Another New High

The crypto market continued to feed off of the rise of the S&P 500 and Nasdaq indexes last week, with BTC setting another fresh monthly high and reaching its highest trading level since August 2022, close to $24,000.

BTC looked past Microsoft’s disappointing earnings forecasts, a host of dovish Fed speakers, and bearish news that Germany and the United States would be supplying tanks to Ukraine.

However, it did react positively to the news that Tesla did not sell any of its bitcoins and that MicroStrategy continued to accumulate the coin in its previous fiscal quarter.

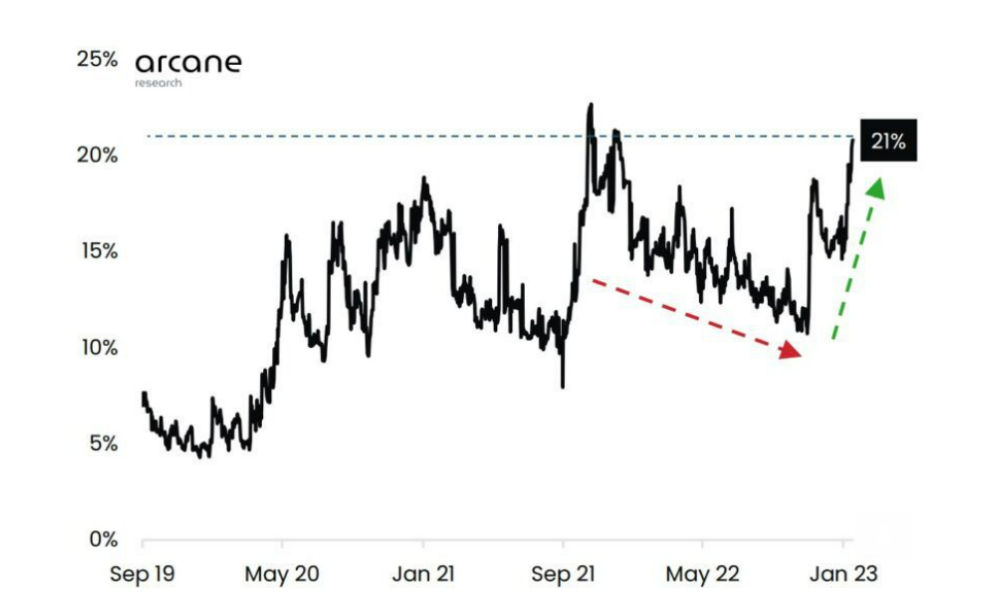

Data from Arcane Research showed that open interest hit 21% for BTC on the CME futures, nearing its all-time high. The figure was only higher on two previous occasions: October 2021 and late December 2021, when futures-based ETFs were launched.

It should be noted that this may not be a bullish sign as Open Interest needs to be compared to the average daily volume of the underlying asset. BTC’s trading and transaction volume are still historically low.

Additionally, the three-month BTC CME futures were operating at a premium of 0.6%. Arcane Research analysts reported that institutional investors were continuing to take a cautious view on bitcoin based on the premium.

Fed Watch

This week’s Fed meeting is one of the most highly anticipated interest rate decisions in some time, due to the fact that the U.S. central bank is expected to enact a 25 basis point increase—very much on the lower spectrum of the recent rate hike cycle. If that indeed happens, it will give a nod to the fact that the Fed is gradually winding down its rate hiking cycle.

Economist Mohamed El-Erian thinks the Fed should raise its benchmark rate by 50 basis points as inflation is likely to be sticky at 4% by mid-year. However, investors are pricing in near 100% odds the Fed will downshift to a rate hike of 25 basis points.

El-Erian has said there are arguments both for and against the Fed moving to 25 basis points, making the February meeting a “tricky one” for policymakers led by Chairman Jerome Powell.

