Trend Test

Last week, bitcoin moved to levels not seen since November 2022 as traders started to price in the possibility that the Fed might finally change its hawkish stance.

At the start of the week, the BTC/USD pair started to edge higher, reaching $18,375 with relative ease, thanks to a quick drop in the USD index and a rally in the U.S. equity markets.

The December CPI report was in line with economist expectations. A monthly dip of 0.1% but a 6.5% rise year-over-year. Although inflation is still high, it’s been trending down since June 2022.

This was enough to send BTC above $19,000 and multiple key resistance levels until $21,400. Altcoins such as AVAX, ATOM, SOL, and ADA also benefited, expectedly outperforming BTC in percentage gains.

Have We Entered a Bull Market?

A compelling case could be made that Bitcoin is now entering a new bull market based on last week’s price action and the technical factors, such as a clear break above the 100-day moving average and some strong buy signals amongst various indicators.

However, as I will discuss in the on-chain section later, the movement on-chain has not been convincing, despite a pick-up in whale transactions and capitulation amongst some long-term holders.

Furthermore, trading volumes have remained abysmal. An influx of buy-side volumes catalyzed most or all of the major bull markets, and last week’s volumes were not high enough to justify a sustainable uptrend.

If BTC reaches $25,000 over the coming days and weeks, it won’t return to its current levels anytime soon. But based on on-chain data and trading volumes, it might not go that high.

Economic Calendar

This week’s major economic release will be the Producer Price Index (PPI) and retail sales. The release of the Fed’s Beige Book is also noteworthy.

The U.S. PPI rose 0.3% month-over-month in November of 2022. This week PPI data is expected to show a 0.4% increase, which is curious given the drops we are seeing with CPI.

On-chain Action

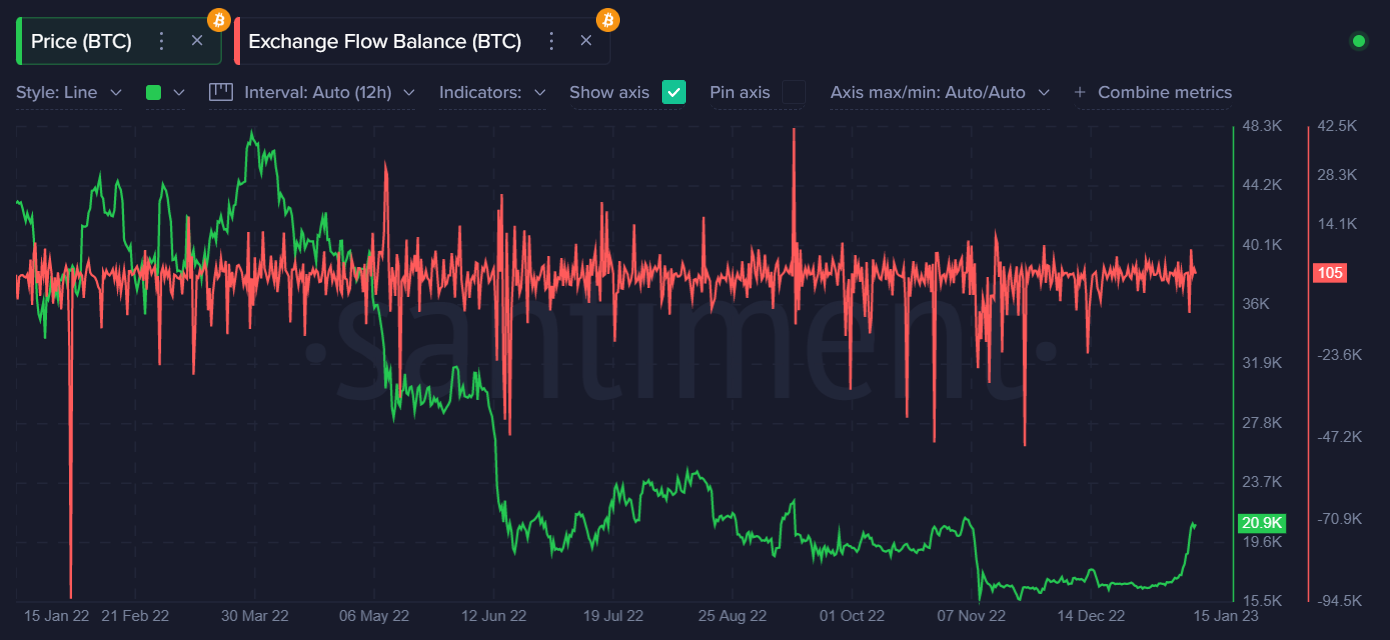

As you can see on the chart below, there have been no notable exchange flows since the FTX downfall in November 2022. Therefore the latest move was most likely a result of margin trading on low liquidity, which isn’t sustainable.

Exchange flows (Source: Santiment).

