May 25 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) came under pressure last week after buyers failed to move price above the $10,000 level, due to weak buying demand and bearish fundamental news.

The BTC/USD pair initially slipped lower on the news that the BitMEX trading platform underwent unscheduled maintenance.

Source: Twitter

Further bearish news that the mysterious Satoshi Nakamoto, may have moved 50 Bitcoins also sent the pioneer cryptocurrency lower on the week.

Source: Twitter

Bitcoin largely failed to recover its recent upside momentum, amid fears of a potential market top in place, due to the 50 Bitcoins being moved for the first-time since 2009.

Options data from Skew.com shows a large increase in BTC put positions amongst traders last week. This means that institutional investors may be expecting more downside in BTC.

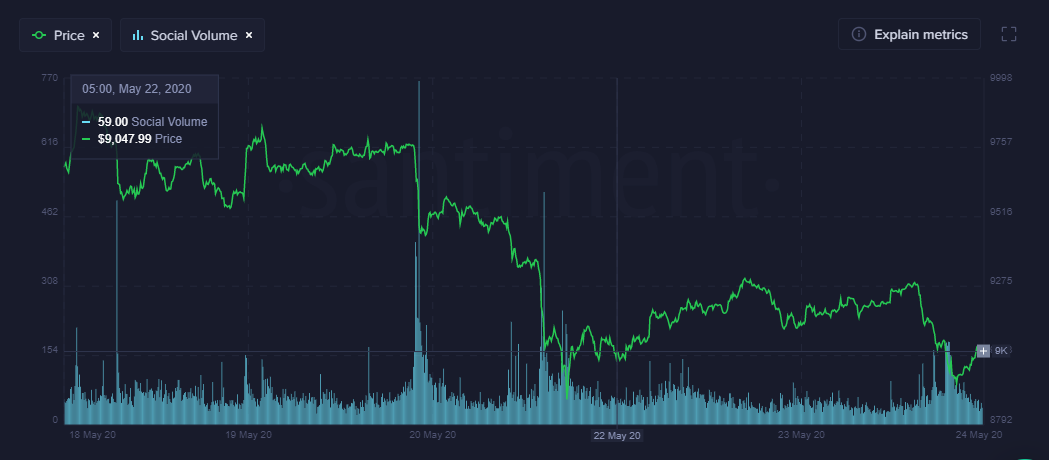

BTC Social Media Volume

Source: Santiment

On-chain metrics for Bitcoin showed that long-term coin holders continued to sit-tight. However, a series of spikes in social media volume indicated that a bearish correction was on the horizon.

The total market capitalization of the cryptocurrency market was dragged lower by Bitcoin into the weekly price close. The altcoin space remained subdued, with many of the top altcoin trapped inside narrow trading ranges.

Crypto Total Market Cap

Source: Tradingview.com

OmigseGo (OMG) was one of the strongest cryptocurrencies inside the top-100 last week. The OMG/USD pair is up triple digits this month, and continued to light-up social media.

Retail trading data from a leading London brokerage continued to show that traders were turning trimming bullish bets towards Bitcoin. Long positions decline for a second consecutive week.

The Week Ahead

Looking at the week ahead, Bitcoin is likely to remain under pressure while trading below the $9,000 level.

The technicals show that false breakout has occurred from a long-time wedge pattern. A major trendline, that has been in place since March this year has now been broken, following the recent decline under the $9,000 level.

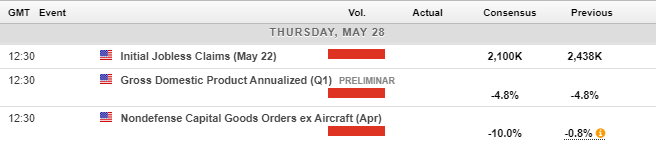

Looking at the United States economic calendar this week, traders will be focused on the latest U.S. GDP number, weekly job figures, and goods orders data.

Economic Calendar

Source: Forexlive.com

From a technical perspective, the $8,100 level could easily be achieved, although the overall risk is a stepper decline towards the $7,000 level.

If price moves above the $9,000 level then a gap on the Bitcoin CME futures chart, extending to the $9,130 level may be filled. Bulls need to anchor price above the $9,400 area to encourage further technical buying.

BTC/USD DAILY Chart

Source: Tradingview.com

Ethereum (ETH) could be dragged lower this week if Bitcoin does start to fall back towards the $8,000 level. Multiple upside failures before the April monthly high are also weighing on the ETH/USD pair.

A move under the $190.00 support level would cause traders to turn bearish towards ETH/USD. Downside targets currently extend towards the $175.00 and $155.00 support levels.

Should the broader cryptocurrency start to turn higher, then the $220.00 level is a key area to watch.

Gains above this level could propel the ETH/USD pair towards the $260.00 resistance area.

ETH/USD DAILY Chart

Source: Tradingview.com