August 10 Crypto Market Roundup

Bitcoin (BTC) traded between the $10,900 to $11,900 price this week, as traders and investors remained largely optimistic towards the ongoing breakout in the number one cryptocurrency.

U.S. President Donald Trump’s ban on TikTok and WeChat operating in the United States briefly hurt crypto sentiment, however, traders continued to buy any meaningful pullbacks, in anticipation of more upside ahead for BTC.

Bitcoin showed only a muted reaction, as the Trump administration issued an executive order on the coronavirus unemployment benefits.

BTCUSD H4 Chart

Source: Tradingview

More bullish fundamental news surrounding Bitcoin, Positive on-chain data, and Bitcoin trading at premium on the CME futures exchanges all helped to underpin the overall bid-tone surrounding the cryptocurrency.

Bitcoin’s rising price also started to translate into higher transaction fees. Analysts speculated that the cryptocurrencies rising value, and increased network usage could be factors behind the increase in transaction costs.

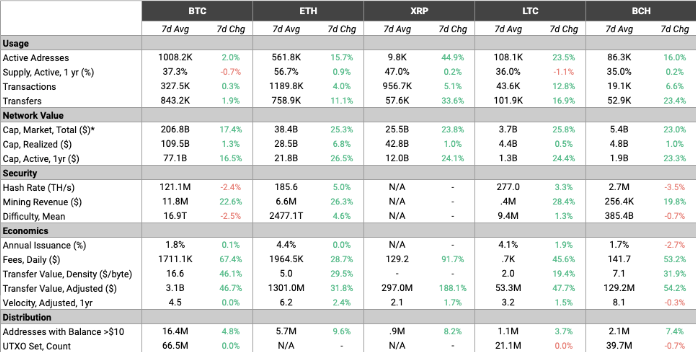

Data also showed that Bitcoin averaged over a million daily active addresses in the last week for the first time since January 2018. The growing usage metrics added further evidence of a rising bull market.

State of The Network Chart

Source: CoinMetrics

Data showed that retail traders were buying Bitcoin at levels not seen since 2017, while whales remained on the sidelines at current levels.

The latest Bitcoin Commitment of Traders report, or CoT report, showed that a slight bearish shift had taken place amongst asset managers since last week.

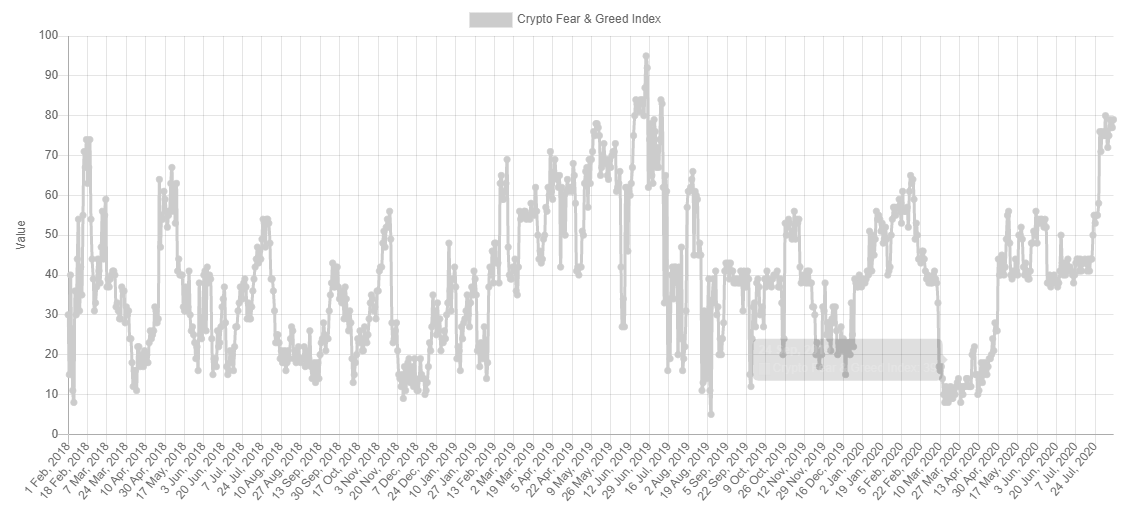

The Crypto Fear and Greed Index held steady at a 14-month peak, as traders remained in a state of “extreme greed” towards Bitcoin.