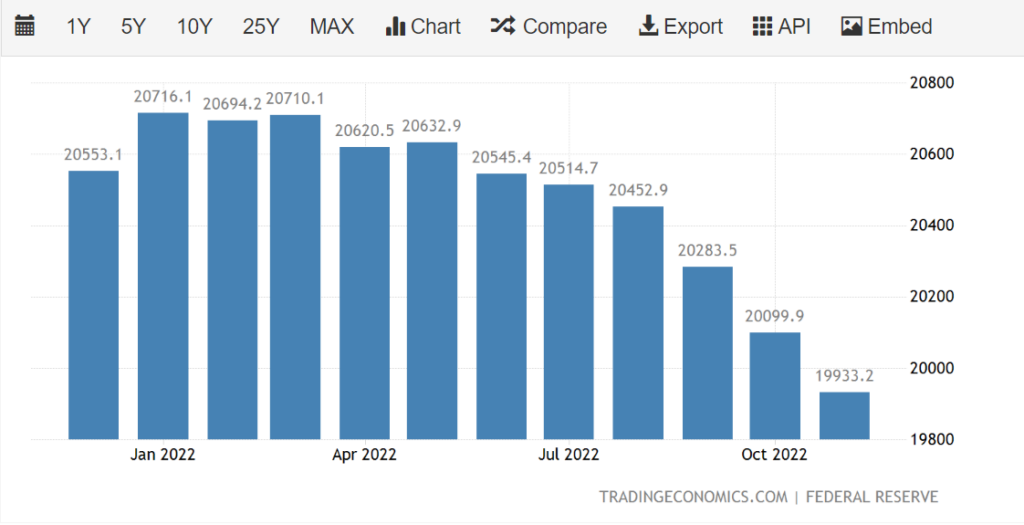

The chart below highlights the drastic reduction in M1 money supply since the Fed began hiking interest rates. The risk of keeping rates this high is that it could eventually cause damage to the economy.

M1 is a narrow measure of the money supply that includes currency, demand deposits, and other liquid deposits, including savings deposits. M1 does not include financial assets, such as bonds.

The basic characteristic that makes it important as a part of the money supply of an economy is its liquidity.

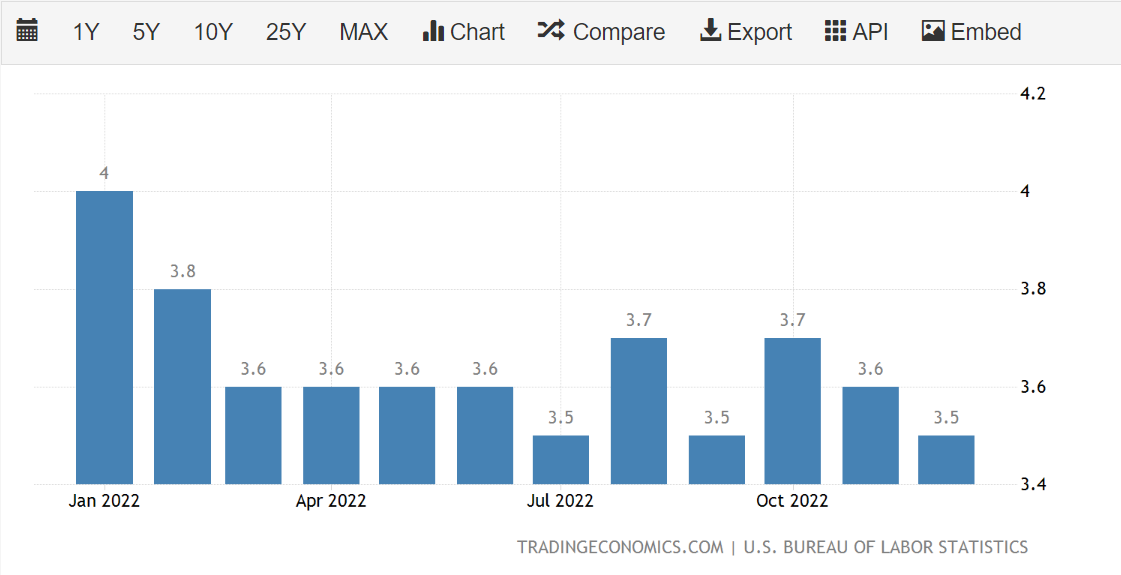

On the flipside, the job situation in America is still very good, and the unemployment rate is also below trend. This could embolden the Fed to hike rates more aggressively as it gives them significant slack.

