The Original ETH-DAI Strategy on Steroids.

Today we’ll take a look at MakerDAO leverage trade.

So, what clever traders would do back in the day was drop their ETH holdings into a CDP and get back DAI. Then, traders would take that newly-minted DAI and buy back more ETH, convert it to DAI, and repeat this cycle.

Though it looks like you’re making money out of nothing, this is essentially leveraged trading.

You’re betting that ETH will continue to rise, and thus buy more of it using debt. This scheme quickly falls apart, though, if ETH drops below the collateralization rate and traders get liquidated. This rate is 150%.

So, yeah, it’s risky. In a bull market, however, this could be a good strategy. Unfortunately, a new ETH bull trade has emerged. It’s from the one-man team behind yEarn Finance and it’s called the yETH vault.

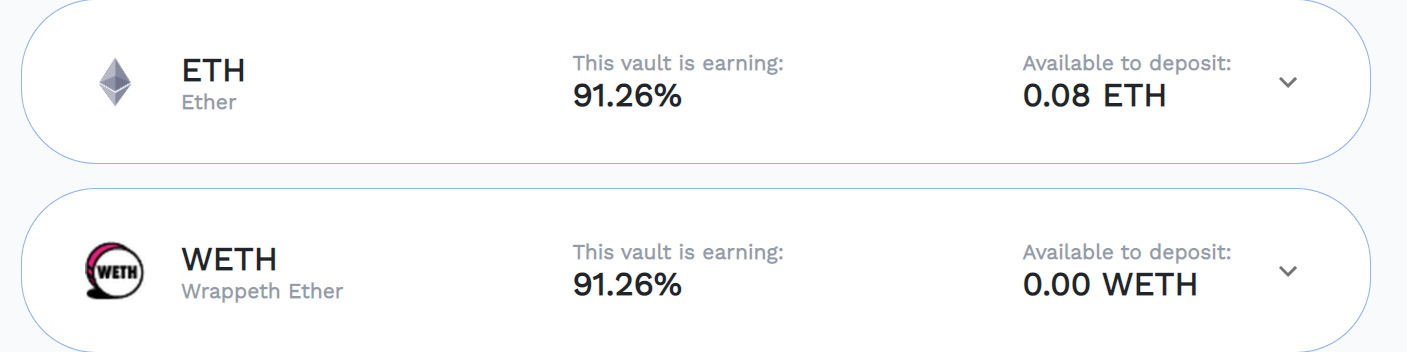

Right now, users are earning 91.26% on their ETH and wrapped ETH (WETH).

Source: yEarn Finance

It works like this: You deposit your ETH into this vault, then an automated strategy mints DAI on Maker with that ETH. Then the strategy takes that DAI and puts it into Curve Finance’s Y Pool and earns LP tokens (yCRV).

Still with me?

The strategy is currently earning on the trading fees from the Y Pool, plus the Curve governance token (CRV). Then the strategy will periodically sell these CRV tokens, buy more ETH, and the cycle continues.

Now that the strategy is clear to everyone, you can be sure that some DeFi users are likely going to try and execute this strategy solo. But what they will inevitably run into is the exorbitant gas fees. yEarn’s key advantage, besides being relatively easy to use, is that it is also much, much cheaper gas-wise.

But, this strategy falls into the same risk as the original MakerDAO strategy. If ETH drops below the collateralization level, which is set at a conservative 200%, the vault will be liquidated. But, as mentioned earlier, it’s bull times so maybe this risk isn’t as serious.