Fed Push

Bitcoin moved to a fresh multi-month high last week, close to the $24,250 level, as it rose alongside stocks and bonds after the U.S. Federal Reserve hiked rates by 25 basis points and said that the disinflationary process was underway.

Even though the announcement was widely expected, and largely priced in by the market, Bitcoin followed the Nasdaq and S&P500’s breakouts, and also reacted positively to a big breakdown in the DXY.

MicroStrategy’s latest earnings report appears to have been the main negative news in the $24,000 area.

The market did not like MicroStrategy’s impairment losses on Bitcoin, which were worth $197.6 million during the fourth quarter of 2022, compared to $146.6 million in Q4 2021. MicroStrategy’s BTC acquisition had an average carrying amount per bitcoin of about $13,887.

Markets also downplayed the news that Twitter had begun applying for regulatory licenses to introduce payments across the platform, which would potentially include Bitcoin and other cryptos.

Jobs Watch

Bitcoin did not like the strong January 2023 US job report. BTC and other risk assets faltered as Nonfarm payrolls increased by 517,000, smashing the 185,000 estimate.

The report was a huge beat that may have had some seasonality to it. However, the idea that the improved job situation in the U.S. could embolden the Fed to raise rates higher for longer could continue to push down the price of risk-on assets.

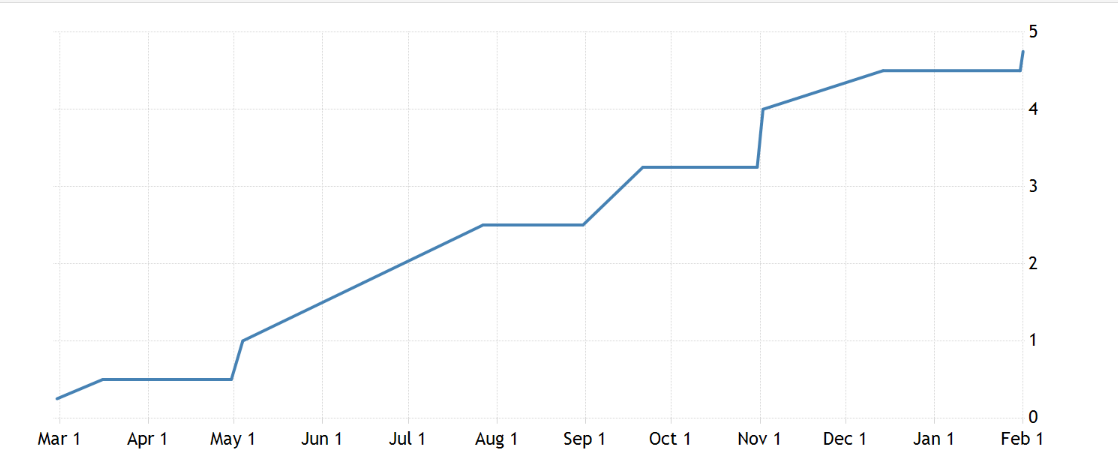

Initial jobless claims numbers in the U.S. have also been declining fast over recent weeks, further hinting that the jobs situation is getting better. This is a trend worth watching.

Extra slack in the jobs market may leave the Federal Reserve some scope to continue to hike in small increments.

Currently, with the re-opening of China, the market is focusing on positive news and ignoring negative ones.

Bitcoin’s ability to hold onto its January price gains will also depend on the next CPI report and any potential bearish catalysts for risk assets.

Macro-wise, with central banks moving away from tightening globally, we would need a major negative shock from the Ukrainian war, or for miners to sell heavily, to pressure BTC lower.

On-Chain View

No real major negative signs have emerged for the current price rally. The mains indicators have yet to produce the type of spikes that would imply a correction is coming.

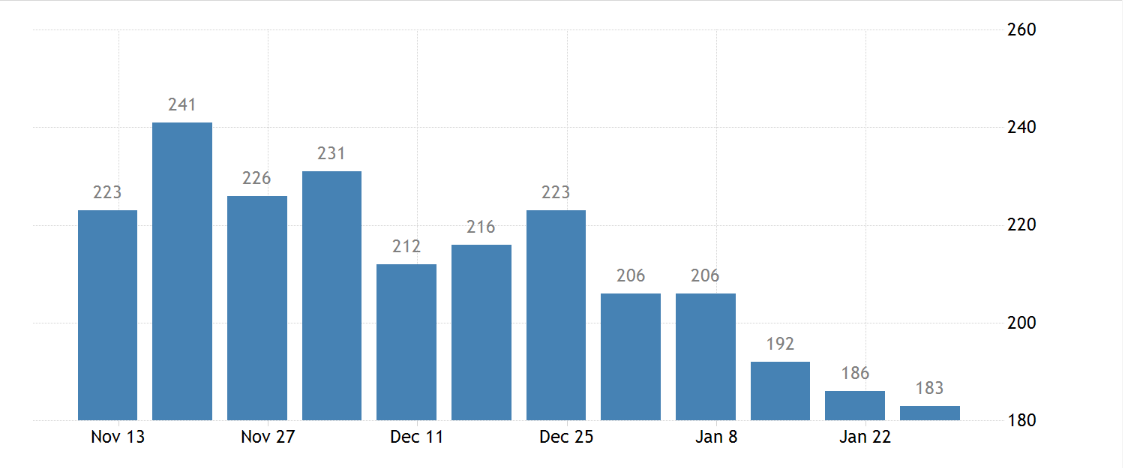

Perhaps the biggest threat to the rally remains the behavior of mid-tier whales, which since January 25 have been selling relentlessly.

Some caution is required, as this historically-price-accurate set of whales are in no mood for buying now.

