Bull Trap

Last week, bitcoin’s price movement was depressed as trading volume and liquidity remained low after the holiday period. It is still confined to a tight price range.

Altcoins got much more attention, with coins like ETC, BONK, SOL, ADA, and ETH going far higher than BTC.

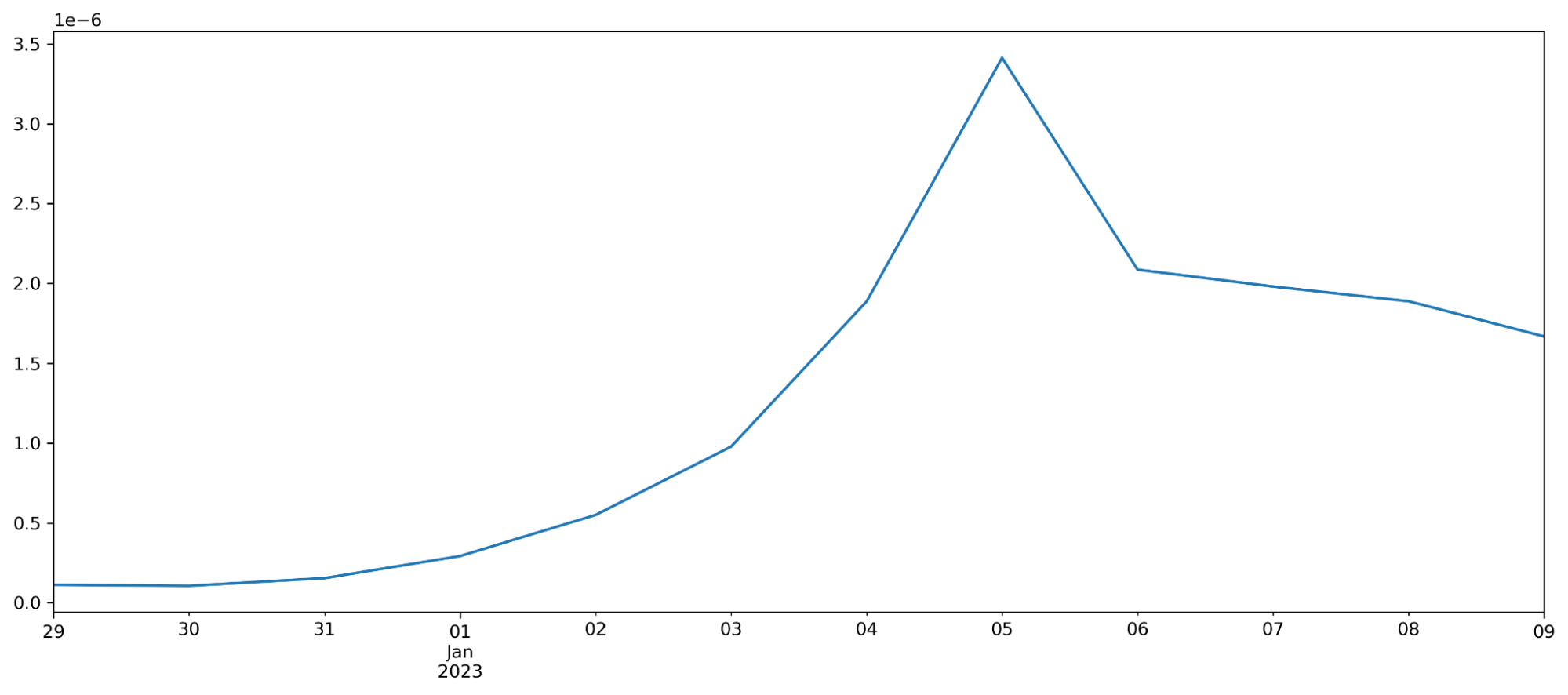

BONK (Source: CoinGecko).

BTC remained at the mercy of key macroeconomic data points. It started to give back its initial weekly price gains after the release of the ADP private sector employment report.

The strong ADP jobs print weakened market expectations of the Fed toning down its aggressive rate hikes. However, this pessimism was soon counterbalanced by the release of the Nonfarm payrolls report as BTC moved back towards $17,000.

