Lending and Margin.

One of the crucial features of DeFi is that it enables users to put their money to work. Before the advent of such apps, people couldn’t do much with their coins besides holding and staking.

Staking is a world of its own. There are many moving parts, and the profits aren’t guaranteed because of price fluctuations. I will speak about it in the following issues of insights, but there’s one crucial thing to consider in the context of staking vs. lending in DeFi: you can lend stablecoins.

In other words, if the decentralized app (dApp) you are lending on doesn’t break or get exploited, and the market doesn’t experience any adverse conditions, you are guaranteed to make profit.

DeFi made passive income on crypto much more rational and convenient. Lenders aren’t exposed to volatility and average percentage yields (APY) come from other users instead of inflation.

Now your cash can yield high rates of interest, always on the ready to be deployed into some speculative asset. Instead of giving cash to a bank for less than 1% APY, you can lend USDC on a platform like Compound for over 4% APY.

The latter option is better, as you can quickly buy Bitcoin or anything else if it dips, while converting cash into crypto is time-consuming. Hence, you won’t miss a good buy opportunity.

Now that I outlined enough pros of lending on DeFi, let’s discuss its basics, risks, and additional uses.

The Basics of On-Chain Lending

Blockchains are largely isolated from the outside world. Hence, they can’t possibly know people’s credit history and issue loans accordingly.

For security guarantees, lending on blockchains is currently done with overcollaterization. Simply put, lenders lock more value than they get out.

Let’s consider one of the largest Ethereum-based lending platforms, Compound. A borrower must first check the collateral factor to take out a loan, which means how much money can be borrowed per unit of collateral.

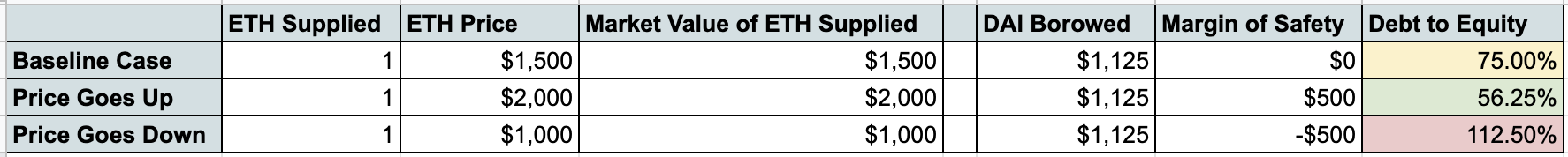

For instance, the collateral factor for DAI is 75%, so only $75 can be borrowed per $100 of collateral. Look at the example below for the three possible outcomes for a borrower who supplies 1 ETH and borrows 1125 DAI.

In the baseline case, the borrower has just enough collateral to keep their position from liquidation. If ETH moves down even a bit, this position will be marked for liquidation. Should ETH go up, the margin of the borrower’s safety would increase as well. So, if it goes down from $2,000, the borrower will have a cushion before getting liquidated.

But why would anyone borrow money if they already have more than they receive? There are types of borrowers for which overcollateralized loans have a practical purpose.

Long-term holders

The advantage of taking out a loan instead of directly using long-term holdings for purchases or paying for living expenses is that it mitigates capital gain taxes.

Crypto is subject to capital gains tax, which doesn’t usually include loans. So, if a ETH holder takes out a lot less than they supply (increasing margin of safety), they can use stablecoins for ongoing expenses and repay the loan to get ETH out later.

If ETH price appreciates in the meantime, the scheme becomes even better, as their debt doesn’t increase.

Traders

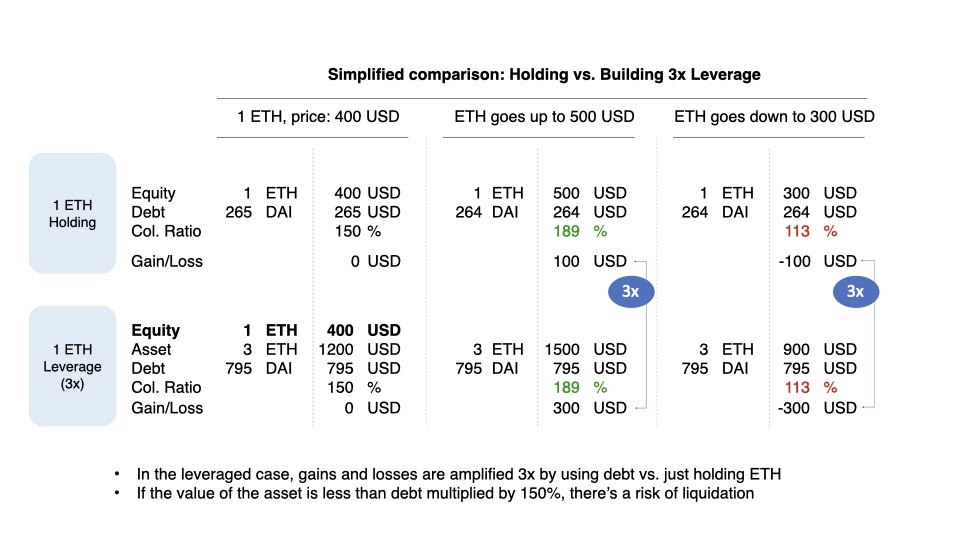

Traders need tools like Compound for on-chain margin trading. If a trader has 1 ETH and thinks that the price will go up, they can take advantage of lending platforms and borrow more ETH to make even more money with leverage.

