The aftermath

Despite a fresh round of bearish news, Bitcoin’s price held up surprisingly well last week. However, the FTX contagion risks are well-alive and continue to create headwinds for the market.

The FTX incident is drawing a comparison to the Bernie Madoff scam and Lehman Brothers. The confidence in centralized exchanges is waning as Bitcoin flows into self-custody wallets reach record levels. Glassnode reported that Bitcoin exchange outflows hit historical levels on a monthly basis at 106,000 BTC.

Under usual circumstances, increasing self-custody is positive for the prices because it means high demand vs. supply. However, the current situation is creating a bank run, testing the liquidity of exchanges, and causing cascading insolvencies.

A story from The Wall Street Journal noted crypto lending platform BlockFi is preparing to file for bankruptcy. The company has acknowledged significant exposure to the FTX exchange. The news comes after BlockFi suspended customer withdrawals last week. Hong-Kong based exchange AAX has also stopped withdrawals. Reports about the possible insolvency of Gate.io are also doing the rounds on Twitter.

The lending arm of crypto investment bank Genesis Global Trading temporarily suspended withdrawals from existing users and stopped new loan originations. Soon enough, Gemini, the cryptocurrency exchange owned by the Winklevoss brothers, stopped redemptions on its Genesis-linked Earn product.

Following the signs of distress at Genesis Global Trading, the crypto community is now demanding proof of reserve from asset manager Grayscale. Owned by Digital Currency Group company, Grayscale holds roughly 634,000 BTC backing its GBTC product. The company reportedly keeps its Bitcoin in reserve at Brian Armstrong’s Coinbase. However, it denied providing on-chain proof for security reasons.

The average on-chain trend is starting to show preliminary signs of a bottom formation. However, based on last year’s euphoria and the massive hole that FTX has left behind, the cleansing period might be more painful.

The Harsh Truth

The unfortunate truth is that the dust has not yet settled on this FTX story, not by some margin. Hence, I don’t think a bottom is in place yet.

According to the Bank of International Settlements (BIS), between 73 and 81 percent of retail Bitcoin buyers are underwater on their investments. This was previously the sweet spot from which Bitcoin drawdowns have reversed.

However, I will argue that Bitcoin has never faced a crisis as large as FTX. Hence, its price could reach a 90 percent plus drawdown from its peak either this year or next year. The lack of interest among whale buyers and the current retail euphoria are two strong pillars of this theory.

Furthermore, I would draw comparisons to the Great Crash stock market on Wall Street in the 1920s. Before this event, there was much euphoria, with shoe shiners on the streets of New York and Chicago giving out stock tips to customers.

I had my own experience with this last November when I had to fill up my gas tank in the middle of nowhere, in the deepest heart of the United Kingdom countryside. In front of me stood two seemingly unremarkable young kids.

Much to my amazement, these two freshly converted crypto dorks, for the lack of a better word, went on to scold each other viciously about not buying the latest price dip in Ethereum, Dogecoin, and Shiba Inu. As if prices only ever went up!

I knew then that 2023 could see many people wiped out. That ominous incident or signal led me to turn bearish toward BTC in early 2022. It can be attested in my BTC PRO Trader emails and why I recently revised my downside projection from $20,000 to $14,000. The point is I don’t think the worst is over. I am expecting more 1920s-style evidence to play out.

