August 17 Crypto Market Roundup

Bitcoin (BTC) traded between the $11,100 to $11,900 levels last week, as traders continued to buy into meaningful price dips, but ultimately failed to crack the technically important $12,000 level.

A resurgence in the greenback and U.S. bond buying, coupled with a major downside correction in the price of gold and silver in early-week trade caused Bitcoin to fall towards the $11,100 level.

Traders used the pullback as a chance to buy in BTC, as technical sellers failed to breach the former weekly low, around the $10,900 support level.

BTCUSD H4 Chart

Source: Tradingview

The fundamental news surrounding Bitcoin was overwhelmingly positive last week, giving further credence to the notion that the pioneer cryptocurrency is set for a long bull run.

On-chain data from crypto behavior analytics provider, Santiment, showed that BTC HODLers were sitting tight, while Grayscale announced that it’s Bitcoin Investment Trust saw a record amount of new institutional investors last week.

Open interest for Bitcoin on the CME exchange also hit a new all-time last week, due to the record surge in interest amongst institutions and professional traders.

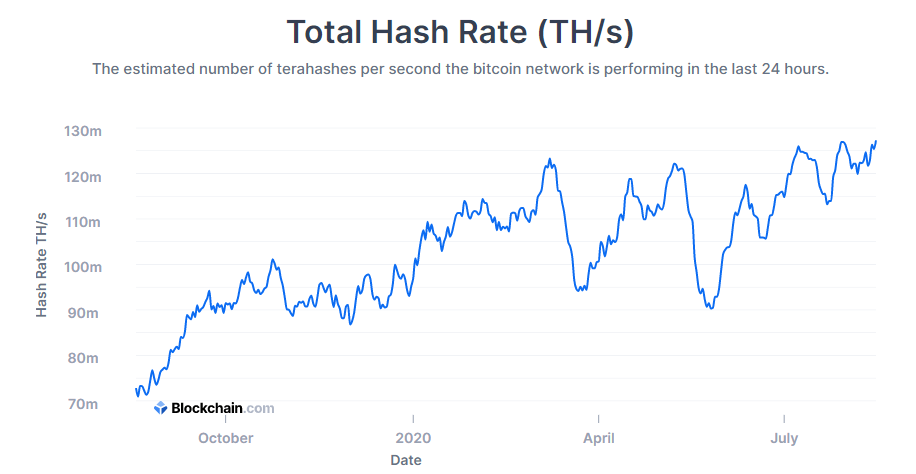

Bitcoin’s network hash rate set a new all-time high last week, while the number of BTC unique addresses also hit a fresh record high.

Bitcoin’s Total Hash Rate

Source: Blockchain.com

A recently published transcript from Federal Reserve Board Governor, Lael Brainard, revealed that the U.S. central bank has been working on creating a digital dollar, alongside the Massachusetts Institute of Technology.

Bitcoin exchange data also showed that the largest spike in BTC exchange inflows since the infamous March 2020 cryptocurrency flash crash took place.

However, Bitcoin also incurred so minor bearish news, as its market dominance fell to a fresh 1-year low, following a surge in the price of Ethereum.

The latest Commitment of Traders report showed that asset managers had started to reduce bullish bets towards Bitcoin.

Source: Santiment

The total market capitalization of the cryptocurrency market traded towards the $368 billion level last week, marking its highest trading level since June 26th 2019.

Spot volumes on the total market capitalization traded fell to their lowest levels since July 27th this year.

Altcoins continued to capture crypto traders’ attention last week. Waves (WAVES) staged a huge upside breakout, while EOS (EOS) launched an unexpected double-digit rally towards the $4.00 area.

