Farmer’s Almanac #0

Even if you’re new to crypto, you most likely heard about yield farming. It sounds enticing to earn extra money on your crypto holdings. However, many people still don’t do it because they think it’s complicated and risky.

Our new series of newsletters, Farmer’s Almanac, will make farming easy for you. Here, we will break down complex things and guide you through farming strategies that generate promising returns.

In each of the following newsletters, you will get a short update on the state of yield farming and hand-picked farms for large-caps, stablecoins, and risky but profitable low-caps. When appropriate, I will provide you with hints and insights to help you up your yield farming game.

Before I continue, let me briefly introduce myself. I’m Sergey, and I have been following and investing in crypto since mid-2017. When the DeFi ecosystem began to grow, I focused on researching DEFI projects and yield farming.

I know how easy it is to get lost with farming. The number of options are overwhelming. Fortunately, I’ll be sharing my years of farming experience with you. I’ll give my personal tips on how to spot good farms and improve your yield-chasing skills.

In this introductory newsletter we’ll review the concept of yield farming, see what returns you can get and the risks you will face.

Why farm?

Yield farming can be highly profitable. People who deposited their crypto into Uniswap, Compound, 1and INCH early saw 100% to 500% returns on their “staked” crypto holdings.

Those who didn’t immediately sell their rewards saw over 10x on their harvest. For instance, UNI started trading at around $3 and peaked at $42.

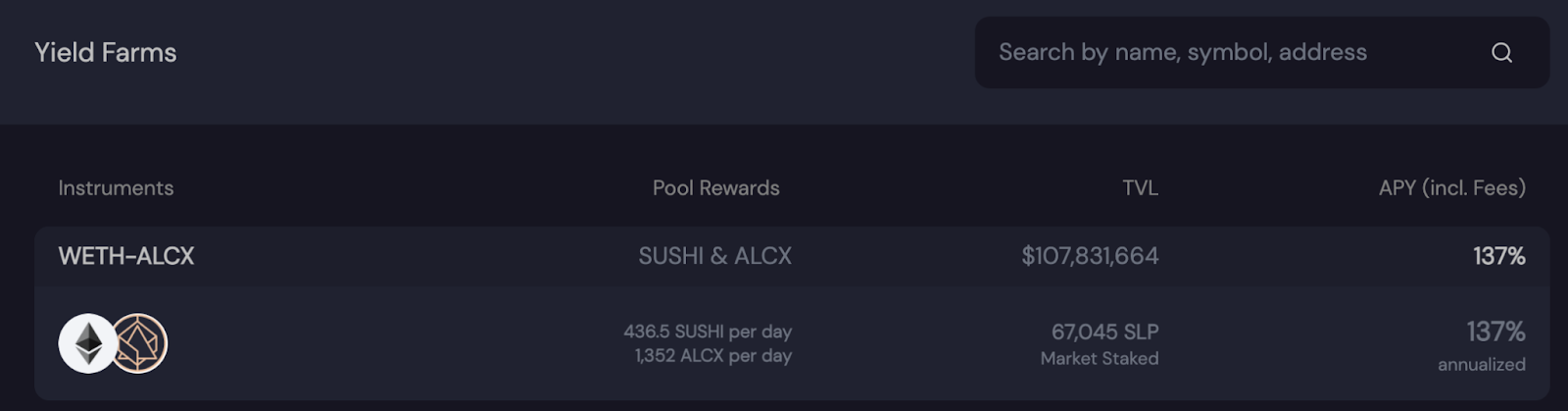

Even after the recent market correction, there are still relatively stable farming options with over 100% annual returns. Also, many farming strategies are efficient when the market moves sideways like it has been doing for over the past several weeks.

Now that you know what results to expect, let’s define yield farming, so we are on the same page in the future.

What is Yield Farming?

Yield farming is a way to generate passive income with cryptocurrency holdings. Instead of holding your crypto on exchanges or wallets, you can put it in decentralized financial applications and earn rewards in return.

DeFi projects don’t hold your money, which is why they can’t facilitate loans or trading unless someone provides liquidity. To attract liquidity providers (LPs), applications share fees with them and sometimes provide extra incentives like governance tokens.

For instance, Compound enables people to loan and borrow money in a decentralized way. Let’s say you want to borrow some ETH. Compound on its own can’t give it to you, so it attracts lenders by offering COMP tokens atop the interest they will get.

On another platform, Uniswap, LPs create an opportunity for trading. If you want to sell your ETH to USDC, you will need someone to have USDC on Uniswap. The more tokens on each side of the trade, the better price you will get if you trade large amounts of money. Hence, Uniswap is motivated to incentivize its LPs with fees and UNI token.

Ironically, the first governance tokens weren’t intended to have financial value at their inception. For example, Andre Cronje said that YFI had zero value when he created it. A few months later, the token was trading over $80,000.

People value some of these tokens because they give access to the protocol’s profits, others because they give decision-making power in successful projects.

While specific governance tokens are worth holding, those that provide 2,000% APR are not meant for the long term as high selling pressure comes with higher farming percent returns.

The Risks of Yield Farming

Yield farming comes with risks such as smart contract exploits, rug pulls, impermanent loss, and dilution.

One of the key risks is smart contracts vulnerabilities. Many protocols are built and developed by small teams with limited budgets, increasing the risk that their apps have bugs.

Moreover, even flawless smart-contracts are still connected to dozens of other projects and can suffer from unexpected exploits.