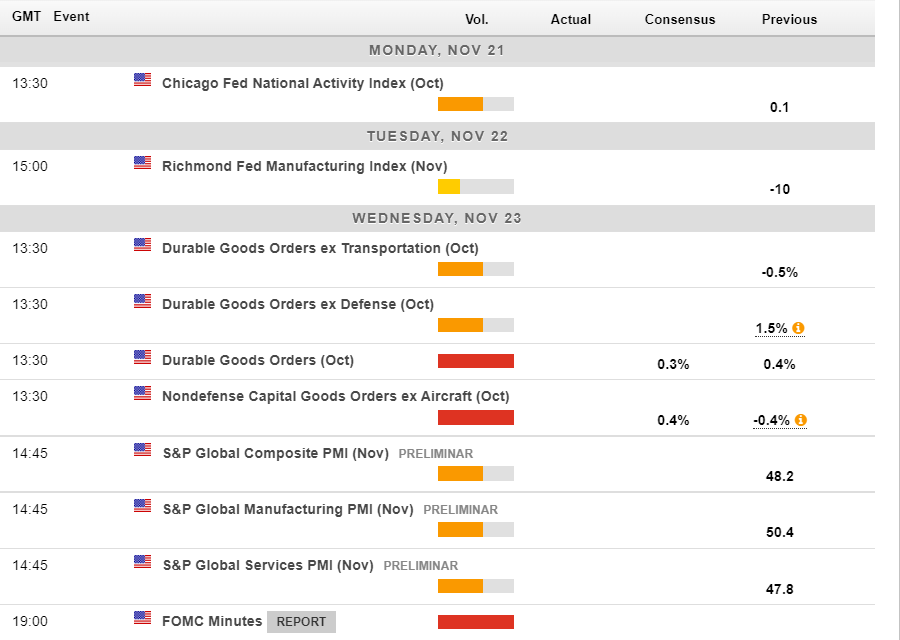

Economic Calendar For The Week

The release of the October Federal Open Market Committee meeting minutes on Wednesday could cause some surprises this week based on how the authorities plan to go forward with quantitative tightening.

But the chances of a Fed-induced price action are unlikely because BTC and crypto have almost totally decoupled from broader financial markets. It is likely to remain the case as contagion news continues to circulate at an ever-rapid pace.

However, a minor price pump could happen if additional signs emerge that the Fed could pivot in December’s policy rate meeting. Don’t hold your breath that any moves will last for long in this challenging environment.

The economic calendar for this week (Source: Forexlive)

