Advanced Staking and Farming.

In the Crypto Farmer’s Almanac, I outlined the basics of liquidity mining, but there’s a lot more you need to know. Today, I will give you strategies that can make yield farming less volatile and more profitable.

The technique I’m about to reveal works best for stablecoins. If you prefer to play it safe and keep most of your funds in stables, you’re going to love this article!

A short refresher on liquidity mining: it is a way to earn passive income by providing your idle crypto to various DeFi protocols. If you missed the SIMETRI Insights article devoted to this topic, read it here.

One of the substantial risk factors for DeFi farmers is volatility. In short, unless you are a long-term holder, unstable assets aren’t a safe choice for farming. Yet, many platforms offer juicy APYs on altcoins, not on stablecoins.

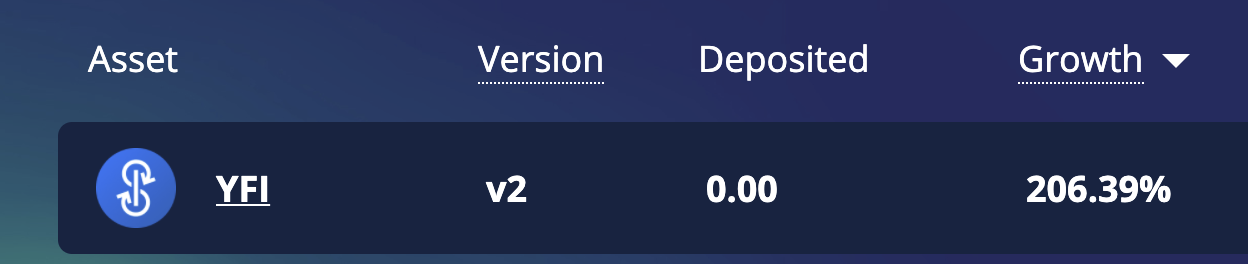

Besides, yields on large-cap assets, such as BTC or ETH, are small compared to alts with coins with lower market capitalizations.

YFI vs. ETH returns on yearn vaults.

Here you face a dilemma. You either take a higher risk and earn more, or you take the conservative route. What if I told you that you could get high yields without the major risks?

Borrow to Farm

- Borrow alts against your long-term holdings in large-cap cryptos or stables,

- Use borrowed alts for farming,

- Repay the loan using the alts you borrowed, pay the interest, and pocket what’s left.

For example, let’s consider you have 25,000 USDC and you want to participate in a farm or a vault that only accepts 1INCH token.

If you buy 1INCH on the spot market, you may lose money if the price of 1INCH plunges during the farming period. However, if you borrow 1INCH, you don’t take that risk because you will need to repay the loan with 1INCH tokens regardless of its price once you have finished farming.

Moreover, if you borrow and 1INCH goes down, your interest payments will decrease. Since you are paying an interest rate in 1INCH, you can buy it at a cheaper rate once it’s time to close the loan.

On the other hand, if the price of 1INCH skyrockets, you can lose your collateral. Let’s take a closer look at such loans.

Choosing a Platform

First and foremost, you need to choose a platform where you can borrow. Here are the criteria I use for selecting a crypto lender: availability of the asset you want, whether the lending platform is centralized, transaction fees, platform’s security.

Remember, you have 25,000 USDC, which is a hefty sum of money. Hence, you don’t want to take a big risk and deposit it as collateral to the platform you don’t trust. It’s better to use tried and tested providers like Aave, Compound, and Binance.

It’s up to you whether to trust your funds to a centralized platform. For some, there’s no other choice as Binance doesn’t offer loans in some jurisdictions. If you are going the decentralized route, keep in mind transaction fees.

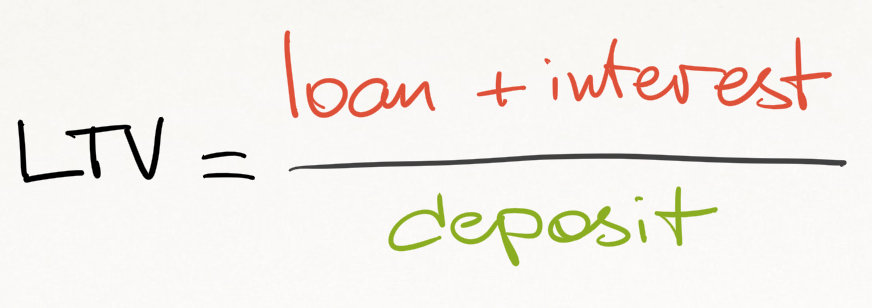

Calculating LTV

Loan to value (LTV) is a metric you will see on all lending platforms. It’s a simple ratio, which looks like this:

