October 5 Crypto Market Roundup

Bitcoin (BTC) once again failed to move past the $11,000 resistance level last week, as a barrage of bearish news caused the cryptocurrency market to turn sharply lower.

The cryptocurrency market gave back it’s early-week gains, following news that the CFTC and FBI were filing charges against the cryptocurrency exchange, BitMEX.

Market sentiment then took another major hit, as United States President Donald Trump tested positive for coronavirus. Bitcoin confirmed its status as a risk asset, as the cryptocurrency tumbled alongside the S&P 500 on the news, while gold and the Japanese yen currency rose.

BTCUSD H1 Chart

Source: Tradingview

Data from on-chain market intelligence company Glassnode showed that Bitcoin has seen a huge spike in activity from new users.

Bitcoin’s on-chain metrics remained a bright spot for investors last week as the cryptocurrencies network health appeared increasingly positive.

Bitcoin’s network hash rate also moved within touching distance of its all-time high last week. The cryptocurrencies network difficulty also moved to its highest ever level during the previous trading week.

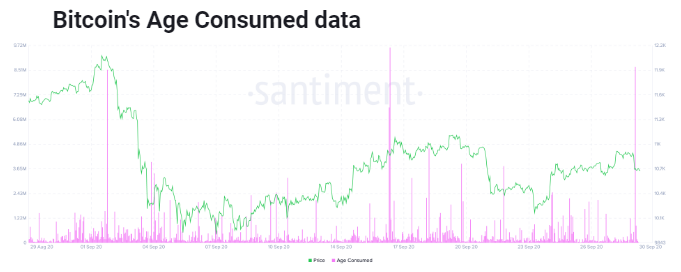

On-chain data showed that a sizable amount of whale activity took place last week. Crypto behaviour analytics platform, Santiment, recorded a large spike in Token Age Consumed as the month and fiscal quarter came to an end.

BTC Token Age Consumed

Source: Santiment.net

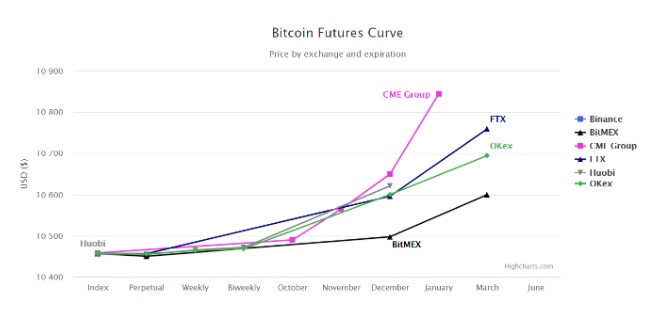

Despite the negative news developments, the futures and options market remained bullish towards Bitcoin, as data showed that traders and investors continued to expect a coming rally towards the $12,000 level.

Retail trading positioning data amongst a number of cryptocurrency exchanges showed a clear bullish bias remained in place, as the majority of traders favoring long positions.

The latest CoT report showed that institutions and asset managers increased bullish bets towards BTC, while professional traders trimmed bearish bets.

The Crypto Fear and Greed Index continued to move lower last week, as traders sentiment edged closer to being a state of “extreme fear.”

Source: Highcharts.com

The total market capitalization of the cryptocurrency market traded between the $324 to $344 billion levels last week, marking the crypto total market caps narrowest weekly trading range since July.

Spot volumes for the total market capitalization hit a five-week low last week, while open interest on the futures market for BTC also fell.

Altcoins took a major hit over the BitMEX news last week, with Chainlink, Cardano, and NEO amongst the worst affected inside the top-20 cryptocurrencies by market capitalization.

Litecoin attempted to stage a notable recovery above its 200-day moving average, however, the bearish news development caused the twelfth largest crypto to give back it’s hard-fought gains.

During my upcoming webinar, I will be charting SOLVE (SOLVE) Monero (XMR), yearn.finance (YFI), and Bitcoin.

Source: Tradingview

The Week Ahead

Bitcoin is likely to take it’s direction from U.S. politics once again this week, as traders and investors react to news about the health of President Trump, and the second coronavirus stimulus bill.

It is certainly noteworthy that Bitcoin has been holding up remarkably well considering the immense amount of negative news developments over recent days.

The crypto market could receive a boost if the coronavirus stimulus bill is approved this week, as traders move back into the U.S. inflation trade that became so popular during the summer months.

We should also consider that Bitcoin recently broke the record for the most amount of days spent above $10,000 last week. This is not an insignificant event.

Coupled with increased institutional demand, bullish on-chain data, inflationary fears, and a weakening U.S. dollar, means that BTC has plenty of reason to rally around current levels.

Ofcourse, downside risks still exist. President Trump testing positive for COVID-19 could continue to weigh on sentiment, as markets hate uncertainty. Crypto traders will also be onguard for any news surrounding the BitMex debacle. While the downside risks are probably priced-in, any news surrounding other exchanges could cause a major hit to crypto sentiment.

The market’s reaction to last Tuesday’s debate has been mixed. As the U.S. election draws nearer we should expect U.S. equity markets to become hyper sensitive to the release of pre-election polls.

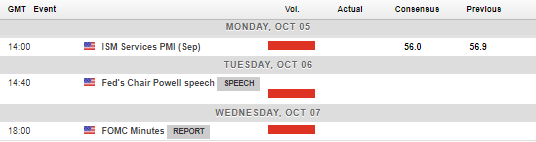

Looking at other events of the economic calendar this week, the big data events will be the ISM services PMI, FED Chair Jerome Powell’s speech, jobless claims, and the FOMC Meeting Minutes.

Economic Calendar

Source: Forexlive

The current technicals for Bitcoin show that the cryptocurrency is trapped inside a large triangle pattern between the $10,300 and $10,900 levels.

If buyers are able to hold Bitcoin back above the $10,900 level this week then we could easily see a surge towards the cryptocurrencies monthly pivot point, around the $11,500 area, although the $12,000 is probably going to be the wider bullish target before the U.S. election.

As I have been pointing out ad nauseam lately, the $11,100 level is the major upside level to watch. Multi-day price stabilization above this level and Bitcoin could soar towards the current yearly high.

Sellers failed to get a daily price close below the $10,000 level during last months sell-off towards the $9,800 level. Technical weakness will likely creep in if daily price closes below the $10,300 level occur, although daily price closes under $10,000 should steam roll BTC lower.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) has its work cut out this week, following last weeks heavy rejection from the $370.00 level. As I have previously mentioned, the neckline of an extremely large inverted head and shoulders pattern is located around the $365.00 level, and remains the central focus of medium to long-term traders at the moment.

Repeated failure to move above neckline resistance, at $365.00, could provoke a much deeper price retracement below the $300.00 level, which would help to complete the final right-hand shoulder of the mentioned bullish pattern.

If we continue to see price rejected from this key area we should expect at least a retest of the $320.00 to the $300.00 support zone over the coming week. The more bearish scenario would see ETH/USD falling as far as $250.00 to $230.00 before recovering back towards neckline resistance.

Should we see Bitcoin rallying above $11,100 this week, ETH/USD could easily reach the $395.00 to $415.00 area, although the $445.00 level appears to be the more likely upside target, prior to the U.S. Presidential election.

Overall, watch out for further gains towards $400.00 if multi-day price stabilization above the $365.00 level takes place. Repeated weakness below the $350.00 area could attract bears, and eventually push towards the $300.00 support region.

ETH/USD H1 Chart

Source: Tradingview