Hong Kong Roller Coaster

Bitcoin moved to an eight-month high last week, close to the $25,250 level, thanks to the news that Hong Kong could be opening its doors to digital assets and investors.

Even prior to the Hong Kong news, BTC made a counterintuitive move higher despite CPI data from the U.S. economy last week that showed inflation remained stubbornly high in January.

Traders ignored the fact that the trend is likely to push the Fed to remain hawkish for longer than anticipated.

Traders were also seen moving away from stablecoins and into BTC and altcoins last week as the crackdown on stablecoins continues.

Moving back into fiat is not an option for many crypto holders, so this could go a long way to explaining the sustained move higher in the crypto market, aside from the bullish catalysts outlined above.

Bitcoin eventually gave back some of its blockbuster gains due to hawkish comments from a number of Fed officials towards the end of week.

Game Changer

The big question for crypto is just how much of a game changer the Hong Kong news might be. Can the news help crypto sustain its recent gains, even in the face of more Fed rate hikes?

Hong Kong basically plans on becoming an Asian crypto hub. This is an ambitious plan, and the actual launch date itself is quite far away, so the move higher is more of a knee-jerk reaction at this stage.

In June, Hong Kong will officially make crypto buying, selling, and trading fully legal for all its citizens. This also includes mainland Chinese institutions, which is obviously a huge market.

Some of the bullish catalysts down the pipeline also include launching bitcoin and ether futures ETFs; Samsung looking to launch a spot bitcoin ETF; Singapore’s biggest bank, DBS, seeking approval to offer bitcoin in Hong Kong; and IB, a 337 billion broker, launching bitcoin and ether trading services.

A fully open Hong Kong also means that money from China can easily flow back into digital assets despite the ban on crypto for individuals.

It is possible that an Asian stablecoin will also emerge in the next market cycle. China and its neighbors have been working hard to distance themselves from the U.S. dollar hegemony, so this could also be a political play.

On-Chain Analysis

Last week Bitcoin’s on-chain activity was not particularly impressive. Most metrics seem to show that a major move isn’t likely.

