How to Spot the Market Top.

“This time is different” is one of the most common phrases during every bull run. Yet, they all end with bear markets.

When dealing with any asset class, including cryptocurrencies, you should exercise forward-thinking and learn to be a contrarian. Planning and risk control is better than succumbing to the euphoria, and this is especially true if you are a newbie in the crypto space.

Longevity in the market is the key. If you just came to see BTC breaking all-time highs, it’s normal to feel like you missed the boat.

Big-time “Bitcoin influencers” will tell you, “Buy before it’s too late!” or “Bitcoin is going to $100K, a few thousand at $30K won’t make a difference.”

No. These influencers and highly-leveraged investors want schmucks like you to buy so they can sell on top of you (or increase the value of their own holdings). When you rush into Bitcoin based on advice like this, you are allowing yourself to get left holding the bag.

If you manage to stick around, crypto will give you a chance to load up your bags when less sophisticated investors capitulate.

So, don’t rush.

For those who have been HODLing from sub $30,000, congratulations! I hope you are enjoying the long-awaited bullish trend. The most important thing now is to look for clues as to when the music will stop. That’s our topic today.

Technical Analysis

Technical analysis is not the best tool to apply when predicting an asset’s price action that recently broke all-time highs for several reasons.

No disrespect to our lead bitcoin analyst Nathan Batchelor is intended when I say this. He does a fantastic job of looking at the sentiment and fundamental signals I mention below.

When the market moves within some established limits (like bouncing between $3,500 to $20,000 on BTC recently), technical patterns are efficient. However, there hasn’t been much trading history after $20.000. So, the charts at this point are less informative.

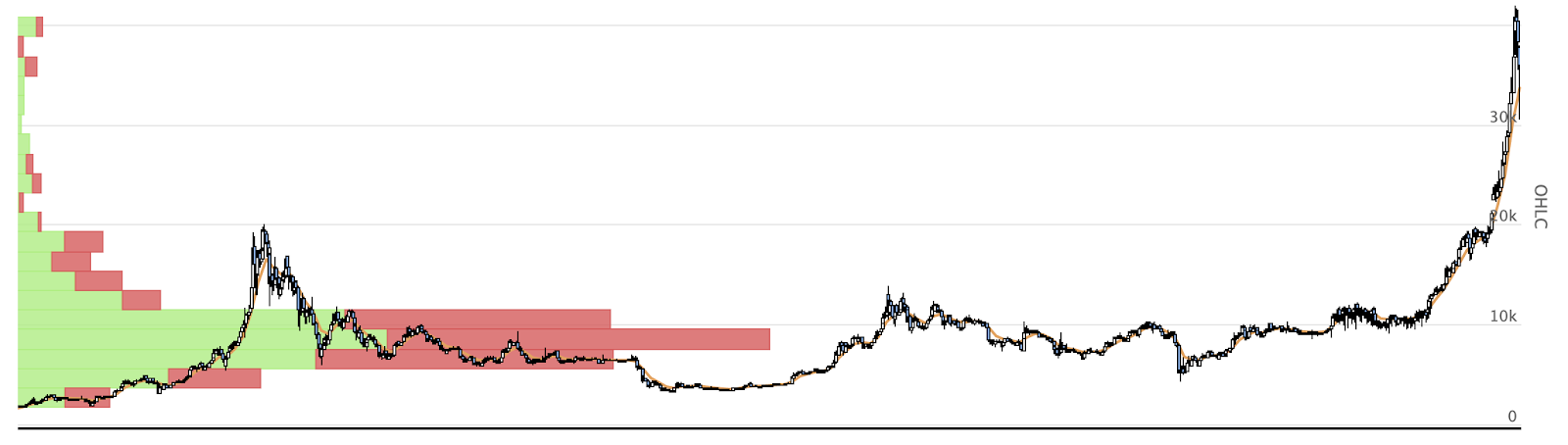

Bitcoin volume (green/red) vs. price. Source: Bitgur. Notice how much volume (and thus price history) is around $3,000-$18,000. Around here, technical analysis can be efficient.

Hodl Waves

Hodl waves are charts showing how long Bitcoin holders have held onto their coins. The full-featured chart is difficult to read, so for convenience, I will show only one hodl wave that reflects addresses that haven’t moved their coins for over a year.

1+year hodl wave. Source: Lookintobitcoin.

On the chart, you can see those hodlers are starting to offload their bags when prices go up—contrary to what unsophisticated investors are doing. When more hodlers start to sell, the market’s bulls get exhausted, and the trend reverses.

At a certain point, someone would rather have a Lamborghini, a private island, or a yacht… Or, more practically, do something like pay off their college debt. Like a stock, you can’t really do much with a Bitcoin until you sell it.

When you see the wave declining as it does right now, that signals that the market is potentially nearing the top.

However, based on hodl waves, it’s too early to call the market’s top at this point. The hodl wave plateaus for some time when the market rises. Hence, what we see now may be a short-term dip in the plateau of the 1+year hodl wave.

Exchange Inflows

While hodl waves provide a macro perspective about whether bitcoin veterans think it’s the top, exchange inflows let you spot a large wave of sellers in real-time.

