SIMETRI Made 480% Gains on These Small-Cap Cryptocurrencies: Performance Report

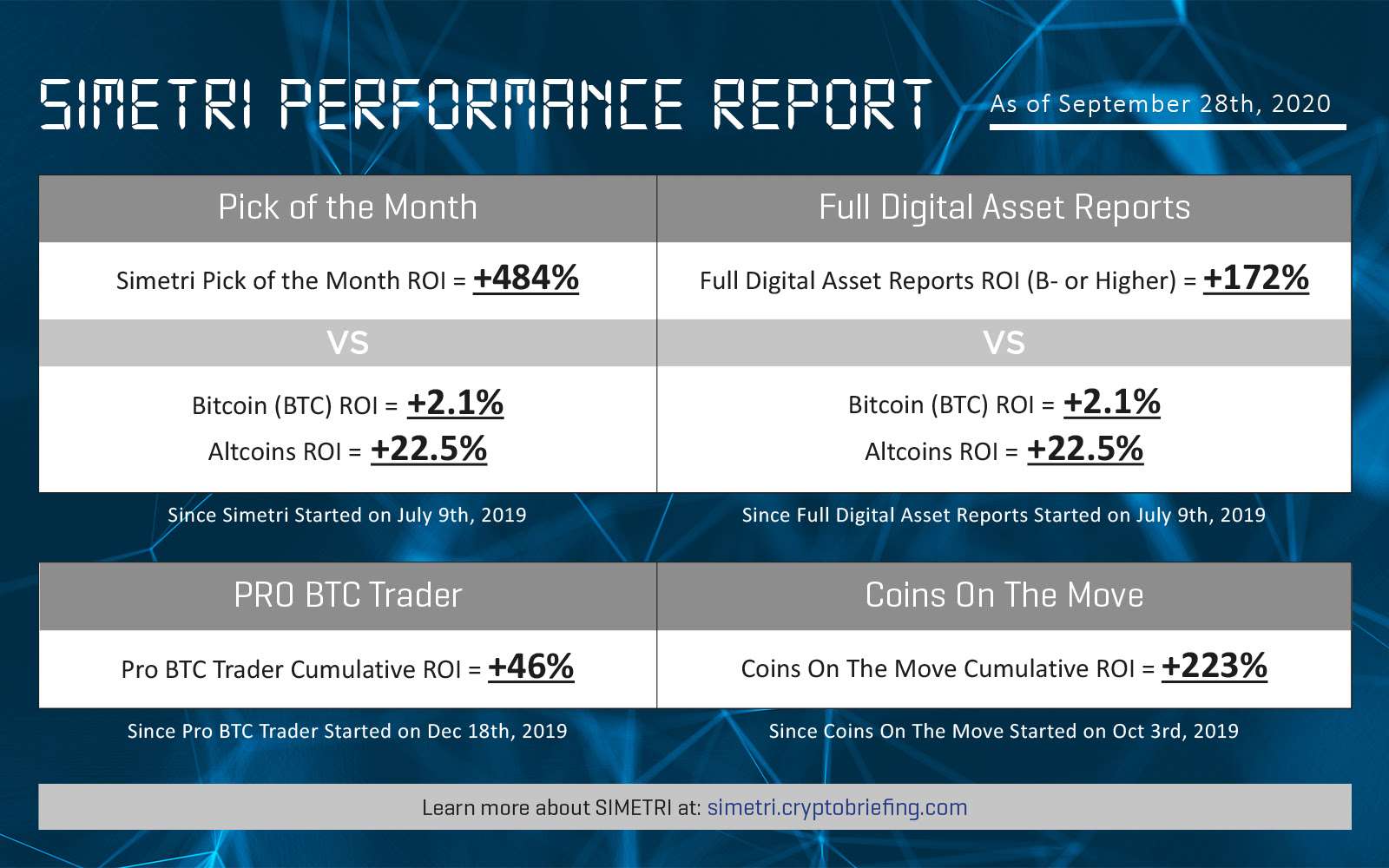

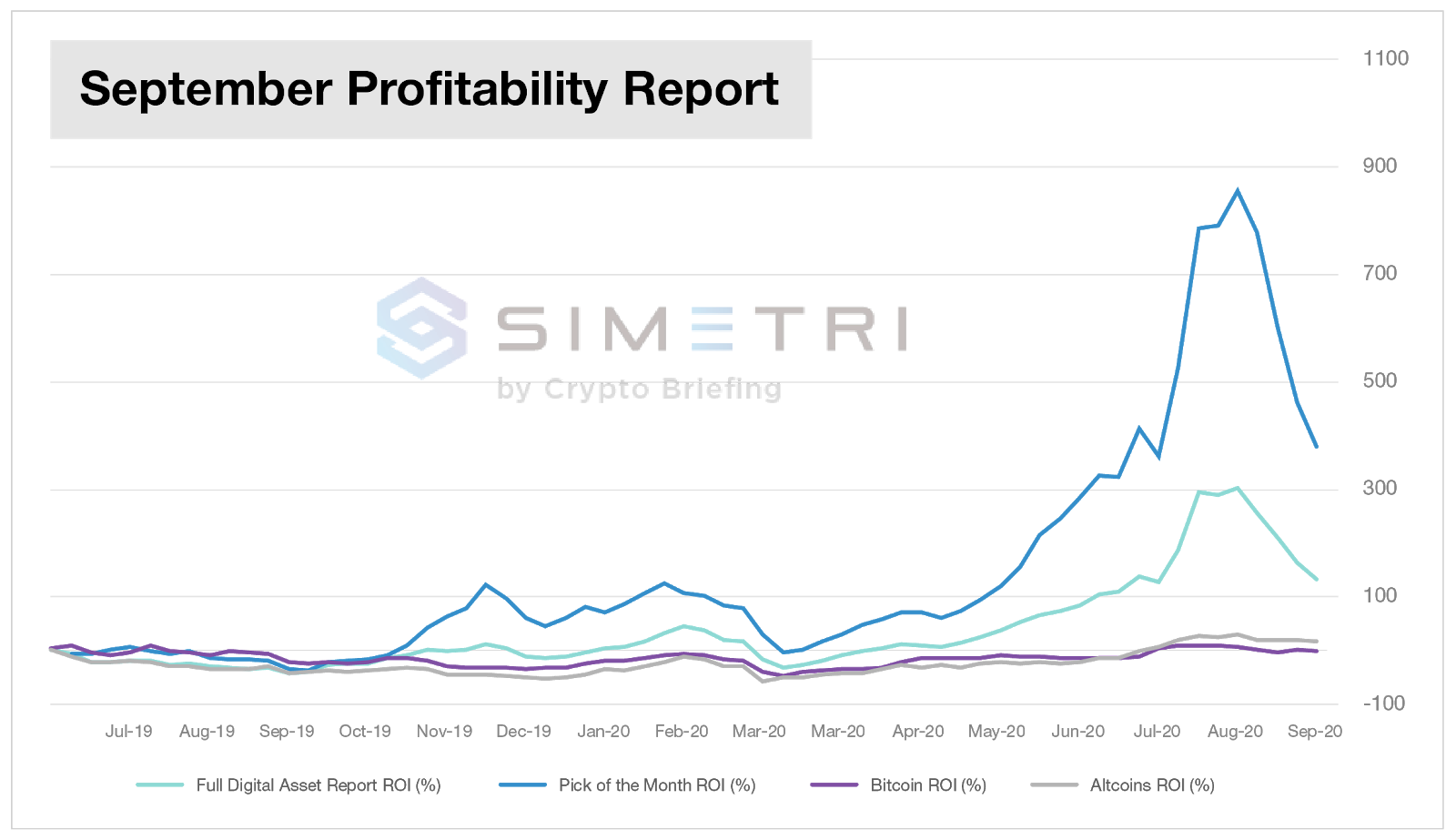

SIMETRI once again beat Bitcoin and a weighted altcoin index with a cumulative ROI of over 480%. Careful analysis of crypto projects with strong teams and promising technology allowed us to outperform the market consistently.

