Pilot.

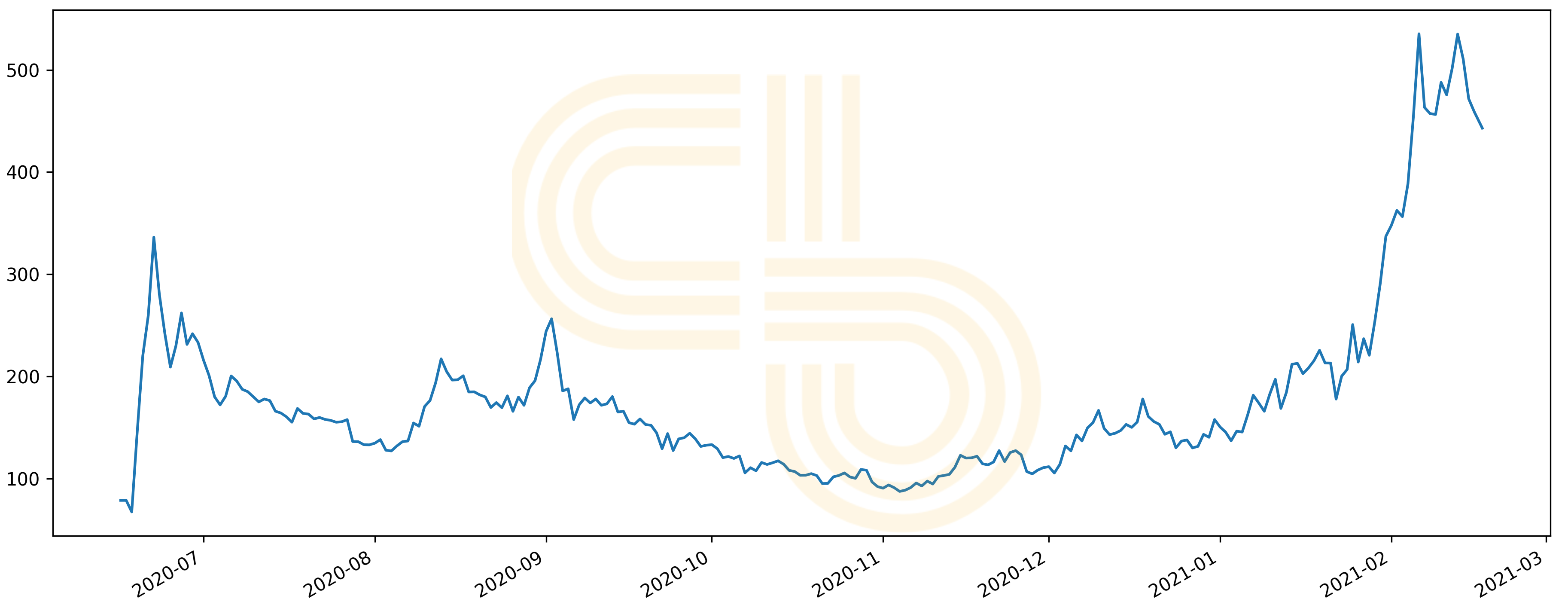

Despite a seaonsal cool-off in Autumn of 2020, DeFi continues roaring as the crypto market is renewing all-time highs. Many Ethereum-based platforms have matured since then. Some through slow and steady growth, and others through trial-by-fire by surviving devastating hacks.

In other words, we’re more comfortable recommending that people put their money in DeFi platforms today than we were six months ago.

One of the key forces behind the outburst of the DeFi craze in the Summer of 2020 was the introduction of governance tokens by Compound. People could provide liquidity to the platform to earn the COMP governance token, which shot up in value after its introduction. Many similar token launches followed soon after.

Compound price. Source: CoinGecko.

Annual yields on these platforms were initially mind-boggling. Some platforms were offering APY greater than 200%. Though yields have decreased since the DeFi summer, there are still great returns to be had on some of these platforms.

The key here is to look for the right balance between platform risk, crypto-asset volatility, budget, and time horizon.

“It ain’t much, but it’s an honest job” has transformed from a popular crypto meme to a close representation of reality. As a contemporary yield farmer, you need to put in some work, and the returns will be modest compared to the capital you put on the table. Still, it’s a great way to put your idle assets to work.

Source: KnowYourMeme.

Choosing a Platform

As I mentioned earlier, the key to selecting a farm is to find the right combination of factors. The first and foremost is your budget.

