Alphaverse

I hope you started the year strong, just like the market did. We don’t know whether this relief rally has legs, but it doesn’t matter all that much since we’ll be looking for ideas that earn regardless of the market’s moves.

The projects in this newsletter require some capital, so it’s ok to skip them and allocate elsewhere. However, not mentioning them would be a mistake on our part.

Airdrop Farming With Cats

The projects that are at the crossroads of DeFi and NFTs are the future, period. One of the most interesting recent ones is Gumball. It focuses on NFT fractionalization, lending, and instant liquidity. The fact that it’s on Arbitrum is the cherry on top.

The project doesn’t have a token, but it just launched LiquiCats NFTs, which will likely give holders some allocations. The process of minting a cat is non-trivial, so I think that’s the reason the mint is going slow. But that’s good news for us.

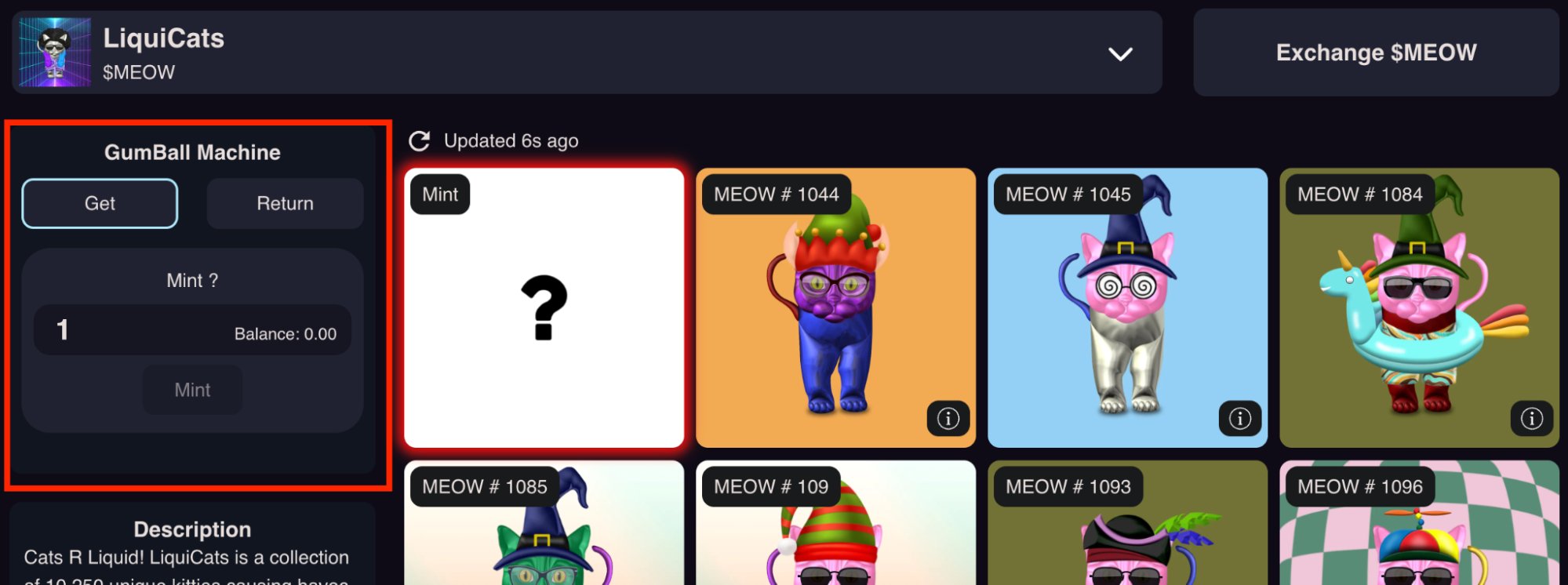

First, you need to get the collection’s fractionalization token called MEOW here. Get some wrapped ETH on Uniswap first (the transaction is like swapping ETH for WETH, but it’s wrapping). Then, swap WETH for 1 MEOW. The price can vary, but it’s around $60-80, which is reasonable for a potential ticket for this kind of project.

Once you obtain 1 MEOW, go to this link and exchange it for an NFT. Click on the Mint button. That’s it.

If you will regret the purchase, you can return the NFT by selecting “Return” in the minting interface.

Get an Ape With Insrt Finance

Insrt is another project that builds on the idea of NFT fractionalization. Unlike Gumball, it focuses on automated yield farming and fractional ownership, which is a much more opinionated approach, and a more passive one as well.

The idea is simple: Insrt raises money to buy some top-tier NFT (e.g., a CryptoPunk), stores it in a vault, and gives shares to people who contributed to the vault. Then, the project uses the NFT as collateral to borrow liquid assets (e.g., ETH) and farm yield.

As a result of the above, the vault’s shareholders get access to yield and can potentially benefit from the price appreciation of the NFT(s) in the vault. For example, if a vault has a Punk that goes from 100 ETH to 200 ETH, shareholders can vote to sell the Punk and get twice as much ETH as they initially deposited, plus the yield that the vault managed to generate.

We already covered Insrt and its genesis NFT collection, which is probably the best proxy for the airdrop. However, participating in vaults might be worth it, given that the market is still largely depressed and Insrt is a good proxy for getting direct access to blue chip NFTs that otherwise are out of reach for most of the market’s participants.

The project’s first vault focused on CryptoPunks and had few seats. There were only a hundred seats to buy a Punk, so the price was steep: 0.7 ETH. However, the next vault will have more seats, meaning a lower share price.

I’m sharing this project with you in advance because vaults get filled quickly. The Punk one filled in about two days amid the most bleak price action in months. If you think Bored Apes will keep being one of the most discussed NFT collections during the next bull run, having exposure to such an NFT is worth it, so you have to be quick to jump into the vault.

To conclude, follow Insrt’s Twitter and turn notifications on. As soon as the second vault goes live, you have to be there. To increase your chances of getting in, you can buy a Dawn of Insrt NFT, but I don’t think that’s necessary. The price per share will most likely be below 0.5 ETH.

That’s it for today. Thank you for reading.