Source: Crypto Fear and Greed Index

The total market capitalization of the cryptocurrency market traded towards the $355 billion level last week, falling just short of the recent high set around the $360 billion mark.

Spot volumes on the total market capitalization traded around the best levels since May 202, and largely matched the previous week’s numbers.

Altcoins continued to see plenty of trading action. Monero (XLM) rallied to its highest level since June 2019, while Zcash (ZEC) and Dash (DASH) continued their recent technical breakouts.

Chainlink (Link) continued its epic run, and moved to a new all-time high last weekend, while Cosmos traded towards the best levels of the year so far.

Source: Tradingview

The Week Ahead

Looking at the week ahead, a degree of caution is certainly warranted, as a sizable technical correction could happen anytime. Bitcoin’s growing credentials as a macro asset, and price correlation with gold and silver are all reasons to be cautious.

Large scale profit taking in the metals space from over stretched levels, or a temporary resurgence in the greenback could provide somes short-term problems BTC.

BTC profit taking could also kick-in if bulls fail to set a minor new yearly high, or indeed if buying interest above the $12,000 area starts to dissipate.

It is worth noting that with Bitcoin racking up a 30% gain in under four-week, a technical correction of 15% to 20% cannot be discounted.

As I previously mentioned, Gold and silver are also trading at lofty levels. Both metals have come a long way in a relatively short period of time, especially silver.

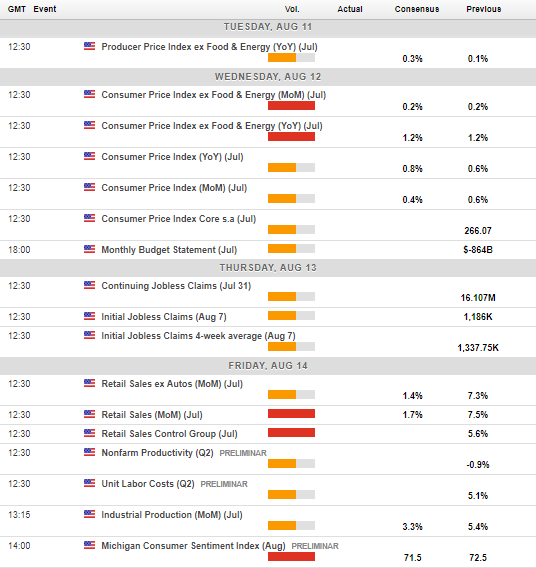

The United States economic calendar is once again busy this week. Traders and investors will look to the release of U.S. Inflation, Housing, Confidence, and Retail Sales data this week, against a backdrop of rising COVID-19 infections, and an economy that is not yet firing on all cylinders.

Economic Calendar

Source: Forexlive

The current technicals show that Bitcoin is expected to peak around the $13,500 level over the coming weeks. Although I would anticipate some sizable pullbacks along the road to $13,500 if the $12,400 to $12,500 resistance zone holds firm.

Should we see the $14,000 resistance level overcome, BTC could easily test towards the $16,400 level, and possibly even the $17,000 level.

Looking at areas to enter back into the prevailing trend, the $11,100, $10,400 to $10,100 regions looks to be a good bet on the charts. The $10,400 level was a major challenge for bulls up until the recent breakout. It is only natural that we may revisit this key technical area once again.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) ideally needs to anchor price above the $410.00 level to encourage a push towards the $480.00 TO $500.00 area this week.

Downside risks will grow if we see multiple daily price closes below the technically important $370.00 area.

Ethereum could be a tremendous buy on a pullback towards the $320.00 to $300.00 level over the coming days and weeks.

Higher time frame analysis certainly suggests that ETH/USD could easily rally towards the $480.00 and possibly the $600.00 levels this year. If Bitcoin breaks past the $14,000 level then the mentioned upside targets for Ethereum could be very conservative, and we could see ETH/USD going much higher than $600.00.

ETH/USD Daily Chart

Source: Tradingview