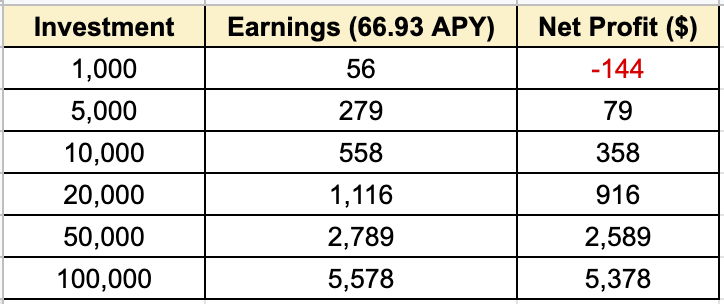

Basically, the smaller your budget, the more APY you need to offset the high costs of Ethereum transaction fees (gas). Let’s consider an example using the popular stablecoin exchange Curve.

At current gas prices, depositing money on Curve will require paying at least $100 in fees. When you collect your rewards and get your deposit returned, you’ll pay another $100. That’s roughly $200 just for doing business.

Now, going to the profits. One of the most profitable pools on Curve, sUSD pool, provides over 66% APY. That’s huge in comparison to banks, which can offer 2% returns at best. Still, Curve’s APY isn’t fixed and may drop dramatically in a few weeks. Hence, you need to consider the shortest time frames for farming. In my example, I will use one month.

Notice that it doesn’t make sense to farm on Curve with $1,000 in your pocket. Ethereum fees will eat all your earnings and leave you with a loss. $5,000 doesn’t seem too attractive either.

Locking up that much money for a month while exposing yourself to all of the DeFi related risks, like hacks, isn’t worth $79 in my opinion.

Based on these calculations, the key takeaway for aspiring farmers is that you should have somewhere around $10,000 to offset Ethereum fees to make DeFi farming worthwhile.

Furthermore, I can’t emphasize the risk enough. DeFi is the frontier of the crypto Wild West. Many of these projects are maintained by anonymous teams with little accountability. Hacks and scams are inevitable. Do you own research before farming with large sums of money and recognize that you could lose your entire deposit.

That said, there are ways to protect your money if things go wrong.

Some platforms provide insurance through dedicated dApps like Nexus Mutual, but insurers may not recognize some insurance cases, like contract exploits. As a result, even if you get insurance you can still lose everything. In the end you still need to trust the projects you’re putting your money into.

The best of these projects are the ones that compensate depositors in the case of an exploit. For instance, Yearn recently suffered an $11 million loss due to an exploit. The team quickly recovered and provided reimbursements to those who lost their money. Such an example makes Yearn look relatively safe for large deposits since the team will likely react in the same fashion if something goes wrong in the future.

Lastly, consider volatility. If you plan to provide liquidity, chances are you are going to supply two tokens in equal amounts to some pool. Here you should account for volatility. Generally, the less volatile an asset is, the lower the APY. But there’s a reason for that.

Consider two different pairs on 1INCH: ETH/USDC (8.8% APY) and 1INCH/ETH (18.2% APY). The first pair consists of a large-cap mature asset and a stablecoin. The second contains a volatile altcoin. In the second case, you get more bang for your buck, but you also risk more.

Let me quickly remind you how liquidity pools work. If ETH drops in value and you have funds locked in the ETH/USDC pool, you will withdraw more ETH and less USDT than you initially deposited. Conversely, if ETH surges, you end up with more USDC.

In an ETH/USDC pair, your risk is substantially limited. Ethereum is the second world’s largest crypto, so you can comfortably hold it over the long-term, even if the price goes down. 1INCH, however, is more volatile and risky. Hence, if it substantially falls in price it may never recover, meaning you would get hosed as a farmer.

Where to Look For Yield?