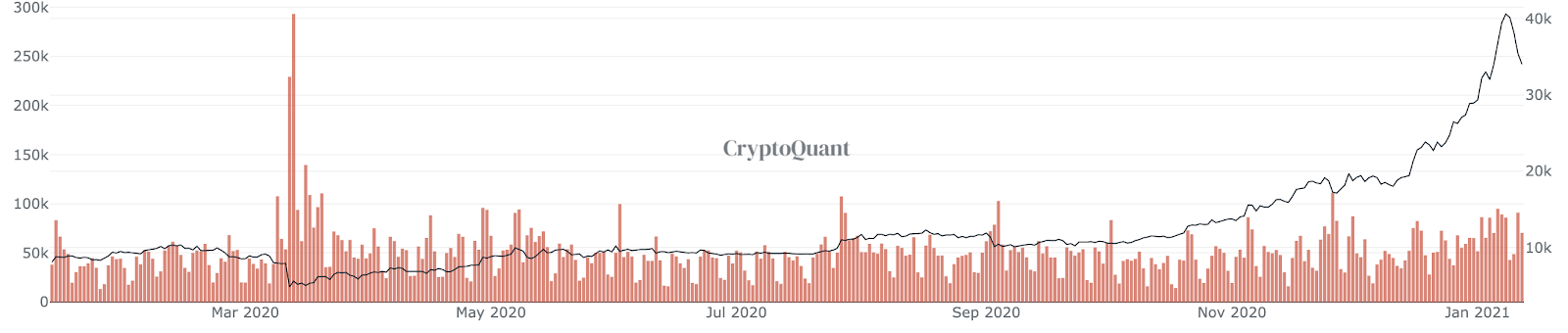

Exchanges BTC Inflow. Source: CryptoQuant

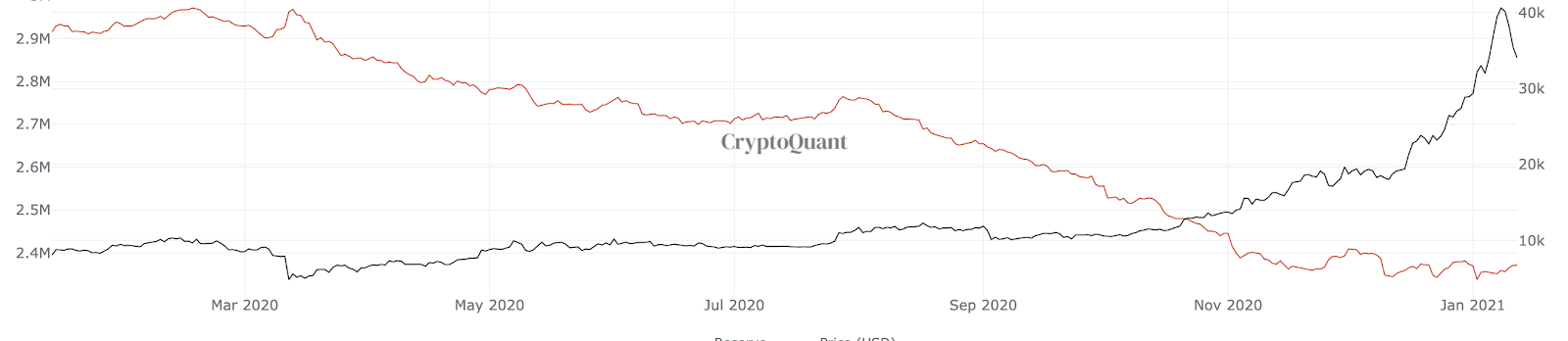

Exchanges BTC Reserves. Source: CryptoQuant.

Usually, there’s a steady inflow of bitcoin to exchanges. Traders, miners, and sometimes hodlers are continuously exiting the market. However, in a bull market, bitcoin’s global outflows from exchanges will outweigh the inflows. At the tipping point, exchange reserves start to drain.

If the order books get thinner, the price becomes more volatile, and when the volatility is to the upside, bitcoin’s price surges to the point where it looks overextended. At this point, they will move their BTC to exchanges to cash out.

Sentiment

When your taxi driver is talking about Bitcoin then it’s probably a good time to sell. Gauging the market’s sentiment is challenging but crucial. In short, when everybody thinks there won’t be any further pullbacks, you need to exit ASAP.

As the euphoria grows, the market becomes ridiculous. Blinded by greed, market participants don’t want to accept any bad news. That’s why bearish headlines are often overlooked, and why Crypto Briefing insists on publishing bearish news in a bull market.

Fear and Greed index. Source: Alternative.

Media coverage of crypto expands as non-crypto outlets try to piggyback on the trend, famous people comment on bitcoin or even endorse crypto startups.

Marketing starts to dominate over the real products. It’s nothing new; during the dot-com bubble of the 1990s, a non-tech company could double in value just by adding ‘.com’ to its name.

The same thing has happened with blockchain. Heard about the Long Island Tea company? Their stock price surged after they changed their name to “Long Island Blockchain,” and the company had nothing to do with the technology at all.

You Can’t Call the Exact Top

Now that we know where to look for when trying to pick the best time to exit the market, I want to briefly remind you that you can’t sell exactly at the top, and you can’t buy exactly at the bottom.

Treat the market as a sort of a poker tournament. As more people come to the table, the more money they put in. However, there will be only one person who eventually wins the pot. The same goes for crypto. The more people who rush to buy BTC and alts, the more tempting it becomes for the whales to sell their gargantuan holdings.

But you can opt-out of this scenario… Crypto is not winner-take-all. Rather than gambling until you lose it all, take some of your winnings out when you’re ahead.

You don’t want to be in the market when the selling wave comes. It usually jams exchanges, so you can’t do anything while the price is dumping. Prepare in advance and focus on longevity; you’ll need to live through another bear market to enjoy the next bull market.