June 8 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

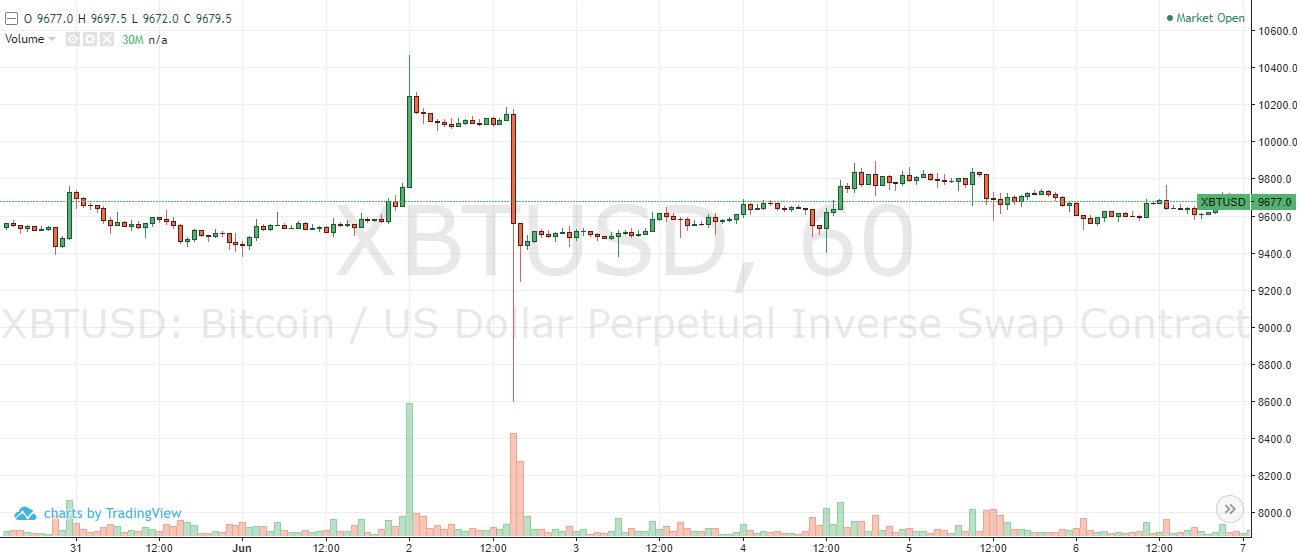

Bitcoin (BTC) suffered another heavy upside rejection from the $10,000 level, shortly after the pioneer cryptocurrency had rallied to its highest trading level since February 14th 2020.

The BTC/USD pair plunged by more than $800.00 over a five-minute period, as bulls once again failed to anchor price above the psychological $10,000 level.

BTCUSD H1 Chart

Source: Tradingview

The decline in BTC/USD halted just below the $9,300 level on most crypto exchanges, although some exchanges, such as BitMEX, recorded BTC going below $9,000.

Many cryptocurrency traders noted that Bitcoin has initially rallied after President Trump threatened to call in the national guard to stem the ongoing riots in the United States.

BTC/USD found notable technical support from its key 200-period moving average on the four-hour time frame, and started to stabilize between the $9,300 to $9,800 price range.

BTC/USD chart

Source: BitMEX Exchange

An outage in the cryptocurrency exchange, Coinbase, also took place moments after Bitcoin tanked, further hurting sentiment towards the crypto market.