- Since July 2019, our flagship research product Pick of the Month yielded 484% from 15 picks and 1 special report.

- We issued 50 full digital asset reports with an “investable” grade of B- or higher, providing investors with cumulative gains of 172%.

- Short-term signals from our Coins on the Move dashboard and Pro BTC Trader email subscription provided 223% and 46% ROI, respectively.

In July 2019, Crypto Briefing founded SIMETRI to give investors the first pick at cryptocurrencies with strong fundamentals and outstanding upside potential. So far we have delivered on this vision, with our Pick of the Month beating Bitcoin by 482%.

Why Pick of the Month Wins

The underlying way we select the Pick of the Month can help explain why it has consistently beat the market.

The SIMETRI research team selects the Pick of the Month by conducting due diligence on tens of coins. We compare the market opportunity, token economics, and the technology behind each project to predict which cryptocurrencies will thrive over the long term. These contenders also need to have a near-term catalyst like a potential exchange listing or an impending mainnet launch.

These factors must indicate that a coin has 10x potential, at a minimum, for it to be selected as our Pick of the Month. So far, we have issued 15 picks and 1 special report. In our opinion, these riskier medium-term investments have the best risk-to-reward profile.

Of our 16 recommendations, there were 9 winners, 4 break-evens, and 3 losers. These picks generated a total ROI of 484% as of Sept. 28, 3:02 PM UTC.

| Project | Date Published | Start Price ($) | End Price ($) | ROI (%) |

| Theta (THETA) | 7/9/2019 | 0.12 | 0.716 | 497 |

| Harmony (ONE) | 8/13/2019 | 0.012 | 0.005 | -55.6 |

| RSK (RIF) | 9/10/2019 | 0.14 | 0.084 | -39.8 |

| THORChain (RUNE) | 10/8/2019 | 0.012 | 0.613 | 5024 |

| Klaytn (KLAY) | 11/12/2019 | 0.157 | 0.508 | 224 |

| Tellor (TRB) | 12/10/2019 | 4.9 | 25.19 | 414 |

| Kava (KAVA) | 1/14/2020 | 1.03 | 2.31 | 124 |

| Huobi Token (HT) | 2/11/2020 | 4.62 | 4.6 | -0.43 |

| Ren (REN) | 3/10/2020 | 0.071 | 0.235 | 230 |

| Band Protocol (BAND) | 4/14/2020 | 0.564 | 6.99 | 1139 |

| Proton (XPR) | 5/12/2020 | 0.02 | 0.011 | -43.1 |

| Kyber (KNC) | 6/9/2020 | 0.874 | 1.05 | 20.1 |

| IDEX (IDEX) | 6/26/2020 | 0.035 | 0.065 | 87.6 |

| Switcheo (SWTH) | 7/14/2020 | 0.015 | 0.032 | 110 |

| UNLOCK (???) | 8/11/2020 | 3.21 | 3.16 | -1.56 |

| UNLOCK (???) | 9/8/2020 | 0.82 | 0.908 | 10.7 |

Over the same period starting July 9, 2019, Bitcoin only gained 2.1% while altcoins are up 22.5%. Those who followed SIMETRI‘s Pick of the Month buy recommendations beat Bitcoin by 482% and a weighted altcoin index by 461%.

The home-run among our picks is THORChain, which went 50x since selection. The next-best performer is Band Protocol, which went up 11x after releasing our report.

Other big winners include Theta Token (+498%), Tellor (+414%), Ren (+230), and Klaytn (224%).

