A Year in Review

The year end is coming, but the markets aren’t hitting that holiday vibe. 2022 was pretty gloomy, and the outlook for 2023 isn’t necessarily better.

Meanwhile, crypto has become “boring” regarding volatility and launched projects / tokens. It’s not a surprising outcome, and those who’ve been through even a single crypto bear market must be experiencing déjà-vu right now.

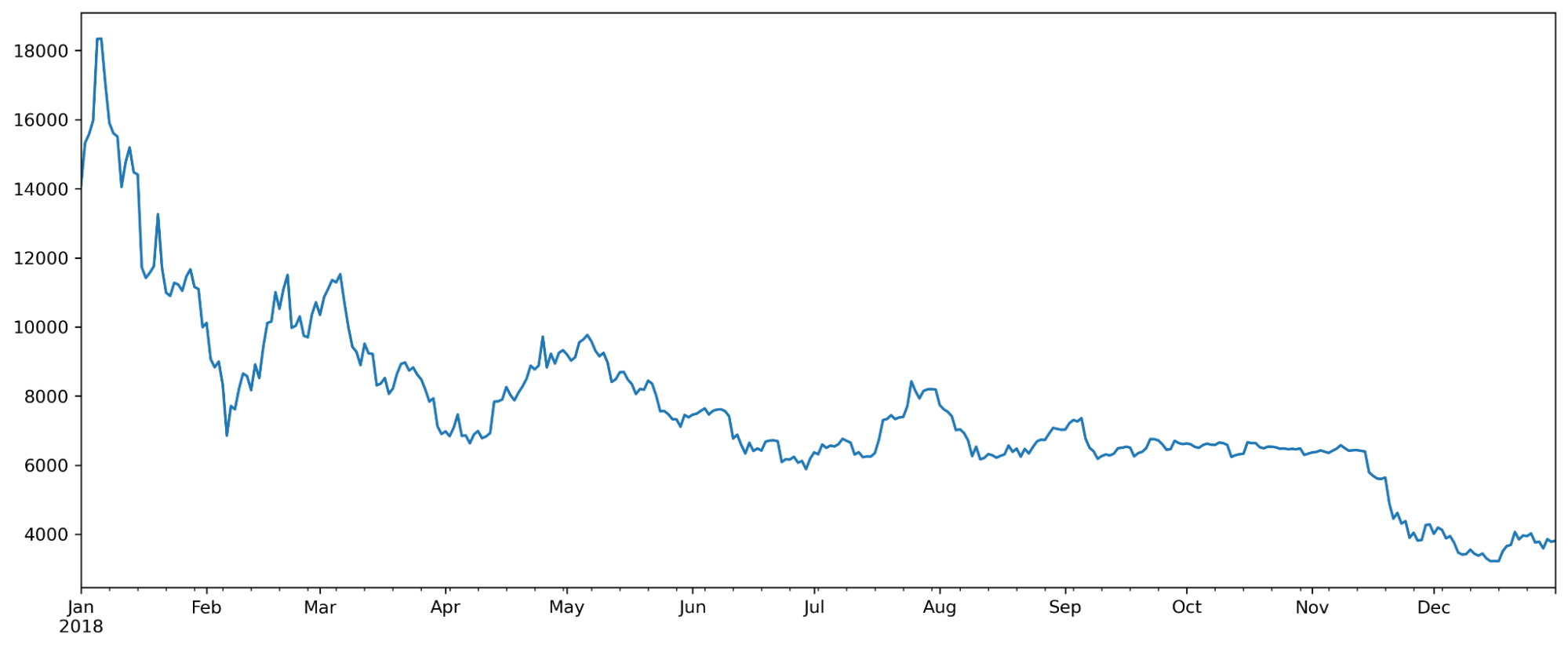

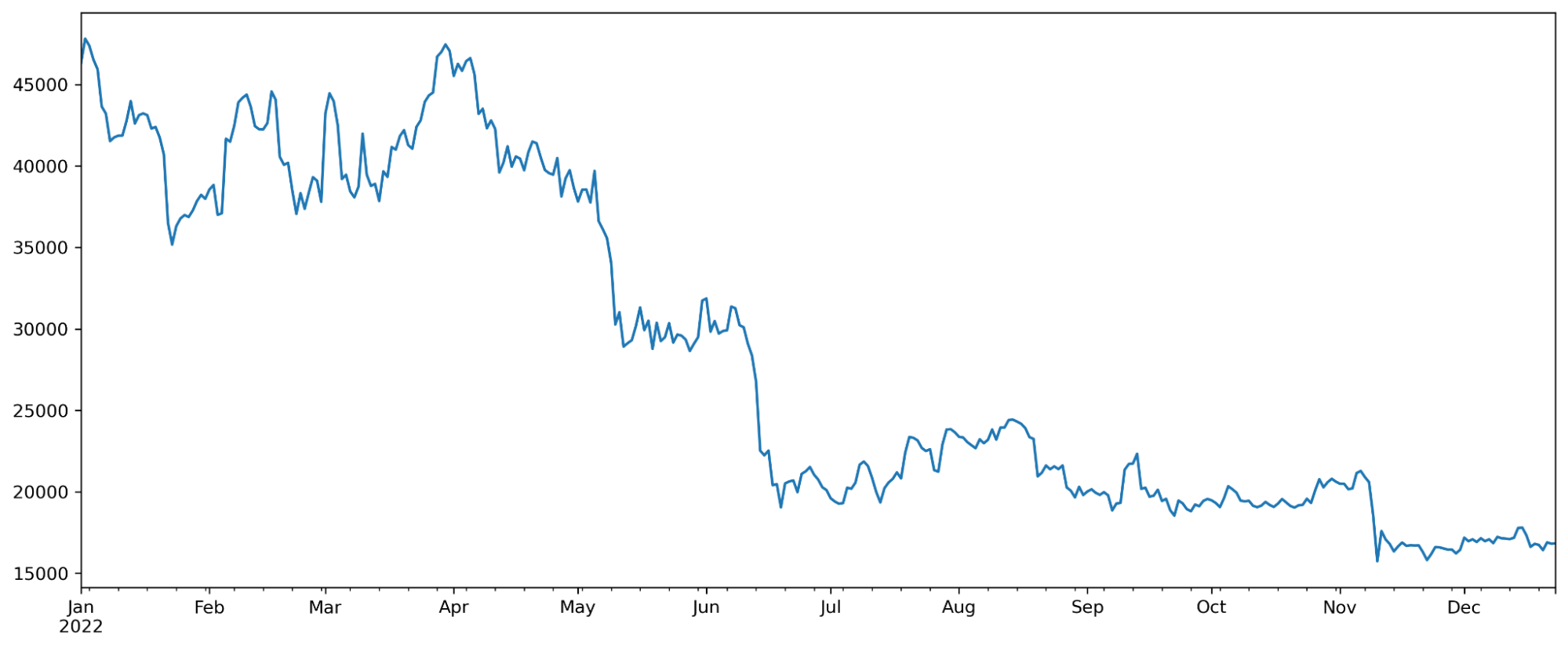

In 2022, BTC was down only, but so was it in 2018. Source: CoinGecko.

