CoinMarketCap Launches Crypto Briefing’s Digital Asset Ratings

In the latest partnership, CoinMarketCap adds Crypto Briefing’s digital asset ratings to their platform, giving investors access to fundamental analysis alongside price and volume data.

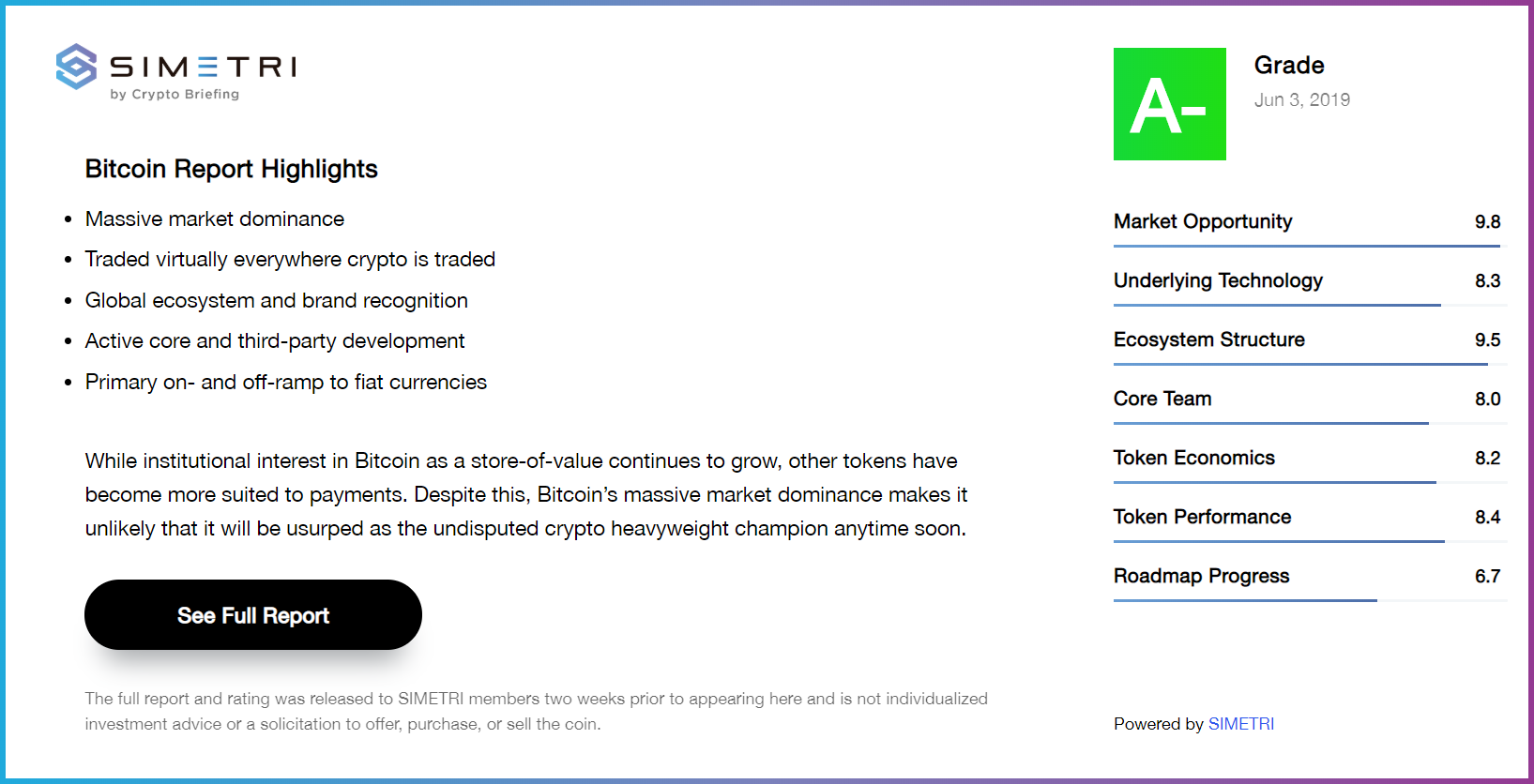

SIMETRI—Crypto Briefing’s institutional-grade research product positioned and priced for the retail investor—provides in-depth fundamental analysis and unbiased, detailed insights into cryptocurrency projects. Each report is concluded with a concise investment grade—now available to tens of millions of users on CoinMarketCap.

These ratings were integrated on major digital asset resources CoinGecko and Binance Info last year.

Beyond Price and Volume Data

Starting today, CoinMarketCap users can visit individual crypto asset pages, and find the new information under the “Ratings” tab. These ratings are included on dozens of coins.

SIMETRI digital asset rating on CoinMarketCap

Crypto Briefing’s ratings metric analyzes dozens of fundamental factors to assess the investability and potential long-term profitability of crypto assets. These factors are provided as an easy-to-understand digital asset grade, allowing investors to look beyond price and volume data to get a more holistic view of the market.

“Crypto Briefing, TokenInsight, and IntoTheBlock are highly respected in the industry for their informative and in-depth offerings, and I’m sure our users will benefit greatly from their valuable data and ratings,” said CoinMarketCap Chief Strategy Officer Carylyne Chan.

By incorporating fundamental analysis in an easy-to-understand digital asset grade it allows investors to look past price and volume data to get a more holistic view of the market. Han Kao, the CEO of Crypto Briefing said of the integration:

“Crypto Briefing has systematically reported on and evaluated hundreds of digital assets. Our connections and expertise allow us to provide valuable recommendations to investors.”

Data Transparency for the Crypto Investor

Inclusion of Crypto Briefing’s SIMETRI digital asset ratings is part of CoinMarketCap’s Data Accountability & Transparency Alliance (DATA) initiative announced May 2019. DATA is CoinMarketCap’s ongoing bid to provide transparency and verifiable order book data from exchanges.

The initiative follows widespread concerns around cryptocurrency market manipulation. Last year, Bitwise released an in-depth analysis of exchange markets and found that roughly 95% of Bitcoin trading volumes may be fabricated through wash trading.

Combined with CoinMarketCap’s recently launched Liquidity Metrics, retail investors can now get a level of detail into markets not previously accessible to the public.

“Crypto Briefing was founded on the principle of information equality for the retail investor. Today, we are one step closer to that goal,” said Kao.