That isn’t to say that all of our picks were winners. Three tokens have fallen substantially since we selected them: Harmony (-56%), Proton (-43%), and RSK (-40%).

| Pick of the Month ROI | Bitcoin | Altcoins Market | |

| July 9, 2019 | – | $12,573 | $124.3B |

| June 24, 2020 | 251.4% | $9,298 (-26%) | $94.2B (-24%) |

| August 12, 2020 | 751% (+199%) | $11,663 (+25%) | $144.2B (+53%) |

| September 28, 2020 | 484% (-36%) | $10,860 (-6%) | $145.6B (+9%) |

Full Digital Asset Reports

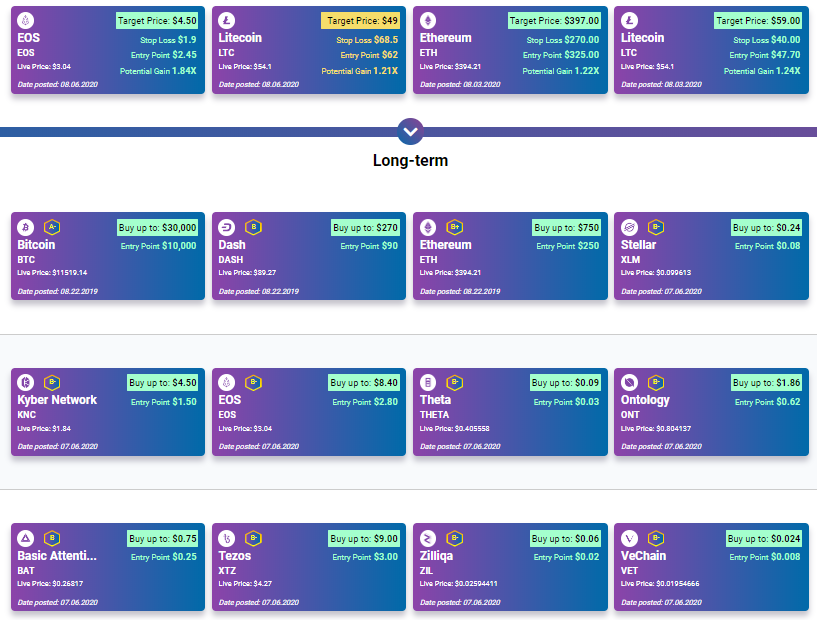

SIMETRI’s Full Digital Asset Reports evaluate established cryptocurrencies which we think are still undervalued. In our opinion, these are more reliable long-term holds. From July 2019 to September 2020, SIMETRI issued 50 reports with an “investable” grade of B- or higher.

Each time we issue an “Upgrade” signal or put out an initial report with a grade of B- or higher, this represents a “Buy,” while a “Downgrade” represents a sell.

Based on our research, prime holds include Bitcoin (A-), Kyber Network (B+), Ethereum (B+), and Binance Coin (B+). Other promising projects on the list are Chainlink (B), Basic Attention Token (B), OKB (B), MakerDAO (B), and Dash (B).

Of these 50 trades, 27 were winners, 2 broke even, and 21 were losers, for total gains of 172% since inception.

Again, researching each coin’s fundamental factors allowed SIMETRI to outperform a more inclusive altcoin index and the broader crypto market.

Short Term Signals

Besides our medium-term and long-term investment recommendations, SIMETRI also provides short-term signals for active traders. Coins on the Move and Pro BTC Trader provide color on the market, as well as solid returns.

The platform issued 47 signals for trading less-speculative altcoins. Of these signals, there were 24 winners, 20 losers, and 3 closed with no gain or loss. In total, these recommendations provided a total ROI of 223%.

From its first signal on Dec. 18, 2019, Pro BTC Trader issued 5 successful recommendations, 5 misses, and 6 trades where a stop-loss was triggered with no gain or loss. Those who followed these trades made a total return of 46%.

Why SIMETRI?

Investing in cryptocurrency is inherently unfair. Poor transparency, unfair token economics, and insider trading mean that small-time investors are the ones left holding the bag when there’s a correction in the market.

Despite the industry’s problems, the potential of Bitcoin and cryptocurrency is real. Blockchain technology can completely change how finance works, liberating it from the bankers and politicians looking to get their cut. Small bets in this nascent industry could yield enormous returns.

We started SIMETRI to help investors navigate the complexities of crypto. Through a combination of research and journalism, we have access to information that nobody else can get. We’re talking to the builders and influencers shaping this industry. We have a record of spotting trends, like DeFi, before they hit the mainstream. And we’re willing to share these secrets with you.