The December jobs report showed a deceleration in wage growth, which investors believe could induce the Fed to become less hawkish. Traders upped bets that the U.S. central bank might raise rates by only 25 basis points at its next monetary policy meeting in February.

Markets now turn their attention to the CPI print that’s going to go out this Thursday.

CPI Watch

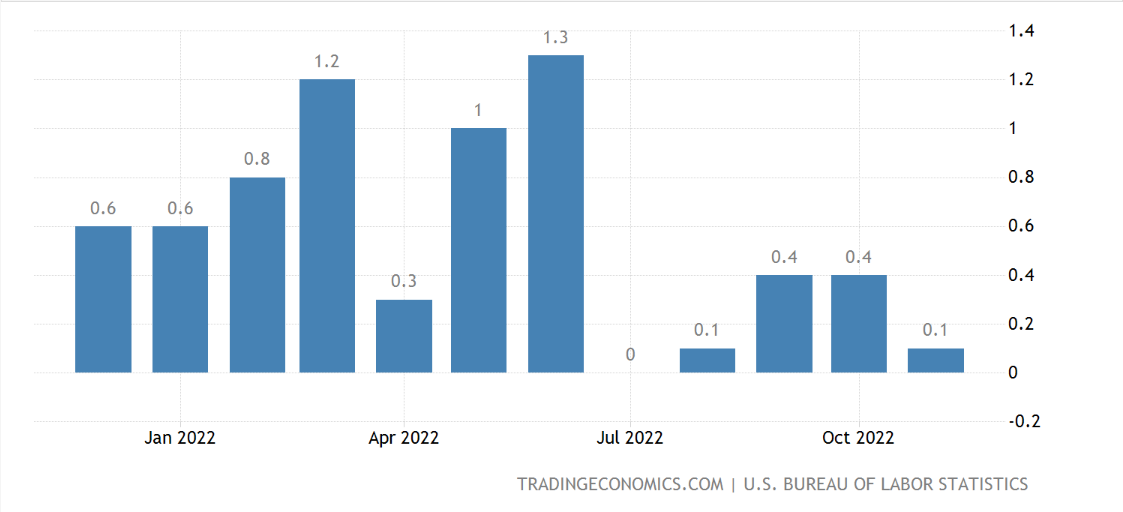

This week’s consumer price index will give a clearer picture of the economy’s direction in 2023. Recent signals from the job market indicate that the Fed’s goal of a soft landing (lower prices without a major recession) may be within reach.

U.S Monthly CPI (Source: Trading Economics).

Despite the slowdown in rate hikes, Fed officials (including chair Jerome Powell) have insisted that interest rates still need to increase.

Although the markets remain skeptical about that narrative, the Fed tends to remain on the side of doing too much rather than too little.

BTC will likely consolidate close to the $17,000 area until the CPI print drops.

Economic Calendar

Besides the CPI print, it’s worth paying attention to Powell’s speech on Tuesday. It has the potential to move markets.

On-Chain Watch

On-chain action has been bland over recent weeks, with BTC/USD Exchange Inflow and Outflow data pointing to low volatility ahead.

