Liquidity Crunch.

All eyes are still on Bitcoin, which is moving near the psychological level of $40,000 once again. In just one month, BTC’s price doubled, and some of us may feel uncertain about whether bitcoin will move higher.

While bitcoin will reach its top at some point, we at the research department don’t think the top is in for several reasons.

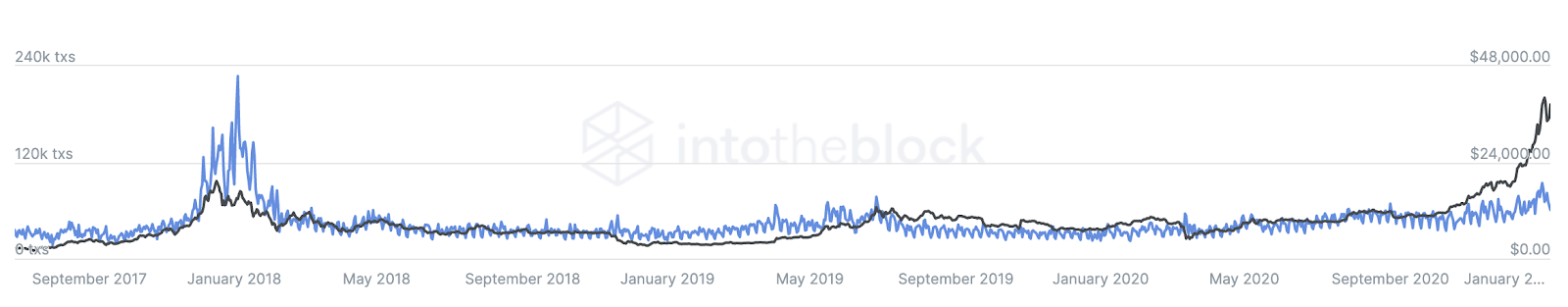

First, BTC and ETH are experiencing a liquidity crunch. There is strong demand from retail and institutional investors while exchange reserves are depleting. Exchange inflows are nowhere near 2017-18 bubble levels, which means that demand significantly outweighs supply.

BTC exchange inflows (blue) vs. price. Source: intotheblock.

Liquidity crunches create volatility, which is amplified by leverage traders. However, if the exchange inflows remain steady, the volatility will eventually turn out on the upside.

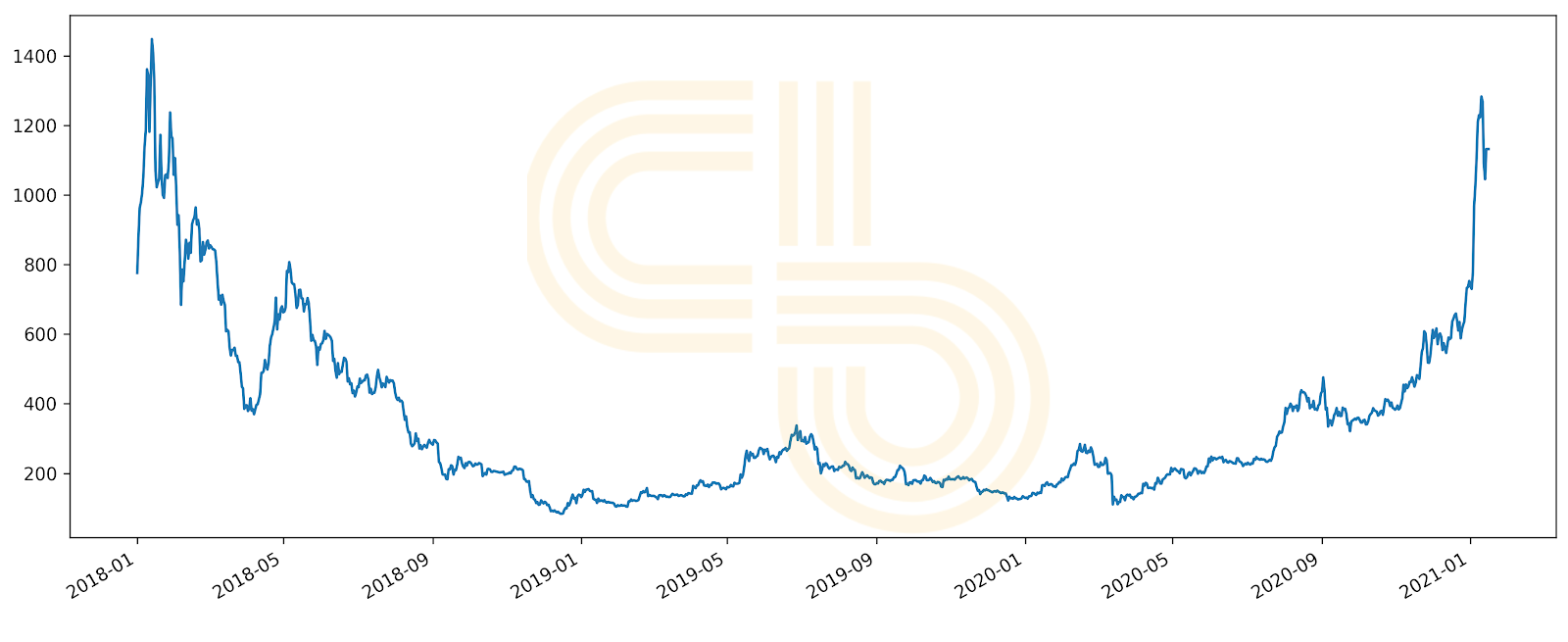

Bitcoin 60-day volatility. Source: Woobull.