So Close Yet So Far

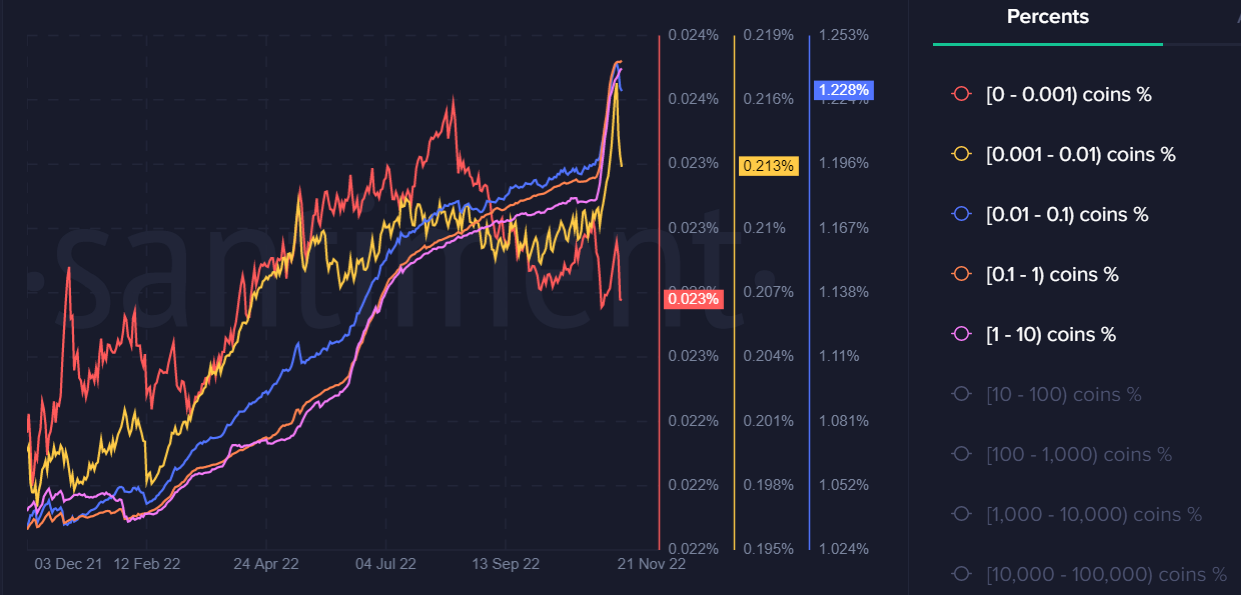

The crypto market is undergoing a massive shakeout and loss of trust as the FTX contagion spreads across the industry. The good part of the nervousness is that retail BTC holders are finally starting to capitulate.

Holdings of addresses of less than 1 BTC, especially the segment between 0.001 and 0.01 BTC and another between 0.1 to 1 BTC, reduced drastically over the weekend. Since the retail holding is near an all-time high, the above is only a preliminary signal of capitulation. There’s a long way to go before their holdings reduce significantly and shift towards whales.

Holding of BTC among retail addresses (Source: Santiment).

The Percent Supply in Profit indicator also confirms that the bottoming process has begun. Currently, more than 55% of Bitcoin’s circulating supply is underwater, which has been the threshold for previous bottoms. Although there’s still room for more downside, similar price levels have historically turned out to be great buying points over a long time frame.

Bitcoin’s Percent Supply in Profit indicator (Source: Glassnode).

