Pricing in Political Turmoil.

After Tuesday’s messy debate between President Trump and Democratic hopeful Joe Biden, market participants have been scrambling to place new bets, cancel old ones, or double down on their position.

So far, it appears that doubling down has been the most popular move.

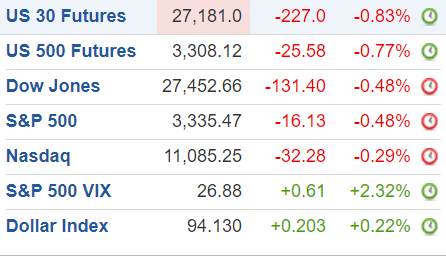

Traditional investors have long been banking on extreme volatility as we edge closer to one of the most contentious elections of this century. This can be seen in the recurring red plaguing the NASDAQ and S&P 500, and the green shoots in markets like the VIX and Dollar Index.

Market outlook roughly 12 hours after the election. Source: Investing.com

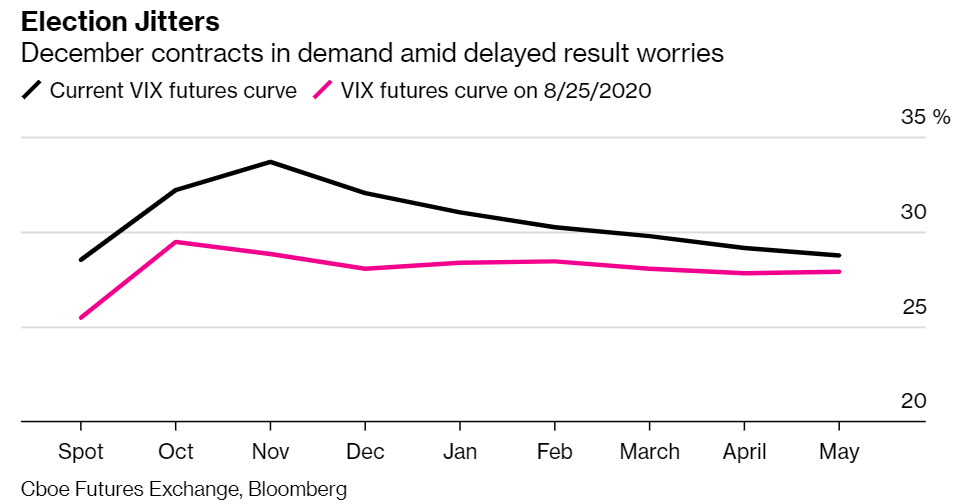

If we bore down on CBOE’s VIX contracts, we can get an even more startling picture.

This is an industry-leading marker for volatility on the financial markets. Investors can trade against this marker using other instruments such as options and futures.

A good rule of thumb, is that as the VIX rises, investors are essentially preparing for more volatility. Hence, the title the “fear index.” At the moment, VIX futures on or around the day of the election are currently the most expensive that they’ve ever been, according to Bloomberg.

But the outcome of the election won’t be decided on Nov. 3. It could very well take a few weeks. And once the outcome has arrived, Trump has made clear that he will contest the results (assuming they land unfavorably for him). But wait, there’s even more uncertainty.

That same week the Federal Reserve will also be meeting, and there’s another jobs report due out at roughly the same time. Oh, and we still don’t appear too far along with a coronavirus vaccine. So, there’s that too.

All in all, it appears like we’re in for a seriously bumpy ride over the next few months. At least for traditional markets.

As for crypto, particularly Bitcoin, technical data indicate only bullish sentiment for BTC.

On Monday, the orange coin marked its longest run above the $10,000 price point. The mining hashrate, that which represents the strength of the network, reached an all-time high. Glass Node, a data firm focusing on crypto markets, also identified Willy Woo’s “Difficulty Ribbon Compression” is trending up.

Woo’s indicator has previously signaled moments before large BTC rallies. Click the link above to read more into that metric.

So, on the one hand traditional markets are the most uncertain they have ever been, and Bitcoin is currently flashing a series of extremely bullish signals.

The final piece to this puzzle is establishing the correlation between the two. If you remember back in March when traditional markets crashed, Bitcoin did the same. It was chaos, but it also revealed that Bitcoin, despite popular marketing materials, is currently being treated as a risk-on bet rather than risk-off, like cash and gold. Essentially, the S&P 500 and Bitcoin have behaved in near lockstep.

Admittedly, it’s a very odd dynamic and thus super difficult to predict how things will play out. Perhaps the hardcore traders and professional analysts among you have already established a strategy.