Death, Taxes, and Yield Farming.

In 1789, Benjamin Franklin said that nothing in life is certain except for death and taxes. In 2020, I’d agree and also add Bitcoin. But even the decade-old cryptocurrency has experienced less than .01% in downtime. So, maybe our founding fathers wouldn’t include it in their list.

Let’s focus in on taxes. All this yield farming has created an absolute mess when it comes to taxes, especially for American users. And though the U.S. government needs to update its stance on the subject, citizens still need to follow the rules.

For pleasant examples of other pro-crypto jurisdictions, look no further than Germany. Gains made in crypto, for instance, aren’t taxable if users hold them for over 12 months. Zero, zilch, or as they say in German, nichts.

Anyway, let’s get back to the yield farming debacle.

Based on current American tax laws, everytime you buy, sell, or trade crypto, you create a taxable event. It doesn’t matter whether you are buying a coffee with your Bitcoin or lending Ethereum in a yEarn Finance vault. And insofar as the United States treats crypto similarly to property, you’re also eligible for capital gains taxes.

There are two types of capital gains taxes: Short-term and long-term.

If you hold your Bitcoin for less than a year before doing something with it, then it’s taxed in the short-term. Longer than a year? You guessed it: Long-term.

Short-term capital gains taxes are the same as income taxes. But if you make more than $78,750 and hold Bitcoin longer than a year, your tax rate is 15%. Ouch.

This becomes much more complicated if you consider airdrops, forks, mining, staking, and, of course, yield farming.

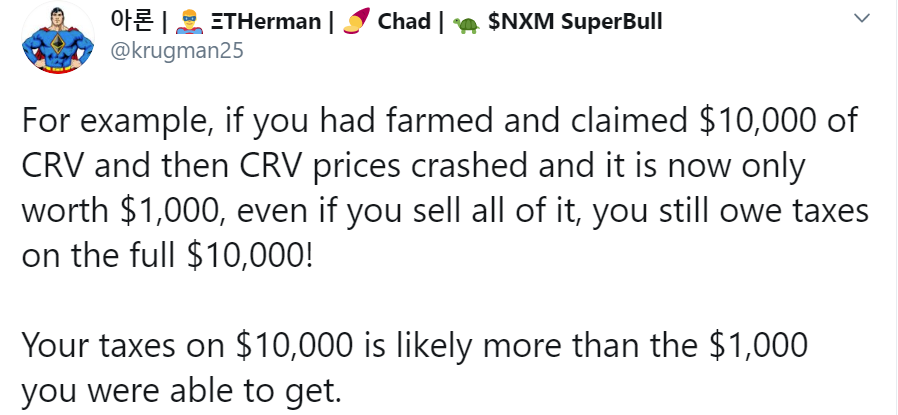

Let’s say that you farmed $5,000 CRV from Curve Finance, but then the price of CRV drops and you are left holding only, say, $1,250. The IRS will still tax you for the $5,000 that you initially farmed even if you sell at a loss.

In the eyes of Uncle Sam, as soon as you “claim” those tokens, he gets his slice. He doesn’t care if whales dump on you later down the line.

Source: Twitter

And though you might think that the IRS will never find you because crypto is still too difficult to understand, trust me, they will. They’ve already been sending out tax letters to folks beginning last month.

There are two ways to minimize your tax overhead.

First, invest a bit in a quality crypto tax specialist. This could be TokenTax, Lukka Tax, CoinTracking, or any other similar service. The second bit of advice is to limit your trading activity, know when to take profits, and avoid following the hype.