Either way, any deviation away from 25 basis points this week—meaning 50 basis points—and crypto and stocks would likely see a bearish knee-jerk reaction of some magnitude.

On-Chain Action

At the start of last week Bitcoin observed minimal on-chain activity, however, towards the end of the week a number of meaningful on-chain metrics started to record sizable changes.

For example, Token Age Consumed spiked the most since the start of the recent rally, indicating that a one-way price swing may be incoming.

Source: Santiment.

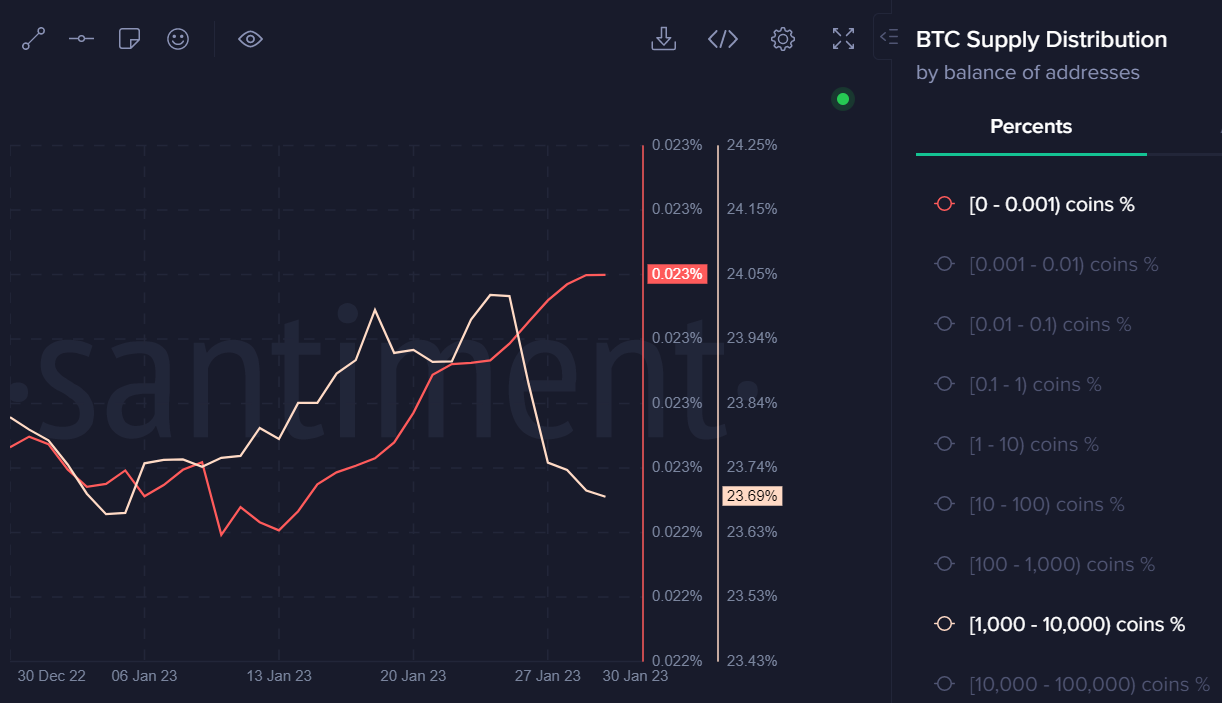

Also, BTC mid-tier whales started to reduce their holdings, while BTC minions significantly added to their bags.

Source: Santiment.

