September 21 Crypto Market Roundup

Bitcoin (BTC) recovered above the $11,000 level last week, as the pioneer cryptocurrency traded to its highest level since September 3rd this year.

Bulls failed to close the weekly candle back above the technically important $11,100 level, further highlighting that uncertain nature of the ongoing recovery from the $9,800 support area.

Bitcoin initially turned lower alongside the S&P 500 and gold, following the September Federal Open Market Committee policy statement, as the central bank sounded less dovish than expected. However, Bitcoin recovered higher as the greenback soon gave back it’s post-FOMC gains.

BTCUSD Weekly Chart

Source: Tradingview

Traders also noted that the ongoing price increase in Bitcoin may be due to a return of institutional demand, bullish on-chain metrics, and DeFi investors moving back into BTC.

Bitcoin’s upside above $11,000 was also tempered by political uncertainty, as U.S. Congressional leaders missed a self-imposed deadline to strike an agreement on legislation that would keep the government open through Dec.

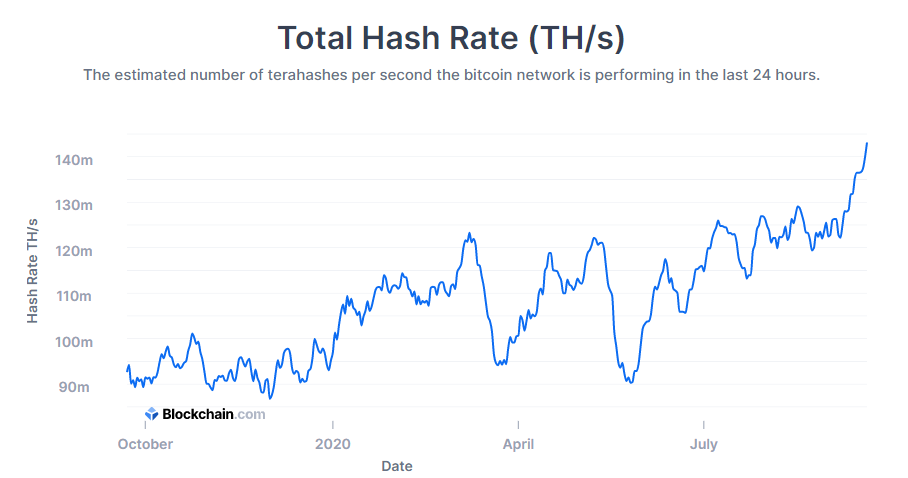

Bitcoin’s hash rate, which represents the measuring unit of the processing power of the Bitcoin network, continued to surge to fresh all-time record highs last week.

On-chain data from crypto behaviour analytics company, Santiment, noted that on-chain data indicated that bearish pressure towards BTC started to weaken, although the current upside move did not appear convincing enough to make a significant breakout move.

BTC Hash Rate

Source: Blockchain.com

Bakkt’s physically delivered Bitcoin futures exchange recorded a new record high in the amount of contracts being traded last week. A number of key on-chain indicators also showed that the cryptocurrency remains undervalued at current levels.

Last week’s Commitment of Traders report from the CME revealed a notable bullish shift, as asset managers dramatically increased bullish bets towards Bitcoin.

On-chain analytics provider Santiment also revealed that weighted social sentiment for Bitcoin hit its lowest level in over two years last week.

The Crypto Fear and Greed Index showed that traders had moved from a state of “fear”, and were now “neutral” towards the direction of the market.

Source: Alternative.me

The total market capitalization of the cryptocurrency traded between the $314 to $341 billion levels. The crypto total market caps 50-day moving average acted as formidable weekly resistance.

Spot volumes for the total market capitalization started to move in a downward trajectory last week, and fell back to levels not seen since late-August.

The top ten altcoins failed to follow BTC higher last week, while many DeFi coins also came under heavy selling pressure.

During my upcoming webinar, I will be taking a look at Ethereum (ETH) Zcash (ZEC), Cosmos (ATOM), and Bitcoin.

Source: Tradingview

The Week Ahead

Bitcoin is likely to take it’s direction from U.S. politics this week, and more specifically the reaction of the greenback, and more broadly U.S equity markets reaction, to the news surrounding the death of Supreme Justice Ruth Bader Ginsburg.

Market participants will be expecting a fierce debate in the U.S. Congress about whether or not to appoint a new Supreme Court Justice before the Presidential election. More political wrangling over the next round of U.S. stimulus should also be expected.

Financial markets typically hate uncertainty, this may mean that the U.S. stock markets could take another big hit. With expectations set very low, any bullish news over the new stimulus package could be U.S. dollar negative.

Markets also have to contend with a rise in global COVID-19 infections, and some governments moving into a second round of lockdowns.

Looking at the S&P 500, the index closed the week below its 50-day moving average for the first-time since April 2020 last week. Daily price closes under 3,300, and the S&P 500 could fall very sharply this week.