To create a leveraged position, a trader borrows a stablecoin like DAI, trades it into the currency of their collateral (e.g., ETH), and takes out more DAI. They can then purchase even more ETH with that DAI, effectively creating a leverage circuit.

As I showed earlier, taking out more debt with the same amount of money reduces the margin of safety. Just like it is on the centralized exchanges, the more leveraged a trader is, the riskier their position becomes. Look at the example below to see how it works.

What’s in It for You?

In the previous issue of Insights, I discussed yield farming and earning passive income in crypto. At this stage, you may be wondering how lending is different from hunting for yields.

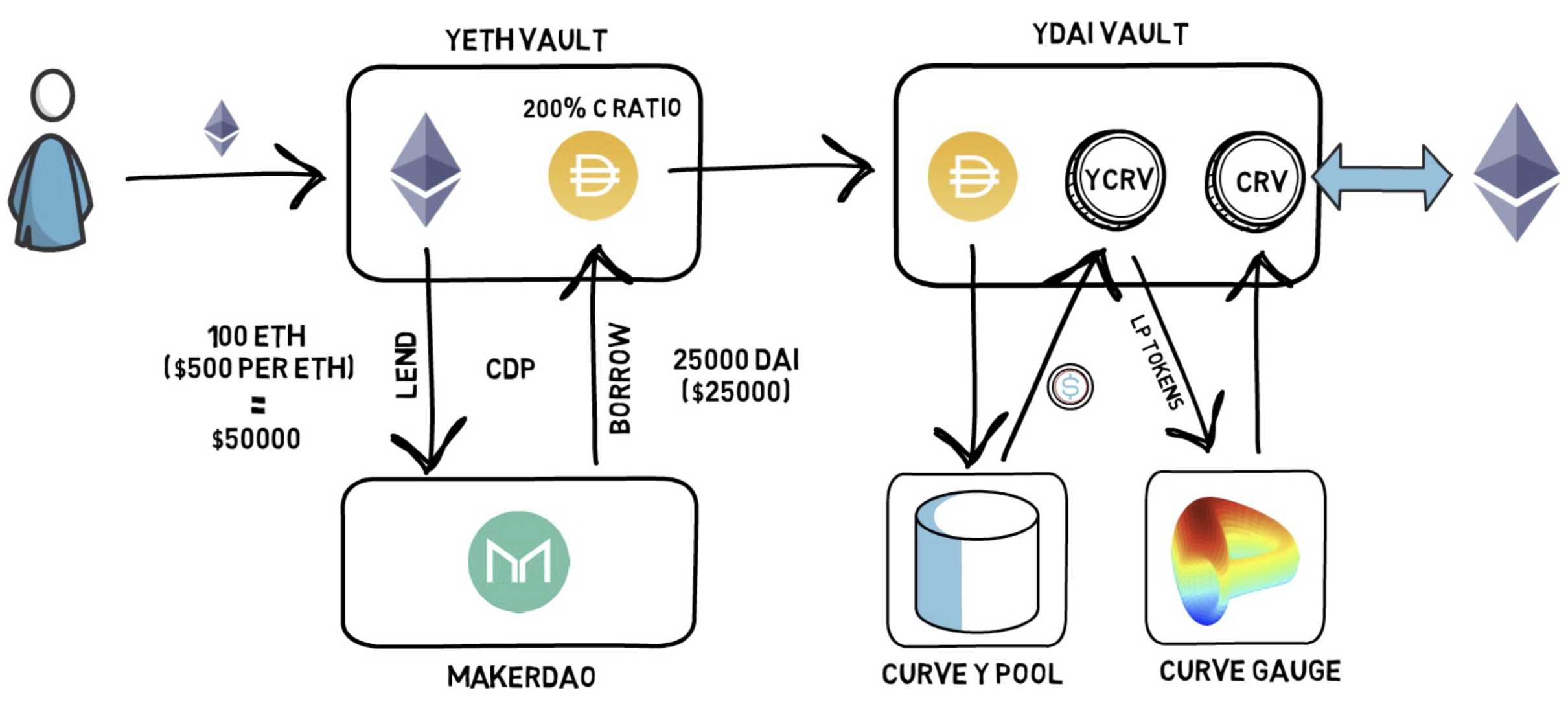

Technically, lending is a part of yield farming, but It’s important that you understand where your yields come from. In other words, lending is less risky than earning through yield extractors like Yearn or Harvest. Take a look at Yearn ETH vault strategy below.

Yearn ETH Vault Strategy. Source: Finematics.

To generate yield, Yearn interacts with MakerDAO and Curve, which significantly increases the number of moving parts and consequently the risk. If something goes wrong with these platforms along the way, you can lose some, or all, of your money.

With lending, you as a lender only interact with a single platform, which decreases the risk. Surely, something can go wrong if the market tanks and liquidators won’t be able to do their job properly, but that’s still not as risky as Yearn’s strategies.