Regulators at the Gates.

As crypto becomes more institutionalized and adopted across the globe, it inevitably attracts the attention of regulators. Since the industry is mostly operating in the grey, regulatory “crackdowns” are a natural outcome of the space’s maturation.

This week was dominated by the news about the SEC charging Ripple for selling $1.38 billion in unregistered securities. On top of that, regulators are eyeing stablecoins , which further increases crypto-market uncertainty—especially for the big institutions.

While crypto startups are fearful about the possibility of further regulation, Bitcoin continues to make new all-time highs. It’s completely decentralized and there’s no team to arrest, so Bitcoin is naturally more resilient to tighter regulations. Ethereum is also in a safer area since it was previously deemed a commodity, but even that won’t guarantee ETH’s safety.

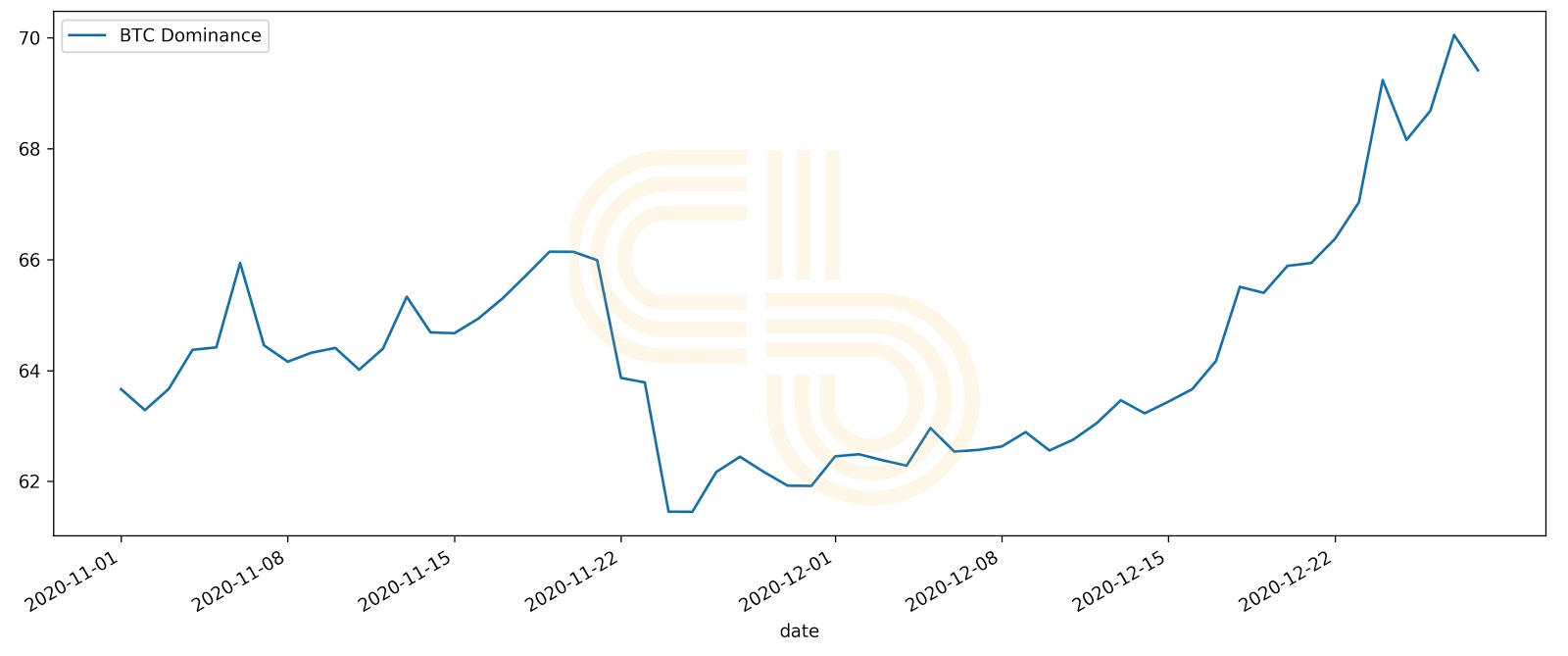

In the current circumstances, the decline of the altcoin market and BTC’s growing dominance are expected outcomes. Bitcoin is less risky because its decentralization makes it harder for governments to control, giving retail investors and more institutions more confidence to place big bets.

