How To Short On Kraken

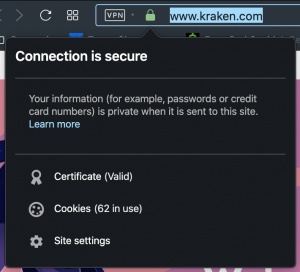

1. Go to https://www.kraken.com. Don’t forget to make sure that the website name is correct the connection is secure. In a browser, look for the ‘lock’ icon to the left of the address field.

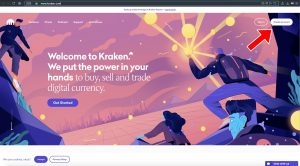

2. If you already have an account, skip to step 7. Otherwise, click on the ‘Create Account’ button in the top right corner.

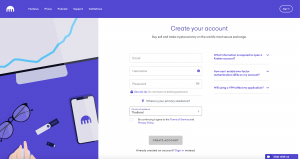

3. Fill in your personal details and create a strong password. You may want to use a password manager like 1Password. Avoid putting your personal data in the password and using a browser-suggested one.

4. You will get a confirmation email. Verify the sender’s address. The email domain name should be the same as the website’s address. Confirm your email.

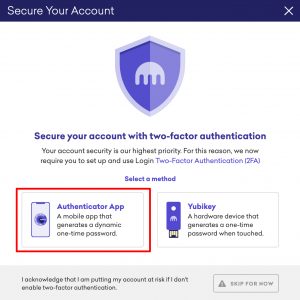

5. The confirmation link will bring you to the login page. Use your freshly created credentials. You will be offered to turn two-factor authentication. The more convenient way is via the Google Authenticator app. The app is available for both iOS and Android. Once you have the app on your device, tap on the ‘+’ icon and scan the QR-code on Kraken with your device’s camera.

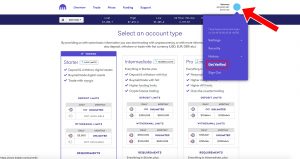

6. You can proceed with an advanced verification to get higher deposit/withdrawal limits, fiat support, and additional trading features. To do this, navigate to your account icon in the top right corner and click on ‘Get Verified’.

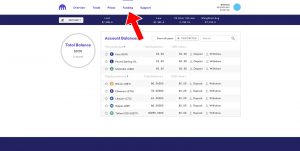

7. Once you are verified, you need to transfer USD or crypto (BTC, BCH, ETH, XMR, XRP, USDT) to fund your account’s collateral. In the dashboard, go to ‘Funding’ and proceed with the desired option.

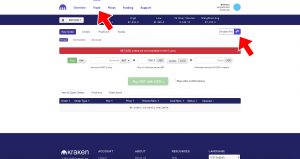

8. When your funds arrive, go to the ‘Trade’ tab on your dashboard and click on the ‘Kraken Pro’ option.

9. In the terminal window, click on the ‘Markets’ tab in the top left corner and select one of the following trading pairs:

– BTC/USD

– BCH/USD

– ETH/USD

– ETH/USD

– XMR/USD

– XRP/USD

– USDT/USD

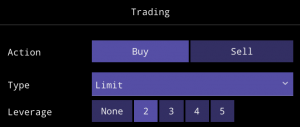

10. On the left, you will see the trading section. Here you need to specify the type of the order. Go with the limit order to enter a position at a specific price.

11. Next, you will be prompted to set the leverage.

Leverage means that you can magnify your purchasing power. For instance, with $1,000 collateral on an account, it is possible to open a position for $5,000 using x5 leverage. Hence, the potential profit from the trade will be 5 times higher than if you made the trade on the spot market without leverage.

Leveraged positions are backed with the assets you just deposited as collateral. If you lose too much money in a trade, you are likely to get margin called. A margin call is a notification from the exchange that you should increase your collateral to keep open positions from being liquidated. Liquidation means forcibly closing some or all open positions at a loss.

Margin call notification is not guaranteed, so it is better to calculate margin in advance to protect against losing money. There are 4 variables to keep track of: Used Margin, Margin Level, Margin Call Level, and Margin Liquidation Level.