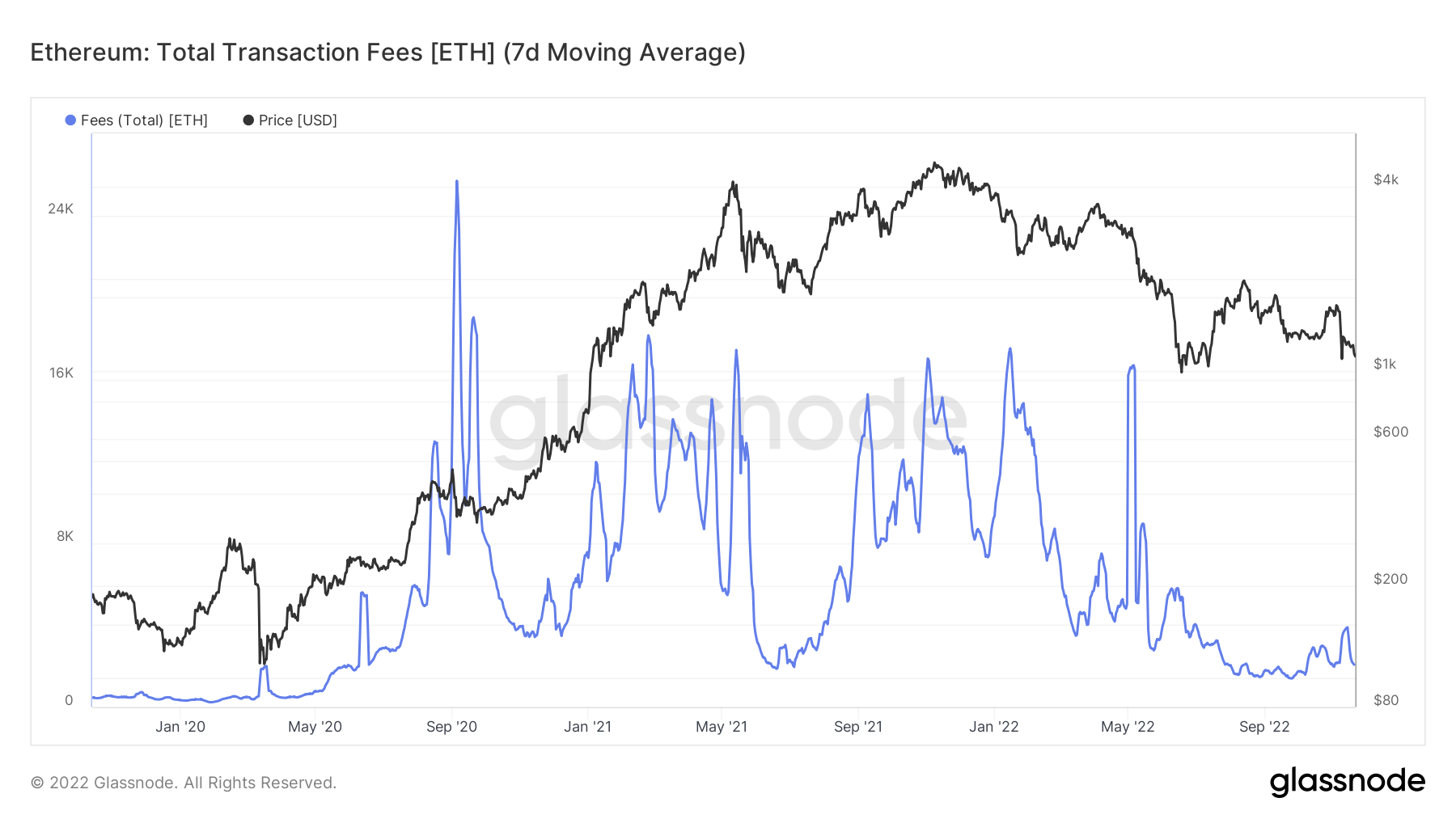

However, the same cannot be said for Ethereum. The Percent Supply in Profit indicator for ETH has yet to reach previous bottom levels by a significant margin. An argument can be made about the solid fundamentals behind Ethereum, and the recent reduction in issuance after the shift to proof-of-stake is preventing an ETH downside.

Percent supply of ETH holders in profit (Source: Glassnode).

However, the transaction volume on Ethereum has fallen back towards early 2020 levels, just around the the dawn of DeFi-summer. After the recent liquidity wipe-out and loss of trust, I expect crypto related activity to slow down further in the coming months.

7-day moving average of total transaction fee on Ethereum (Source: Glassnode).

There might also be numerous forced sellers of ETH as the FTX contagion unfolds. The risk of a strong drawdown in Ethereum cannot be ruled out under these circumstances.