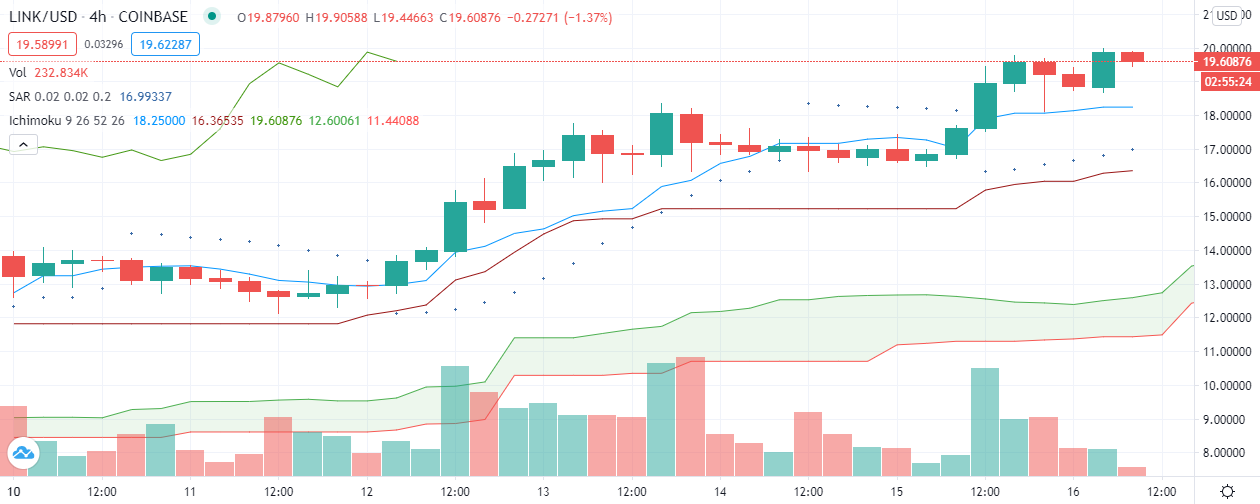

Chainlink (Link) exploded high last week, and reached the psychological $20.00 barrier. Chainlink, also usurped Bitcoin Cash as the fifth largest digital currency by market capitalization.

Source: Tradingview

The Week Ahead

Looking at the week ahead, Bitcoin has just set a new 2020 trading high, breaking the $12,000 level, placing the $12,400 level as the next bullish target..

If we do to see BTC struggling with the $12,400 level over the coming days we could see a wave of profit taking. This then opens-the-door for a better entry point for BTC bulls from lower levels.

We must also consider the other side of the trade, with large-scale accumulation happening at current levels, as whales, institutions, and HODLers continuing to anticipate more double-digit gains for BTC.

Any dips below the $11,000 levels are therefore likely to be short-lived, unless we see a major market catalyst presents itself, such as extreme risk-off market sentiment.

Gold and silver have now corrected lower. I would expect both metals to begin to push back towards the best levels of 2020 of the coming weeks, if the former weekly lows for both of these metals hold firm.

The U.S. dollar also looks ripe for its next major leg-lower against the major currencies, this bodes well for BTC, and also precious metals.

The next big market theme to watch as the summer comes to an end is the upcoming U.S. election. Election uncertainty is going to be a major factor as we move closer to the November 3rd voting date. Personally, I would expect that if President Trump starts to gain momentum in the polls it should benefit the greenback, needless to say this could be problematic for BTC in the lead up to the election.

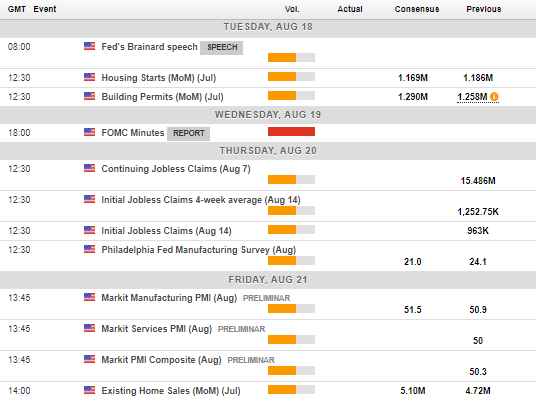

In the near-term, the FOMC Meeting Minutes headlines the United States economic calendar this week. Traders really do pay attention to the FOMC Minutes, any deviation from the current line of thinking from the U.S. central bank has the ability to generate volatility in financial markets.

Economic Calendar

Source: Forexlive

The current technicals show that Bitcoin has moved above an ascending triangle pattern after breaking above the $12,000 level in early week trade.

It is especially noteworthy that the recent breakout in BTC/USD from $9,800 level to $11,000 happened after an ascending triangle pattern breakout was triggered.

Bullish patterns have a high probability of playing out during uptrends, so this pattern should be observed carefully. The pattern holds an upside projection of $1,000, which could take BTC towards the $13,000 area.

Earlier, I mentioned profit taking. I reiterate that BTC could come off very hard if profit taking starts to really kick-in, especially considering the massive run higher since last month.

Buying into dips towards the $10,400 to $10,000 area seems to be the obvious strategy if a downside breakout occurs.

At the moment, the $11,600 level is the big downside level to watch prior to $11,100. A break of $11,100 and BTC could see heavy technical selling towards the mentioned areas.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) rallied towards the $440.00 area last week, following a powerful upside breakout from a triangle pattern.

Bearish divergences for ETH/USD are apparent on multiple time frames, and extend down towards the $395.00, and also the $310.00 area.

I believe that Bitcoin would need to fall significantly in order for Ethereum to reach the $310.00 area at the moment, given the bullish technicals and fundamentals.

A pullback towards the $395.00 area this week may present an excellent chance to buy into the prevailing uptrend, with the $480.00 to $500.00 area as the immediate bullish targets.

Again, daily price closes around the $395.00 level will be key if we do see a pullback. Buying around the $440.00 is simply not attractive, given the bearish divergences in play.

ETH/USD Daily Chart

Source: Tradingview