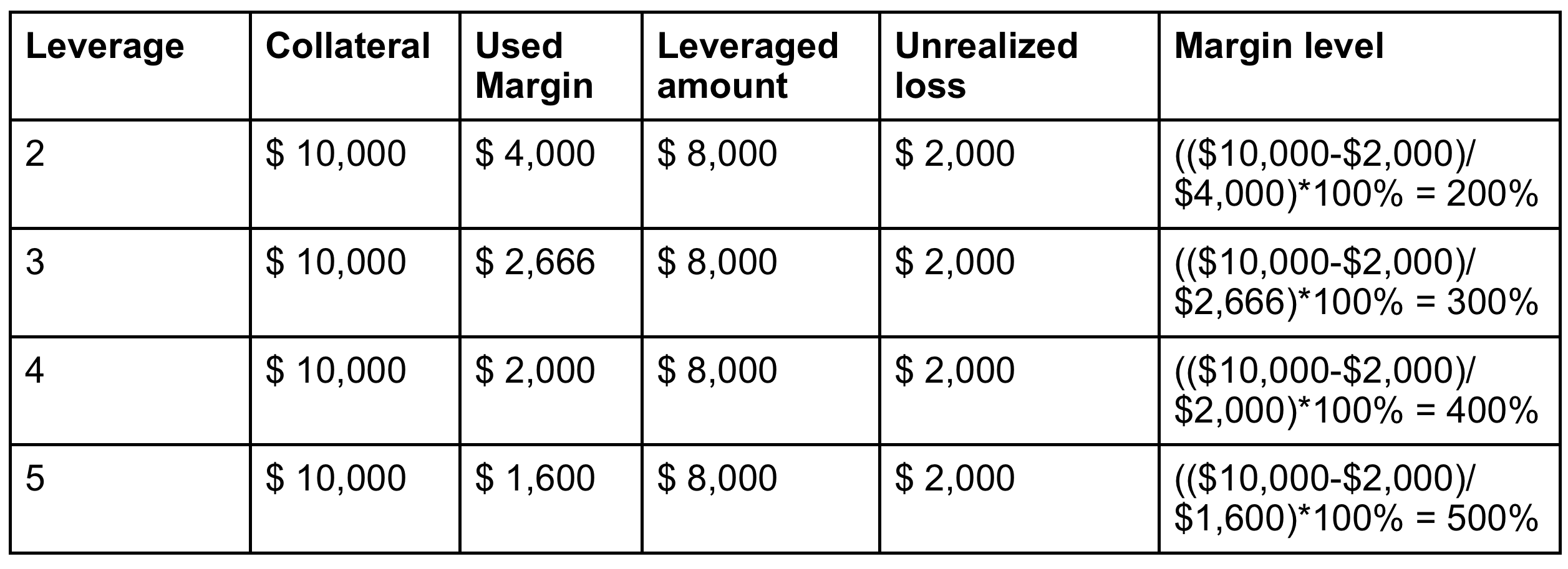

The used margin is how much collateral is used in a trade. For instance, let’s take an account with $10,000 in collateral and a margin position for selling 1 BTC at the price of $8,000 at x2 leverage. If the x2 leveraged position equals $8,000, then the used margin is $4,000 ($8,000/2) and the remaining funds are $6,000 ($10,000-$4,000).

The margin level is calculated by the formula: Margin Level = (Equity/Used Margin)×100, where ‘Equity’ is Trade Balance (total value of the collateral deposited to the account) + Profit/Loss. Following the example above, If the current price of BTC is $7,500, the trade is in profit of $500. Hence, the equity will be $10,000 (Trade Balance) + $500 (Profit) = $10,500 and the margin level will be (10,500/4,000)*100 = 262.5%.

Margin call level on Kraken is 80%, meaning that if the margin level will get below this threshold, the exchange will require additional funds in collateral to maintain position.

Margin liquidation level on Kraken is 40%, meaning that if the margin level gets below this threshold the exchange will automatically close all open positions. It is important to understand that liquidation can happen at any point between the margin call and margin liquidation levels if the exchange deems that necessary.

You can either rely on Kraken’s examples to calculate these levels or use a calculator. Here is a reference table for leverage trading on Kraken.

Example BTC Short Position (Opening price – $8,000, current price – $10,000)

Closing position with no profit or loss will still incur losses as there are the opening and the rollover fees. The opening fee is deducted at the time the position was initiated and the rollover fee is deducted every 4 hours for using the borrowed assets. You can find more information about the exact fees for each asset here. It makes little sense to put your stop orders at the margin call threshold as sometimes the price may go just a little above it and then reverse. Hence, sometimes it is better to add to the collateral to maintain the open position.

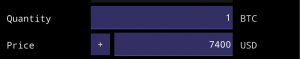

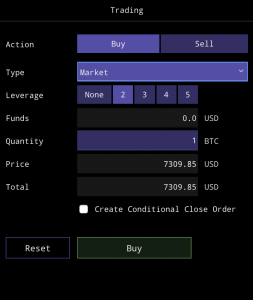

12. Going further, specify how many units of the desired asset you want to sell and at what price you want to enter the position.

13. After the entrance point is determined, you can set the timing for the position. After the time window expires the order is automatically canceled if it has not been filled.

14. Click on ‘Sell’ to review your order.

15. Once you have reviewed your order, press ‘Confirm’ to add it to the order book. If the price reaches your entrance target, your order will execute automatically.

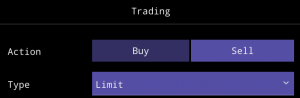

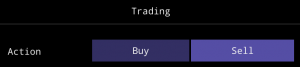

16. To protect yourself from significant losses, you need to create a buy order of the same volume as your sell order to close the position if the market goes against you. Click on the ‘Buy’ tab in the ‘Action’ field of the trading section.

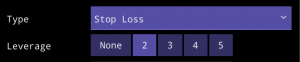

17. Specify the type of order, in this case, ‘Stop Loss’ along with leverage.

18. Enter the quantity of assets and the price at which your position will get automatically closed at a small loss should the price grow significantly.

19. Next, set expiration time.

20. Finally, click on ‘Buy’, review and confirm your stop loss.

21. If you don’t use a stop loss and reach a margin call, you may want to maintain an open position to wait out the price pressure. To do so, you will need to send more funds to your account.

Return to your account’s dashboard, go to ‘Funding’ and proceed with the desired option.

22. For taking profit, create a buy limit order of the same volume as your short position at your target price. In the same ‘Buy’ tab switch the order type to ‘Limit.’ Leave leverage at the same level as you were creating the short order.

A single take profit order can close multiple open positions at once depending on its size. If you create a closing order that is larger than your open positions, you will automatically bet on the opposite direction of the market. For instance, if your short position is for 1 BTC and you close it for 3 BTC, you will end up having a leveraged long position for 2 BTC.

23. Next, specify the target price at which the trade will be closed automatically should the market go in your favor.

24. Next, set expiration time.

25. Finally, click on ‘Buy’, review and confirm your take profit.

26. You can also close your short position immediately using the ‘Market’ order type instead of limit. This will close your position at the best available price.