September 28 Crypto Market Roundup

Bitcoin (BTC) had a week of mixed fortunes during the previous trading week, as the cryptocurrency traded between the $10,135 and $10,995 levels.

Fears over a second wave of global COVID-19 infections, and the death of Supreme Justice Ruth Badar Ginsburg caused broader financial markets to move into risk-off trading mode.

Bitcoin started to turn lower in early-week trading as the price of gold tumbled by $100, and the S&P 500 fell to its weakest trading level since late-July.

The U.S. dollar index also had its best trading week since March this year, as traders moved back into the greenback.

BTCUSD H2 Chart

Source: Tradingview

Bitcoin managed to stage an impressive recovery from the $10,135 level, due to strong institutional demand, whale accumulation , a recovery in U.S. indices, and the bullish on-chain metrics surrounding the cryptocurrency.

The number one cryptocurrency also brushed-off the bearish news surrounding a $200 million hack involving the cryptocurrency exchange KuCoin.

The $1 billion worth of BTC option expirations largely proved to be a non-event, as Bitcoin traded in a narrow range during the last Friday of September.

On-chain data from crypto behaviour analytics company, Santiment, showed the largest spike in whale activity since mid-September. The spike in whale activity took place during Bitcoin’s plunge towards the $10,135 level.

BTC Token Age Consumed

Source: Santiment.net

Bitcoin’s market dominance also staged a notable technical breakout last week, hitting 62.3 %, which marked its highest level since August 11th this year.

Ki Young Ju, CEO of CryptoQuant, noted that Bitcoin is likely on the verge of a full-blown bull run as the mining ecosystem flashes a number of buy signals.

Last week’s Commitment of Traders report from the CME also revealed that professional futures traders had reduced recent bearish bets towards Bitcoin.

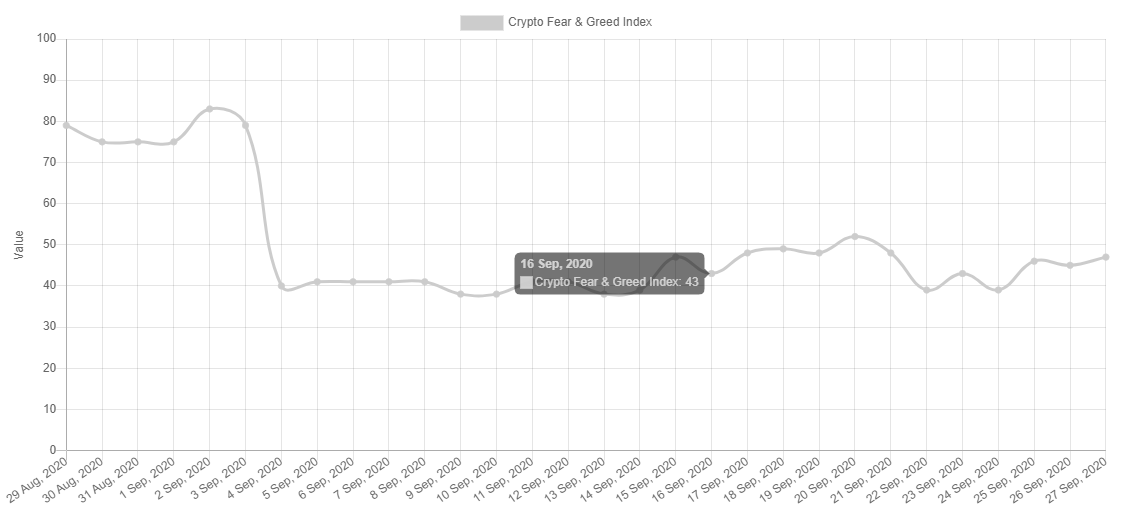

The Crypto Fear and Greed Index showed that traders remained in a state of “fear”, despite a notable recovery in Bitcoin and a number of top coins.

Source: Alternative.me

The total market capitalization of the cryptocurrency market traded between the $300 to $335 billion levels last week, marking the crypto total market caps lowest Average True Range since August 1st.

Spot volumes for the total market capitalization continued to decline, while open interest on the futures market hit a record high.

Chainlink, Aave, Cosmos, and Cardano staged notable recoveries last week, while Ethereum bounced by over ten percent after falling towards the $313 support area.

