June 1 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) rallied back towards the $9,750 level last week, after the number one cryptocurrency performed its strongest monthly price close since August 2019.

The BTC/USD pair started the week under pressure, however, a lack of selling interest below Bitcoin’s 52-week moving average, around the $8,700 level, and a rally in the broader market boosted sentiment towards cryptos.

BTC CME Futures

Source: Tradingview

The recovery in Bitcoin closed an important price gap on the CME futures chart around the $9,130 level. BTC bulls remained in control once the price gap was filled, as selling interest below the $9,000 level soon dried up.

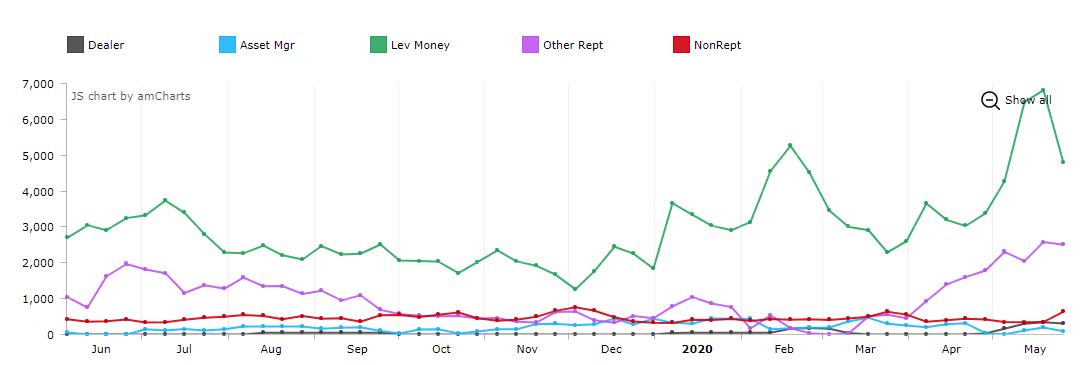

Last week’s Commitment of Traders report, otherwise known as the CoT report, showed that asset managers were increasing BTC longs and reducing BTC short positions.

BTC CoT REPORT

Source: Fxstreet

Bitcoin options data also indicated that professional traders and institutions were becoming more bullish towards BTC, as put calls saw a sharp decrease.

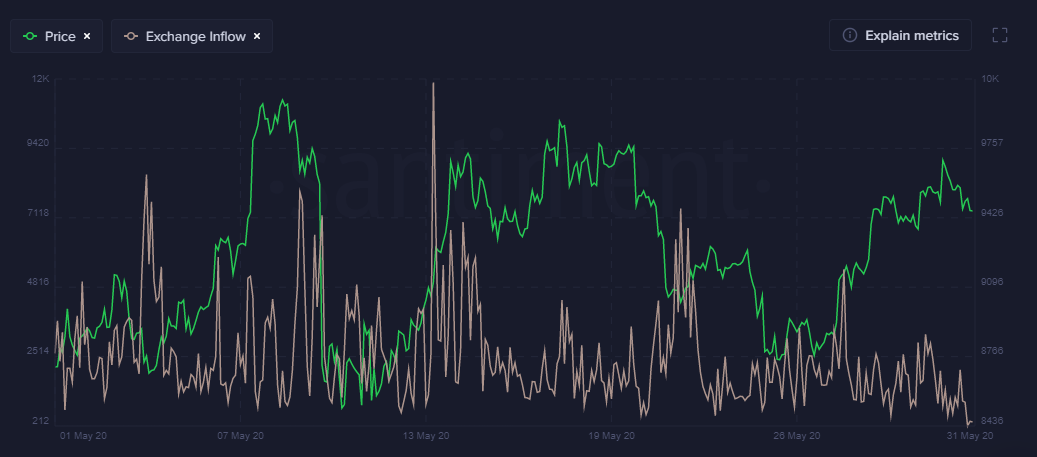

Data from crypto analytical behaviour platform Santiment showed that BTC exchange inflow and outflow fell towards record lows.

On-chain analysis from Santiment continued to show that long-term Bitcoin holders were sitting tight, and still expecting the price of BTC to rise.

BTC Token Age Consumed

Source: Santiment

The total market capitalization of the cryptocurrency market rallied to its highest level since late-February last week as altcoins finally started to rally alongside Bitcoin.

Crypto Total Market Cap

Source: Tradingview

A select few altcoins saw huge double-digit moves last week, with Cardano and Maker amongst the notable gainers inside the top-30. Theta had an incredibly volatile trading week and pulled back sharply after hitting a fresh all-time record high.

Retail trading data from a leading London brokerage showed that traders reduced bullish bets towards Bitcoin by around 9% last week.

For those of you who may have missed it, we recently published a comprehensive report on what to expect after the Bitcoin halving.

The Week Ahead

Looking at the week ahead, Bitcoin appears poised to test towards the best level of 2020 so far. The technicals show that only a break under the $8,500 level would cause concern amongst BTC bulls.

Looking at the upside for BTC this week, a breakout above the $10,080 level could cause the BTC/USD pair to rally towards the $10,500 level, and possibly even the $11,600 level.

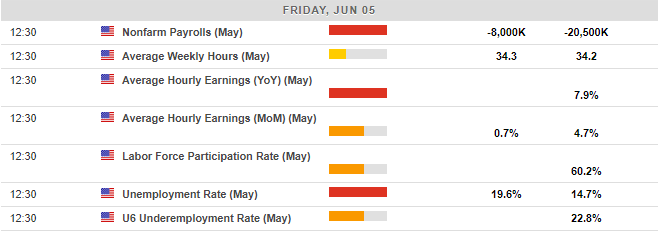

The United States economic calendar this week is jammed packed with high-impacting events. Traders will be heavily focused on the latest U.S. monthly jobs report this coming Friday, with the unemployment rate and headline jobs figure the central focus.

Economic Calendar

Source: Forexlive

From a technical perspective, the $9,000 level offers strong support this week. The $8,800 to $8,700 offers the final line defense before the $8,500 support area.

As long as price remains above the $9,000 level then short-term bulls remain in control, and higher BTC prices should therefore be expected.

BTC/USD DAILY Chart

Source: Tradingview

Ethereum (ETH) has started to move notably higher over recent days. A breakout above the $250.00 level exposes further upside towards the $275.00 and possibly even the $300.00 level.

A bullish breakout from an inverted head and shoulders pattern is currently underway on the lower time frames. The breakout remains valid while price trades above the $230.00 level.

Should the broader cryptocurrency start to turn lower, then the $225.00 and $217.00 levels currently offer major support this week.

ETH/USD DAILY Chart

Source: Tradingview