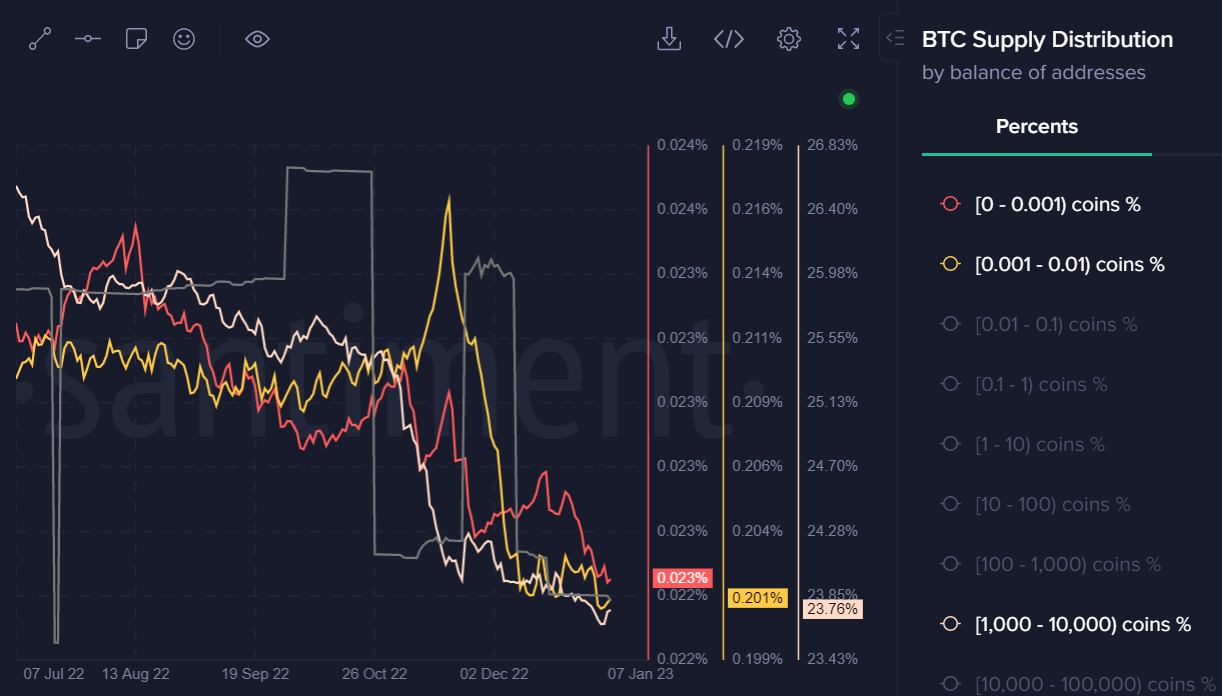

Notably, last week we saw the price-sensitive and accurate mid-tier whales starting to pause selling, which may have contributed to the ongoing BTC bounce.

Whales paused selling. (Source: Santiment).

With this in mind, a near-term upside is possible. However, take this with a grain of salt because the bearish trend is still intact.

The two smallest sets of BTC holders had a mixed week, with tiny holders continuing to sell while holders with 0.001 to 0.01 BTC being bullish.

Overall, I expect selling pressure to resume for much of Q1 2023.

$17,400 possible

Currently, bitcoin is carving out a pitiful price range, making it very undesirable to trade unless you are short. Meanwhile, a head and shoulders pattern is still forming.

While the pattern can be easily invalidated, the ongoing bearish trend suggests that BTC will eventually give in and go lower to around $14,000 and maybe even $12,800.

Anyone looking for a tradable swing opportunity in BTC/USD this week may look towards the $17,300 to $17,400. Failure at this level will trigger a resumption of the bear trend.

BTC/USD four-hour chart (Source: TradingView).

ETH/USD: Lack of Sustainability

ETH/USD’s recovery doesn’t appear sustainable. I tend to think that termination of the recovery could take place slightly above $1,400 in the short term.

In the long term, ETH looks doomed to get another down leg unless we see a sustainable breakout above the $1,800 resistance and BTC surges past $20,000. I’m not expecting it to happen in January, though.

Overall, it’s better to sell the rips and wait to buy the dip.

ETH/USD four-hour chart (Source: TradingView).

LTC/USD: A Looming Short

Litecoin is becoming increasingly attractive as signs emerge that LTC/USD could be preparing for a final price ramp above $80.00 one more time.

It is debatable whether LTC can actually get above $80.00, but a substantial swing sell opportunity may await around the $85.00 to $90.00 level.

LTC/USD four-hour chart (Source: TradingView).

The Market Is Testing Us

The market conditions are challenging for traders and accumulators. However, I believe brighter days lay ahead.

I expect a capitulation event at 20% to 30% lower from our current levels.

On the bright side, once capitulation takes place, a multi-month recovery with strong momentum should take place in Q2 2023, eventually culminating in a test of $25,000.

For regular updates on my thoughts and trades, please check out PRO BTC Trader.