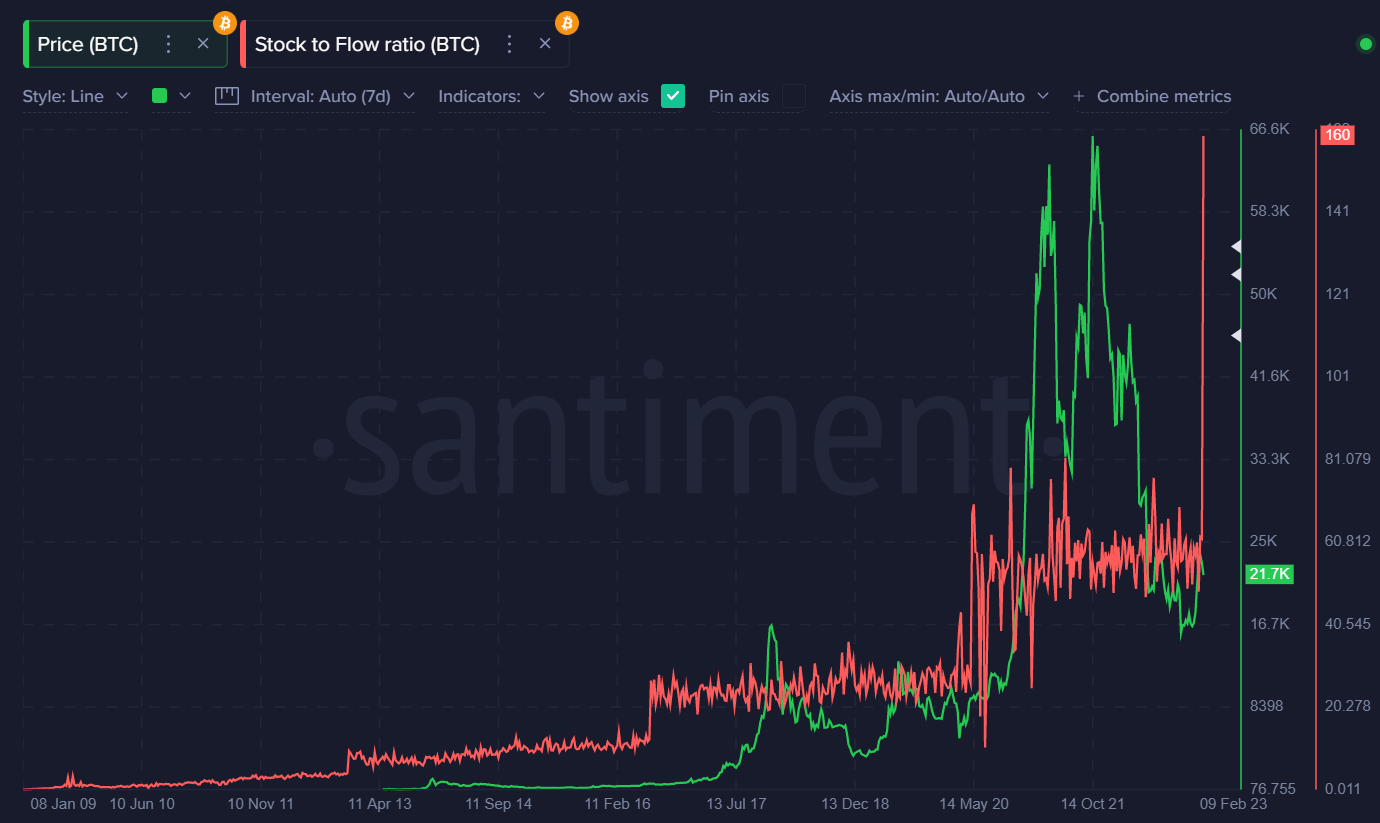

Aside from the previous week’s spike in Bitcoin’s Stock-To-Flow Ratio, very little on-chain data actually predicted the move to $25,000.

Source: Santiment.