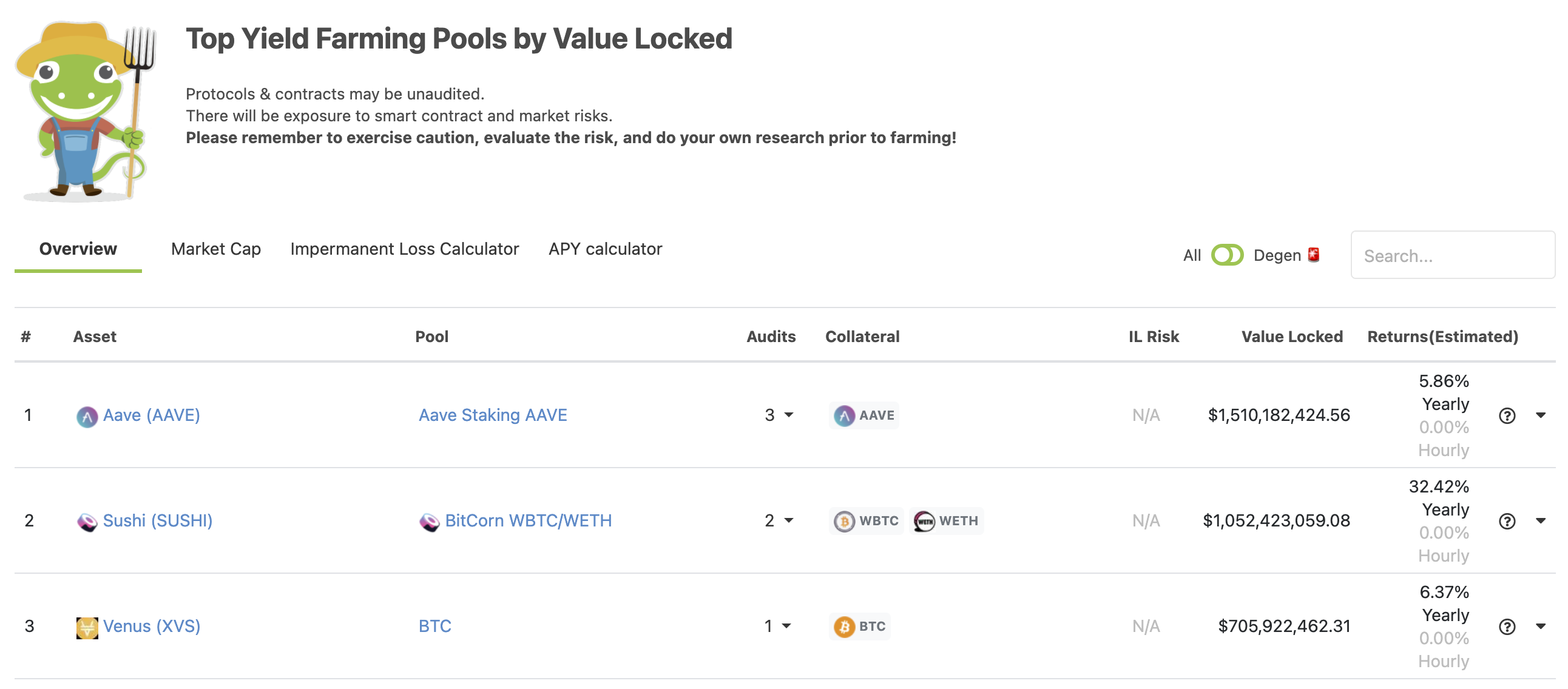

Now that you understand the implications of being a liquidity farmer, it’s time to look for those juicy yields. The first stop is CoinGecko.

CoinGecko is a reliable aggregator of blockchain data. It’s similar to CoinMarketCap, but with additional features. The website has a dedicated page for farmers with all of the important details conveniently grouped and represented as a table.

Yield farming pools. Source: CoinGecko.

