Bitcoin’s Major Moves, Ethereum’s Rally, and Disaster in DeFi

In the span of a week, the market gained over $15 billion in market capitalization and then promptly lost those gains.

Greed drove the rally as BTC raced past $10,000, only later to see a correction below this psychological barrier. But, this is another chance to buy in before the next rally.

Bitcoin’s Major Movements

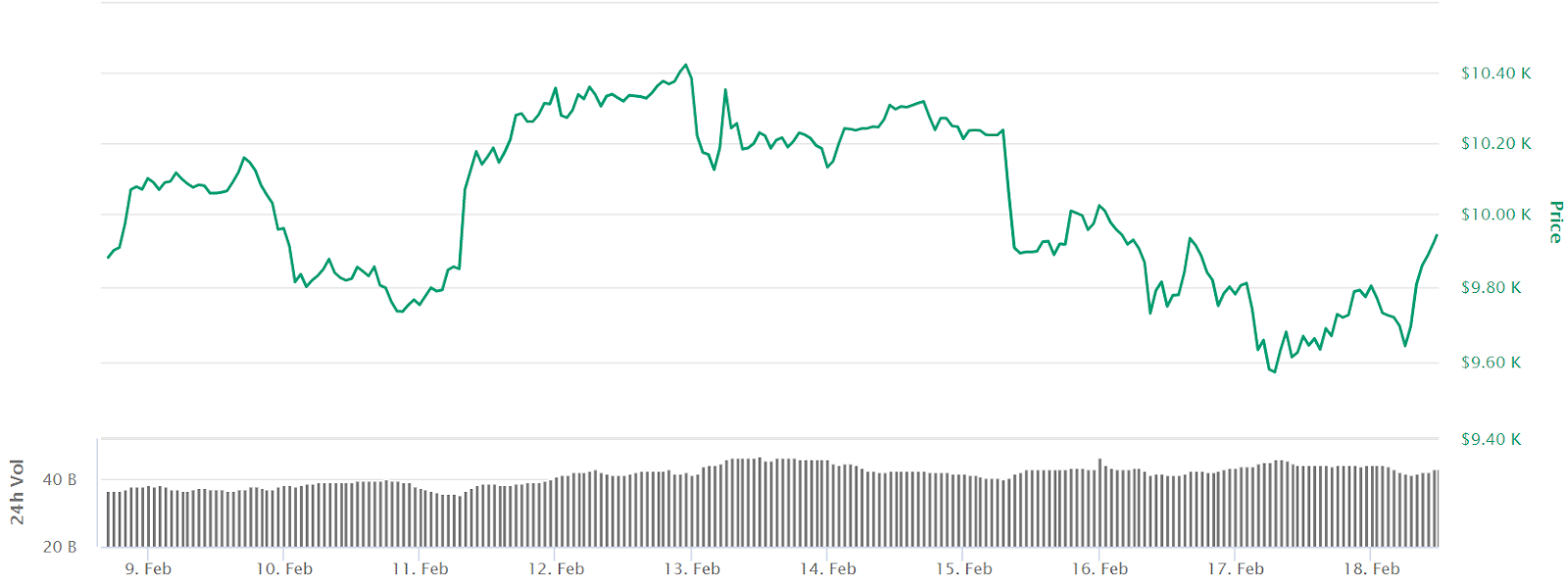

Bitcoin reflected the broader market, where at the start of last week it was trading just below $9,800 before breaking above $10,000 and hovering between $10,100 and $10,400. Prices dropped as quickly as they rose, falling below $9,700 in the span of two days.

Source: CoinMarketCap

Today, Bitcoin jumped 3% to narrow the gap to $10,000, hovering just short at $9,900. Altcoins also benefited from the rally, with many outperforming Bitcoin over the same period.

Action in Altcoins

XRP popped 22% from $0.27 to $0.33 before crashing back to $0.30. Litecoin rose modestly from $73 to highs in the low $80s before settling at $76.

But, one outperformer among the major altcoins was Ethereum. ETH rose from $221 to highs of $285 before stabilizing at $280—up an impressive 26%.

The biggest loser among the large-cap coins was Bitcoin Cash, which rode Bitcoin’s price rise from $446 to $490 before falling below $414. Losses of over 7%.

In January, our Coins on the Move signals helped traders secure gains of 80%. For February to date, returns were even better, providing traders with cumulative returns of over 120%.

Contention in Bitcoin Cash

The reason for the market’s loss of confidence in BCH—the risk of another fork.

Bitcoin Cash is struggling with funding its developers. To address the problem, a cartel of some of the largest miners us attempting to push through a block reward tax, a tax on all miners.

Bitcoin Cash figurehead Roger Ver disapproved of the proposal, but it seems to be going forward anyway in the next update. This may split the community. The increase in uncertainty is reflected as higher risk for holding BCH, and thus lower prices.

Major Exploit in DeFi

This week we also saw a major DeFi exploit, resulting in the loss of $330,000 in funds.

The open finance protocol bZx was attacked through a series of complex manipulations of different thinly-traded DeFi protocols, faking crucial information it relied on.