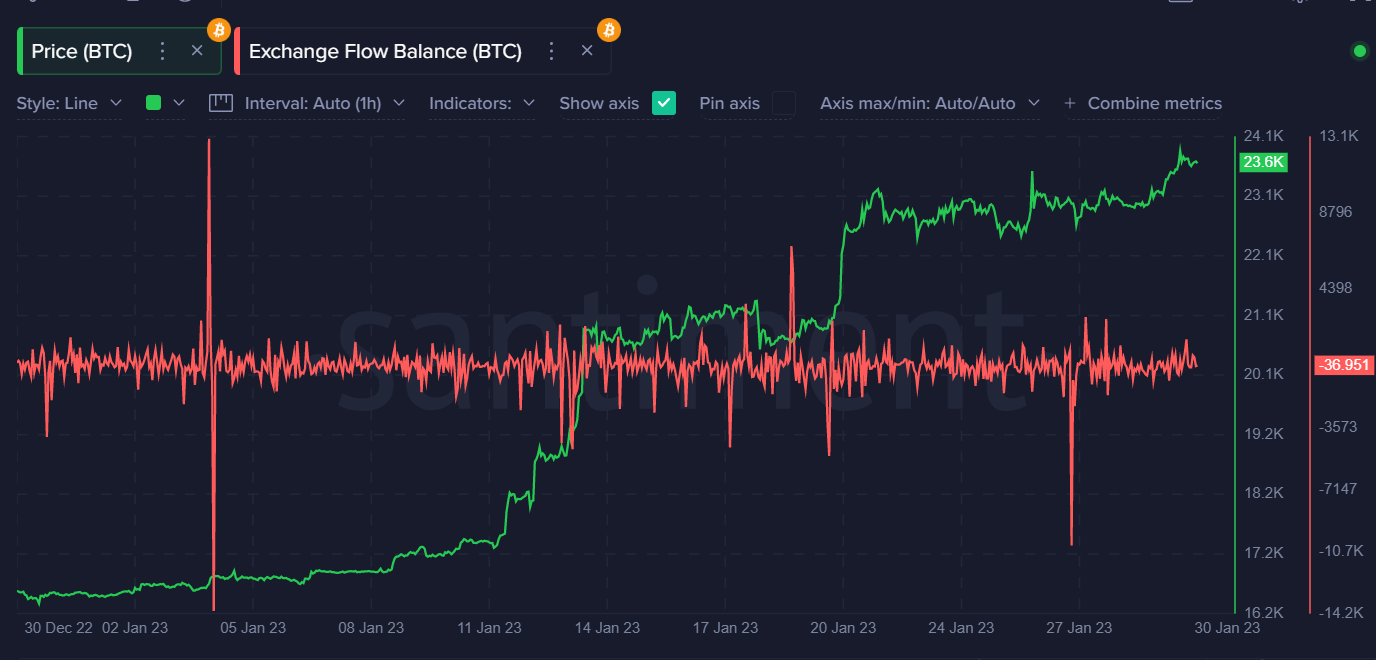

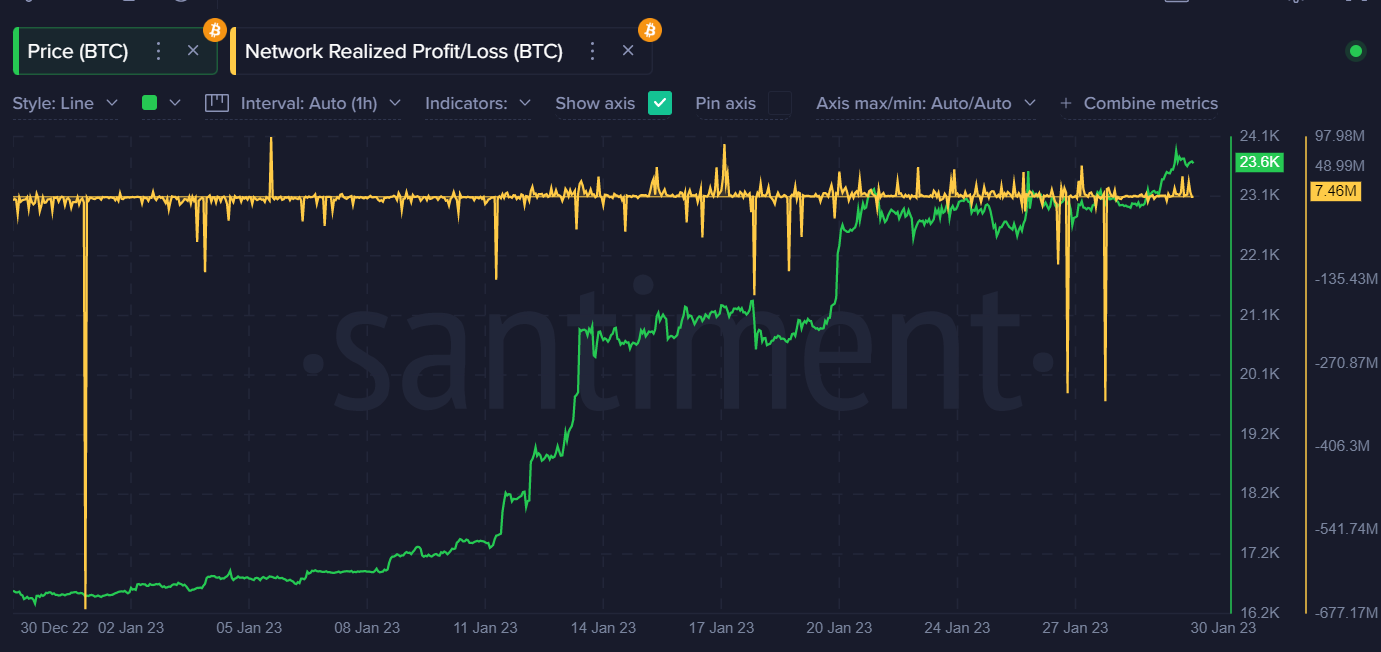

Other interesting changes were also observed, such as downticks in BTC Exchange Flow Balance and Network Profit & Loss.

Source: Santiment.

Source: Santiment.

Overall, the number one leading indicator for some time has been mid-tier whales. As they begin to sell, the chances of a solid price reversal dramatically increases, meaning we could be in for a correction this week.

Charting BTC

BTC is showing signs of upside exhaustion, however, it is also still seeing strong dip-buying interest, which makes it particularly difficult to trade right now.

Technical indicators remain overbought on the higher time frames, and the emergence of whale selling also adds some credence that a correction may be nearing.

The only issue is selling too prematurely. If Bitcoin rallies after the Fed decision, then the risk would be to miss a trip towards the $25,000 to $25,500 area. However, the opportunity cost of missing a short sell down towards at least $20,000 is also high.

BTC/USD four-hour chart (Source: TradingView).

Ethereum caution

Ethereum has not been one of the main leaders of this latest recovery, which is curious considering it has strong fundamentals. It has been well overtaken in terms of gains by many other inferior altcoins.

Technically, the risk is still a spike up towards the $1,700 area this week. Selling prematurely could be quite costly in this instance.