During my upcoming webinar, I will be charting Litecoin (LTC) Stellar Lumen (XLM), Cardano (ADA), and Bitcoin.

Source: Tradingview

The Week Ahead

Bitcoin is likely to take it’s direction from U.S. politics once again this week, as traders and investors react to the first Presidential debate between President Trump and Joe Biden.

The volatility could be quite severe in traditional financial markets, so now could be a good time to discuss potential scenarios, and how it could affect the price of Bitcoin.

I recently discussed with a friend of mine who handles currency hedging for a number of leading companies in the UK about his current thoughts on the upcoming elections. He noted that the U.S. dollar and the S&P 500 will likely rise if President Trump wins the upcoming election, and vice versa if Joe Biden wins.

His reasoning was that market participants think that a potential Biden administration is currently seen as being more likely to enforce a second round of Covid-19 lockdowns in the United States than the current Trump administration, and thus the knee-jerk reaction will be a major sell-off.

I appreciate that Bitcoin may not always follow the S&P 500 higher or lower, however, we do have to respect the rising correlation that the index and BTC has had recently. If we do see a large drop in U.S. stocks my gut feeling is that we will likely see Bitcoin turning lower as well.

The market’s reaction to Tuesday’s debate will be fascinating on many levels, and the outcome will likely set the tone for what we should come to expect during the lead up to election day.

I believe as the weather starts to worsen into the winter, a rise in COVID-19 infections is also likely to affect the stock markets, alongside the buzz around the election. Paying attention to the U.S. index’s, and in particular the S&P 500 is going to be important for crypto traders.

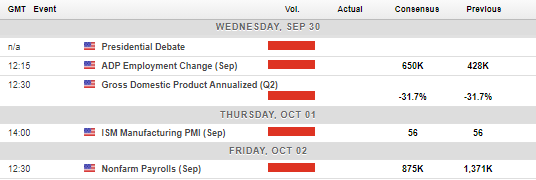

Looking at other events of the economic calendar this week, the big data events will be U.S. manufacturing, GDP, jobless claims, and the monthly job report. Last week saw a massive spike in jobless claims, which is even more reason to pay attention to Friday’s job report.

Economic Calendar

Source: Forexlive

The current technicals for Bitcoin show that the cryptocurrency needs to move above the $11,100 level to secure its short-term bullish bias, and further upside towards $12,000.

If buyers are able to hold Bitcoin back above the $11,100 level on the upcoming monthly price close it would be seen as a major buy signal going in October.

Failure to gain traction above this important technical area and BTC will more than likely start to revisit the $10,000 level. In short, Bitcoin is at a critical junction, and there is only some much technical failure before $11,000 that traders will tolerate before exiting longs.

In the near-term, if BTC bulls can consistently hold price above the $10,780 level then the cryptocurrency is in a strong position, and could challenge the mentioned $11,100 area, at any time.

It is particularly noteworthy that an extremely large bullish reversal pattern will form if price reaches the $11,200 level. The potential price pattern is projecting an eventual rally towards the $12,200 area.

Briefly looking at the downside, key weekly support for BTC below the $10,780 level is found at the $10,640, $10,550, $10,300, and $10,130 levels.

BTC/USD H4 Chart

Source: Tradingview

Ethereum (ETH) failed to close the week above the technically important $365.00 level last week, however, this has failed to deter short-term bulls as the cryptocurrency continues to grind higher alongside Bitcoin.

Last week’s recovery from just above the $310.00 level created a bullish higher low, as sellers failed to breach the September low, around the $300.00 level.

Furthermore, price action surrounding the ETH/USD pair is starting to appear more bullish. It must be noted that the recent failure to close the weekly candle above the $365.00 level is making me cautious.

If we see the monthly candle closing above the $365.00 it may be time to consider that the multi-week downside correction in Ethereum may finally be coming to an end.

We should also consider that if Bitcoin starts to close above the $11,100 level it could drag Ethereum and a host of top coins higher along.

Lower time frame analysis shows that a bullish reversal pattern has started to form, and is projecting a possible run towards the $390.00 level. The $415.00 and $450.00 levels are potential bullish targets above $390.00 in October.

To the downside, sustained weakness under the $330.00 level could see the ETH/USD pair revisiting the former weekly low, and possibly the $300.00 level. Ethereum could quickly come undone if the $300.00 level is broken.

ETH/USD H4 Chart

Source: Tradingview