a major move in BTC was brewing.

Bitcoin’s Weekly Average True Range also traded at its lowest level since June 2019 prior to the breakout, while the weekly Bollinger Band indicator continued to contract.

BTC Token Age Consumed

Source: Santiment.net

Volatility data from the crypto analytics platform, Skew, also showed that Bitcoin’s realized volatility crashed to a three-year low prior to last week’s important range breakout.

BTC social media sentiment measures also hinted that a major move was about to take place, as sentiment towards BTC on Twitter fell to its lowest levels since 2017.

On-chain data also painted a positive price picture for BTC, as the amount of Bitcoins on exchange continued to tumble, and the amount of unique BTC addresses continued to skyrocket.

Source: Tradingster.com

Bloomberg’s October crypto report also noted that Bitcoin is on its way to $14,000. The report also states that BTC should currently be trading closer to $15,000 than $10,500.

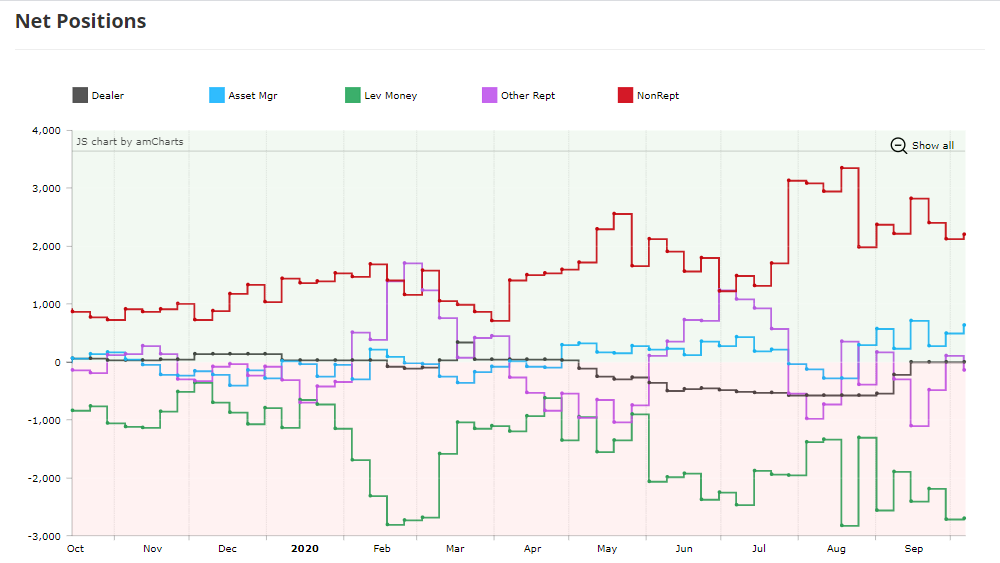

Last week’s CoT report showed a major increase in bullish bets from institutions, asset managers, and professional traders.

Source: Tradingview

The total market capitalization of the cryptocurrency market hit $355 billion last week, marking an important range breakout, and bringing the crypto total market towards a five-week high.

Spot volumes for the total market capitalization finally started to pick up after declining over the last few weeks, and reached levels not seen since September 13th.

The top altcoins benefitted from Bitcoin’s rise, with Ripple, Litecoin, and Monero amongst the leaders, however, it was another bad week for the DeFi space, with yearn.finance amongst the worst affected.

During my upcoming webinar, I will be charting Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin.

The Week Ahead

Bitcoin is poised to build on last week’s gains, as long as bulls can continue to defend the $11,100 support level, and the market shrugs-off any more nasty October surprises.

Broader financial markets are still optimistic about the second coronavirus stimulus bill being approved, and are so far reacting positively to Joe Biden’s alleged lead in the polls.

At this point, it seems like markest do not really care who wins the Presidency, as long as either party delivers another massive stimulus package after the election.

Something else we should also consider is the market ability to go higher ahead of the US election, both US equities and cryptos.

The market can remain irrational longer than traders can remain solvent is an old adage that is widely used, and probably appropriate to the stock market at the moment.

The short-squeeze in the stock market could ugly here. If risk sentiment holds up, the technicals show the S&P 500 could hit 3,700, and possibly higher. It should be an interesting week to say the least.

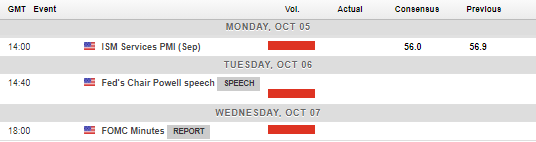

The U.S. election debate and the EU leaders meeting are the key risk-events on the economic calendar this week. Of course, the market will also be focused on the stimulus ongoing negotiations.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) is likely to stage its next major push higher if bulls can continue to defend the $11,100 support area, which traders will remember was an extremely important technical zone from August and early-September.

A large price gap on the CME futures chart from last Friday certainly hints that Bitcoin could swoop lower and test the $11,100 to $11,000 area before staging its next major push higher.

Traders have been struggling to surpass the $11,500 resistance level over recent days, so bulls may need to see the $11,100 area start to hold downside attacks before committing to fresh longs.

If the outlined scenario takes place, then BTC could easily challenge the $12,500 and $13,500 levels in rapid fashion. Traders should be aware that the weekly chart shows that a huge bullish reversal pattern will form if BTC reaches $13,500.

To the downside, a sustained loss of the $11,000 level and Bitcoin could be in big trouble, and could fall back towards the $10,550 to $10,300 area.

Recent strong dip-buying and impressive BTC flows certainly does not suggest that a decline is likely. However, this is crypto, so it is important that we know the big levels that traders are watching.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) set a new higher high last, after attracting buying demand around the $330.00 area, following weeks of sluggish price action.

Bitcoin’s recent rise has also lended a hand to ETH/USD, despite ETH/BTC taking a notable hit. The theory being amongst crypto traders that if Bitcoin is rallying, then the top altcoins such as ETH/USD and XRP/USD are probably going to follow along.

If we continue to see EHT/USD holding above $365.00, then it will encourage bulls to enter in the short-term, with the $395.00 and $415.00 level as near-term targets.

Technical analysis shows that an inverted head and shoulders pattern will form if ETH/USD reaches $395.00 this week. The overall upside projection of the pattern would take Ethereum close to $450.00.

Overall, ETH/USD is extremely likely to follow BTC/USD higher in the near-term, and with that being said, selling Ethereum is not an option at present. Positioning into the expected up move around current levels, or buying a break above $395.00 would appear to be safest option.

ETH/USD H1 Chart

Source: Tradingview