April 6 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

After a fairly uncertain start to the month of April the cryptocurrency market continued its recovery last week as institutional money finally started to return after weeks on the sideline.

Bitcoin ended the trading week just below the $6,800, after finding strong technical support from the $5,850 level.

After steadying back above the $6,000 level Bitcoin eventually traded to a three-week high, around the $7,290 level.

The broader cryptocurrency market also continued to recover alongside BTC, with the total market capitalization peaking around the $198.50 billion level.

Total Market Cap (excluding BTC)

Source: Tradingview.com

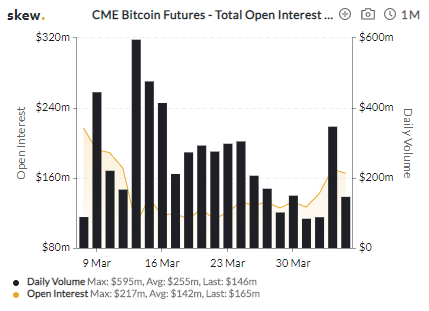

Bitcoin also benefited from an increase in trading volume last week. Quarterly data from 22 exchanges actually showed a 61 percent increase in trading activity from the previous fiscal quarter.

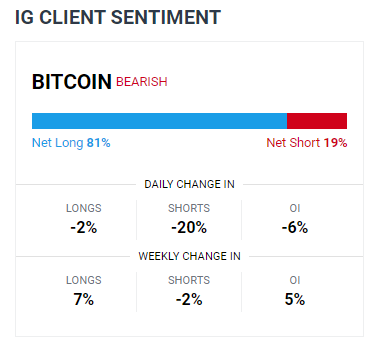

Margin retail traders also remained bullish towards Bitcoin last week. Data from a leading broker from the United Kingdom showed that over 80 percent of margin retail traders were long Bitcoin.

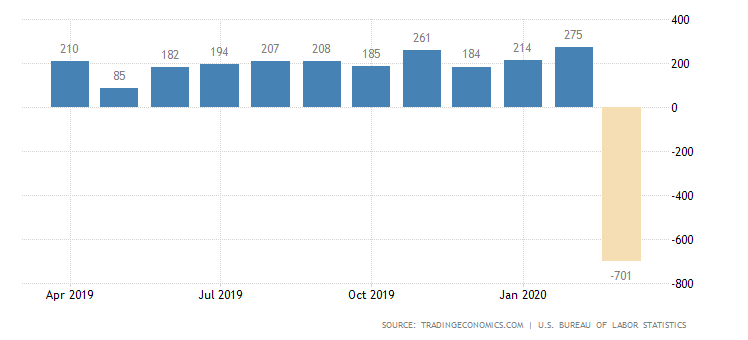

Bitcoin also continued to decouple from its recent correlation with the S&P 500, and shared a higher correlation with the price gold. Gloomy economic data from the United States continued to keep equity investors at bay, and further bolstered demand for alternative asset classes.

The Non-farm payrolls monthly jobs report last Friday declined by 701,000 in March, further details inside the report revealed that the U.S. unemployment rate in March surged to 4.4% from 3.5%, and came in much worse than analysts previous estimates of 3.8%.

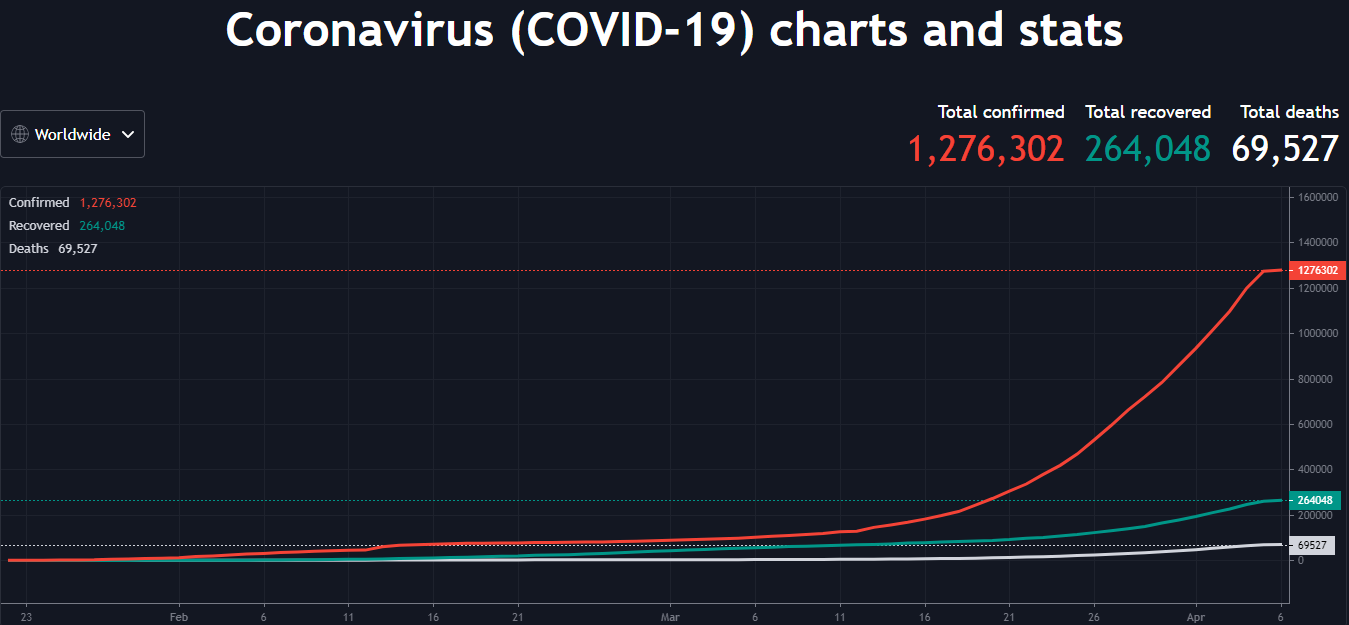

The ongoing narrative amongst crypto enthusiasts that the uncertainty towards the global spread of the coronavirus is likely to be bullish for digital currencies remained in play.

As global lockdowns continue and economic activity contracts, central banks around the world were seen as being more likely to adopt the unlimited QE programs that the Bank of Japan and the Federal Reserve are currently undertaking.

Coronavirus (COVID-19) Stats

Source: Tradingview.com

The Week Ahead

Looking at the week ahead it should be a big week for the cryptocurrency market. If Bitcoin continues to gain traction above the $7,000 level it is not beyond the realm of possibility that the $8,000 to $8,100 level can be achieved.

Failure to move above the $7,300 resistance level this week and Bitcoin could get smacked down towards the $6,000 support level, where dip-buyers could be lurking to pick-up BTC at a more attractive entry price.

BTC/USD H1 Chart

Source: Tradingview.com

It is also noteworthy that Bitcoin is currently showing no selling interest below its key 200-week moving average, around the $5,600 level. It therefore appears bulls may be attracted to BTC’s 200-day moving average, around the $8,100 level.

In fact, Bitcoin’s trend defining 200-day moving average could act as a magnet for buyers if price starts to trade above the $7,300 level this week.

Stellar Lumen (XLM) is starting to look more bullish lately. We recently issued a signal for XLM/USD on Coins on The Move and it is surging higher already.

Ethereum (ETH) is also on our radar this week. This is one coin that has consistently held critical long-term support, and could be poised to stage a rally. Watch out for fireworks in ETH/USD in BTC/USD crosses $7,300.