Bitcoin dominance | Source: CoinMarketCap

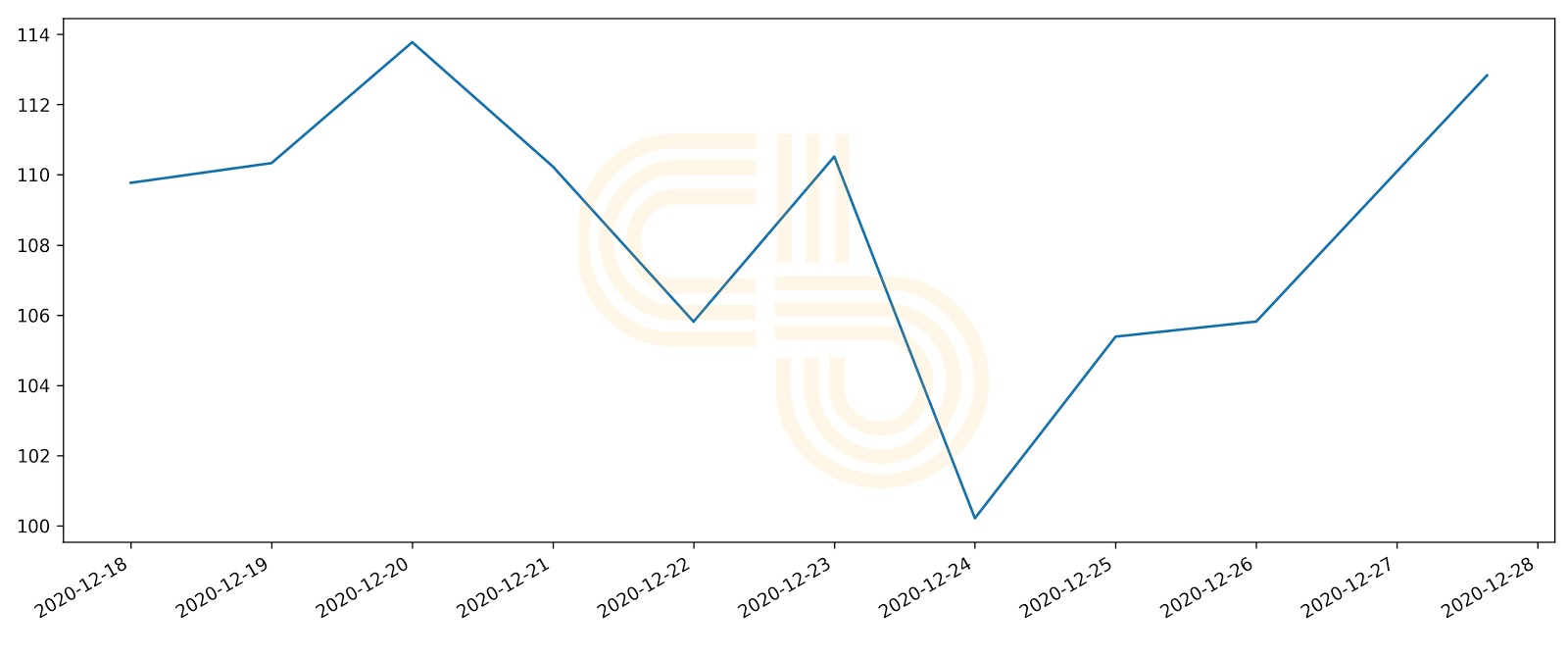

In comparison, DeFi’s focus on decentralization and anonymity didn’t help the sector withstand the market’s adverse regulatory conditions. The DeFi Pulse Index, which includes top-tier DeFi projects, dropped over the last week, albeit it quickly rebounded showing that the niche’s narrative is still strong.

DeFi Pulse Index | Source: TokenSets

The U.S. dollar Currency Comptroller Brian P. Brooks said at the beginning of December, there will be more clarity for cryptocurrency regulations shortly.

Hopefully, the pro-crypto voices from people like SEC Commissioner Hester Peirce will make the regulations more reasonable for crypto companies.

Unfortunately, the industry won’t be able to depend on regulators like the CFTC’s Heath Tarbert anymore, who recently announced his resignation. As the chairman of the CFTC, he declared that ETH should be treated like a commodity and opened up the possibility for Ethereum-backed ETFs.