This faked information allowed them to take advantage of the protocol for a large profit.

In the long-term, DeFi will create billions in wealth as new financial products, derivatives, and services become cheaply available. However, the journey there will be riddled with hacks and exploits.

Many DeFi services are still largely untested and not only susceptible to technical failure, like hacking, but also from manipulation of the data these decentralized services depend upon.

The interconnectedness of DeFi cannot be understated. Changes in rates on one product can have a profound impact on another.

This is why DeFi currently offers highly attractive interest rates, anywhere from 5 to 20%. People pay for these rates in risk—even potentially losing everything.

But, with high risk comes the potential for large returns. Those who are informed and can avoid the pitfalls and reap the rewards in this rapidly growing segment.

Insurance and Hedging

Since the bZx exploit, DeFi enthusiasts have flocked to products insuring themselves against these kinds of catastrophes in the future.

And now, with the ease of creating new financial products, it’s possible to hedge away this risk through options or insurance.

But, as with the rest of DeFi, these products are still nascent. Even so, there will be a Cambrian explosion in terms of innovation in the coming few years. The wealth creation will be enormous.

New kinds of derivatives, betting markets, and other much-needed products will become available to people all over the world. People in the suburbs of Indian Mumbai will have just as much access as those in the Bronx of New York.

Disclaimer

SIMETRI Research is an Internet based newsletter and publication on the Crypto Briefing site (the “Site”) and is owned by Decentral Media Inc., a Delaware Corporation (the “Company”). Neither SIMETRI Research nor the Company is registered as an investment adviser with any federal or state regulatory agency, or with any other governmental body or organization. To the extent that any portion of the Site content would need to rely upon an exemption from such registration, the Company and/or SIMETRI Research would rely upon the “publisher’s exclusion” from the definition of “investment adviser” as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. To the extent reliance on the publisher’s exemption is necessary, the Site and/or SIMETRI Research is a bona fide publication of general and regular circulation offering impersonalized investment-related advice to users and/or prospective users (e.g., not tailored to the specific investment portfolio or needs of current and/or prospective users).

The Site is limited to the dissemination of impersonal and objective investment-related information [together with access to additional impersonal investment-related information and links.] The publication of the Site on the Internet and the publication of any content should not be construed by any user and/or prospective user as SIMETRI Research’s (i) solicitation to effect, or attempt to effect transactions in securities over the Internet, or (ii) provision of any investment related advice or services tailored to any particular individual’s financial situation or investment objective(s).

Users do not receive investment advisory, investment supervisory or investment management services, nor the initial or ongoing review or monitoring of the user’s individual investment portfolio or individual particular needs. Therefore, no user should assume that his/her/its use serves as a substitute for individual personalized advice from an investment professional of the user’s choosing. Rather, the Site is designed solely to provide users with a method to evaluate certain investment-related information and trading methodologies/systems.

The user maintains absolute discretion as to whether or not to follow any portion of the Site content. SIMETRI Research does not offer or provide investment implementation services, nor does it offer or provide initial or ongoing individual personalized advice (neither in person nor via the Internet). It remains the user’s exclusive responsibility to review and evaluate the content and to determine whether to accept or reject any Site content. SIMETRI Research expresses no opinion as to whether any of the Site content is appropriate for a particular user’s investment portfolio, strategy, financial situation, or investment objective(s).

It is the user’s exclusive responsibility to determine if any portion of the investment-related information and trading methodologies/systems on the Site, if any, is suitable or appropriate for his/her financial situation and/or investment objectives, both initially and on an ongoing basis. No current or prospective user should assume that the future performance of any specific investment, investment strategy (including the investments or trading methodologies/systems discussed on the Site) or any other Site content will be suitable or profitable for a user’s portfolio, equal historical or anticipated performance level(s), or prove to be correct.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a user or prospective user’s investment portfolio. Investments in cryptocurrencies or digital assets such as tokens are particularly risky and speculative investments. Users do not receive investment advisory, investment supervisory or investment management services, nor the initial or ongoing review or monitoring of the user’s individual investment portfolio or individual particular needs. Therefore, no user should assume that his/her/its use serves as a substitute for individual personalized advice from an investment professional of the user’s choosing.

The information contained on this website and in SIMETRI Research may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. No representations or warranties are made as to the accuracy of such forward-looking statements. Any projections, forecasts and estimates contained on this website, our reports, or newsletters are necessarily speculative in nature and are based upon certain assumptions. These forward-looking statements may turn out to be wrong and can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, most of which are beyond our control. This may include misrepresentations by the project teams, faulty due diligence, or the vagaries and volatility of the nascent cryptocurrencies market and early use stages of blockchain technology. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results.

RELEASE: Each user or prospective user acknowledges and accepts the limitations of the Site and SIMETRI Research and agrees, as a condition precedent to his/her/its access to the Site, to release and hold harmless Decentral Media Inc., its members, officers, directors, owners, employees, advisors, affiliates, and agents from any and all claims and adverse consequences resulting from his/her/its use, including, but not limited to, losses resulting from the user’s implementation of any of investment-related information, recommendations and/or trading methodologies/systems.