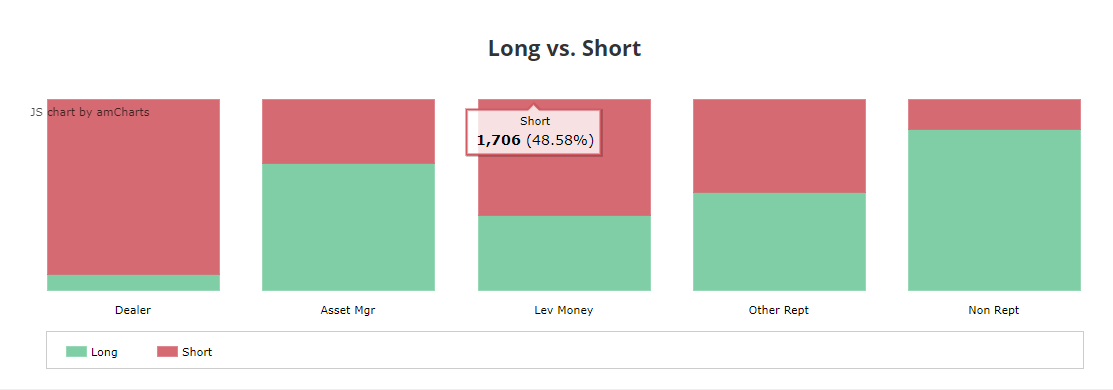

BTC Long positions amongst margin retail traders on many cryptocurrency exchanges were heavily skewed to the upside before the price crash in BTC/USD.

Last week’s CoT report also showed that institutional traders increased short positions towards Bitcoin. Leveraged funds saw the most dramatic increase.

Data from crypto analytical behaviour platform Santiment showed that social media volume spiked to its highest level since the recent halving event.

However, on-chain analysis from Santiment, continued to show that long-term Bitcoin holders were sitting tight, despite the sudden price plunge.

BTC Social Media Volume

Source: Santiment

The total market capitalization of the cryptocurrency market rallied towards the $290 billion mark, but was quickly dragged lower by Bitcoin’s price plunge.

Traders struggled to break the $300 billion mark over recent weeks, and take out the current 2020 trading high for the crypto total market capitalization.

Crypto Total Market Cap

Source: Tradingview

Cardano was one of the more volatile coins in the altcoin space last week. The ADA/USD pair rallied by over 30%, after coming under pressure after Bitcoins early price crash.

Retail trading data from a leading London brokerage showed that traders were overwhelmingly bullish towards. With a 95% long bias.

Altcoins appeared to be primed for a major rally this month, as Bitcoin starts to consolidate ahead its next move.

The Week Ahead

Looking at the week ahead, Bitcoin appears to be primed for a major directional move, once the $9,300 to $9,850 price range is broken.

Looking at the upside for BTC this week, a breakout above the $9,850 level exposes further upside towards the $10,100 and possibly another shot at the $10,500 level.

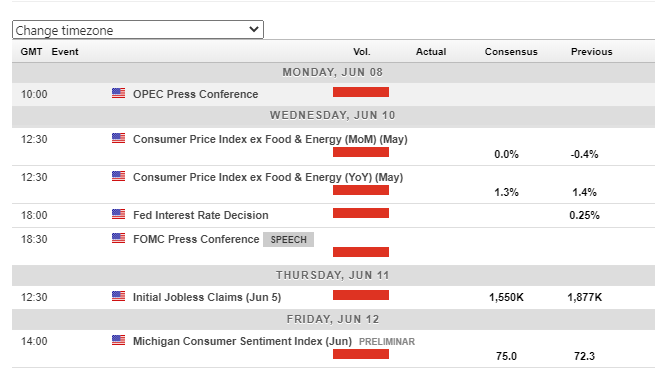

The United States economic calendar this week is largely focused on the FOMC interest rate decision. The ongoing riots in the U.S. will also be of particular interest to investors and traders.

Economic Calendar

Source: Forexlive

A bullish pattern on the lower time frames are warning of a coming rally towards the $11,600 level. This remains a likely scenario of bulls activate the pattern and anchor BTC/USD above the $10,100 level.

To the downside, losses under the $9,300 level may trigger selling towards the $9,000 or $8,800 level. Losses under the $8,700 would concern medium-term bulls.

BTC/USD DAILY Chart

Source: Tradingview

Ethereum (ETH) broke through the $250.00 level last week, but failed to gain traction above the $255.00 level.

A correction down towards the $225.00 area may attract more dip-buying interest. At present the $300.00 level is seen as a valid bullish target if the $255.00 level is overcome.

Should the broader cryptocurrency start to rally, ETH/USD pair could be one the largest gains. Losses below the $200.00 level may concern medium-term bulls.

ETH/USD DAILY Chart

Source: Tradingview