Despite the sentiment, the market still technically looks bullish. So, our outlook remains the same. When BTC starts moving sideways, altcoins will likely enter a growth phase.

According to our lead Bitcoin analyst, Nathan Batchelor, the ongoing BTC rally has steam at least until the total market cap reaches $780 billion. Assuming Bitcoin will move upwards, altcoins will continue to suffer.

However, once BTC finishes its run, alts will wake up to the new highs as liquidity will flow back into them. Hence, our strategy continues to be patiently waiting for this surge before taking profits.

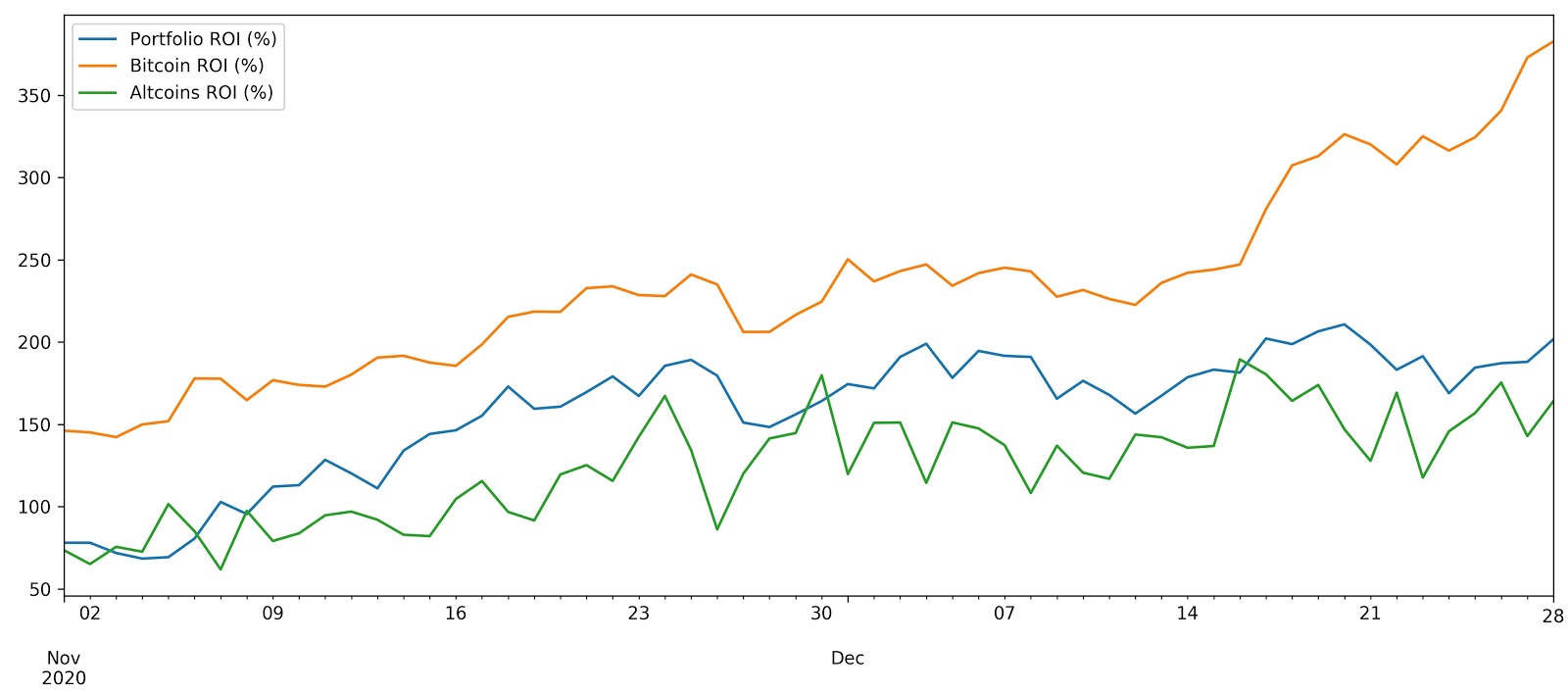

SIMETRI Portfolio Outperforms Alts

While SIMETRI Portfolio retracted a little from last week, the dent wasn’t significant. Currently, the Portfolio’s ROI is down from 555% to 539%. What’s important is that it has consistently outperformed an altcoin index, which has broadly suffered substantial losses.

Moreover, as I pointed out in the previous Digest, the decline in performance was expected.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.