Token Activity increased, but nothing significant to speak of except the substantial spike around November 2022. The size of the current spike does not allude to any move greater than around $2,000 to $3,000, which has already largely played out.

Age Consumed (Source: Santiment).

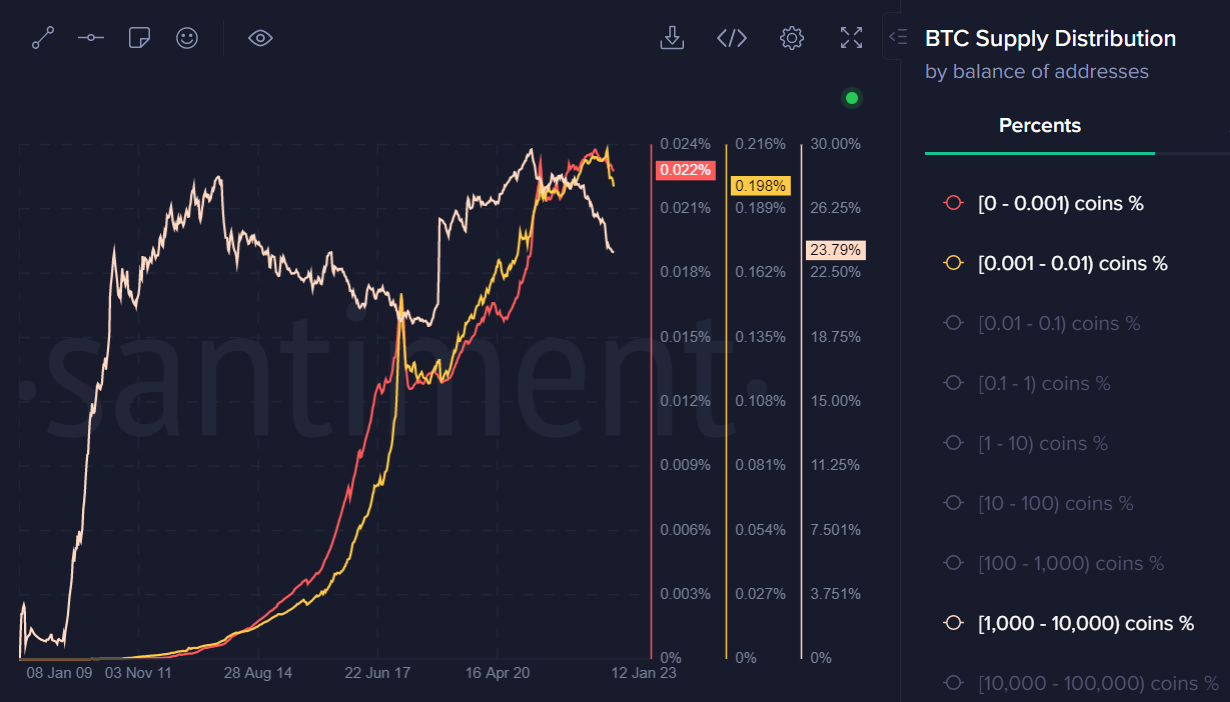

Meanwhile, though some data providers report an uptick in mid-tier whale BTC holdings, Santiment (which I trust more) says that it only went from 23.65% to 23.80%.

Whales hardly paused selling. (Source: Santiment).

Overall, the on-chain data is not consistent with a major trend change.

BTC/USD: A Move up Is Not Impossible

If bitcoin builds support above the November 2022 trading levels, it may test $25,000 this month. Otherwise, it’s headed towards $19,200 support.

If BTC gets rejected, the weekly candle close should help to understand whether buying the dip will be justified.

ETH/USD: Triangle Break

ETH has broken above a triangle pattern; if we evaluate its size, it predicts ETH could shoot up to well above $2,000.

However, false triangle patterns happen, and I am still not entirely convinced that ETH is going to $2,000 and beyond. Much will depend on what BTC does this week.

If a false breakout has happened then expect a quick test towards the $1,400 area and potential shot at $1,200.

XRP/USD: A Bearish Pattern

XRP performed worse than other altcoins and is now completing a head and shoulders pattern.

Selling weaker coins during recoveries is often a good strategy. If the market goes lower this week, XRP could be a great shorting opportunity toward $0.2150. The bearish outlook will be invalidated at $0.5.

Bull vs. Bear Cases

We need to keep a close eye on BTC’s next weekly price close and the on-chain data. If BTC holds above the November 2022 highs, the crypto market is off to the races.

Much of the on-chain data I have viewed does not indicate that a trend change has taken place. I also want to note that trading volumes are not that high, which is a potential bearish factor.

And finally, I do not think fundamentals fit with this recovery. A significant risk factor in the market is still the macroeconomic backdrop. If stock markets reverses, Bitcoin will likely follow.