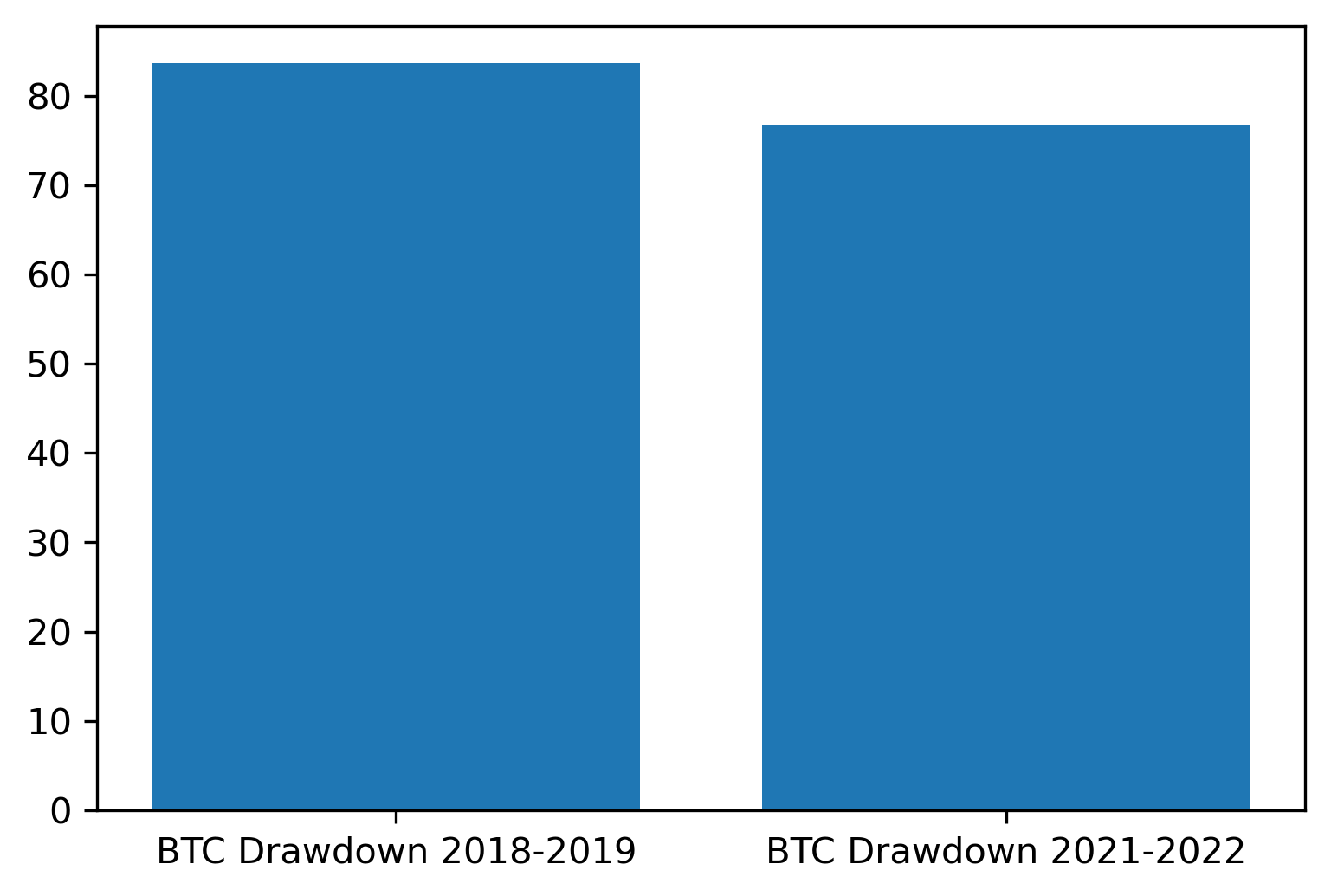

The charts above show that BTC’s performances in 2018 and 2022 are very similar. 2019 was better, so if you extrapolate past performance onto the future, now would be a good time to buy. Plus, the BTC drawdown is very close to historic bottom levels, meaning that the downside move potential is relatively low, even if you are too early.

Source: CoinGecko.

Still, past performance isn’t indicative of future performance. History rhymes, but it often does so in confusing ways that might spook you out of the market at the wrong time. It’s crypto’s first time facing a global economic recession, and the market is influenced by equities more than ever. So, some unpleasant surprises might be in store.

Your risk profile matters a lot. If you’re okay with seeing your portfolio shrink by 25% in a day, buying now likely won’t shake you. On the other hand, if you’re nervous about “losing” money due to downside volatility, it’s better to wait for signs of strength. There’s nothing wrong with that.

Even if the 2019-2020 scenario reoccurs, 2019 was still pretty bleak. It was better than 2018, and some money could be made, but the despair was still there. Many companies I knew then had to close or considerably contract by the end of 2019.

The strategy for the upcoming year remains simple: waiting for quantitative easing. Risk-on assets, including crypto, will thrive as soon as credit becomes cheap again.

SIMETRI Portfolio – Profit Taking for the Win

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.