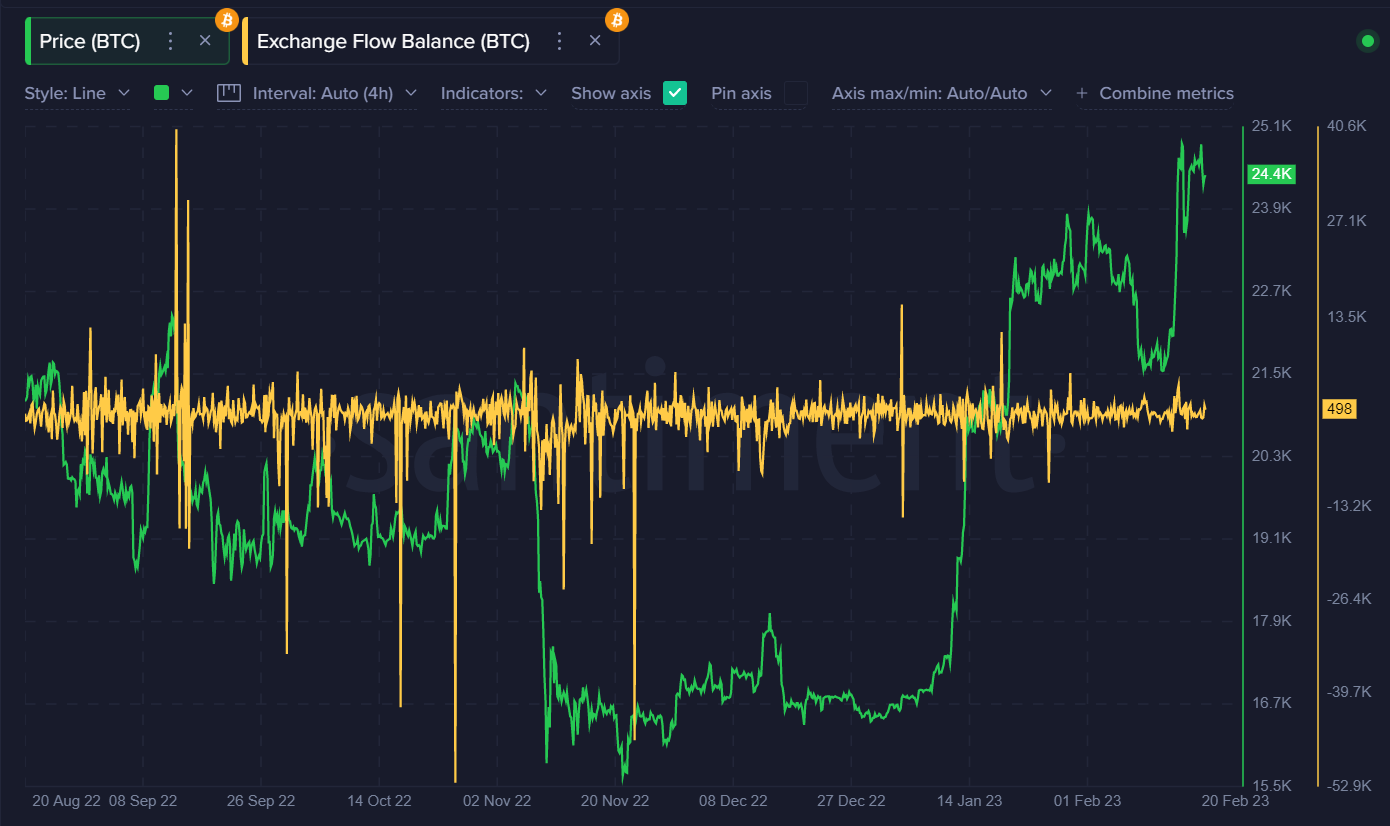

As you can see from the attached price charts, Exchange Activity and Token Age Consumed metrics were extremely muted during this volatile period.

Source: Santiment.

Source: Santiment.

The only indication that the market could reverse quite substantially after this pump is the behavior of mid-tier whales, who did not buy much last week. Retail, of course, bought in excess.

Source: Santiment.

Usually, mid-tier whales are considered the smart money, so this may perhaps indicate the move higher is not sustainable.

BTC Reversal

The main point of contention this week will be whether bitcoin can quickly pick up last week’s momentum, attack the $25,300 level, and break out towards the $28,000 level.

Much will depend on price dips. If Bitcoin falls and bounces from the $23,500 to $22,800 support zone this week, the momentum will probably still be alive.

A series of daily closes under the $21,700 level and all bets are off. Bitcoin could quickly sink towards the $20,000 level.

BTC/USD four-hour chart (Source: TradingView).

ETH Fails

Ether failed quite spectacularly last week around the $1,700 resistance, signaling that all is not well with the second-largest cryptocurrency.

If ETH can blow past the $1,720 resistance zone this week, then we will probably see substantial buying pressure towards the $1,900 zone.

Failure to launch this week would put ETH in failed breakout territory. We could quickly see a downturn towards the $1,410 area.

ETH/USD four-hour chart (Source: TradingView)

LTC Watch

Litecoin did not follow through above the $100.00 resistance area, which sets up a very interesting trading week.

Strong daily and weekly buy signals are in play for the LTC/USD pair right now across the Alligator Williams Indicator, making it a dangerous coin to short.

The $125.00 level would be my primary upside target if LTC heads higher this week.

Only a sustained move under the $87.00 level would get the bear party started.

LTC/USD four-hour chart (Source: TradingView)

In Summary

Fighting the Fed is one of the worst trading tactics on record. This makes me slightly nervous about BTC’s latest move higher, which culminated around $25,000.

The Hong Kong news is extremely bullish, however, crypto demand in Asia is likely to culminate in the summer and crypto winter is still in the thawing process.