Should we see ETH start to roll over, a break under $1,420 would likely kick-start the bear party. This is a huge support, and a do-or-die level on the charts for the ETH/USD pair this week.

ETH/USD four-hour chart (Source: TradingView).

XRP drop

Of all the altcoins that look ready to drop right now, I think XRP stands out in terms of its strange behavior during this year’s crypto recovery and its inability to take out meaningful resistance levels.

In terms of price patterns, a nasty looking head and shoulders pattern currently engulfs the XRP/USD pair which is promising to do some damage and send price towards at least the $0.2800 area if it is activated.

Selling the weaker looking cryptos during relief rallies has always seemed like a good strategy to me. Usually, when they start to roll over, the downside can be fast and pretty substantial. Therefore, I am certainly considering a short sell signal for Coins On The Move for Ripple this week.

XRP/USD four-hour chart (Source: TradingView).

Particularly important

When we talk about important weeks in the cryptocurrency market many analysts tend to over-hype them with middle of the road data releases and not very exceptional crypto related events.

However, this week does look to be very important for the crypto market as we will get to find out if this year’s crypto recovery is genuine—or built on straw—shortly after the Fed decision this Wednesday.

I believe this rally has happened too early, too fast, and is currently overdone to the upside. I would not at all be surprised to see $20,000 tagged before BTC tests $25,000 again.