The complexity of these integrations make it possible to break projects that have fundamentally sound code. If you are locking your funds in smart contracts, there is always a chance of losing your entire principal.

Next, yield farming is a highly competitive and fast-paced market where rewards can fluctuate rapidly. As a result, if a farming strategy generates outsized profits, many farmers will jump on the opportunity, diminishing the potential reward for everyone.

Another major risk is impermanent loss (IL) which comes up when you are depositing liquidity on decentralized exchanges. IL happens when the price of your deposited assets changes compared to when you deposited them. The more significant this change is, the more you are exposed to impermanent loss.

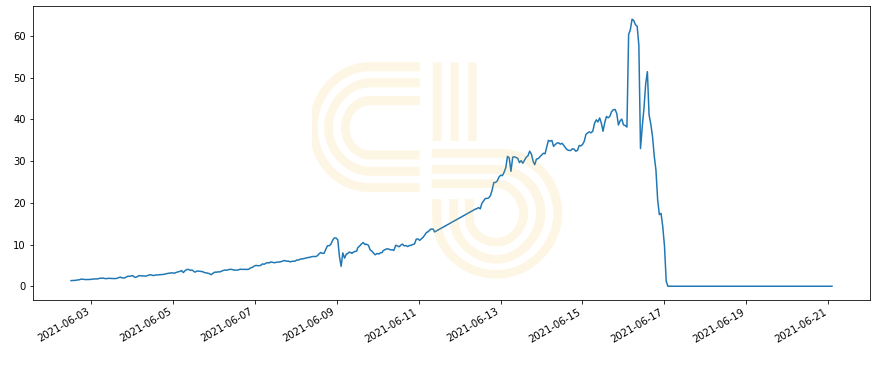

For example, the recently launched project Iron Finance on Matic network had over 2,000% annual percentage return through a liquidity pair with its own governance token. However, given high farming APR, investors started selling, causing prices to go down by more than 99% and destroying the profits.

The APR was above 7,000,000% at one point. However, if a token crashes then the APY figure is not a realistic representation of what you’ll actually make per year.

TITAN Price. Source: CoinGecko.

Even billionaire Mark Cuban who farmed on this protocol, lost his entire position of over a million dollars in hours.

Lastly, farmers can suffer from rug pulls where developers run away with deposited funds or pull liquidity from the market. In an environment where many teams are anonymous, this is especially common.

Farming Strategies

Despite the farming risks, certain farms are relatively safe. Hence, if you are a long-term crypto holder, you can deposit them into protocols for additional yield.

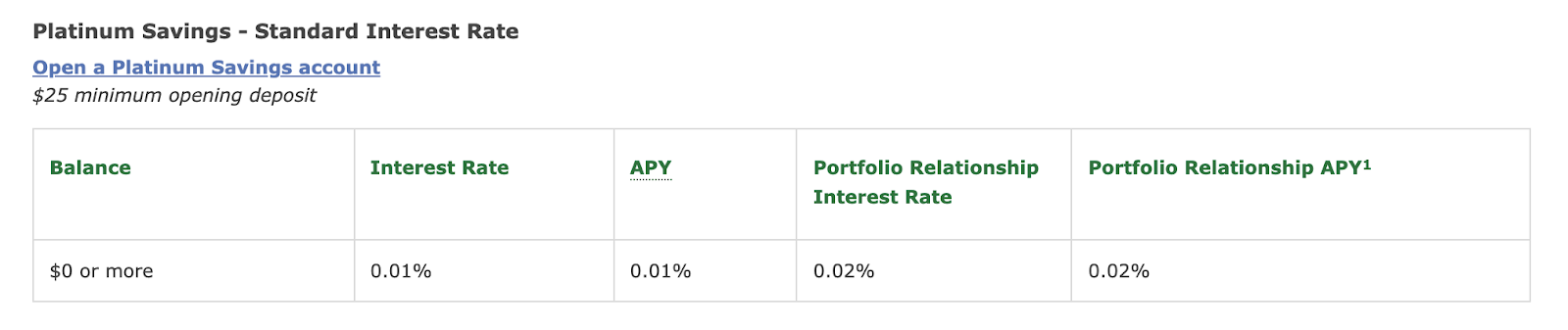

If you are uncertain about the market and would like to stay away from volatility, you can deposit your stablecoins for rewards too. That’s a good alternative to a bank deposit because yield in the most secure low-risk farms is still way more attractive than fixed returns on bank deposits.

Wells Fargo ‘Platinum Savings’ gives you only 0.01% APY. (It’s not a joke)

The annual yield on your stablecoins can reach up to 20%, which is higher than your average portfolio of stocks and bonds with a moderate risk profile targeting 4%-5% and aggressive 8%-9% annual returns.

That’s for the safe bets. You can also farm more aggressively with leverage, more volatile cryptocurrencies, and fresh unaudited platforms with anonymous founders.

Needless to say that the bigger reward will come with much more risk. So, it’s a bad idea to go down the aggressive route without learning the ropes first.

Besides risks, the only cost that you incur while farming is the opportunity cost of not utilizing capital somewhere else. So, if you are not utilizing your stablecoins, BTC, ETH, or other crypto, you miss out on yield!

Disclosure: The author of this newsletter holds BTC, ETH, and ALCX. Read our trading policy to see how SIMETRI protects its members against insider trading.