For now, as bitcoin is moving in a sideways channel, its dominance has slightly dipped under 70%, which gives alts a short breather. However, the full-fledged alt season still has not materialized. Even Ethereum hasn’t reached its 2018 all-time high yet.

Ethereum price. Source: CoinGecko.

According to our lead Bitcoin analyst, Nathan Batchelor, BTC will likely move upwards past $40,000 in the short-term. Hence, there is a high probability that liquidity will run from altcoins to BTC again soon.

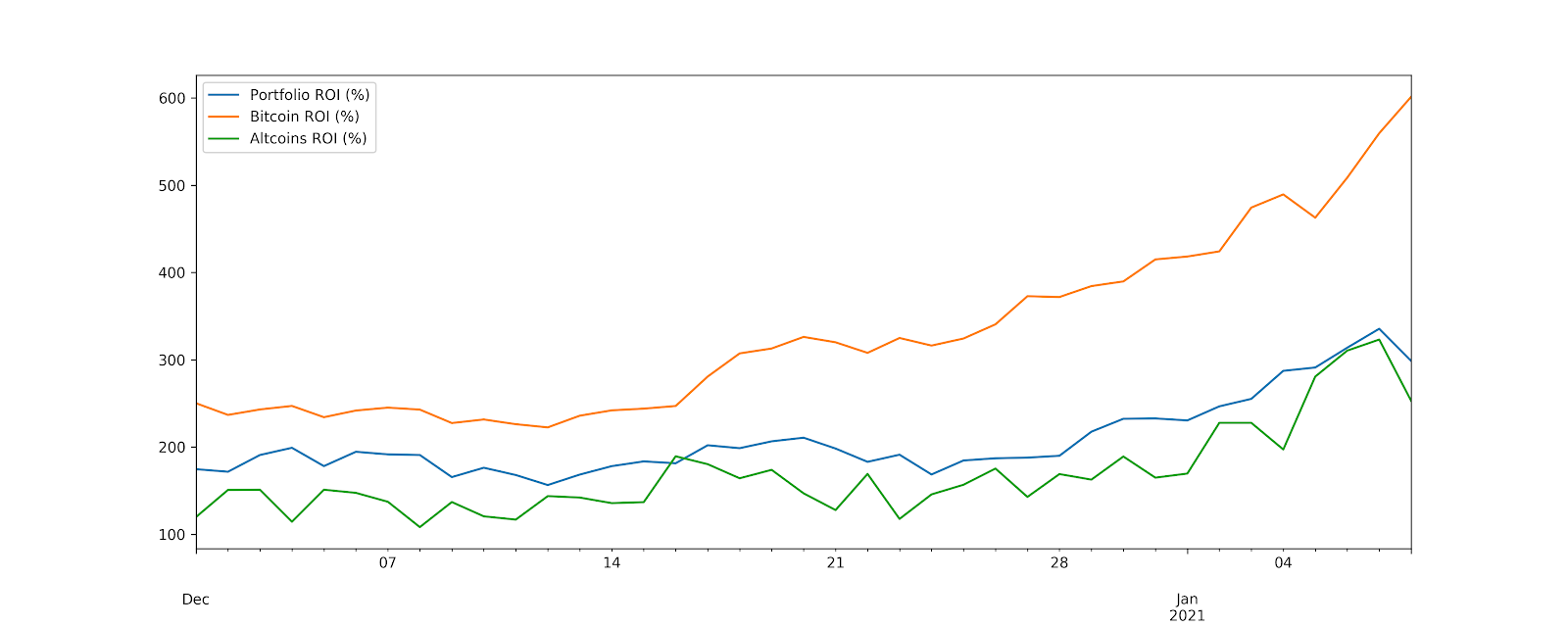

Thus, our strategy is to wait until Bitcoin shows more indicators of being overheated. Patience is critical here. While SIMETRI Portfolio ROI has increased significantly, taking more money off the table would be foolish given the potential upside from the macro perspective.

Is the SIMETRI Portfolio Dump Proof?

While the altcoin market was hammered during the recent bitcoin pullback, SIMETRI’s portfolio picks held strong. This means that people holding our Picks are long-term focused and don’t panic when the market shakes.

Portfolio’s ROI exceeded the 1,000% mark, which is a substantial gain compared to last week’s 808%. It is now at 997%.

Pick of the Month ROI performance against Bitcoin and altcoins. To view live data, click on this link.