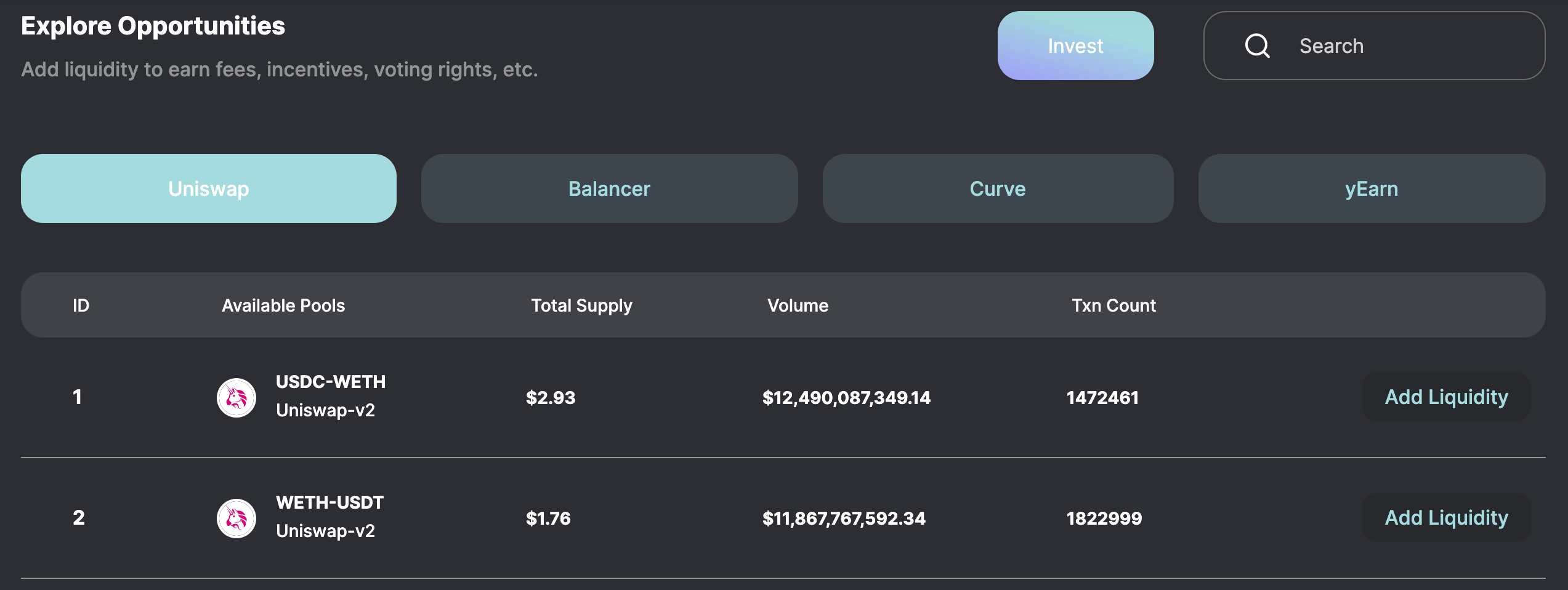

The next stop is a tracking app, such as OctoFi, Zerion, and Zapper. These platforms aggregate all the farming opportunities on-chain, so you can supply money directly through them.

Liquidity pools. Source: OctoFi.

Note that not all the pools represented on either CoinGecko or tracking apps distribute projects’ tokens as rewards. Some of them only provide trading fees, so you need to verify that the pool you select is incentivized.

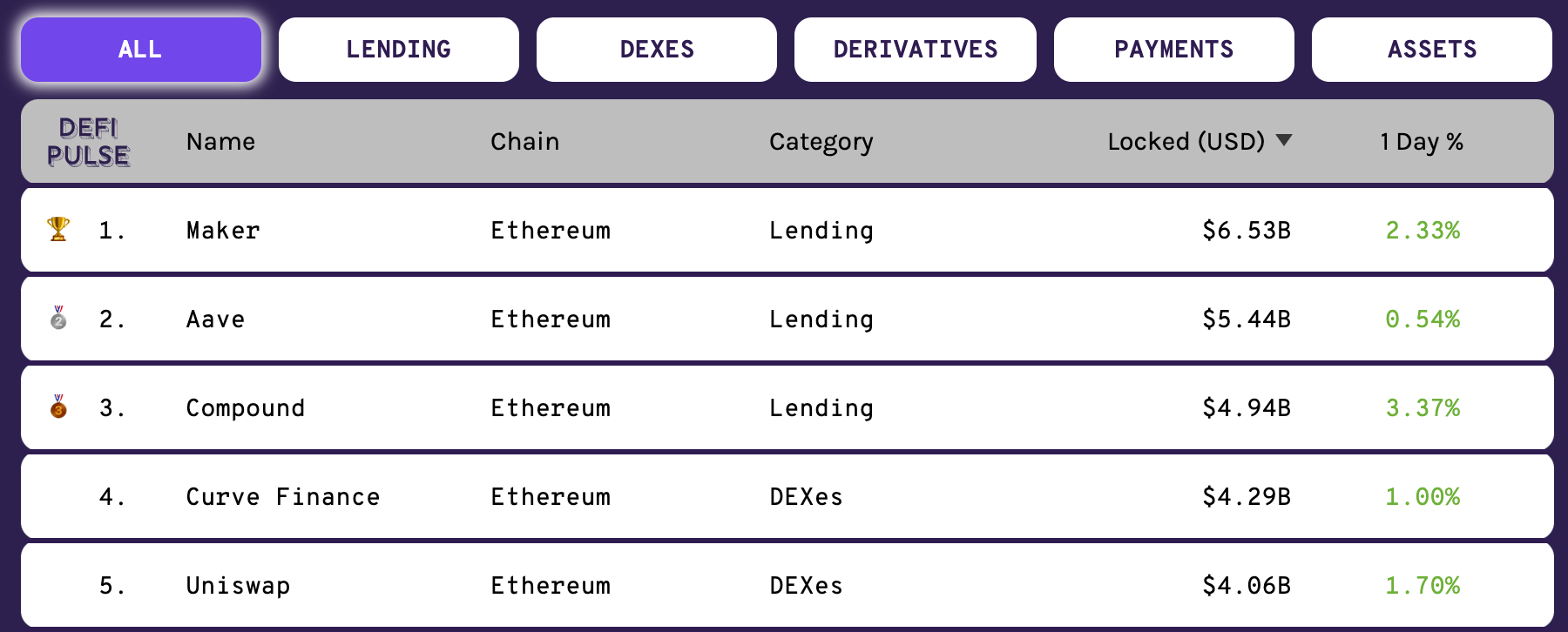

Finally, you can look at the top DeFi projects yourself and see whether they have some hidden gems. Aggregators like DeFi Pulse will help to navigate through Ethereum-based DeFi dApps and show you which of them have the most usage.

DeFi apps ranking. Source: DeFi Pulse.