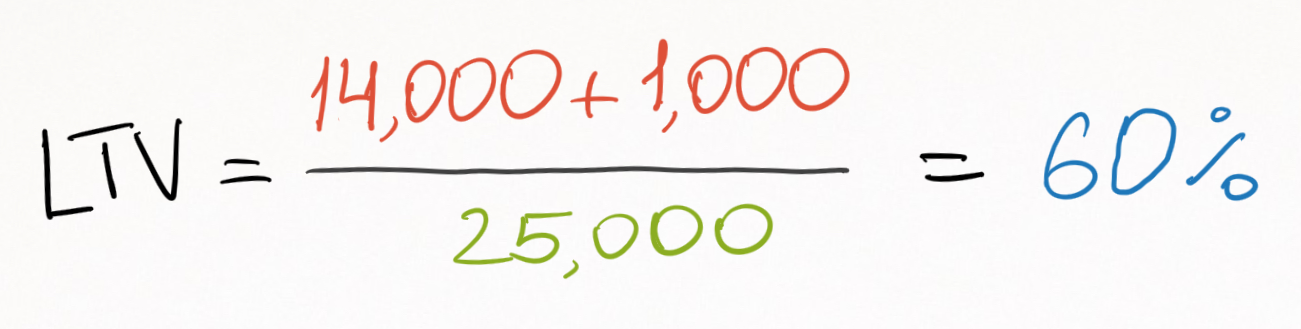

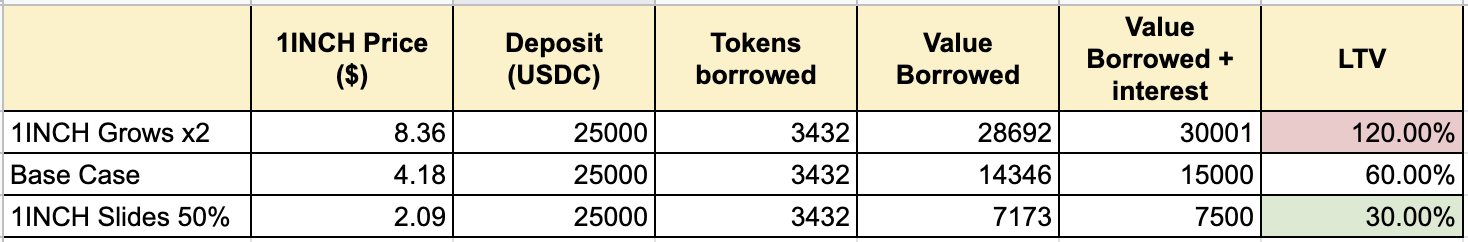

In our example, if you want to take $14,000 worth of 1INCH with and your overall interest over the target period would be worth $1,000 in 1INCH, then your LTV is 60%.

Maximum loan to value depends on the platform and assets in question. For example, it’s 60% if you borrow 1INCH with USDC as collateral on Binance. This metric represents how much you can borrow with your money.

Like I said, if you borrow and 1INCH plunges, your LTV will decrease and vice versa. Hence, it’s not good practice to borrow the maximum available amount because you need some safety margin.

Liquidation LTV

If 1INCH surges and LTV goes up too much, the platform will take your collateral and repay the loan. Importantly, you will still have 1INCH even after liquidation, so theoretically, you can offset losses if it continues to appreciate. However, it’s better to control risks in advance.

All lending platforms have a liquidation LTV, the threshold where the platform will take your collateral. In our example, the liquidation LTV on Binance is 83%. If you take a maximum available loan, your margin of safety is only 23%.

If the market does well and 1INCH doubles in price, your LTV goes far beyond 83%, and your loan will get liquidated. On the other hand, you won’t feel bad as the value of your 1INCH is more than what you deposited.

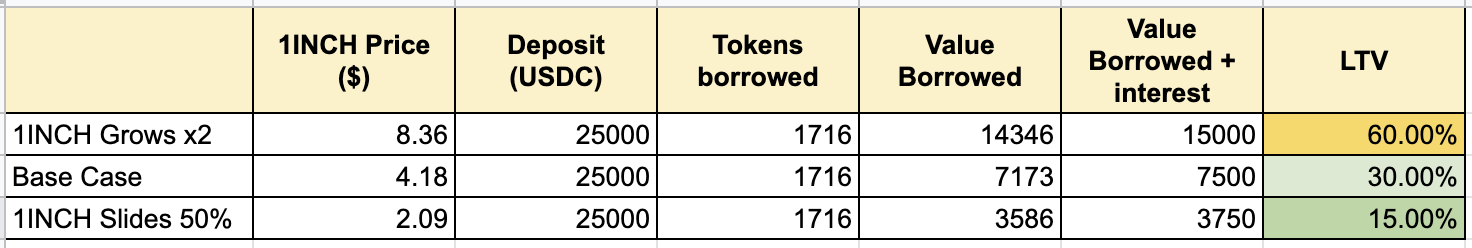

Again, the first scenario in the table above isn’t guaranteed. The price can move up, but it might not be enough to offset the loss due to the liquidation. Hence, keeping your LTV low is a safer approach.

By borrowing less, you can withstand the borrowed asset’s higher volatility. If you borrow half of your maximum initial LTV and 1INCH doubles in price, you won’t get liquidated.

Moreover, our example is for stablecoins as collateral. If you put something like BTC or ETH, low LTV is even more preferable.

After you borrow funds, you can use them for farming. Critically, the APY of the farm you are about to participate in should be higher (preferably much higher) than your interest rate.

For those going the decentralized route, keeping LTV as low as possible is a must. On-chain interactions on Ethereum are slow and expensive, so you should have time to act and preferably to wait until gas fees go down.

Finally, it may be a good idea to buy tokens for your interest in advance. Remember, you are paying interest using the currency you borrowed. So, if it appreciates, the USD value of your interest increases too.

And there you have it. Now you know how to mitigate volatility risk and not miss out on those juicy APYs.