July 27 Crypto Market Roundup

Bitcoin (BTC) finally started to breakout to the upside last week, following weeks of narrow range bound trading conditions, and depressed trading volumes.

The BTC/USD pair started to rally after moving back above its key 50-day moving average, which had been acting as a major technical resistance barrier for the pioneer cryptocurrency for much of July.

Bitcoin appeared to rally, after the news that national banks in the United States had been given the regulatory green light to offer cryptocurrency custodial services.

BTCUSD Daily Chart

Source: Tradingview

Other analysts noted that Bitcoin could be rallying in anticipation of the U.S. government announcing a $2 trillion stimulus package this week.

Payment giant, Visa, also announced that they are setting out a “road map” to support Bitcoin and a number of other top cryptos.

According to data from Skew.com Bitcoin’s correlation with the price of gold reached a four-month high last week, as the yellow-metal stage a huge upside move alongside silver.

Hedge fund manager, Kyle Bass, also said last week that Bitcoin was preparing for a massive up move alongside gold and silver, as both metals approached multi-year highs.

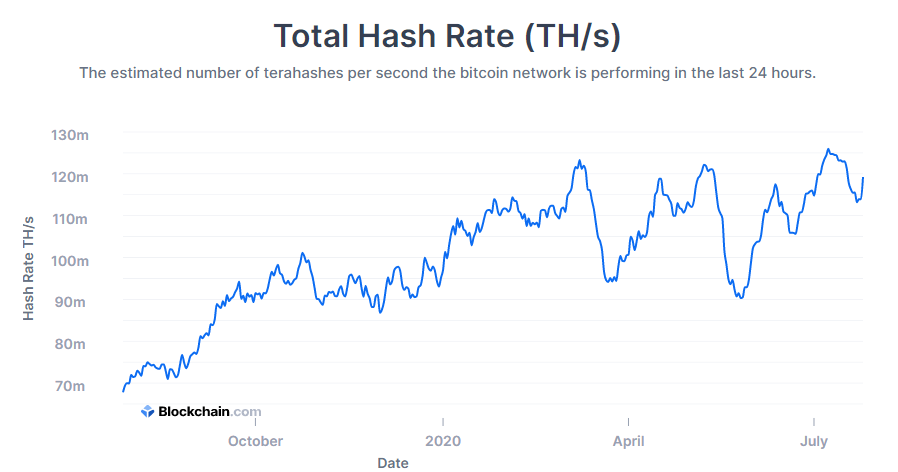

Source: Blockchain.com

BTC Open Interest hit a new multi-month high last week before the rally took hold, while Bitcoin’s network hash rate traded towards back it’s all-time high, following a short-lived pullback.

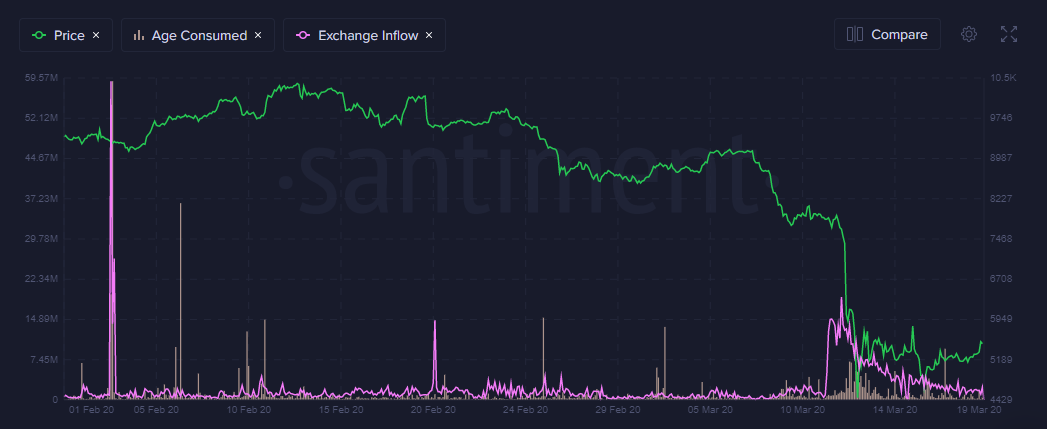

On-chain data showed no significant BTC exchange inflows from whales during last week’s advance, while BTC exchange reserves have also hit a one-year low.

Bitcoin’s Average True Range Percentage also hit its lowest reading on record prior to the cryptocurrency breaking out to the upside.

The latest Bitcoin Commitment of Traders report, or CoT report, showed that a bullish shift had taken place amongst asset managers.

Source: Santiment

|

The total market capitalization of the cryptocurrency market staged a rally towards the $300 billion level, and moved within touching distance of the current yearly trading high. Bitcoin’s market dominance attempted to recover from depressed levels, as BTC and a number of top altcoins staged powerful technical breakouts, while the DeFi space had a mixed trading week. Ethereum and Litecoin stole the show in the altcoin arena, Ethereum rallied to its highest trading level since June 2019. Some analysts speculated that ETH/USD was rallying in anticipation of Ethereum 2.0. The popularity of DApps, DeFi tokens and their increasing market share of the Ethereum ecosystem were all seen as possible driving forces behind the recent price rise. |

Source: Tradingview

The Week Ahead

Looking at the week ahead, now that range bound trading conditions have been broken, Bitcoin and other coins could start to see some significant price moves.

The ongoing breakout in gold should be watched carefully this week. If XAU/USD continues to hold above the $1,920 level it could be extremely bullish for BTC/USD.

Traders attention will also be focused on the greenback this week, following its major drubbing on the foreign exchange market last week. The decline in DXY has been accelerating, and shows no signs of abating after six-straight weeks of losses.

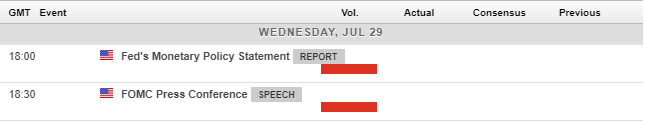

The United States economic calendar is fairly busy this week, traders and investors will be highligly anticipating the FOMC interest rate and policy statement this Wednesday.

The tone of the Federal Reserve is likely to set the tone for stocks, metals, and the greenback going into August, which of course has the potential to affect the price of BTC.

Economic Calendar

Source: Forexlive

The current technicals show that Bitcoin (BTC) has broken through the top of an ascending triangle pattern around the $10,000 level. A sustained break above the triangle has the ability to start a $1,000 directional move, at a minimum.

More interesting, a huge bullish reversal pattern will be activated on the daily and weekly time frame if Bitcoin rallies above the $10,500 level this week. If the breakout is genuine, then BTC/USD has the potential to rally towards the $17,000 level.

To the downside, bears need to move price below the $9,700, and finally the $9,470 level to negate the ongoing bullish breakout. At present, the chances of Bitcoin reaching the $11,800 to $12,400 area look very good.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) is oncourse for starting a major new price trend while trading above the $300.00 support level.

If bulls can continue to anchor price above the $290.00 to $300.00 resistance zone Ethereum has the potential to rally towards the $480.00 over the medium-term.

Higher time frame analysis is far more bullish and is projecting a rally towards the $900.00 area. However, ETH/USD bulls still must clear strong resistance from the $370.00 to $380.00 technical area.

ETH/USD H4 Chart

Source: Tradingview