The stock market Fear and Greed Index is currently neutral, so a major range break appears on the cards. Crypto markets also have to contend with another round of massive options expirations taking place this coming Friday.

This has the potential to generate even more volatility, although it is certainly noteworthy that recent BTC options expiration events have not lived up to the hype.

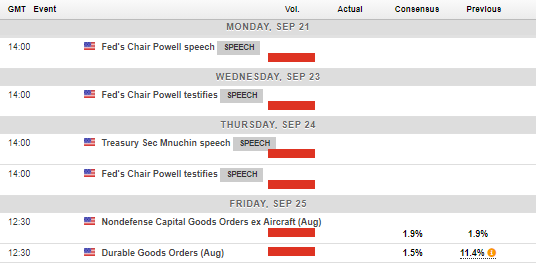

The economic calendar is once again dominated by FED Chair Jerome Powell, who is set to deliver a scheduled speech, and also testify before the U.S. Congress this week. U.S. Treasury Secretary Mnuchin will also be delivering a speech before U.S. Congress, which also has the ability to move financial markets.

Economic Calendar

Source: Forexlive

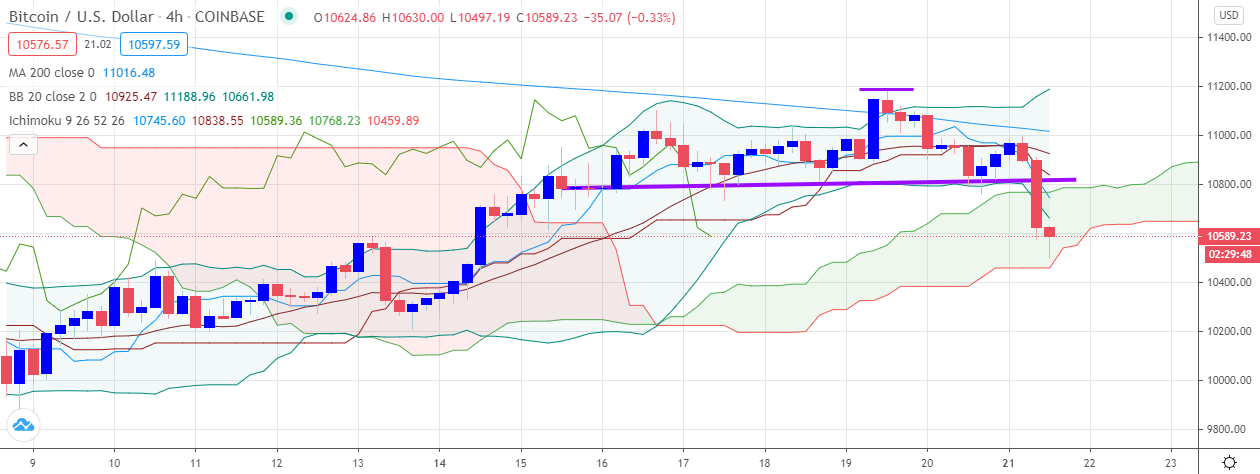

The current technicals for Bitcoin show that the cryptocurrency remains vulnerable to technical selling while bulls are able to anchor price above the $11,100 level.

If buyers are able to move Bitcoin back above the $11,100 level on a multi-day basis then further gains towards the $11,400 and $11,700 are certainly possible.

Last week’s price close was neither overly bullish or bearish, however, traders do need to respect the fact that Bitcoin continues to hold above the $10,000 level.

Traders that are bullish towards BTC may be waiting for a pullback towards the $10,000 levels to attempt to enter into the prevailing uptrend from a more attractive entry point.

In the near-term, Bitcoin remains vulnerable to further downside while trading below the $10,750. The BTC/USD pair’s weekly pivot point is located just above this level, around the $10,783 level, making this an important technical area this week.

Key weekly support for BTC below the $10,000 level is found at the $9,800, $9,600, and $9,000 levels.

BTC/USD H4 Chart

Source: Tradingview

Ethereum (ETH) once again performed a bullish price close above the $365.00 level, however, the price action surrounding the cryptocurrency has been extremely weak.

Lower time frame analysis shows that a breakout under a rising price channel has taken place, which could send the ETH/USD pair towards the $300.00 support level.

Should we see the BTC/USD pair heading towards the $10,000 area the outlined scenario appears likely.

It is also noteworthy that negative MACD price divergence for the ETH/USD pair is also present until the $270.00 and $230.00 areas, so traders will be cautious if weakness under the $300.00 level persists.

Overall, Ethereum’s chances of rallying back above the $400.00 level are starting to dwindle, leaving the cryptocurrency exposed to losses under the $300.00 level.

Multiple daily time frame price closes above the $365.00 level are required to attract fresh technical buying interest.

ETH/USD H4 Chart

Source: Tradingview