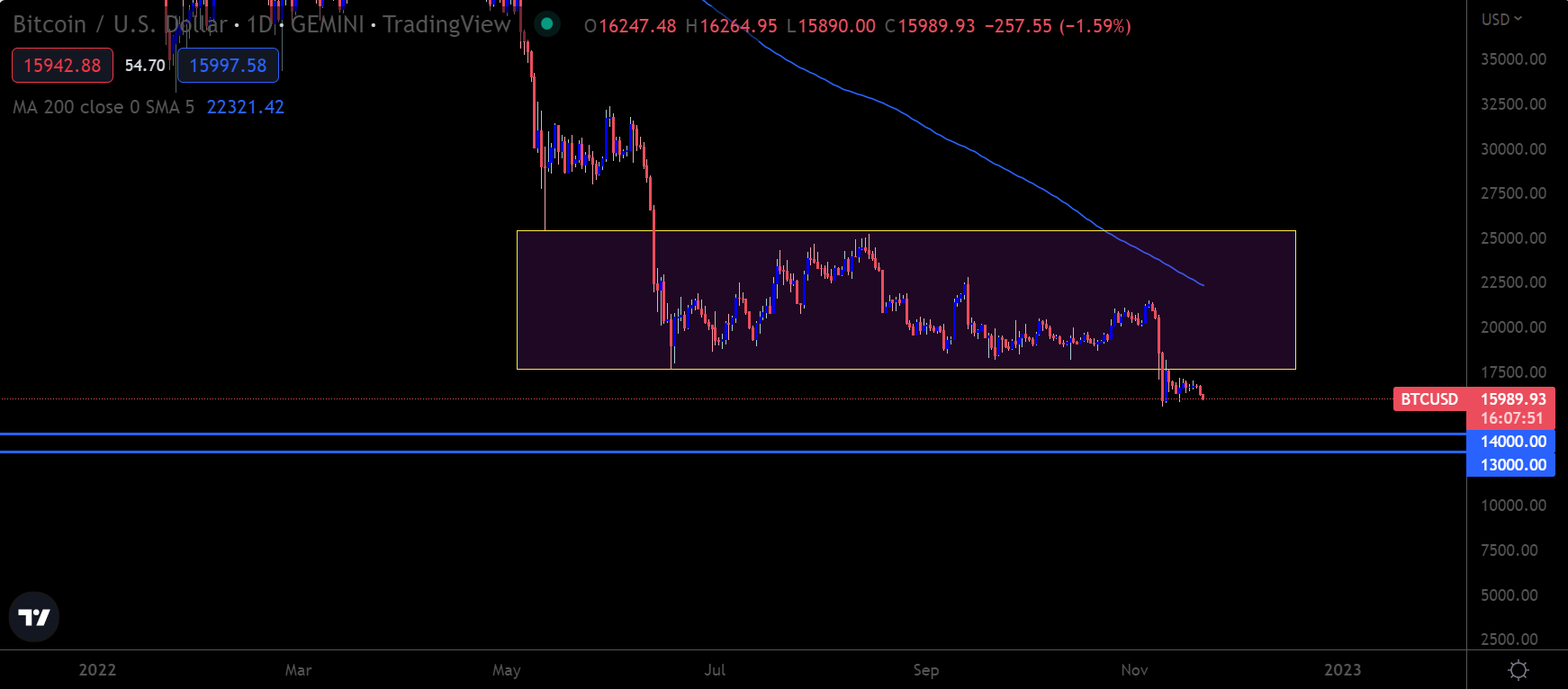

Sell BTC/USD Rips

While we will see lower prices for Bitcoin, this does not mean that it will go down in a straightforward manner. There is a likelihood of a minor price pump before the next death spiral lower.

Looking at the charts, the $18,000 area is the apparent bullish target. It is the neckline of a head and shoulders pattern, and the former 8-week range low of the $18,000 to $21,480 price range. Another move towards that area this or next week could be a solid selling opportunity. However, weakness below $15,500 would make the pump-and-dump event challenging for buyers.

The chances of BTC tagging $14,000 or even $13,000 remain very high. BTC could do a huge wash and rinse down to $10,000.

BTC/USD Daily chart (Source: TradingView).

Avoid ETH/USD dips

Buying ETH on dips does not interest me at this stage, no matter how great the fundamentals are for this coin. Confidence is so severely shaken that buying around current levels is very risky.

A move towards the $1,400 or $1,450 area could be a good selling opportunity and a chance to get positioned for the next $500 move lower. The previous low, around $800, would be an enticing buy. However, even then, I would not rule out the possibility of an eventual cycle bottom around $500.

ETH/USD Daily chart (Source: TradingView).

Ignore The LTC/USD Hype

The price of Litecoin has confounded sellers recently as LTC/USD has done surprisingly well during a troubled time. However, without a real spike in usage or payment partner announcement, I doubt this current pricing and believe we could see it moving back to $35 or even $30.

On a long-time frame, I will only consider a positive momentum shift once the price breaks the $90 mark. I doubt this will happen soon, so moves into the $68 or $70 range look like a good selling opportunity.

LTC/USD Daily chart (Source: TradingView)

The Elephant In The Room

The elephant or 500-pound gorilla in the room right now remains FTX. Sentiment in the market is low due to the shocking revelation of a multi-billion dollar scam. It makes perfect sense that it will take a long time before confidence is restored.

The market is undergoing a systemic crisis, making it difficult for individual coins to pump on crypto-specific news.

At what point crypto reaches a fundamental “value proposition” is hard to predict. Based on the fundamentals and price action, it is certainly not at current levels. This is why I am inclined to say that after one (hopefully) more short pump, we could see another significant decline in crypto.