Source: Santiment.

Also, the smallest subset of retail holders has been feverishly buying around the top of the range last week. Not a great sign.

Source: Santiment.

Certainly, this provides us with ample reason to expect a coming correction.

Should we see Token Age Consumed, Exchange data, and Network Profit & Loss all spiking this week, it could well signal the start of a correction.

Sentiment Analysis

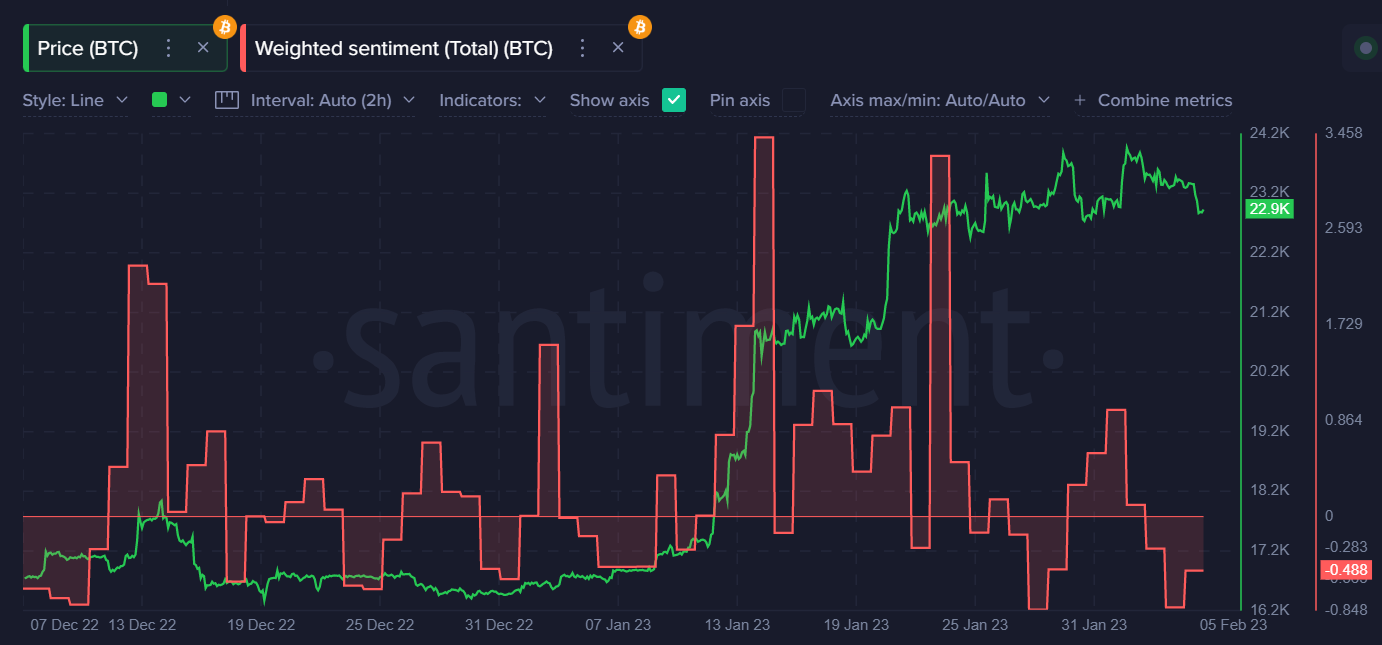

Sentiment getting better over recent weeks is keeping me cautious as well.

We are not seeing the highest levels ever recorded in Weighted Social Sentiment, but the metric did creep higher last week.

Source: Santiment.

Also, the Crypto Fear & Greed Index has moved into a state of greed. It is well worth keeping an eye on sentiment if BTC cannot blow past $25,000 this month.

Trend Watch

Something to watch for this week will be Bitcoin’s ability to hold above the $23,500 area, and potentially ignite a golden-cross, whereby the 50-day SMA crosses over the 200-day SMA.

The golden-cross on the daily time frame has ignited some pretty powerful buy signals previously, so if that happens BTC could attack the $25,000 level.

On the flip side, if we fail to see another new weekly high, and we see some weakness below $22,200 then I think a technical test of at least $21,500 seems highly plausible.

BTC/USD four-hour chart (Source: TradingView).

Ethereum Pivot

Looking at Ethereum this week, a strong buy signal is in place as long as the ETH/USD pair holds above the $1,685 level. A technical test of $1,750 would then be in the cards.

The scary part for ETH bears would be that there is no real strong resistance on the charts until $2,000 to $2,200 if ETH crosses $1,750.

The bear case is also quite substantial if technical failure takes holds, and a trip towards the $1,410 level would seem logical in terms of a technical retest.

ETH/USD four-hour chart (Source: TradingView).

Litecoin Breakout

Litecoin started to breakout above a really well flagged broadening wedge pattern last week, placing the odds in favor of bulls—at least as long as the breakout lasts.

I must admit I am not entirely convinced with the bull case, but let’s run with it for now, as LTC is above $98.00 this week. Targets of $110.00 and $125.00 are on the table while the trend lasts.

If this entire move is a fakeout then LTC could implode with some gusto towards the $70.00 area this month. It really depends on the broader market.

LTC/USD four-hour chart (Source: TradingView).

In Summary

Being bearish while Bitcoin and the entire crypto market continues to grind higher is becoming somewhat painful, to say the least.

The current behavior of mid-tier whales suggests that a solid correction could commence this month. It will be very interesting to see if they stack their bags again during the next major price decline.

Personally, I am still very cautious and need to see either a solid dip or BTC crossing $25,000 before I start to entertain the notion that the bear market has indeed ended.